Business

Are You Suffering From Impostor Syndrome?

Are You Suffering From Impostor Syndrome?

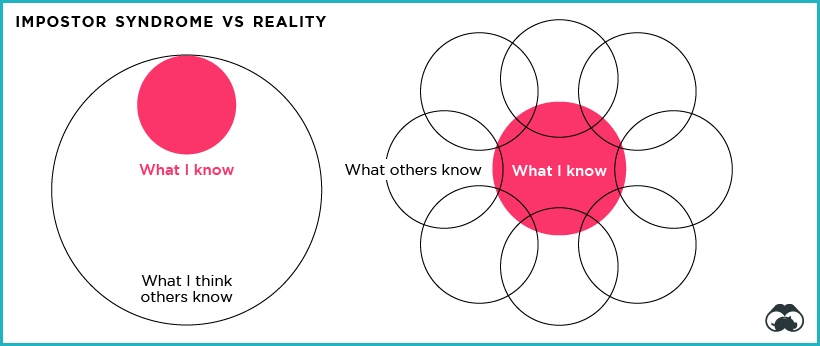

If you have ever felt unworthy of your position at work, or felt uncomfortable about receiving praise from colleagues, then you’re not alone.

The psychological pattern of impostor syndrome is widespread, with the majority of people experiencing some form of it over the course of their careers.

Today’s infographic, from Resume.io, provides a useful guide to identifying the various manifestations of impostor syndrome, and how to potentially overcome it.

What is Impostor Syndrome?

People suffering from impostor syndrome doubt their skills and accomplishments, live in fear of being exposed as not worthy of their position, and even downplay their success, attributing it all to luck or good fortune.

These feelings, which were first collectively known as “impostor phenomenon,” were introduced in a 1978 study of 150 highly successful women. Today, we have an even more nuanced view of how feelings of anxiety and inadequacy can afflict people in a professional setting.

Impostor Syndrome Archetypes

According to Dr. Valerie Young, a leading expert on the subject of impostor syndrome, these feelings of self doubt are not one-size-fits-all.

Here are the five different types of impostor syndrome:

| Number | Archetype | Description |

|---|---|---|

| #1 | Expert | You expect to know everything and feel ashamed when you don't. |

| #2 | Soloist | You believe work must be accomplished alone and refuse to take any credit if you received any kind of assistance. |

| #3 | Natural Genius | You tell yourself that everything must be handled with ease, otherwise it's not "natural talent". |

| #4 | Superperson | You feel you should be able to excel at every role you take on in your life. |

| #5 | Perfectionist | You set impossibly high standards for yourself and beat yourself up when you don't reach them. |

Understanding the different types of impostor syndrome is an important first step, as each manifestation requires a unique toolkit of solutions to help overcome this common psychological trap experienced by professionals.

Slaying Self Doubt

While impostor syndrome can afflict anyone, women have been shown to experience it more often – even once they have experienced high levels of success in their career.

A recent KPMG study of 750 high-performing executive women found that:

- 75% had experienced impostor syndrome at some point in their career

- 81% of these woman also believed they put more pressure on themselves than their male counterparts

Though progress has been made, lack of diversity at the C-suite level is still fueling some of these feelings. 32% of women identified with impostor syndrome because they did not know others in a similar place to them either personally or professionally.

When it came to combating feelings of self-doubt, many woman found support within their network and organizations:

- 72% said they looked to a mentor or trusted advisor for help and advice when the doubt creeps in

- 54% received support and guidance from performance managers

Actively creating a culture that supports honest conversations in the workplace is key to helping individuals slay professional self doubt.

Together, we have the opportunity to build corporate environments that foster a sense of belonging and lessen the experience of impostor syndrome for women in our workplaces.

– Laura Newinski, U.S. Deputy Chair and COO of KPMG

Business

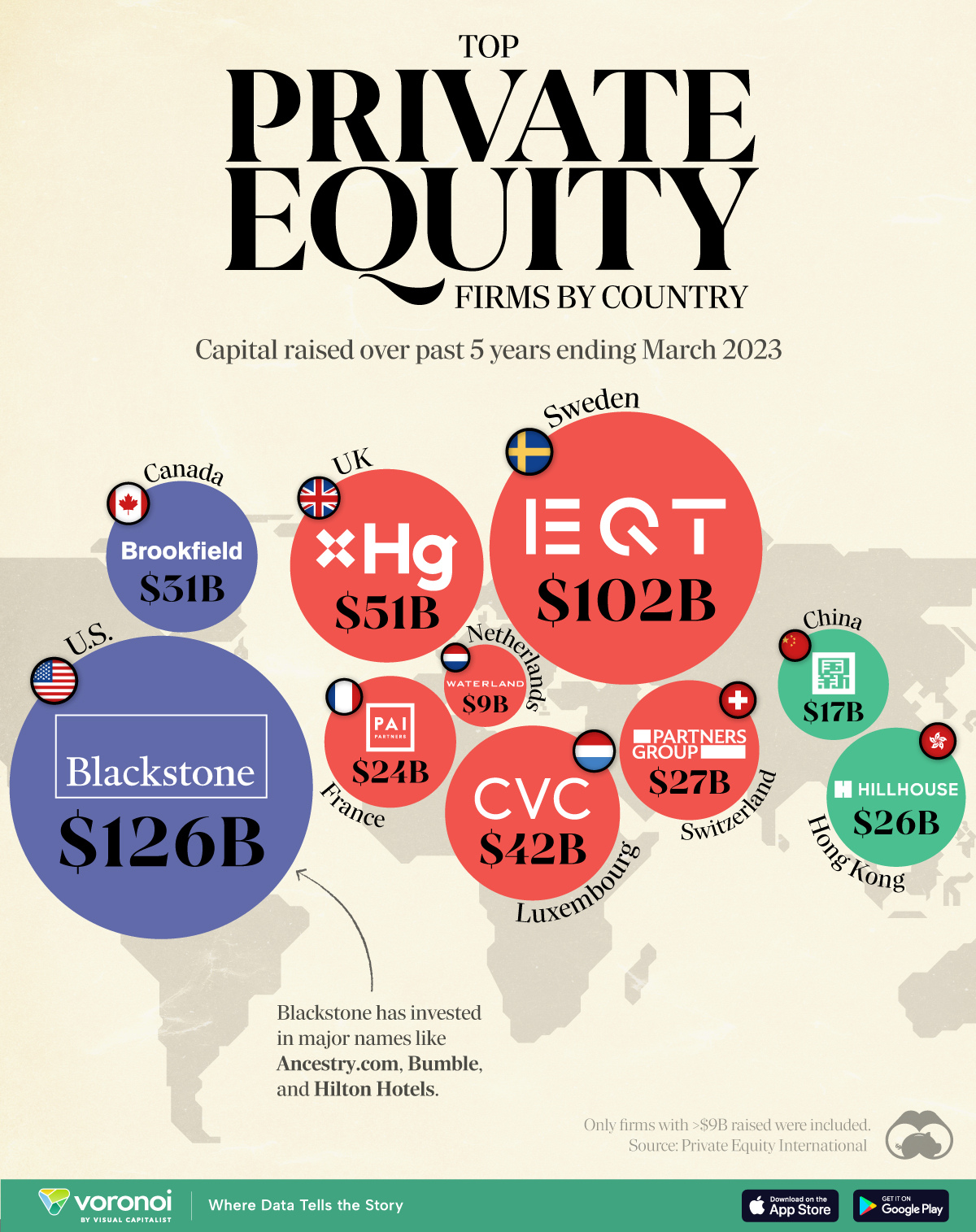

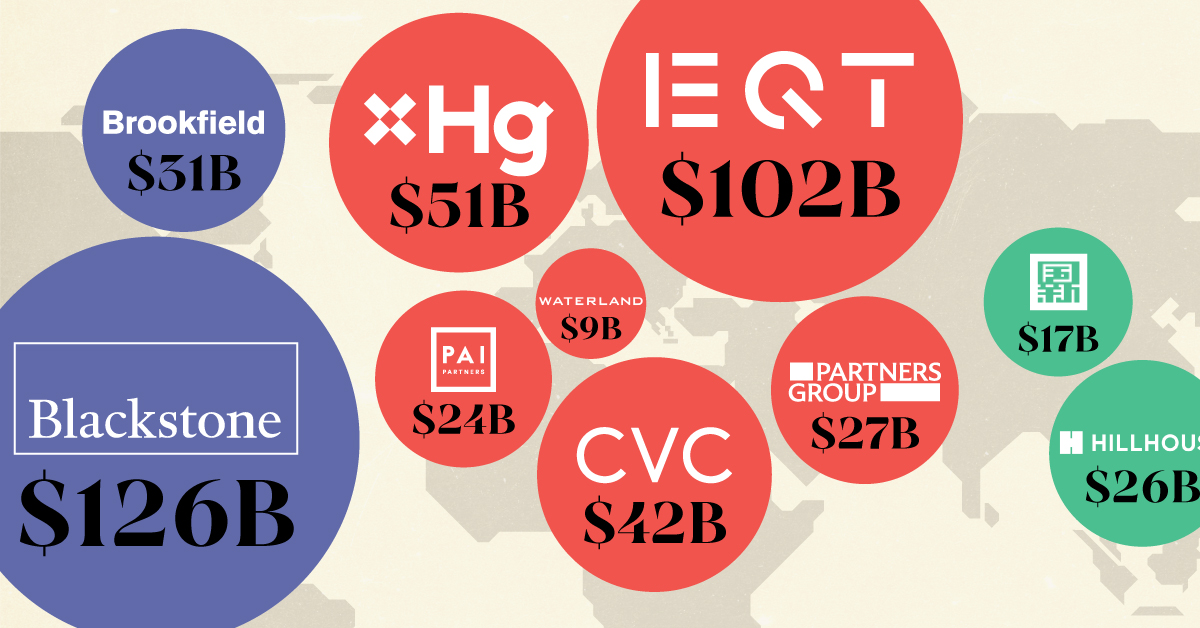

The Top Private Equity Firms by Country

This map visualizes the leading private equity firms of major countries, ranked by capital raised over the past five years.

The Top Private Equity Firms by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Private equity firms are investment management companies that pool investor capital to acquire stakes in private companies. Through strategic management, they aim to enhance the value of these companies, then profit from a future sale or public offering.

To gain insight into this industry, we’ve visualized the top private equity firms in various countries, ranked by the amount of capital they raised over the past five years ending March 2023.

The cutoff for inclusion in this graphic was $9 billion raised. All figures come from Private Equity International’s PEI 300 ranking.

Data and Highlights

The data we used to create this graphic is included in the table below.

| Country | Firm | Amount raised |

|---|---|---|

| 🇺🇸 US | Blackstone | $126B |

| 🇸🇪 Sweden | EQT | $102B |

| 🇬🇧 UK | Hg | $51B |

| 🇱🇺 Luxembourg | CVC Capital Partners | $42B |

| 🇨🇦 Canada | Brookfield Asset Management | $31B |

| 🇨🇭 Switzerland | Partners Group | $27B |

| 🇭🇰 Hong Kong | Hillhouse Capital Group | $26B |

| 🇫🇷 France | PAI Partners | $24B |

| 🇨🇳 China | China Reform Fund Management Corp | $17B |

| 🇳🇱 Netherlands | Waterland Private Equity | $9B |

U.S.-based Blackstone is the world’s largest private equity firm, with operations in additional areas like credit, infrastructure, and insurance.

While not shown in this graphic, the U.S. largely dominates the private equity landscape. If we were to rank the top 10 private equity firms by the same metric (capital raised over past five years), U.S. firms would account for eight of them.

More About Blackstone

Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman, both former Lehman Brothers employees.

Notably investments that Blackstone has made include Ancestry.com, where it acquired a majority stake for nearly $5 billion in 2020.

In 2007, it also acquired Hilton Worldwide (one of the world’s biggest hotel operators) for roughly $26 billion.

Sweden’s EQT

EQT is Sweden’s largest private equity firm, and third largest globally. It is just one of three firms that have raised over $100B in capital over the past five years alongside Blackstone and KKR (also American).

EQT made news earlier this year when it raised $24B in two years for its EQT X private equity fund, which invests in the healthcare, technology and tech-enabled service sectors.

If you found this post interesting, check out this graphic that visualizes the most common types of investments that financial advisors use with their clients.

-

Economy7 days ago

Economy7 days agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Energy2 weeks ago

Energy2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?