Energy

Visualizing the EU’s Energy Dependency

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

Visualizing the EU’s Energy Dependency

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

In response to Russia’s 2022 invasion of Ukraine, the U.S. and EU have imposed heavy sanctions aimed at crippling the Russian economy. However, these bold actions also come with some potentially messy complications: Russia is not only one of the world’s largest exporters of energy products, but it is also Europe’s biggest supplier of these fuels.

As of October 2021, Russia supplied 25% of all oil imported by the EU, which is three times more than the second-largest trade partner. Naturally, the policies and circumstances that have led to this dependency have been under major scrutiny in recent weeks.

To help you learn more, this infographic visualizes energy data from Eurostat.

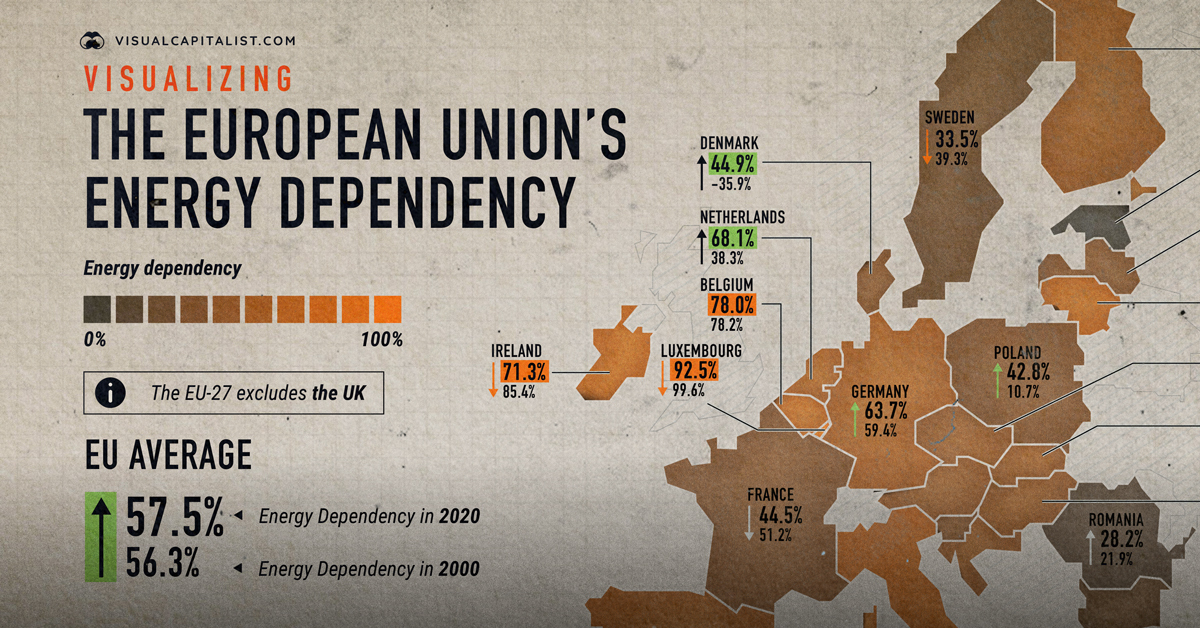

Energy Dependency, by Country

To start, let’s compare the energy dependence of each EU member, both in 2000 and 2020 (the latest year available). This metric shows the extent to which a country relies upon imports to meet its energy needs.

Note that Denmark’s value of -35.9% for the year 2000 is not a typo. Rather, it means that the country was a net exporter of energy.

| Country | 2000 | 2020 |

|---|---|---|

| 🇦🇹 Austria | 65.5% | 58.3% |

| 🇧🇪 Belgium | 78.2% | 78.0% |

| 🇧🇬 Bulgaria | 46.4% | 37.9% |

| 🇭🇷 Croatia | 48.5% | 53.6% |

| 🇨🇾 Cyprus | 98.6% | 93.1% |

| 🇨🇿 Czechia | 22.7% | 38.9% |

| 🇩🇰 Denmark | -35.9% | 44.9% |

| 🇪🇪 Estonia | 34.0% | 10.6% |

| 🇫🇮 Finland | 55.5% | 42.0% |

| 🇫🇷 France | 51.2% | 44.5% |

| 🇩🇪 Germany | 59.4% | 63.7% |

| 🇬🇷 Greece | 69.1% | 81.4% |

| 🇭🇺 Hungary | 55.0% | 56.6% |

| 🇮🇪 Ireland | 85.4% | 71.3% |

| 🇮🇹 Italy | 86.5% | 73.5% |

| 🇱🇻 Latvia | 61.0% | 45.5% |

| 🇱🇹 Lithuania | 57.8% | 74.9% |

| 🇱🇺 Luxembourg | 99.6% | 92.5% |

| 🇲🇹 Malta | 100.2% | 97.6% |

| 🇳🇱 Netherlands | 38.3% | 68.1% |

| 🇵🇱 Poland | 10.7% | 42.8% |

| 🇵🇹 Portugal | 85.3% | 65.3% |

| 🇷🇴 Romania | 21.9% | 28.2% |

| 🇸🇰 Slovakia | 65.1% | 56.3% |

| 🇸🇮 Slovenia | 51.9% | 45.8% |

| 🇪🇸 Spain | 76.8% | 67.9% |

| 🇸🇪 Sweden | 39.3% | 33.5% |

| Average | 56.3% | 57.5% |

Over this 20-year timeframe, the EU-27 average country’s energy dependence has increased from 56.3% to 57.5%, meaning EU members became slightly more reliant on energy imports over those two decades.

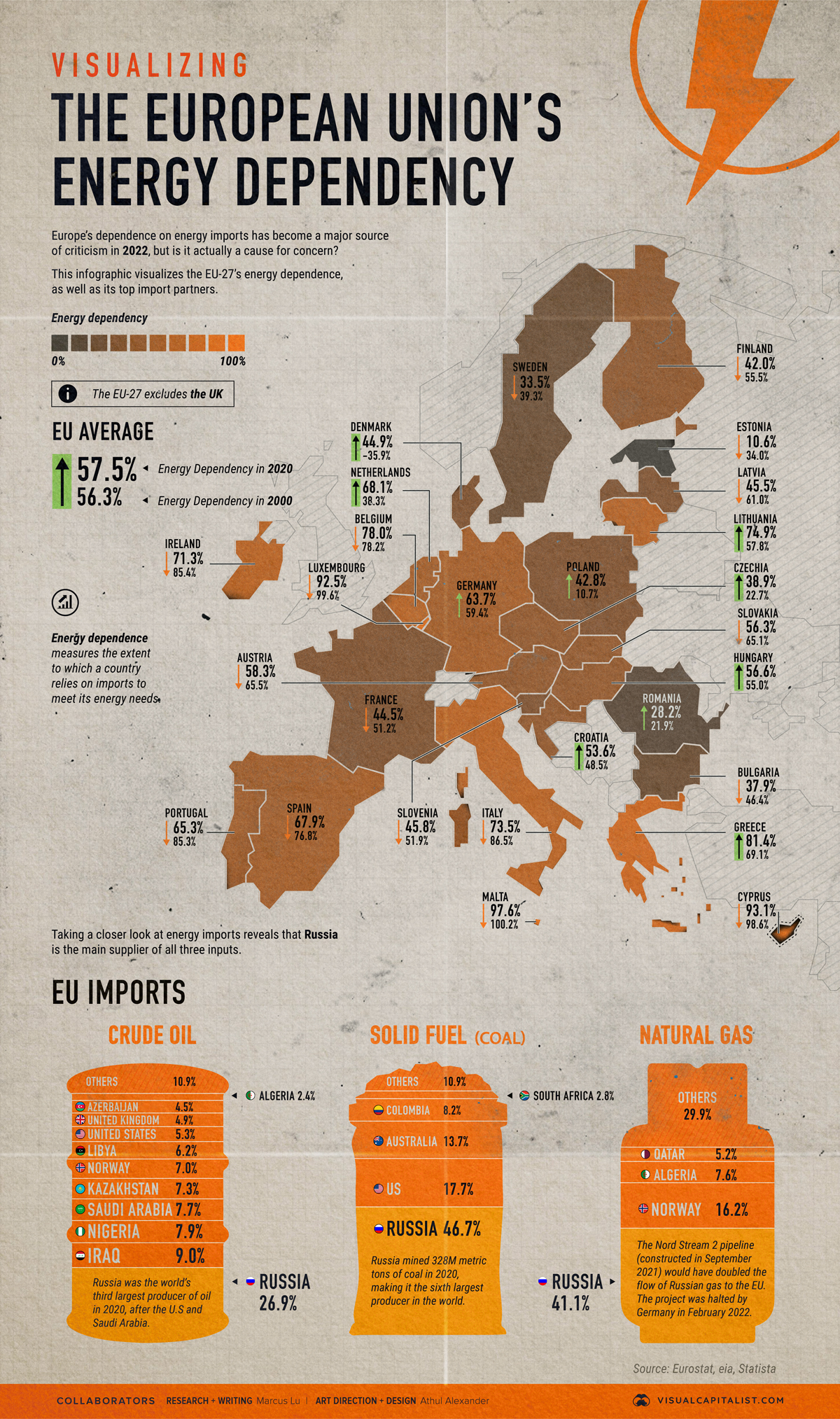

Where Do EU’s Energy Imports Come From?

Looking further into energy imports reveals that Russia is the main supplier of crude oil, coal, and natural gas. Continue below for more details.

Crude Oil Imports

The EU imports more crude oil from Russia than the next three countries combined.

| Country | Percentage of total |

|---|---|

| 🇷🇺 Russia | 26.9% |

| 🇮🇶 Iraq | 9.0% |

| 🇳🇬 Nigeria | 7.9% |

| 🇸🇦 Saudi Arabia | 7.7% |

| 🇰🇿 Kazakhstan | 7.3% |

| 🇳🇴 Norway | 7.0% |

| 🇱🇾 Libya | 6.2% |

| 🇺🇸 United States | 5.3% |

| 🇬🇧 United Kingdom | 4.9% |

| 🇦🇿 Azerbaijan | 4.5% |

| 🇩🇿 Algeria | 2.4% |

| Others | 10.9% |

This shouldn’t come as a surprise, as Russia was the world’s third largest producer of oil in 2020. The country has several state-owned oil companies including Rosneft and Gazprom.

Coal Imports

Coal-fired power plants are still being used across the EU, though most member states expect to completely phase them out by 2030.

| Country | Percentage of total |

|---|---|

| 🇷🇺 Russia | 46.7% |

| 🇺🇸 United States | 17.7% |

| 🇦🇺 Australia | 13.7% |

| 🇨🇴 Colombia | 8.2% |

| 🇿🇦 South Africa | 2.8% |

| Others | 10.9% |

Russia has the second largest coal reserves in the world. In 2020, it mined 328 million metric tons, making it the sixth largest producer globally.

Natural Gas Imports

Natural gas is commonly used to heat buildings and water. A majority of the EU’s supply comes from Russia via the Nord Stream series of pipelines.

| Country | Percentage of total |

|---|---|

| 🇷🇺 Russia | 41.1% |

| 🇳🇴 Norway | 16.2% |

| 🇩🇿 Algeria | 7.6% |

| 🇶🇦 Qatar | 5.2% |

| Others | 29.9% |

Nord Stream 1 is the longest sub-sea pipeline in the world and was completed in 2011. It starts from the Russian city of Vyborg and connects to the EU through Germany.

Nord Stream 2 is a recently constructed expansion which was expected to double the project’s capacity. Germany has since halted the approval process for this pipeline in response to Russia’s 2022 invasion of Ukraine.

What Happens Now?

In retaliation against Western sanctions, Russia has announced an impending ban on exports of certain goods and raw materials.

European gas prices skyrocketed in response, as many fear that Russia could cut off natural gas supplies. This, of course, would have very negative effects on both consumers and businesses.

In early March 2022, both the European Commission and the International Energy Agency (IEA) introduced proposals on how Europe could reduce its energy dependency.

We must become independent from Russian oil, coal and gas. We simply cannot rely on a supplier who explicitly threatens us.

– Ursula von der Leyen, President of the European Commission

Cutting off one’s biggest supplier is likely to cause issues, especially when dealing with something as critical as energy. Few countries have the capacity (or willingness) to immediately replace Russian imports.

The proposals also discussed options for boosting Europe’s domestic output, though the commission’s report notably excluded nuclear power. For various reasons, nuclear remains a polarizing topic in Europe, with countries taking either a pro or anti stance.

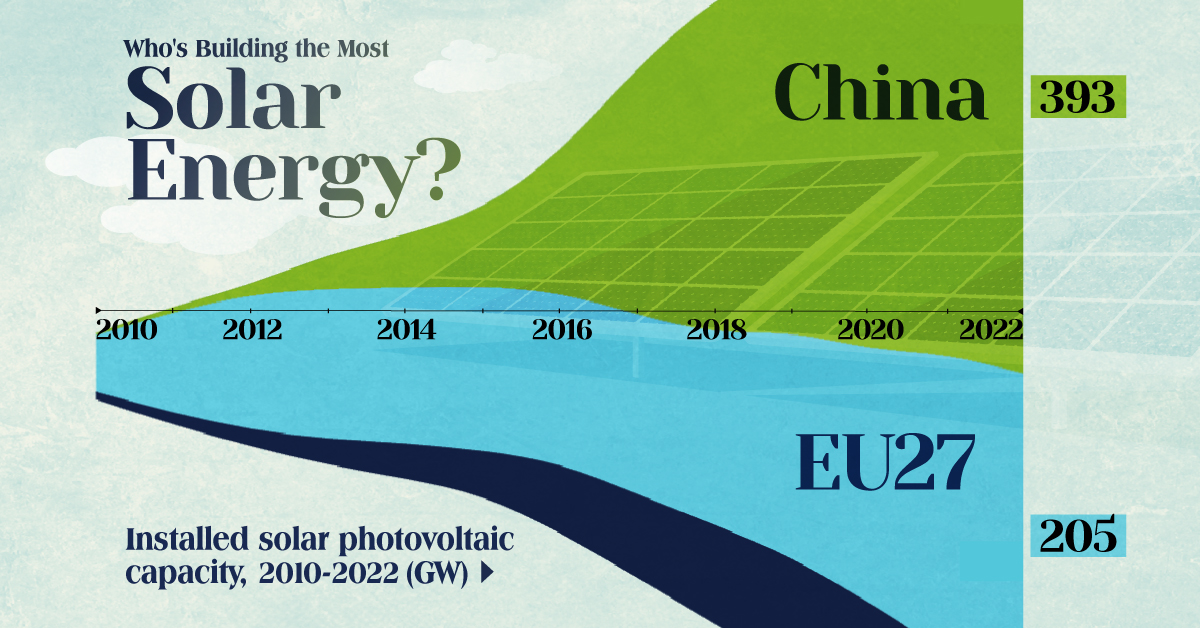

Who’s Building the Most Solar Energy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

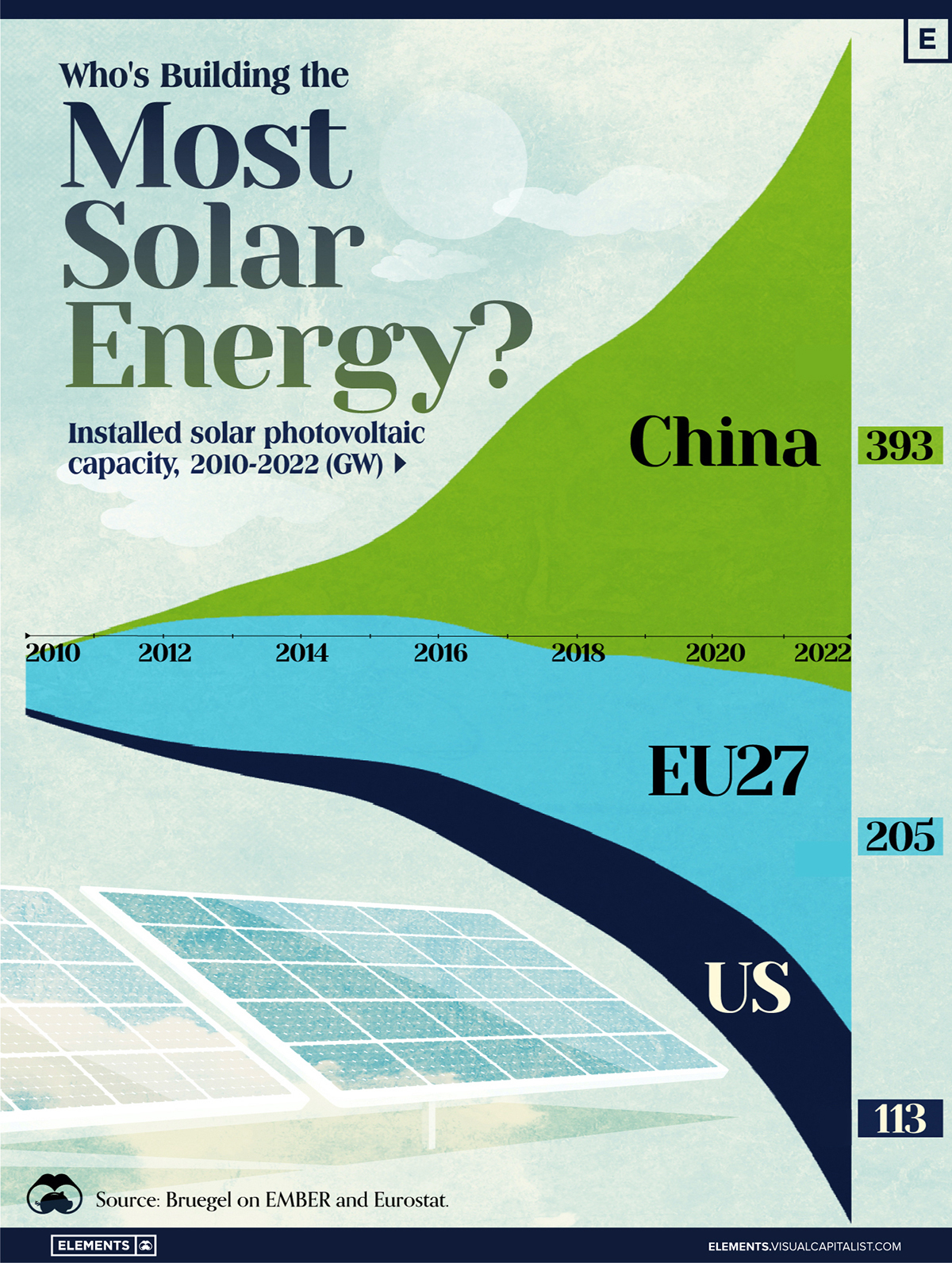

In 2023, solar energy accounted for three-quarters of renewable capacity additions worldwide. Most of this growth occurred in Asia, the EU, and the U.S., continuing a trend observed over the past decade.

In this graphic, we illustrate the rise in installed solar photovoltaic (PV) capacity in China, the EU, and the U.S. between 2010 and 2022, measured in gigawatts (GW). Bruegel compiled the data..

Chinese Dominance

As of 2022, China’s total installed capacity stands at 393 GW, nearly double that of the EU’s 205 GW and surpassing the USA’s total of 113 GW by more than threefold in absolute terms.

| Installed solar capacity (GW) | China | EU27 | U.S. |

|---|---|---|---|

| 2022 | 393.0 | 205.5 | 113.0 |

| 2021 | 307.0 | 162.7 | 95.4 |

| 2020 | 254.0 | 136.9 | 76.4 |

| 2019 | 205.0 | 120.1 | 61.6 |

| 2018 | 175.3 | 104.0 | 52.0 |

| 2017 | 130.8 | 96.2 | 43.8 |

| 2016 | 77.8 | 91.5 | 35.4 |

| 2015 | 43.6 | 87.7 | 24.2 |

| 2014 | 28.4 | 83.6 | 18.1 |

| 2013 | 17.8 | 79.7 | 13.3 |

| 2012 | 6.7 | 71.1 | 8.6 |

| 2011 | 3.1 | 53.3 | 5.6 |

| 2010 | 1.0 | 30.6 | 3.4 |

Since 2017, China has shown a compound annual growth rate (CAGR) of approximately 25% in installed PV capacity, while the USA has seen a CAGR of 21%, and the EU of 16%.

Additionally, China dominates the production of solar power components, currently controlling around 80% of the world’s solar panel supply chain.

In 2022, China’s solar industry employed 2.76 million individuals, with manufacturing roles representing approximately 1.8 million and the remaining 918,000 jobs in construction, installation, and operations and maintenance.

The EU industry employed 648,000 individuals, while the U.S. reached 264,000 jobs.

According to the IEA, China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028.

Despite the phasing out of national subsidies in 2020 and 2021, deployment of solar PV in China is accelerating. The country is expected to reach its national 2030 target for wind and solar PV installations in 2024, six years ahead of schedule.

-

Mining6 days ago

Mining6 days agoVisualizing Global Gold Production in 2023

-

AI2 weeks ago

AI2 weeks agoVisualizing AI Patents by Country

-

Markets2 weeks ago

Markets2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods

-

United States1 week ago

United States1 week agoVisualizing the Most Common Pets in the U.S.

-

Culture1 week ago

Culture1 week agoThe World’s Top Media Franchises by All-Time Revenue