Technology

A Visual Guide to Profile Picture NFTs

A Visual Guide to Profile Picture NFTs

How do you represent yourself on social media? For most people it’s a selfie, a photo with their friends, or a picture of their pet—but what about a digitally-created character?

Profile picture NFTs are pieces of digital artwork that people use to express themselves online. Each item is a depiction of a character’s face, and has a unique mix of attributes that gives it a sense of collectability.

Like other NFTs, they’re secured on a blockchain and can be bought and sold for cryptocurrency. And while there’s nothing to stop you from screenshotting an NFT and using it for your own profile, the market for these items continues to grow.

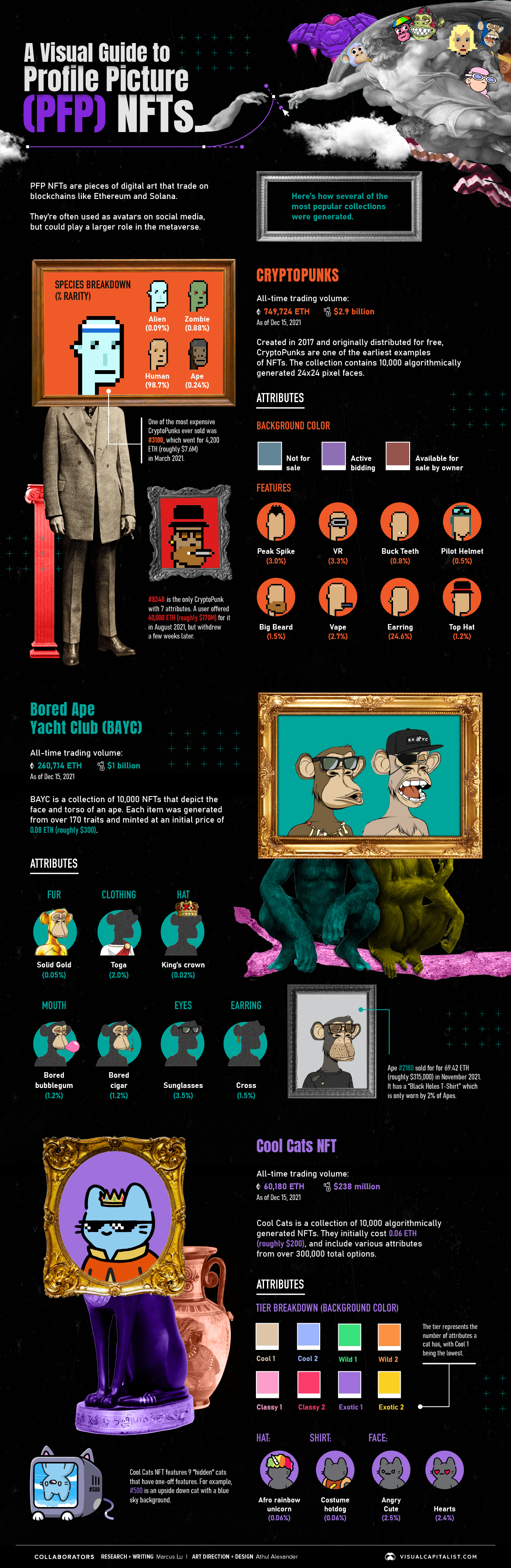

To learn more, this infographic explains how three well-known profile picture NFT collections were created.

CryptoPunks

CryptoPunks are commonly regarded as one of the first examples of NFTs. The collection consists of 10,000 unique “punks” and was released in 2017 by Larva Labs.

One interesting fact is that these NFTs were originally given out for free—today, they are worth thousands or millions of dollars each. According to OpenSea, one of the largest NFT marketplaces, CryptoPunk #3100 was sold for 4,200 Ethereum (roughly $7.6 million) in March 2021.

A large component of #3100’s perceived value is its blue alien skin, which only eight other punks have. In other words, it’s incredibly rare. The following table shows the species distribution of the CryptoPunks collection.

| Species | % Rarity |

|---|---|

| Human | 98.7% |

| Zombie | 0.88% |

| Ape | 0.24% |

| Alien | 0.09% |

In addition to species, each punk features a unique mix of facial accessories or “attributes”. Examples include a big beard (found in only 146 punks), and a VR headset (found in 332 punks).

Bored Ape Yacht Club

Next is the Bored Ape Yacht Club (BAYC), another collection of 10,000 unique profile picture NFTs. Unlike CryptoPunks, BAYC NFTs show both the head and torso of a character (in this case, an ape).

This opens up many combinations of clothing items, facial features, and accessories. Altogether, there are seven categories of attributes: Background color, Clothes, Earring, Eyes, Fur, Hat, and Mouth.

The following table lists some examples of BAYC attributes, and their % rarity. To explore further, visit the BAYC gallery.

| Attribute Category | Attribute Name | % Rarity |

|---|---|---|

| Fur | Solid Gold | 0.05% |

| Fur | White | 3.9% |

| Hat | King's Crown | 0.02% |

| Hat | Stuntman Helmet | 1.6% |

BAYC NFTs also grant access to members-only benefits. This includes access to a collaborative graffiti board, as well as other NFTs from spin-off collections like the Bored Ape Kennel Club (BAKC). As its name suggests, the BAKC is a collection of dogs, rather than apes.

Cool Cats NFT

The last collection is Cool Cats NFT, which again amounts to 10,000 images. Cool Cats were minted at a cost of 0.06 Ethereum each, or roughly $200. The act of “minting” an NFT is similar to when metal coins are entered into circulation.

Each Cool Cat NFT is a depiction of a cartoon cat with a varying number of facial features, hats, and shirts. Altogether, there are over 300,000 possible options that could be included.

This collection also features nine “hidden” cats which boast one-off features. #500 is an upside down cat floating in a blue sky background, while #2288 is simply a skeleton.

Building Your Identity in the Metaverse

A criticism of today’s social media is that there’s little room to express yourself.

Think back, for a moment, to the days of MySpace. Users could spend hours customizing their profile page, adding music, art, and whatever else they felt was an expression of themselves. As the platform’s name implied, it was a space that belonged to you.

The metaverse offers something similar. To take part in a virtual universe, you need an avatar—a digital manifestation of yourself. Avatars will be highly customizable and far less constrained by the limitations of the real world.

If you’re having trouble imagining this, check out VR Chat, a virtual reality game where players socialize as aliens, monsters, and other “interesting” beings.

This may help to explain the recent craze around profile picture NFTs. When the metaverse arrives, these NFTs could become a user’s avatar. After all, who wouldn’t want to have blue alien skin?

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries