Technology

Chart: Fintech Investment in 2016

Chart: Fintech Investment in 2016

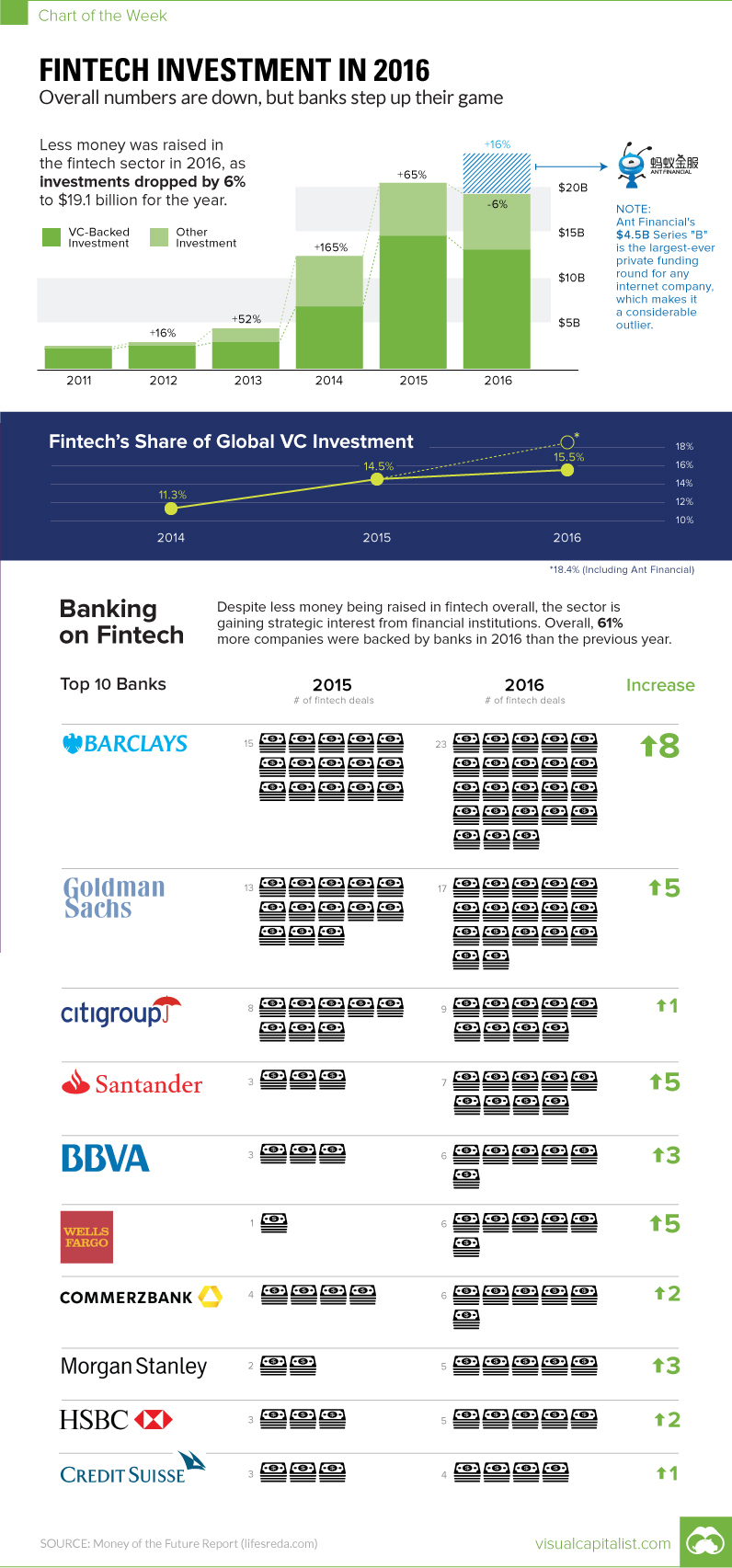

Overall numbers are down, but banks step up their game

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

According to a new report by Singapore-based venture capital firm Life.SREDA, last year was a mixed bag for fintech.

On the one hand, the Money of the Future Report pegs 2016 as the first year to have an overall decrease in fintech funding after taking into account any outliers. By their calculations, dealflow slowed in the last couple of quarters of the year, while the amount of funding flowing into fintech fell 6% to $19.1 billion.

On the other hand, the one deal that was considered an outlier was a big one: Alibaba affiliate Ant Financial, the world’s second-largest unicorn (behind Uber), raised a Series B of $4.5 billion in early 2016. That’s the largest ever fundraising round for a private tech company.

Further, for the deals that were done in 2016, one could say there was an element of quality over quantity. Established financial institutions are no longer sitting on the sidelines for fintech – in fact, banks have increased the number of investments in VC-backed fintech companies by 61% since the previous year.

Who’s Banking on Fintech?

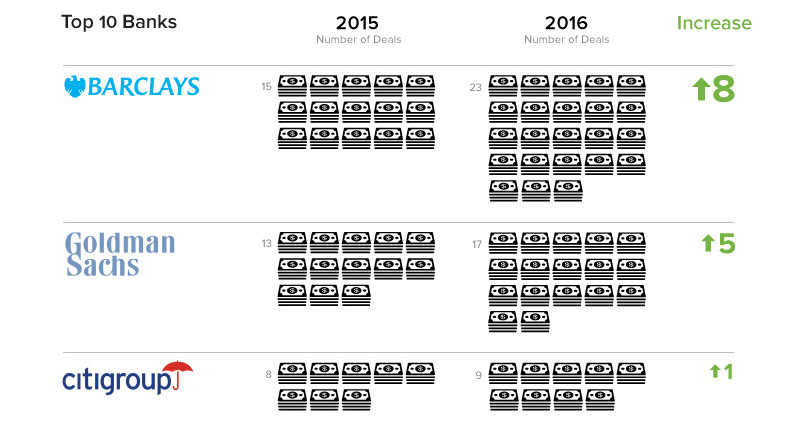

Some banks are more active than others.

JP Morgan, at one end of the spectrum, only booked three fintech deals last year, which is the same as they did for 2015.

Companies like Barclays and Goldman Sachs have more of a shotgun approach: get in on as many fintech companies as possible. Barclays invested in 23 deals in 2016 for a 53% increase in activity, while Goldman got in on 17 deals for a 31% bump in activity.

Partnerships and product integrations, accelerators and innovative labs, direct investments and venture debts, corporate VCs and fund-of-fund investments — banks started to use all available mechanisms in order not too lose in the digital war with the new hungry players.

Even though Barclays and Goldman Sachs are both heavy investors in the space, each has a different rationale behind their tactics. Goldman Sachs invests in fintech startups solely with expectations of a financial return, while Barclays and banks such as BBVA are looking for more strategic investments that can also enhance their core businesses.

Regardless of the differing tactics and rationales, it looks like banks are officially in the tech game for good. The question is: can hulking, conservative institutions like banks be agile enough to make use of these upcoming investments – and will they pay off?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?