Technology

Animated Chart: The Smartphone Effect on the Camera Market

Charting the Smartphone Effect on the Camera Market

The smartphone camera has come a long way since the early 2000s, and its impact on the overall camera market cannot be understated.

In fact, modern smartphones have become so sophisticated that the CEO of Sony’s semiconductor manufacturing company predicts that smartphone cameras will soon produce better quality images than DSLR cameras.

Whether smartphones will be able to completely replace standalone cameras is still a contentious debate topic, but one thing is clear—while smartphone sales have skyrocketed over the last decade, digital camera sales have plummeted.

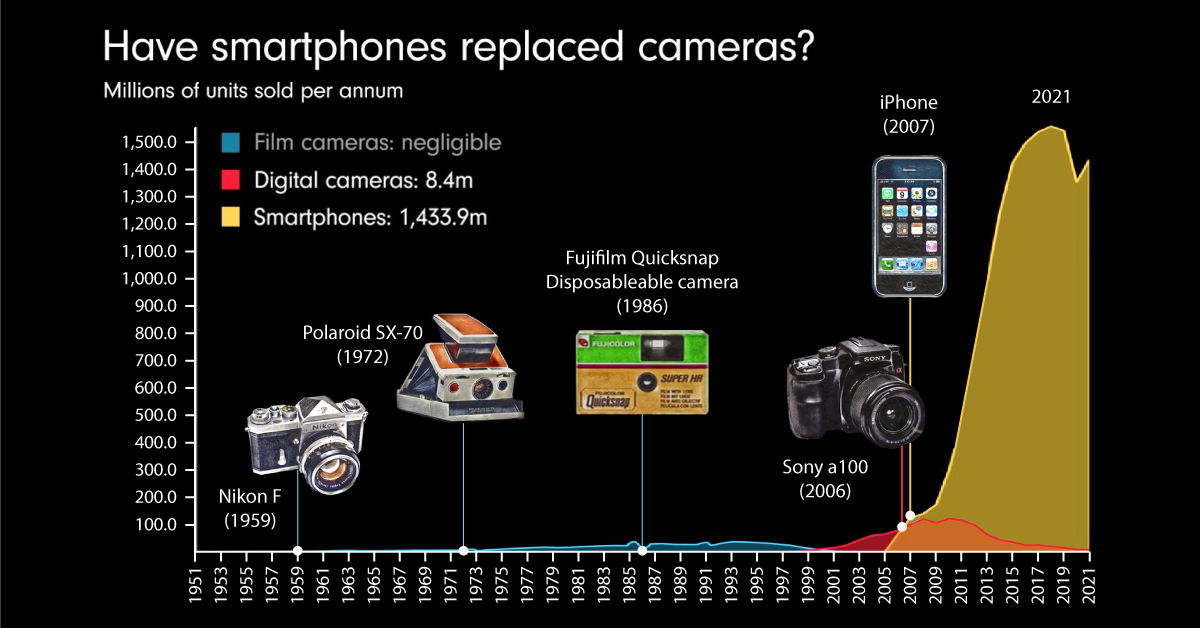

This animation by James Eagle compares annual sales data for film cameras, digital cameras, and smartphones over the years to show just how much smartphones have impacted the camera market.

A (Brief) History of Standalone Cameras

Below, we’ve broken down the history of cameras into three overarching periods: early cameras, film cameras, and digital cameras.

Early Cameras

Cameras have been around for thousands of years, with descriptions of camera-like devices found in historical writings dating back as far as the 4th century:

- 330 AD: Ancient Chinese texts describe a device known as a camera obscura. Similar to pinhole cameras, these didn’t produce actual photographs, but rather reflected light onto screens which could then be traced to produce a lasting image.

- Early 1800s: It’s generally accepted that Joseph Nicéphore Niépce invented the first photographic camera in 1816. Using silver chloride, Niépce managed to develop an image that’s still around today.

- 1840s: Early cameras produced negative images which had to be color corrected, until mirrored cameras were invented. Alexander S. Wolcott was the first person to patent a mirrored camera in 1840.

- 1871: Richard Leach Maddox came up with an invention that led to instantaneous exposure, meaning cameras only needed to be exposed to light for a few seconds before producing an image.

These early inventions were critical milestones in the development of the modern-day camera. However, cameras and film weren’t available to the masses until Kodak’s Brownie camera made photography relatively cheap.

The Emergence of Film Cameras

Released in 1900, the Kodak Brownie was a handheld, inexpensive roll film camera invented by George Eastman.

When it first launched, the camera sold for $1.00, equivalent to about $35.48 in 2022 dollars. With more than 100,000 cameras sold within the first year, Eastman is often credited for making photography accessible to the masses.

Fast forward a few decades, and technological advancements led to features in cameras like viewfinders, different shutter speeds, and detachable lenses. These features were possible on what’s known as twin lens reflex cameras, or TLR for short, but they were soon replaced by single lens reflex cameras (SLR).

Digital Cameras Enter the Scene

By the late 1990s, digital cameras were invented and began quickly outselling film cameras.

Unlike their film counterparts, digital cameras feature a digital sensor, and store images on a memory card which could store thousands of pictures.

Digital camera sales grew throughout the early 2000s—in 2005 the Photo Marketing Association International even estimated that 52% of households would own a digital camera by the end of the year.

The Smartphone Camera Changes the Game

In the early 2000s, camera phones were far less powerful than their standalone counterparts.

For instance, one of the first camera phones to hit the market, Samsung’s SCH-V200, could take 20 pictures at 0.35-megapixel resolution. In contrast, Canon’s EOS D30 digital camera released the same year had a resolution of 3 megapixels.

But the advent of the iPhone, and the rollout and accessibility of modern smartphones with powerful cameras, quickly saw many non-enthusiasts switch to smartphone cameras only. In 2022, Google’s Pixel 7 has multiple built-in cameras, with both a 50 megapixel wide rear camera and a 12 megapixel ultrawide rear camera. In comparison, Canon’s enthusiast EOS 850 has a 24.1 megapixel sensor.

The animated chart above highlights the direct impact on the digital camera market after its 2009/2010 peak:

| Year | Digital Camera Sales |

|---|---|

| 1999 | 10.2 million |

| 2009 | 121.2 million |

| 2021 | 8.4 million |

So does that make a modern smartphone camera better? Not at all, as there are other a multitude of factors to consider when assessing a camera’s quality besides resolution. But in an article in Wired Magazine, tech journalist Sam Kieldsen explains how the market has shifted:

[Smartphones have] effectively killed off the cheap pocket point-and-shoot camera already, but there’s still so much they can’t do in comparison to a true purpose-built mirrorless or DSLR camera. Low light image quality, convincing bokeh effects and extreme close-up macro photography are all still significantly better on a real camera.

Smartphones may not be fully replacing DSLR cameras anytime soon, but they’ve certainly changed the industry and game in which it plays.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024