Technology

The Companies that Defined 2021

The Companies that Defined 2021

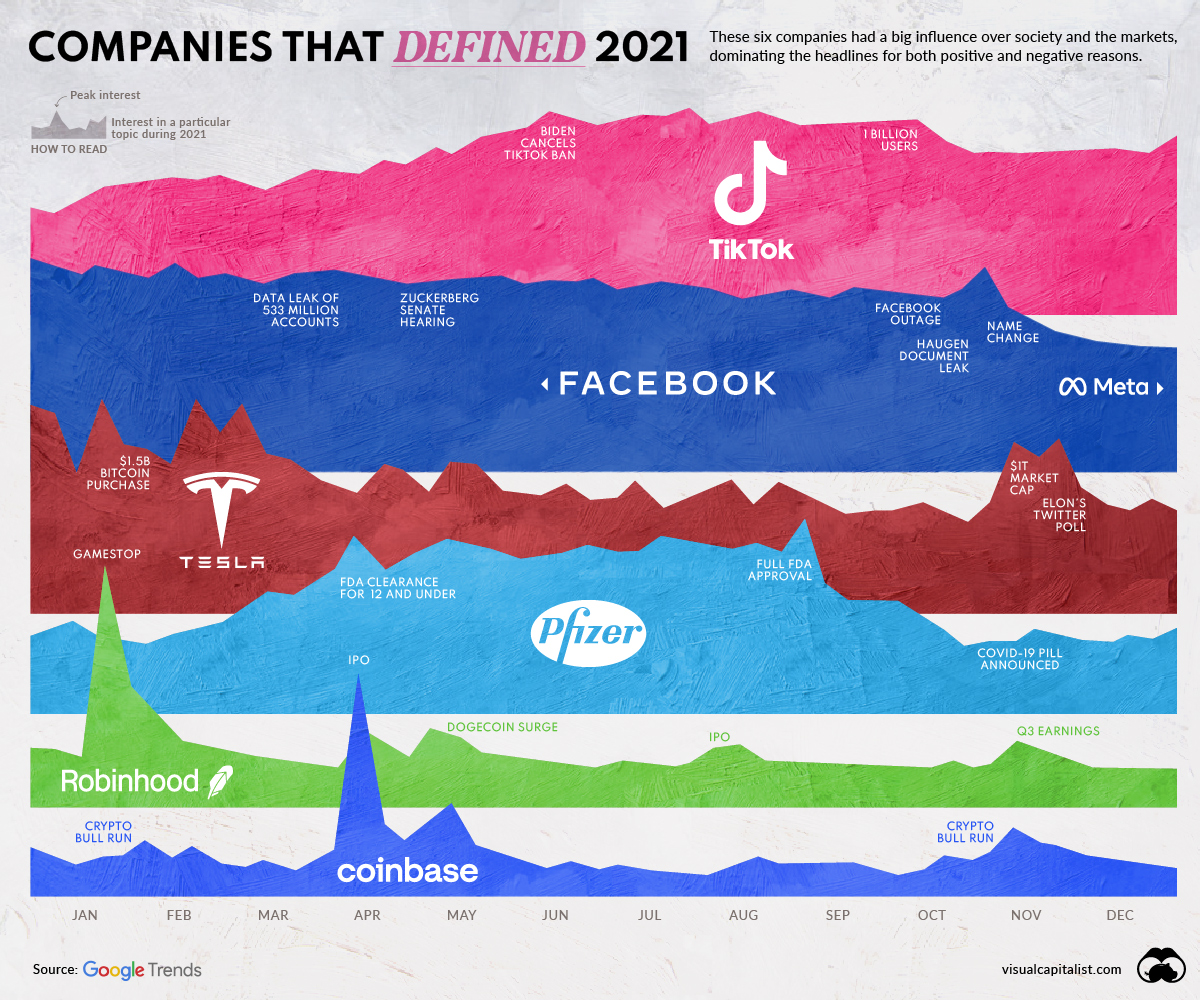

Attention is an increasingly valuable form of currency in the Information Age.

In 2021, a handful of companies stood out from the pack, dominating the conversation and influencing society in both positive and negative ways. After vigorous internal debate, here is Visual Capitalist’s list of companies that defined 2021:

- Robinhood

- Pfizer

- Coinbase

- Tesla

- TikTok

- Facebook/Meta

We looked at a number of metrics to select these companies, including Google search and news volume, performance relative to competitors, industry-specific indicators, and more.

Many of these are digital companies, and all have massive reach, scale, and influence. Interestingly, many of these companies also faced controversies along with their success, and were caught up in movements that were bigger than themselves.

With this context in mind, let’s dive in.

Robinhood

Robinhood’s eventful year reached its peak when the stock trading app was caught in a frenzy involving retail traders, short sellers, and “meme stonks”. It did not take long for Robinhood to go from hero to villain in this story. As the Gamestop stock shot up past $400, trading was halted and position limits were initiated on the app.

As well, Robinhood’s stated goal of democratizing finance came under scrutiny due to their pay-for-order-flow business model, where sensitive user trade activity data is sold to the highest bidder who then gets ahead of the trade, otherwise known as “front-running”.

Despite the controversy, Robinhood’s platform now has over 22 million users, many of whom are younger, first-time investors. While they have key attractions like zero commission trades, they were also accused of gamifying investing with features like confetti shooting across the screen after a trade is made (a feature that was removed after media criticism).

The company frequently made front page financial news in early 2021, and while the often negative press didn’t get in the way of their IPO—which commenced in late July—it has affected investor sentiment. Since their 52-week high of $70 per share in August, the stock has fallen some 70% towards the $18 range.

Furthermore, the SEC is rumored to be launching an investigation into them. With these headwinds, investing on Robinhood has probably fared better so far than investing in Robinhood.

Pfizer

Perhaps there was no bigger story in 2021 than COVID-19 vaccines.

Early in the year, the race to secure vaccines was on. Wealthy countries scrambled to buy stock and roll out widespread vaccination programs ahead of spring.

And the companies that managed to produce efficient vaccines saw the biggest benefits, like pharmaceutical giant Pfizer. The company’s COVID-19 vaccine, made in partnership with German firm BioNTech, ended up becoming the world’s most-preferred vaccine to fight the pandemic.

The company is forecasting revenue of $36 billion from its vaccine this year.

Competing vaccines from Moderna and AstraZeneca also saw their parent companies rise in both market cap and newsworthiness. All of the involved pharma companies have also faced constant scrutiny, with many countries in the world struggling to secure COVID-19 vaccines, and others dealing with vaccine hesitancy.

As the pandemic continues with the Omicron variant quickly spreading around the globe, Pfizer and its competitors will continue to be impactful into the new year. The company announced a COVID-19 antiviral pill that is planned to be released in the near future, and more effective vaccines and boosters against other variants are still a hot commodity.

Coinbase

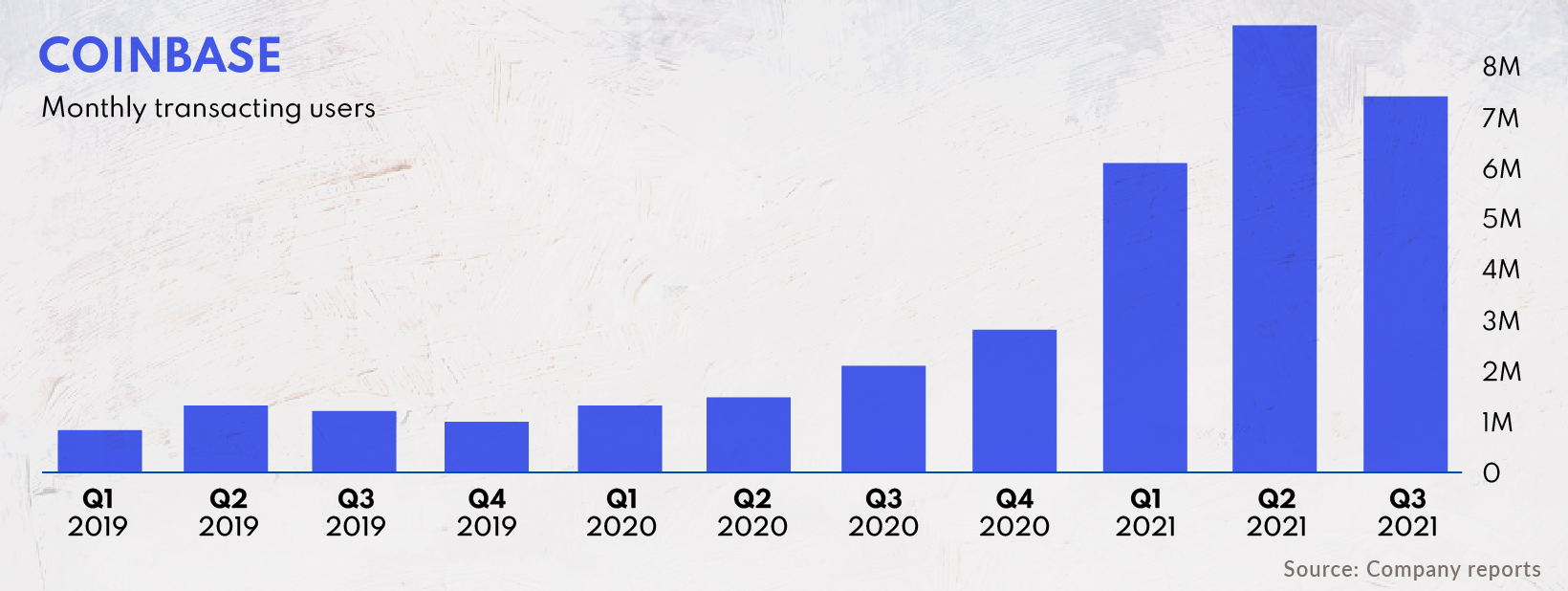

2021 was a pivotal year for cryptocurrency. Prices reached new highs, and institutions and retail investors alike poured into the market.

With its user-friendly app and focus on security, Coinbase was well positioned to benefit from this surge in interest. The exchange started off the year by more than doubling its transacting user base as Bitcoin prices shot to new heights.

It’s easy to underestimate the influence of the company’s IPO—especially as its share price slid as the crypto market cooled off—but the exchange’s very entry into the public markets was a huge boost in legitimacy for crypto, paving the way for similar companies to IPO in the future.

Tesla

Nobody captures attention and creates controversy quite like Tesla’s CEO, Elon Musk.

Most of Tesla’s actions are tied closely to the famous entrepreneur, who’s known for his brazen online presence. Musk’s social media persona is so strong, one tweet can send Tesla’s stock plummeting, like it did last year after Musk told Twitter that “Tesla’s stock is too high imo.”

While naysayers are quick to criticize Tesla and Musk, the company has some impressive numbers to back up its hype. 2020 was already a ridiculous year for Tesla—its stock surged by nearly 700%, and with a valuation of $630 billion, it became one of the most valuable companies in the world.

This momentum carried over into 2021. This year, revenue rose each quarter, and in October, the company’s market value surpassed $1 trillion.

Tesla was also intertwined within other societal narratives over the course of the year. The automaker’s move from California to Texas was part of a larger conversation about the “Bay Area exodus”, as jurisdictions in Texas and Florida looked to steal Silicon Valley’s thunder.

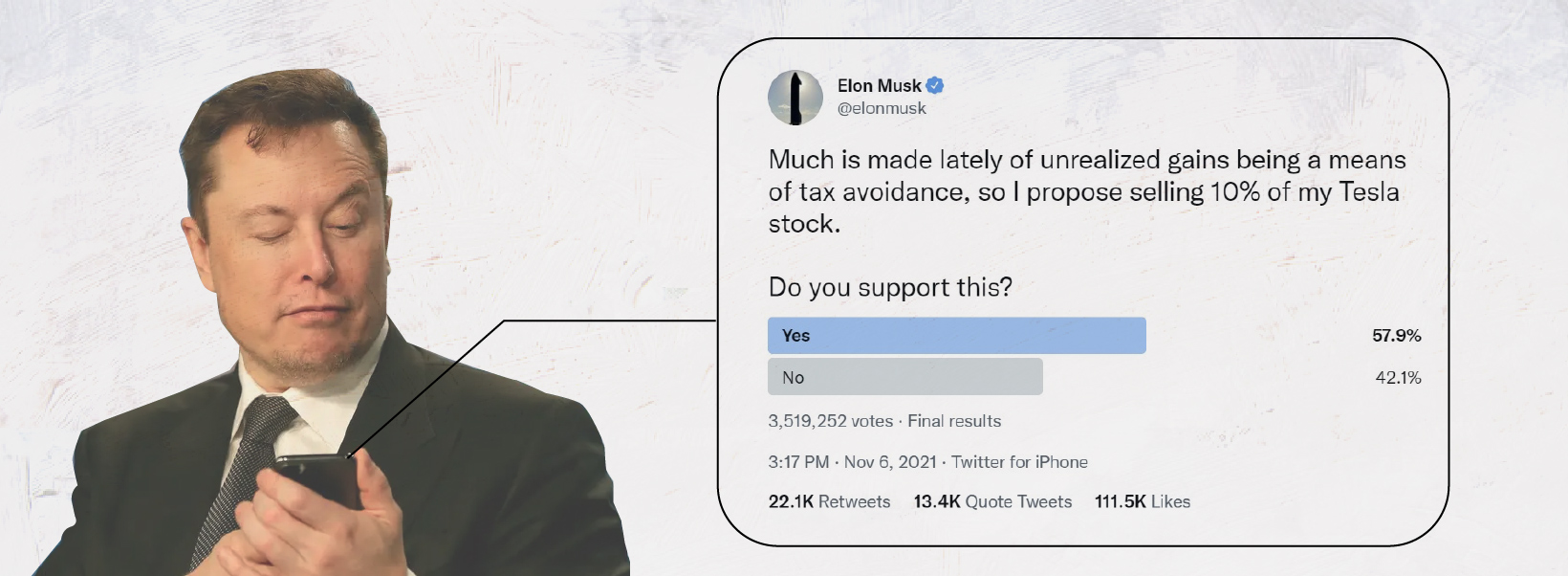

Musk’s Tesla stock sales generated a lot of buzz in Q4 as well.

Seemingly in response to criticism over inequality and tax avoidance, Musk ran a Twitter poll to decide whether or not to sell a significant portion of his Tesla holdings. After a majority “yes” vote, the Tesla CEO now appears to have sold off enough stock to hold up his end of the bargain.

TikTok

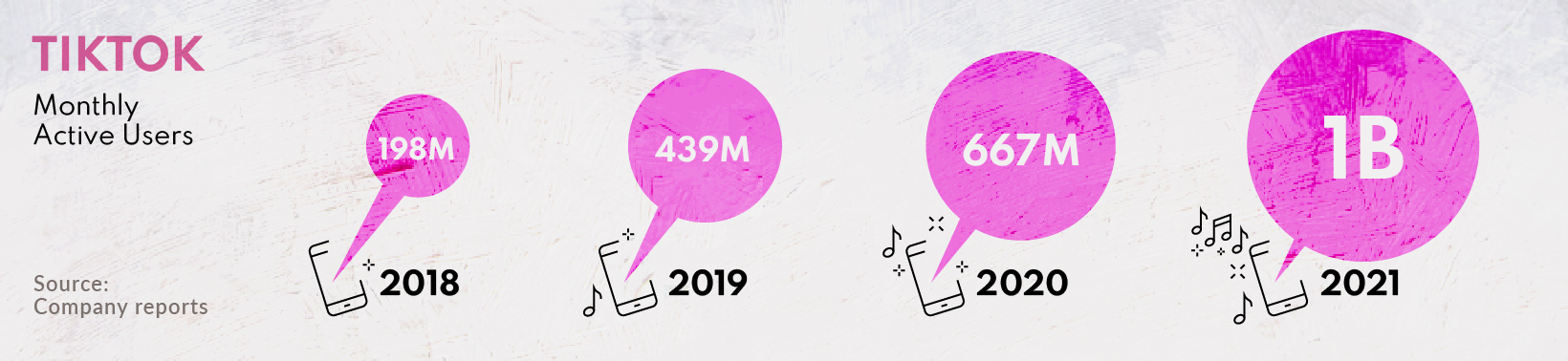

TikTok was already popular in 2020, but this year truly solidified its status as a cultural phenomenon.

The app topped a billion users in 2021, just five years after its launch in 2016. For context, it took Facebook and Instagram nearly eight years to hit that same milestone.

What’s so appealing about TikTok? Experts have many theories, but in an interview with Forbes, John Holdridge, GM of Fullscreen, puts its simply: “TikTok’s success can be attributed to how it flips what we think of as social media on its head, while at the same time returning us all to roots of the original appeal–the ability to go viral.”

TikTok’s short-style video format has become so popular that it’s inspired a slew of copycat apps, especially in regions like India where TikTok is banned.

Even established companies like Meta have tried to mimic TikTok’s success. In 2020, Instagram launched “reels,” its own short-form video feature where users can create and share 30 second videos. But Instagram reels failed to overtake TikTok’s growth—instead, reels has become a place for users to share and promote their TikTok videos.

Facebook/Meta

Facebook frequently finds itself in the news, given its status as the world’s largest social network. In 2021, however, it was for two different reasons.

The first was the U.S. Capitol Riot on January 6, 2021. In the aftermath of this event, many blamed Facebook for not doing enough to mitigate the negative effects of its platform—mainly polarization, conspiracy theories, and hate speech.

The controversy reached its peak in September 2021, when internal files leaked by whistleblower Frances Haugen were published. These documents exposed Facebook’s internal struggles with combating misinformation, as well as employee dissent.

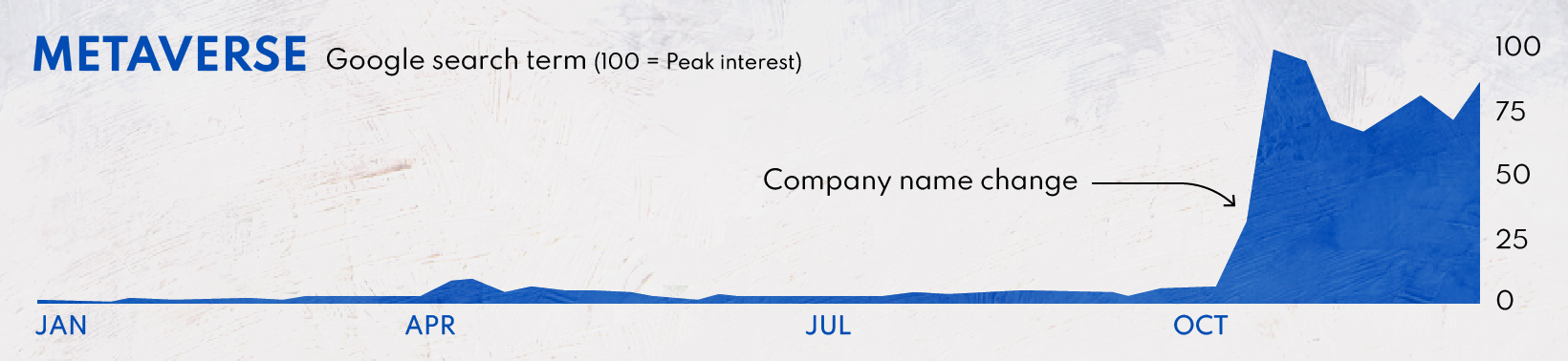

Ultimately, Facebook weathered the storm and opted to shed its baggage with a new name. Not only does this help the company disassociate from its previous scandals, it also lines up with Mark Zuckerberg’s ambitions of pioneering the metaverse.

Following the announcement, “metaverse” exploded overnight and became one of the hottest topics of 2021. The word “Meta” has also become incredibly valuable—Meta (the company) recently completed a $60 million deal to acquire the trademark assets of Meta Financial Group, a regional U.S. bank.

Honorable Mentions

While the companies highlighted above were undeniably influential in 2021, any list like this is bound to be subjective and open to debate. Here is a shortlist of other companies that we considered for the Companies that Defined 2021 list:

The surge in investment that propelled Robinhood and Coinbase to new heights was partially fueled by communities on Reddit. One of the most fascinating moments of the year came when Reddit user u/deepfuckingvalue appeared before the House Committee on Financial Services proclaiming, “I am not a cat” and “I like the stock”.

On the business front, the “Front Page of the Internet” saw double-digit user growth during the pandemic, and now has a valuation of $10 billion after a hefty round of funding.

OpenSea

NFTs had a Cambrian explosion alongside the crypto bull run, with OpenSea emerging as the dominant marketplace this past year. In the second half of 2021, OpenSea made up 95% of NFT trading volume on major marketplaces, and has transacted $1.42B in volume in December so far.

While it seemed OpenSea was planning an IPO after their CFO Brian Roberts commented how “you’d be foolish not to think about it [OpenSea] going public,” user backlash resulted in Roberts later tweeting that the company is not actively planning an IPO. Whether or not OpenSea does set sail onto the public markets, they’ll soon have some serious competition from Coinbase’s own NFT marketplace currently in the works.

Netflix

Despite intense competition from rival streaming platforms, Netflix will finish the year on top once again. The company has a number of impressive tallies in the win column this year.

First, Squid Game was a cultural phenomenon, quickly becoming the streaming service’s number one show, and also the world’s most Googled TV show of 2021.

Next, Netflix’s Red Notice is likely the most watched new movie of 2021, logging well over 300 million hours of viewing time. Not bad, considering its tepid score of 36% on Rotten Tomatoes. It remains to be seen whether deep-pocketed competitors like Disney+ are able to dethrone Netflix, but for now, the company is as culturally relevant as ever.

SpaceX

The fact that Elon Musk has two companies in this conversation points to why he was named Time’s Most Influential Person for 2021.

SpaceX has made launching rockets drastically cheaper in recent years, which helps explain its massive reported valuation of $200 billion. The company, which is the top commercial launch provider in the U.S., will round out the year with 31 launches.

Which companies would you add to this list?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Business2 weeks ago

Business2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.