Technology

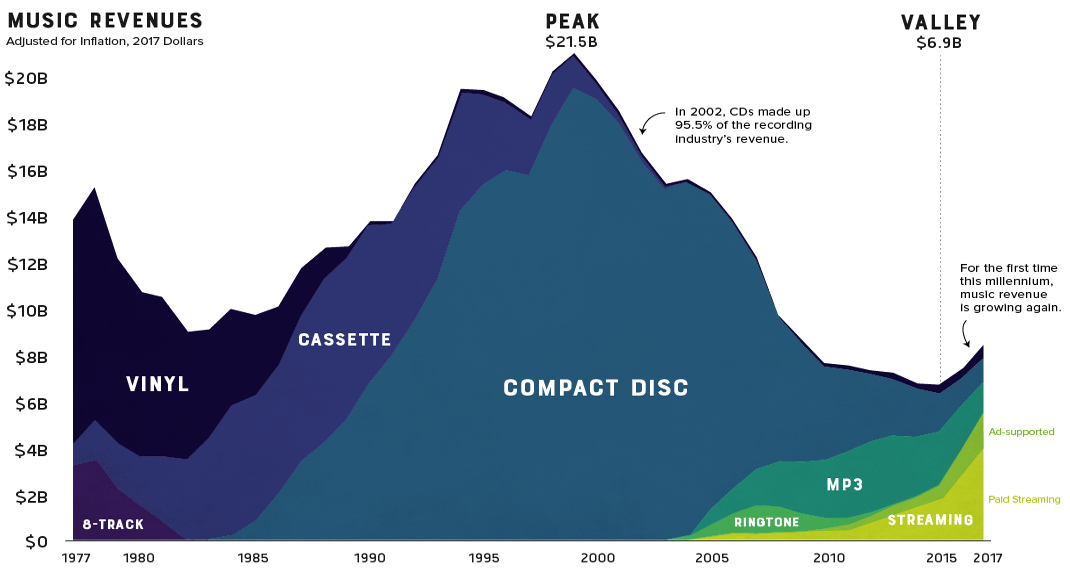

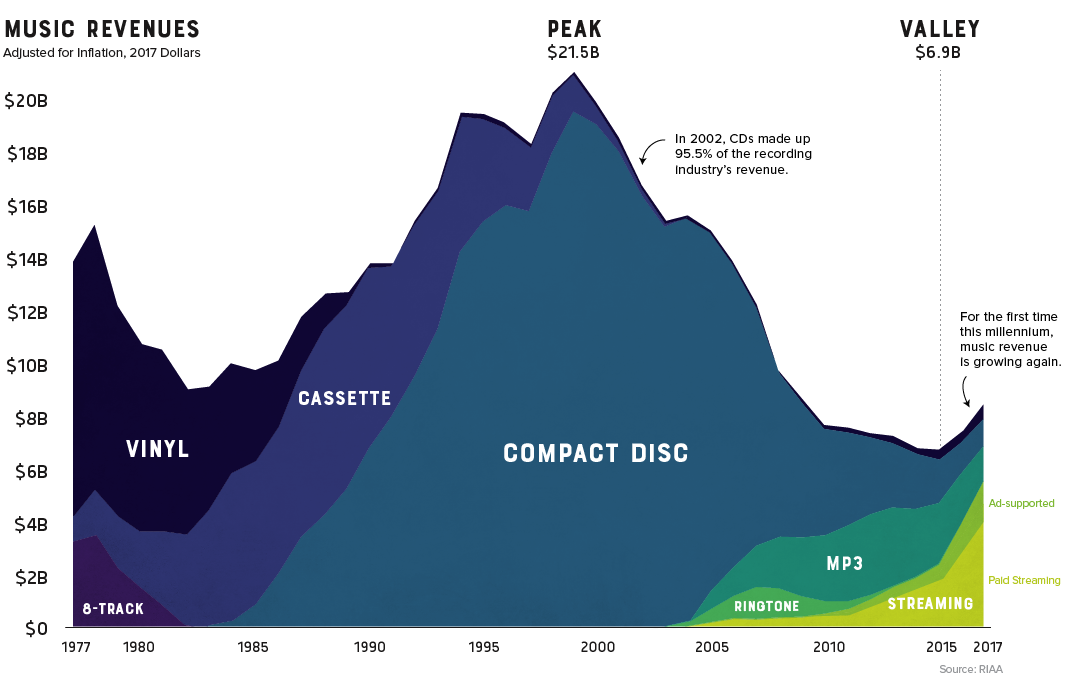

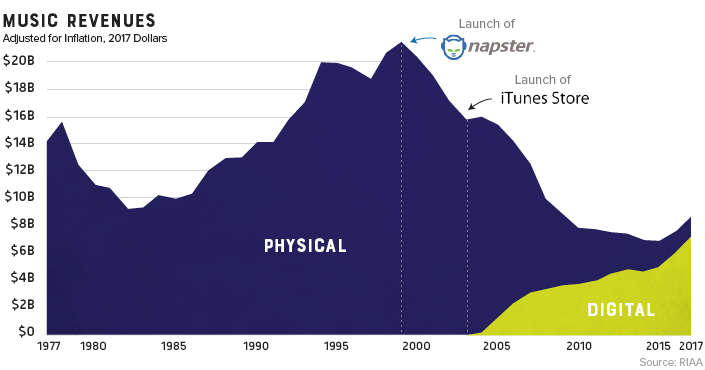

Visualizing 40 Years of Music Industry Sales

40 Years of Music Industry Sales

The record industry has seen a lot of change over the years.

8-tracks took a short-lived run at the dominance of vinyl, cassettes faded away as compact discs took the world by storm, and through it all, the music industry saw its revenue continue to climb. That is, until it was digitally disrupted.

Looking back at four decades of U.S. music industry sales data is a fascinating exercise as it charts not only the rise and fall the record company profits, but seismic shifts in technology and consumer behavior as well.

The Long Fade Out

For people of a certain age group, early memories of acquiring new music are inexorably linked to piracy. Going to the store and purchasing a $20 disc wasn’t even a part of the thought process. Napster, the first widely used P2P service, figuratively skipped the needle off the record and ended years of impressive profitability in the recording industry.

Napster was shut down in 2002, but the genie was already out of the bottle. Piracy’s effect on the industry was immediate and stark. Music industry sales, which had been experiencing impressive year-over-year growth, began a decline that would continue for 15 years.

The Ringtone Era

While acquiring music was as easy opening Limewire on your desktop computer, transferring that new T-Pain track to a flip-phone wasn’t a seamless experience.

This brief gap in technology – before smartphones hit mass adoption – brought us the ringtone era. Distribution was controlled by mobile carriers, so ringtones were a comfortable gateway for the record industry to get a taste for digital-based revenue. In 2008 alone, they injected over a billion dollars of revenue into an industry that was getting used to gloomy forecasts.

Paddling Upstream

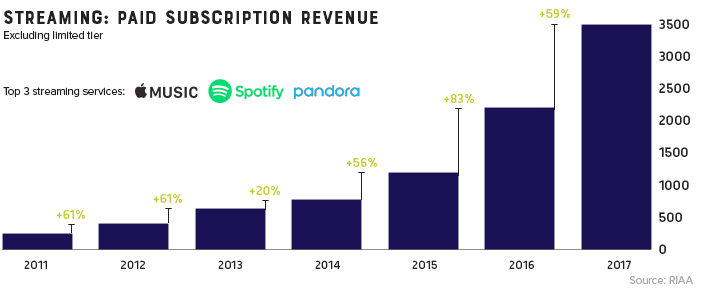

Though services like Spotify and Pandora haven’t replaced the money pipeline that CD sales provided, they have reversed the industry’s tailspin. For the first time this millennium, record industry posted an increase in revenue for two consecutive years (and likely a third in 2018).

It took a while for consumers to warm up to paying for a premium music subscription, but today, there’s a solid basis for optimism. Music streaming is now the most common format for music in the United States, and the RIAA reports that streaming now makes up nearly half of the market.

The End of Physical Format?

Gone are the days when people would line up at the music shop for a hot new release. In fact, CD sales are down 80% in the past decade. Today, physical format sales only account for 17% of the industry’s revenue.

There is, however, one bright spot in physical format segment: vinyl. In 2017, vinyl sales hit 25-year high after making a slow and steady comeback.

Vinyl is written in stone. I think if it’s made it for 120 years now, it’s here forever.

– Jack White

Digital Transformation

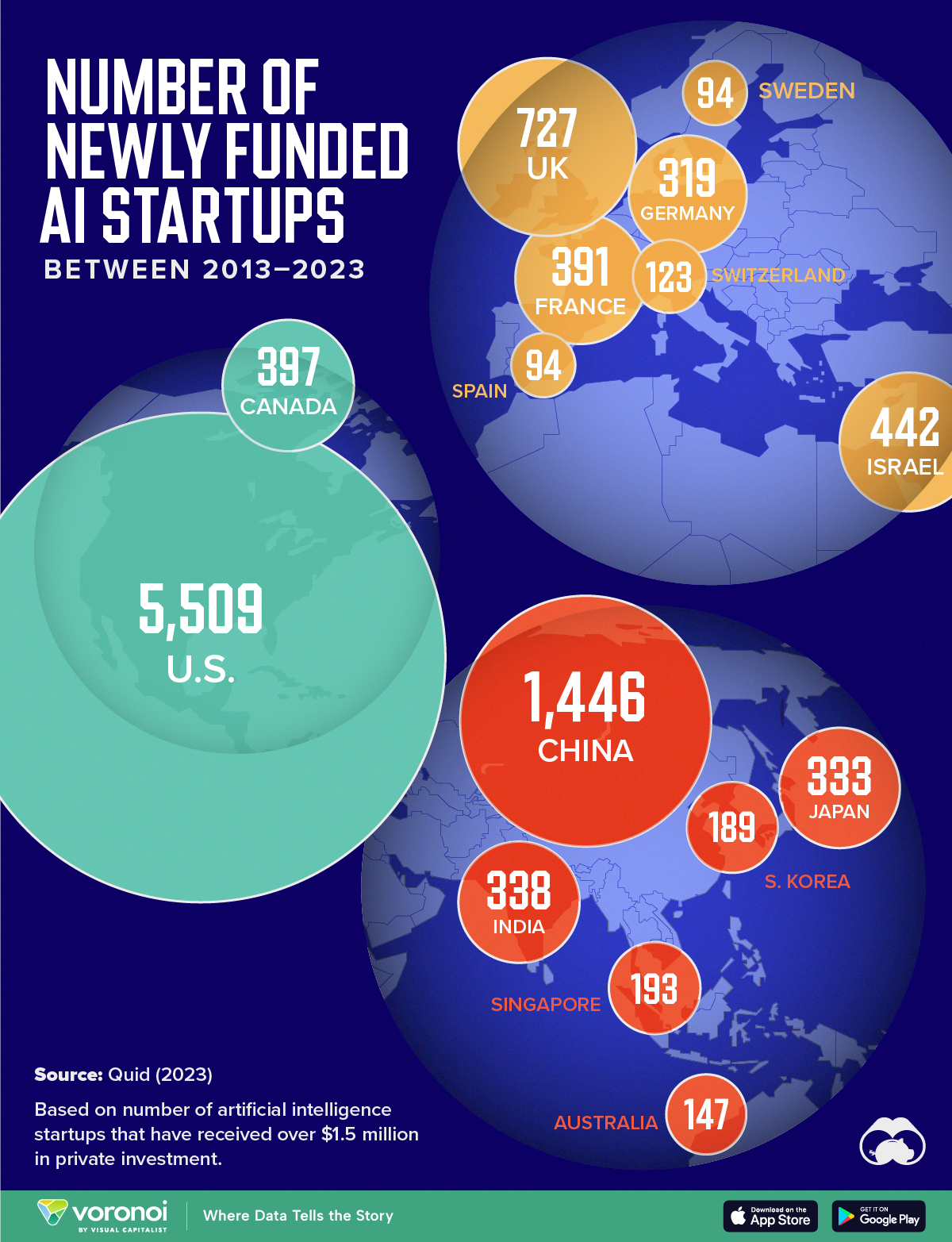

Mapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

Mapped: The Number of AI Startups By Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

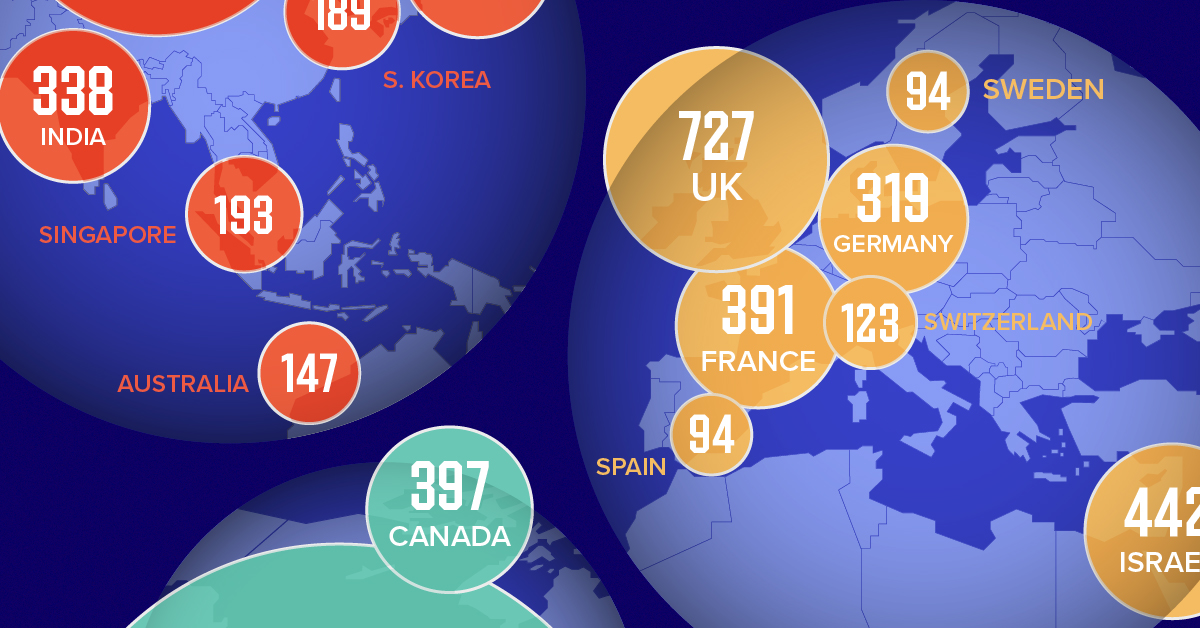

Amidst the recent expansion of artificial intelligence (AI), we’ve visualized data from Quid (accessed via Stanford’s 2024 AI Index Report) to highlight the top 15 countries which have seen the most AI startup activity over the past decade.

The figures in this graphic represent the number of newly funded AI startups within that country, in the time period of 2013 to 2023. Only companies that received over $1.5 million in private investment were considered.

Data and Highlights

The following table lists all of the numbers featured in the above graphic.

| Rank | Geographic area | Number of newly funded AI startups (2013-2023) |

|---|---|---|

| 1 | 🇺🇸 United States | 5,509 |

| 2 | 🇨🇳 China | 1,446 |

| 3 | 🇬🇧 United Kingdom | 727 |

| 4 | 🇮🇱 Israel | 442 |

| 5 | 🇨🇦 Canada | 397 |

| 6 | 🇫🇷 France | 391 |

| 7 | 🇮🇳 India | 338 |

| 8 | 🇯🇵 Japan | 333 |

| 9 | 🇩🇪 Germany | 319 |

| 10 | 🇸🇬 Singapore | 193 |

| 11 | 🇰🇷 South Korea | 189 |

| 12 | 🇦🇺 Australia | 147 |

| 13 | 🇨🇭 Switzerland | 123 |

| 14 | 🇸🇪 Sweden | 94 |

| 15 | 🇪🇸 Spain | 94 |

From this data, we can see that the U.S., China, and UK have established themselves as major hotbeds for AI innovation.

In terms of funding, the U.S. is massively ahead, with private AI investment totaling $335 billion between 2013 to 2023. AI startups in China raised $104 billion over the same timeframe, while those in the UK raised $22 billion.

Further analysis reveals that the U.S. is widening this gap even more. In 2023, for example, private investment in the U.S. grew by 22% from 2022 levels. Meanwhile, investment fell in China (-44%) and the UK (-14.1%) over the same time span.

Where is All This Money Flowing To?

Quid also breaks down total private AI investment by focus area, providing insight into which sectors are receiving the most funding.

| Focus Area | Global Investment in 2023 (USD billions) |

|---|---|

| 🤖 AI infrastructure, research, and governance | $18.3 |

| 🗣️ Natural language processing | $8.1 |

| 📊 Data management | $5.5 |

| ⚕️ Healthcare | $4.2 |

| 🚗 Autonomous vehicles | $2.7 |

| 💰 Fintech | $2.1 |

| ⚛️ Quantum computing | $2.0 |

| 🔌 Semiconductor | $1.7 |

| ⚡ Energy, oil, and gas | $1.5 |

| 🎨 Creative content | $1.3 |

| 📚 Education | $1.2 |

| 📈 Marketing | $1.1 |

| 🛸 Drones | $1.0 |

| 🔒 Cybersecurity | $0.9 |

| 🏭 Manufacturing | $0.9 |

| 🛒 Retail | $0.7 |

| 🕶️ AR/VR | $0.7 |

| 🛡️ Insurtech | $0.6 |

| 🎬 Entertainment | $0.5 |

| 💼 VC | $0.5 |

| 🌾 Agritech | $0.5 |

| ⚖️ Legal tech | $0.4 |

| 👤 Facial recognition | $0.3 |

| 🌐 Geospatial | $0.2 |

| 💪 Fitness and wellness | $0.2 |

Attracting the most money is AI infrastructure, research, and governance, which refers to startups that are building AI applications (like OpenAI’s ChatGPT).

The second biggest focus area is natural language processing (NLP), which is a type of AI that enables computers to understand and interpret human language. This technology has numerous use cases for businesses, particularly in financial services, where NLP can power customer support chatbots and automated wealth advisors.

With $8 billion invested into NLP-focused startups during 2023, investors appear keenly aware of this technology’s transformative potential.

Learn More About AI From Visual Capitalist

If you enjoyed this graphic, be sure to check out Visualizing AI Patents by Country.

-

Energy6 days ago

Energy6 days agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

AI2 weeks ago

AI2 weeks agoVisualizing AI Patents by Country

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue