Markets

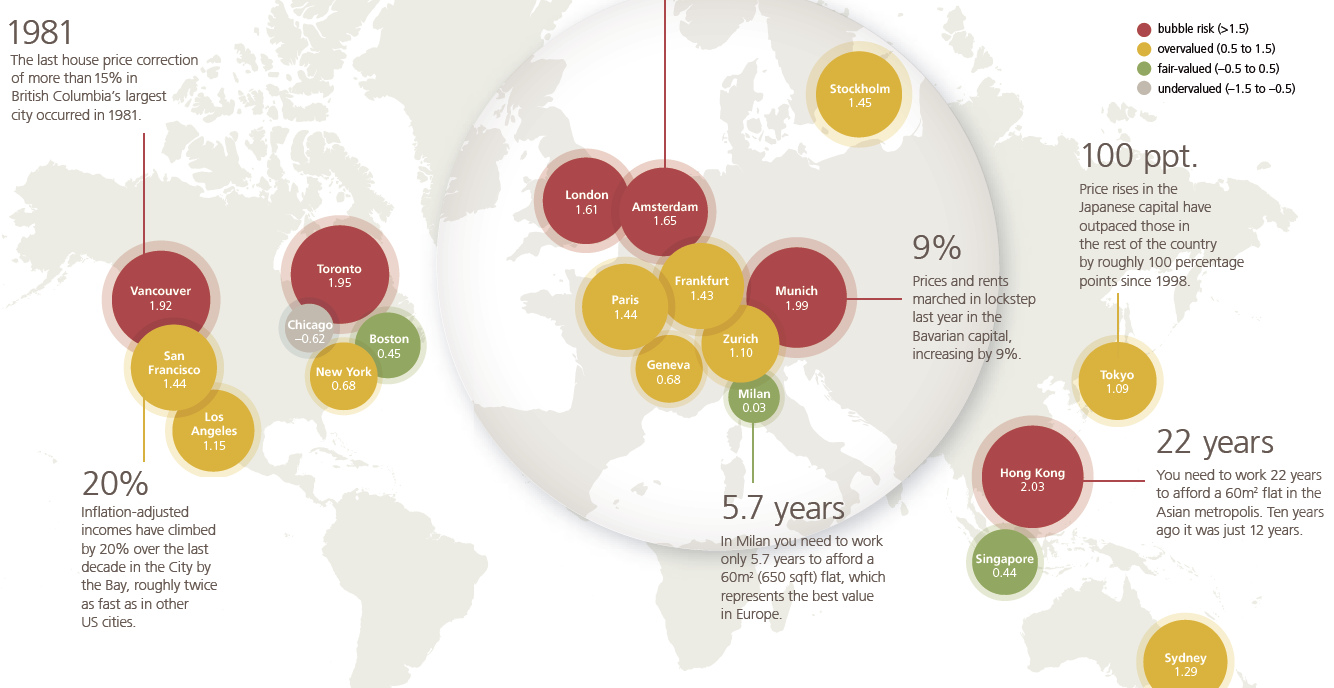

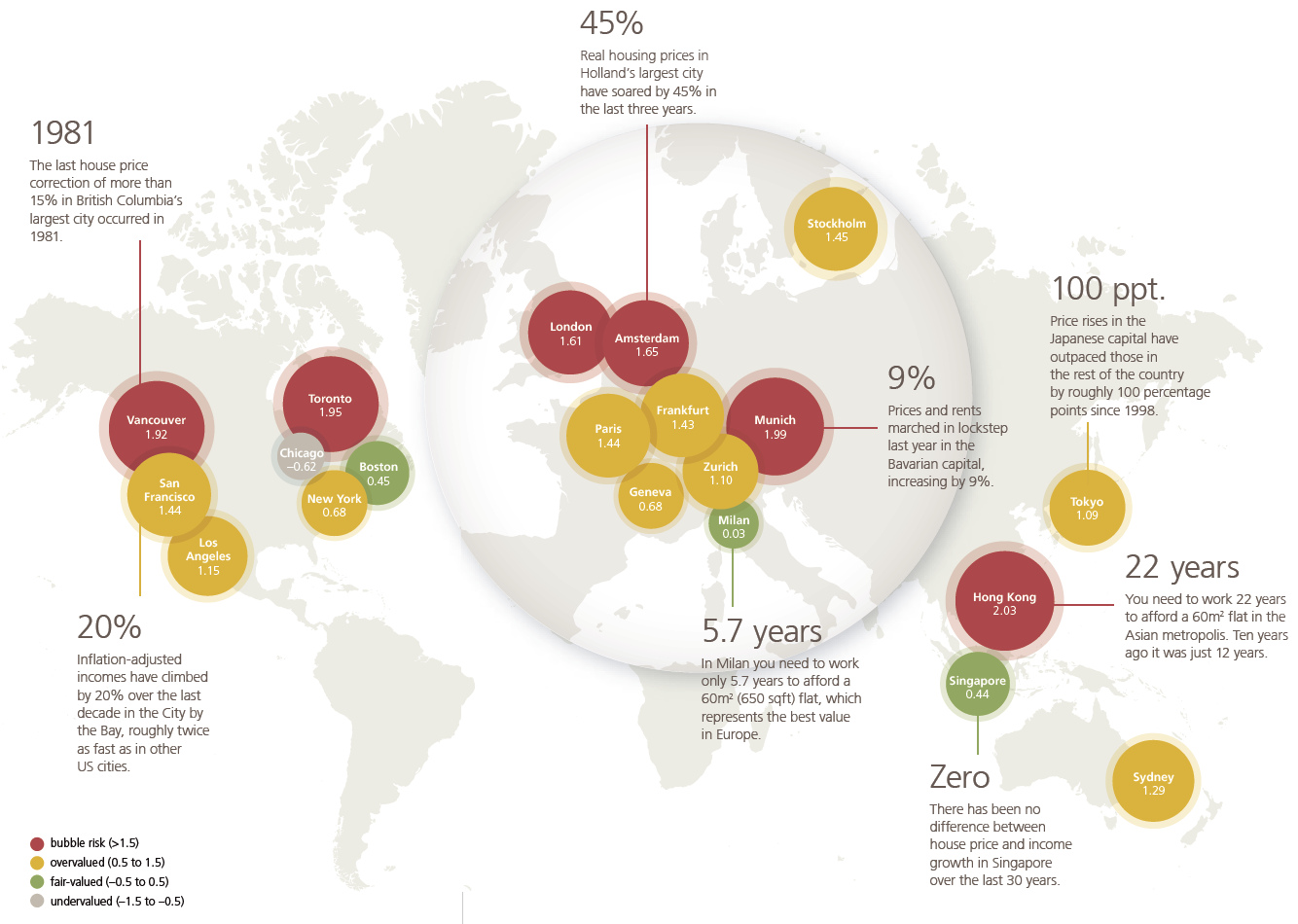

The World’s Biggest Real Estate Bubbles in 2018

Note: Cities with a “Bubble Risk” (>1.5) are shown in red

Courtesy: UBS

The World’s Biggest Real Estate Bubbles in 2018

With the current stock market bull run reaching nearly 10 years in length, it’s understandable that many investors are nervous about the end of the party coming sooner than later.

However, as UBS notes in its latest report, there is also growing concern about another prominent bubble that’s been in the works since the aftermath of the financial crisis.

Large amounts of easy money have fueled real estate bubbles in the world’s major cities – and the Swiss investment bank now sees the property markets in six global cities as being at risk.

The Bubble Index

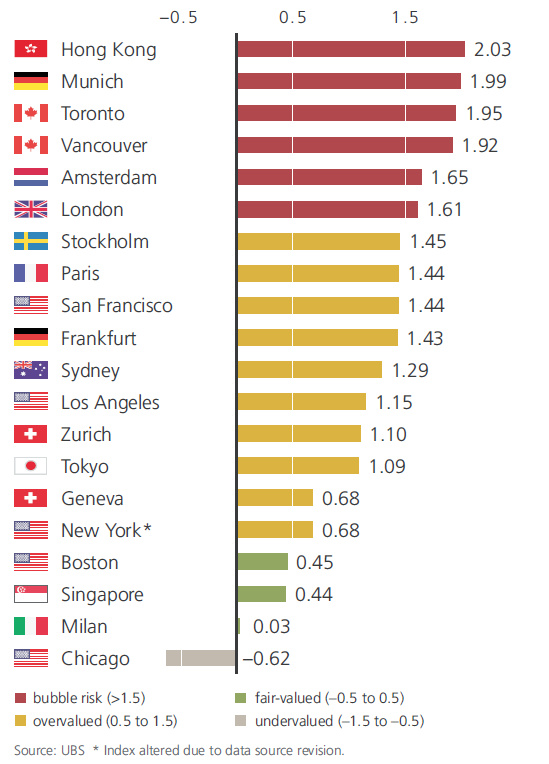

In the 2018 edition of the bank’s Real Estate Bubble Index, here are the major cities around the globe that are in or near bubble territory:

Any city with a score over 1.5 is considered at “Bubble Risk”, and right now those include two cities from Canada, one from Asia, and three from Europe.

Hong Kong (2.03) tops the index this year, leaping past Munich (1.99), Toronto (1.95), and Vancouver (1.92) which all remain at bubble risk themselves. Amsterdam and London are the two other cities that score higher than a 1.5 on the rankings.

It’s also very important to note that there are four cities that score just under the 1.5 threshold: Stockholm (1.45), Paris (1.44), San Francisco (1.44), and Frankfurt (1.43).

A Coming Correction?

Investor and writer Howard Marks has noted in recent months that the wider market is in its “8th inning”, and the same case could be made for real estate.

Historically, investors have had to be alert to rising interest rates, which have served as the main trigger of corrections.

– UBS Report

According to UBS, the cracks are already starting to show at the top end of the market, with housing prices declining in half of last year’s list of bubble cities. Some of the worrying factors include rising interest rates, as well as growing political tensions as the crisis of affordability makes it harder for average people to live in these global financial centers.

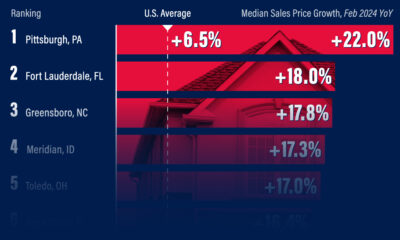

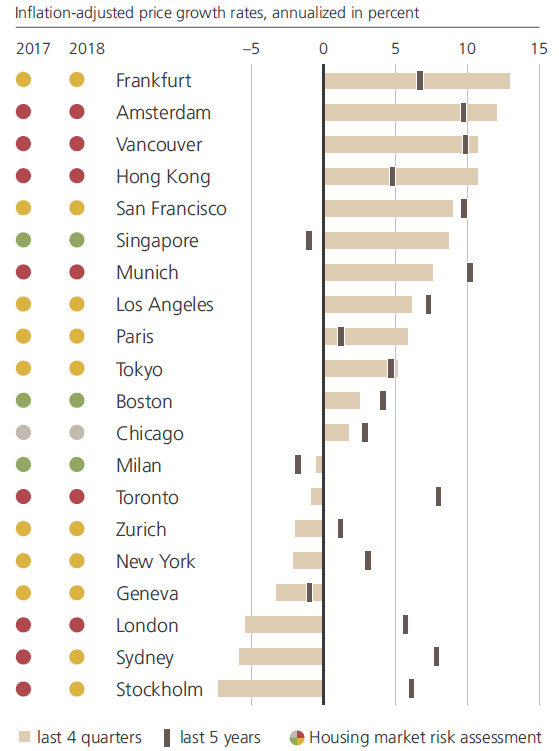

Here is annualized growth in percent over the last year, as well for the last five years for cities in the index:

As you can see, some of these cities have had negative growth over the last 12 months, including New York, Toronto, Sydney, London, and Stockholm.

Charting Specific Markets

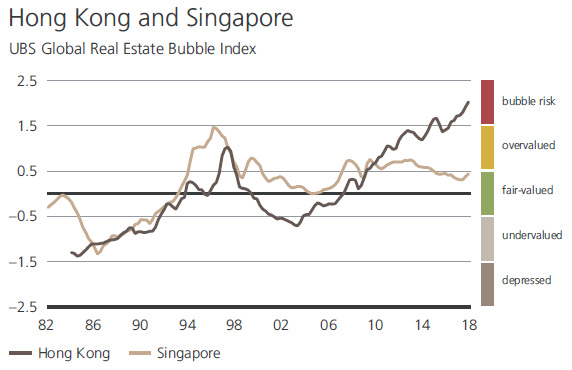

In Hong Kong, you need to work 22 years to afford a 645 sq. ft (60m²) apartment, when that took just 12 years just a decade ago. In recent years, Hong Kong’s ascent to becoming one of the biggest real estate bubbles has become very evident, especially when juxtaposed with Singapore:

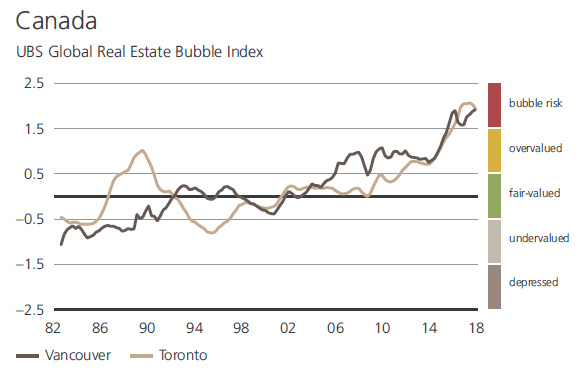

In Canada, the two cities in the index are starting to go in alternate directions, although recent signs also point to a potential slowdown in Vancouver:

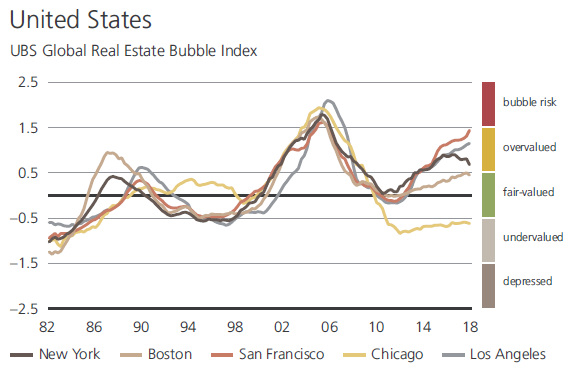

Finally, the U.S. market – which felt the pain of the housing crash in the late 2000s – is home to zero cities in the bubble risk category, according to UBS.

Whether it is a bubble or not, many people agree that San Francisco’s housing situation is still a crisis. In the Bay Area hub, 60% of all rental units are in rental-controlled buildings, and the median single-family house price is a hefty $1.7 million.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?