Misc

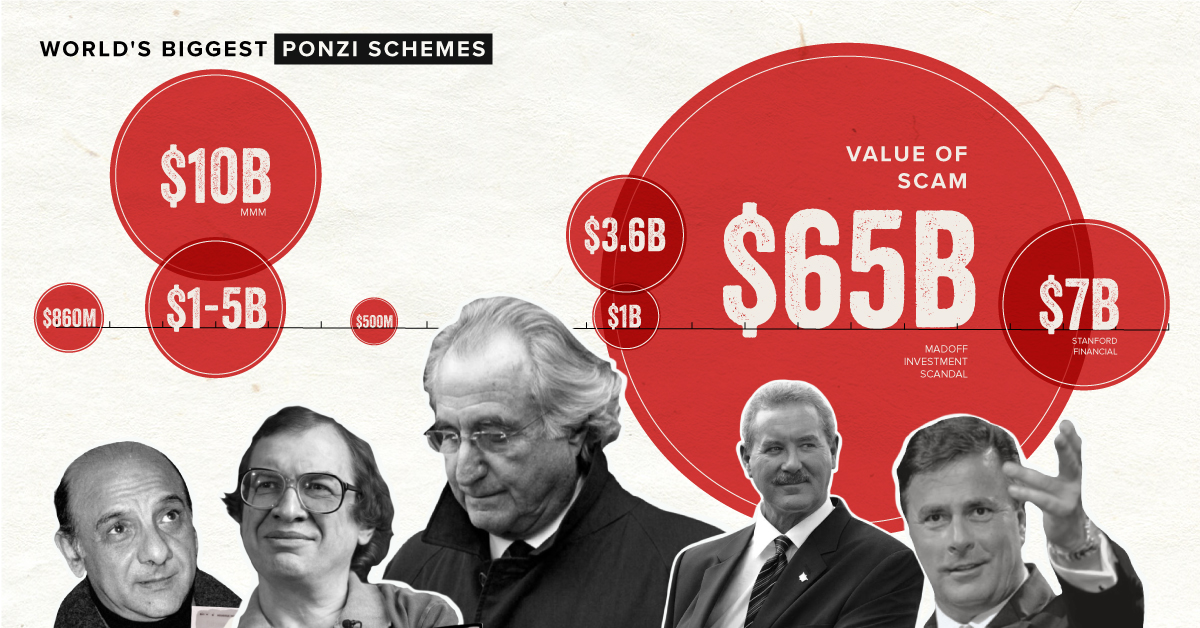

Visualized: The Biggest Ponzi Schemes in Modern History

The Biggest Ponzi Schemes in Modern History

Some things simply sound too good to be true, but when money is involved, our judgement can become clouded.

This is often the case with Ponzi schemes, a type of financial fraud that lures investors by promising abnormally high returns. Money brought in by new members is used to pay the scheme’s founders, as well as its earlier investors.

The scheme is named after Charles Ponzi, an Italian who became infamous in the 1920s for claiming he could double his clients’ money within 90 days. Since then, numerous Ponzi schemes have been orchestrated around the globe.

To help you learn more about these sophisticated crimes, this infographic examines some of the biggest Ponzi schemes in modern history.

Ponzi Schemes in the 20th Century

The 1990s saw a number of large Ponzi schemes worth upwards of $500 million.

| Country | Date Ended | Name of Scheme and Founder | Value (USD) |

|---|---|---|---|

| Belgium | 1991 | Moneytron, Jean-Pierre Van Rossem | $860M |

| Romania | 1994 | Caritas, Ioan Stoica | $1B - $5B |

| Russia | 1994 | MMM, Sergei Mavrodi | $10B |

| U.S. | 1997 | Great Ministries International, Geral Payne | $500M |

In many cases, these schemes thrived by taking advantage of the unsuspecting public who often lacked any knowledge of investing. Caritas, for example, was a Ponzi scheme based in Romania that marketed itself as a “self-help game” for the poor.

The scheme was initially very successful, tricking millions of people into making deposits by offering the chance to earn an 800% return after three months. This was not sustainable, and Caritas was eventually unable to distribute further winnings.

Caritas operated for only two years, but its “success” was undeniable. In 1993, it was estimated that a third of the country’s money was circulating through the scheme.

Ponzi Schemes in the 21st Century

The American public has fallen victim to numerous multi-billion dollar Ponzi schemes since the beginning of the 21st century.

| Country | Date Ended | Name of Scheme and Founder | Value (USD) |

|---|---|---|---|

| U.S. | 2003 | Mutual Benefits Company, Joel Steinger | $1B |

| U.S. | 2003 | Petters Group Worldwide, Tom Petters | $4B |

| U.S. | 2008 | Madoff Investment Scandal, Bernie Madoff | $65B |

| U.S. | 2012 | Stanford Financial Group, Allen Stanford | $7B |

Many of these schemes have made major headlines, but much less is said about the thousands of everyday Americans that were left in financial ruin.

For victims of the Madoff Investment Scandal, receiving any form of compensation has been a drawn-out process. In 2018, 10 years after the scheme was uncovered, a court-appointed trustee managed to recover $13 billion by liquidating Madoff’s firm and personal assets.

As NPR reported, investors may recover up to 60 to 70 percent of their initial investment only. For victims who had to delay retirement or drastically alter their lifestyles, this compensation likely provides little solace.

Do the Crime, Pay the Time

Running a Ponzi scheme is likely to land you in jail for a long time, at least in the U.S.

In 2009, for example, 71-year-old Bernie Madoff pled guilty to 11 federal felonies and was sentenced to 150 years in prison. That’s 135 years longer than the average U.S. murder conviction.

Outside of the U.S., it’s a much different story. Weaker regulation and enforcement, particularly in developing countries, means a number of schemes are ongoing today.

Sergei Mavrodi, known for running the Russian Ponzi scheme MMM, started a new organization named MMM Global after being released from prison in 2011. Although he died in March 2018, his self-described “social financial network” has established a base in several Southeast Asian and African countries.

If you or someone you know is worried about falling victim to a Ponzi scheme, this checklist from the U.S. Securities and Exchange Commission (SEC) may be a useful resource.

Misc

Visualizing the Most Common Pets in the U.S.

Lions, tigers, and bears, oh my!—these animals do not feature on this list of popular American household pets.

Visualizing The Most Common Pets in the U.S.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we visualized the most common American household pets, based on 2023-2024 data from the American Pet Products Association (accessed via Forbes Advisor).

Figures represent the number of households that own each pet type, rather than the actual number of each animal. The “small animal” category includes hamsters, gerbils, rabbits, guinea pigs, chinchillas, mice, rats, and ferrets.

What is the Most Popular American Household Pet?

Based on this data, dogs—one of the first domesticated animals—are the most common pets in the United States. In fact, around 65 million households own a dog, and spend an average of $900 a year on their care.

| Rank | Species | Households |

|---|---|---|

| 1 | 🐶 Dog | 65M |

| 2 | 🐱 Cat | 47M |

| 3 | 🐟 Freshwater Fish | 11M |

| 4 | 🐰 Small Animals | 7M |

| 5 | 🐦 Bird | 6M |

| 6 | 🦎 Reptile | 6M |

| 7 | 🐴 Horse | 2M |

| 8 | 🐠 Saltwater Fish | 2M |

Note: Households can own multiple pets, and are counted for all relevant categories.

Cats rank second, at 47 million households, and these smaller felines are a little less expensive to own at $700/year according to Forbes estimates.

But aside from these two juggernauts, there are plenty of other common pet types found in households across the country.

Freshwater fish can be found in 11 million households, along with small animals—rabbits, hamsters, guinea pigs—in 7 million. Meanwhile, nearly 6 million homes have birds or reptiles.

Pet Ownership is on the Rise in America

Forbes found that 66% of all American households (numbering 87 million) own at least one pet, up from 56% in 1988. One third of these (29 million) own multiple pets.

A combination of factors is driving this increase: rising incomes, delayed childbirth, and of course the impact of the pandemic which nearly cleared out animal shelters across the globe.

America’s loneliness epidemic may also be a factor. Fledgling research has shown that single-individual households with pets recorded lower rates of loneliness during the pandemic than those without a pet.

-

Lithium6 days ago

Lithium6 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?