Technology

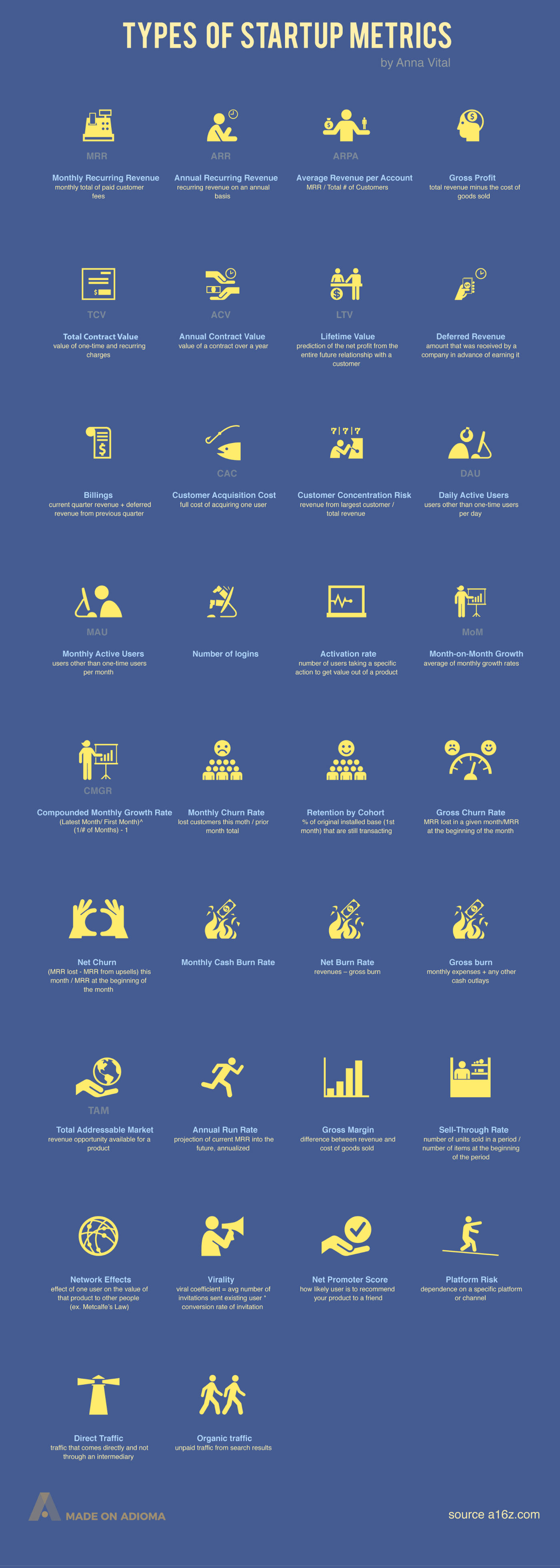

34 Startup Metrics for Tech Entrepreneurs

Courtesy of: Funders and Founders

34 Startup Metrics That Tech Entrepreneurs Need to Know

Today’s infographic comes from Funders and Founders and information designer Anna Vital, and it lists the important metrics to gauge traction and success of new startups.

Several years ago, a key challenge with launching a new tech startup venture was that there weren’t many precedents to follow.

- How do you scale a company?

- How do you measure growth and costs in a more meaningful way?

- Does the company have real traction?

Of course, there were knowledgeable people in the tech ecosystem that knew these things – for example, venture capitalists and ex-founders that had been successful with previous ventures – but they were tough to gain access to, and many of their theories and best practices weren’t yet widespread.

Fast forward to today, and the practices around new startups are much more established. While this can be a blessing and a curse to new founders, at least a more standardized set of metrics helps to give founders a sense of where their company stands.

Key Startup Metrics, According to VCs

The infographic from Funders and Founders lists 34 startup metrics for founders to know – but which one should be a focus for new ventures?

Here’s what three bigtime VCs have said about the startup metrics that they consider to be most important at early stages:

“Month-over-Month Organic Growth”

For most companies, MoM organic growth is a very useful metric and depending on the base, 20–50% MoM growth can be good. Retention, referral, and churn are all things we look at, too.

– Aileen Lee, Cowboy Ventures

According to Aileen Lee, who originally came up with the “unicorn” term, organic growth is a particularly useful metric.

On the other hand, Bill Gurley of Benchmark says that monitoring conversions is a comprehensive metric that is a good proxy for several key business areas.

“Conversion Rate”

No other metric so holistically captures as many critical aspects of a web site – user design, usability, performance, convenience, ad effectiveness, net promoter score, customer satisfaction – all in a single measurement.

– Bill Gurley, Benchmark

Paul Graham, of Y Combinator fame, says that the metric depends on the stage. If you have revenue, then revenue growth is the metric you want. If you’re not there yet, user growth is a good proxy.

“Revenue Growth or Active Users”

The best thing to measure the growth rate of is revenue. The next best, for startups that aren’t charging initially, is active users. That’s a reasonable proxy for revenue growth because whenever the startup does start trying to make money, their revenues will probably be a constant multiple of active users.

– Paul Graham, VC and co-founder of Y Combinator

It should also be noted that the most relevant metric to you depends on your business model. For example, MRR (Monthly recurring revenue) and churn rates would be particularly important to SaaS (Software-as-a-service) startups, while MAUs (Monthly active users) and organic traffic may be more important measurements for online media companies.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023