Technology

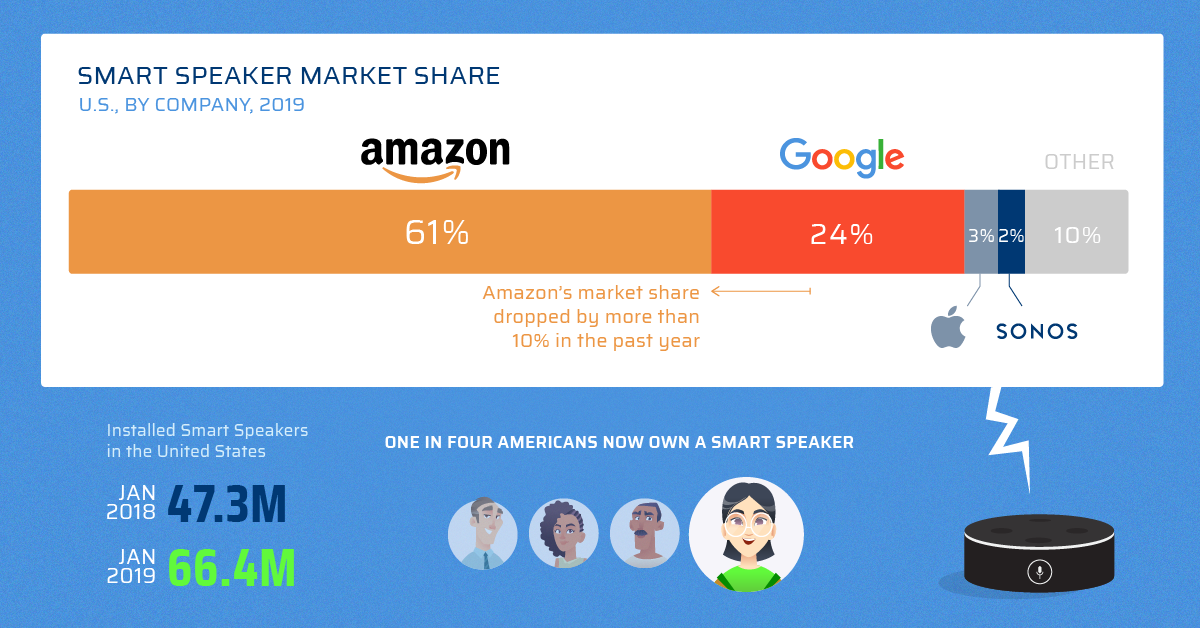

The Fight for Smart Speaker Market Share

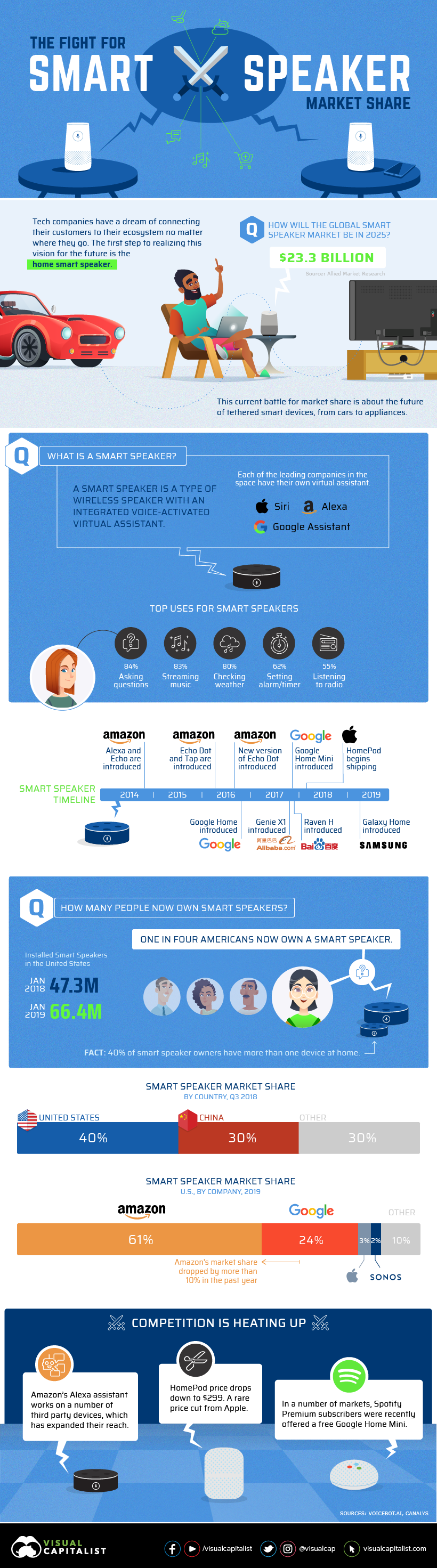

Tech companies are betting that the future of personal computing will be driven by the sound of your voice.

If they’re right, this early stage of smart speaker adoption will have a massive impact on future profits. Switching smartphone brands is relatively straightforward, but switching an entire voice assistant ecosystem? That’s not quite as easy.

Voice Assistants like Siri and Alexa will transform behavior inside the home. At the center of that behavior is a smart speaker, serving as the hub of a connected lifestyle.

– Andy Chambers, Vice President of Connected Home, Assurant

Today’s infographic is an overview of the rapidly expanding smart speaker market, and how the major players in the space are competing for critical early market share.

Moving towards Majority

Adoption of smart speakers really began to gain traction with consumers in 2018, when the percentage of American adults with such a device passed the 20% mark. Today, the U.S. adoption rate sits at about 25%, and by 2022, it’s expected to more than double to 55%.

In just one year, China’s global share of the smart speaker market went from almost zero to 30%, and the country’s smart home market was valued at over $7 billion. Companies like Baidu and Alibaba are fighting their own battle for domestic market share.

Amazon’s Head Start

It has now been almost five years since Amazon announced Alexa and the Echo to the world, kicking off the age of the smart speaker.

The sting of Amazon’s failed foray into the smartphone market was still fresh, and the initial reaction to a device listening inside the home was mixed. That said, Amazon’s huge built-in customer base and two-year head start was enough to bag a hefty portion of the smart speaker market. Now, other brands are playing catch-up.

Here’s a look at U.S. smart speaker market share by device:

| Company | Device | Voice Assistant | Market Share |

|---|---|---|---|

| Amazon | Echo Dot | Alexa | 31.4% |

| Amazon | Echo or Plus | Alexa | 23.2% |

| Home | Google Assistant | 11.2% | |

| Home Mini | Google Assistant | 11.2% | |

| Amazon | Echo Spot | Alexa | 3.5% |

| Amazon | Echo Show | Alexa | 3.0% |

| Apple | HomePod | Siri | 2.7% |

| Sonos | One | Alexa | 2.2% |

| Home Hub | Google Assistant | 1.2% | |

| Home Max | Google Assistant | 0.2% |

The Fight is Heating Up

Companies are responding to Amazon’s market dominance in different ways.

Apple recently dropped the price of its HomePod smart speaker to $299, a rare price cut for a company that is used to people lining up to buy its products. Unlike its competitors, Apple can’t go all-in on using the device as a “loss leader” to support advertising or e-commerce. HomePod is positioned as a more premium product, but price will be a sticking point for many.

Google, on the other hand, is taking a drastically different approach. The company released the Google Home Mini as a cost effective entry point for consumers looking to try out a voice-directed device.

As well, Google partnered with Spotify to offer Home Minis as a free promotion for Spotify Premium customers. Spotify’s premium userbase is nearly 90 million, so if even a fraction of users take the free offer, a massive influx of Google smart speakers will enter the market.

Over the last year, Amazon saw over 10% of its market share chipped away by competitors, and Google accounted for about half of that loss.

What’s Next? It’s Hard to Say

With the promise of future connected home profits on the line, it’s hard to say what lengths companies will go to outmanoeuver each other. One thing is clear though, the overall smart speaker market is still in the midst of a major growth cycle, and we’re just seeing the beginning of what’s possible with voice-directed devices.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries