Technology

Visualizing the Importance of Trust to the Banking Industry

Visualizing the Importance of Trust to the Banking Industry

In the digital age, money is becoming less tangible.

Not only is carrying physical cash more of a rarity, but we are now able to even make contactless payments for many of the products and services we use on the fly.

Our financial transactions are starting to be analyzed and optimized by artificial intelligence. Meanwhile, investments and bills are paid online, and even checks can now be deposited through our phones. Who has the time to visit a physical bank these days, anyways?

Trust in the Digital Age

The migration of financial services to the cloud is increasing access to banking solutions, while breaking down barriers of entry to the industry. It’s also creating opportunities for new service offerings that can leverage technology, data, and scale.

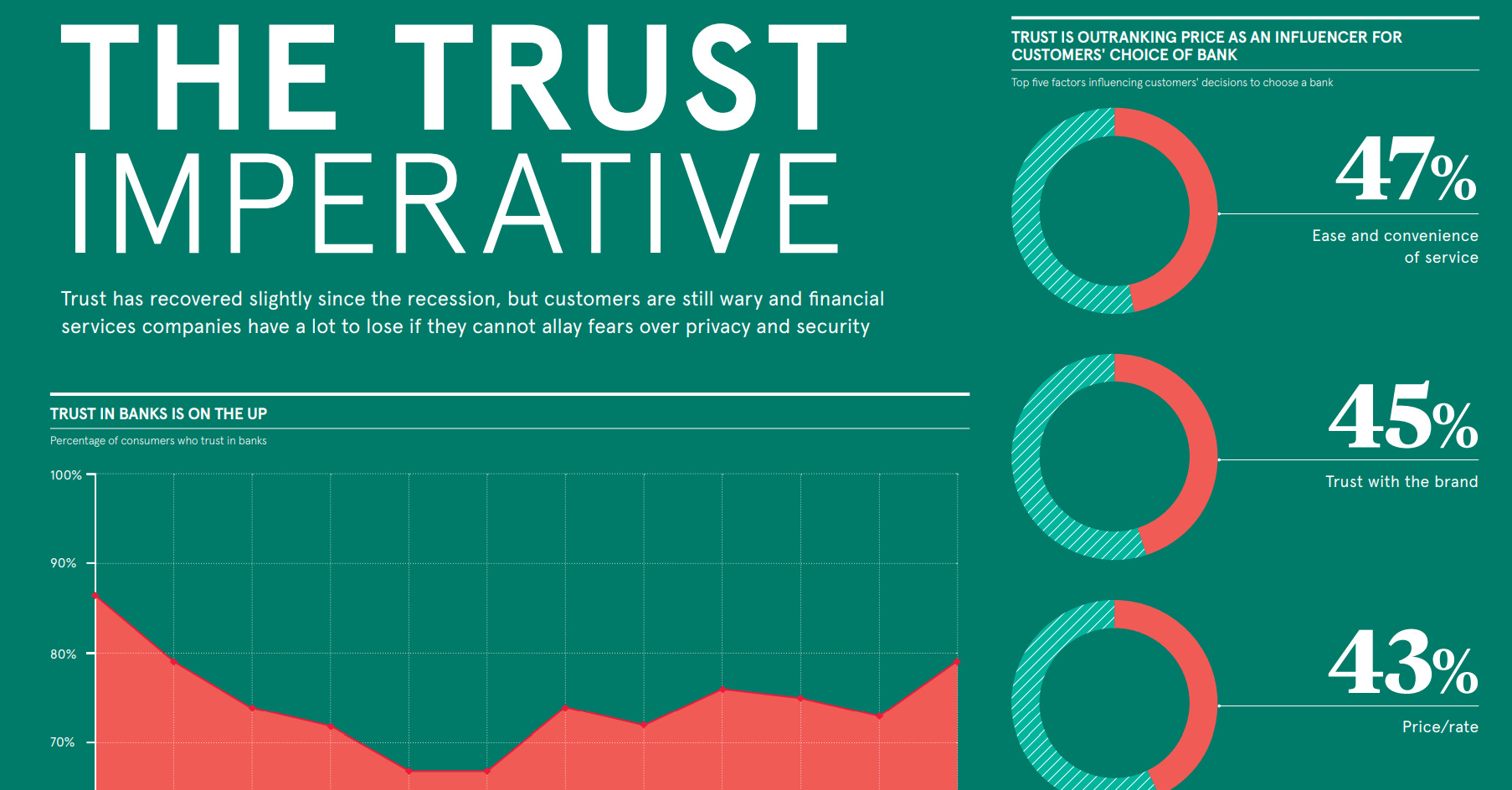

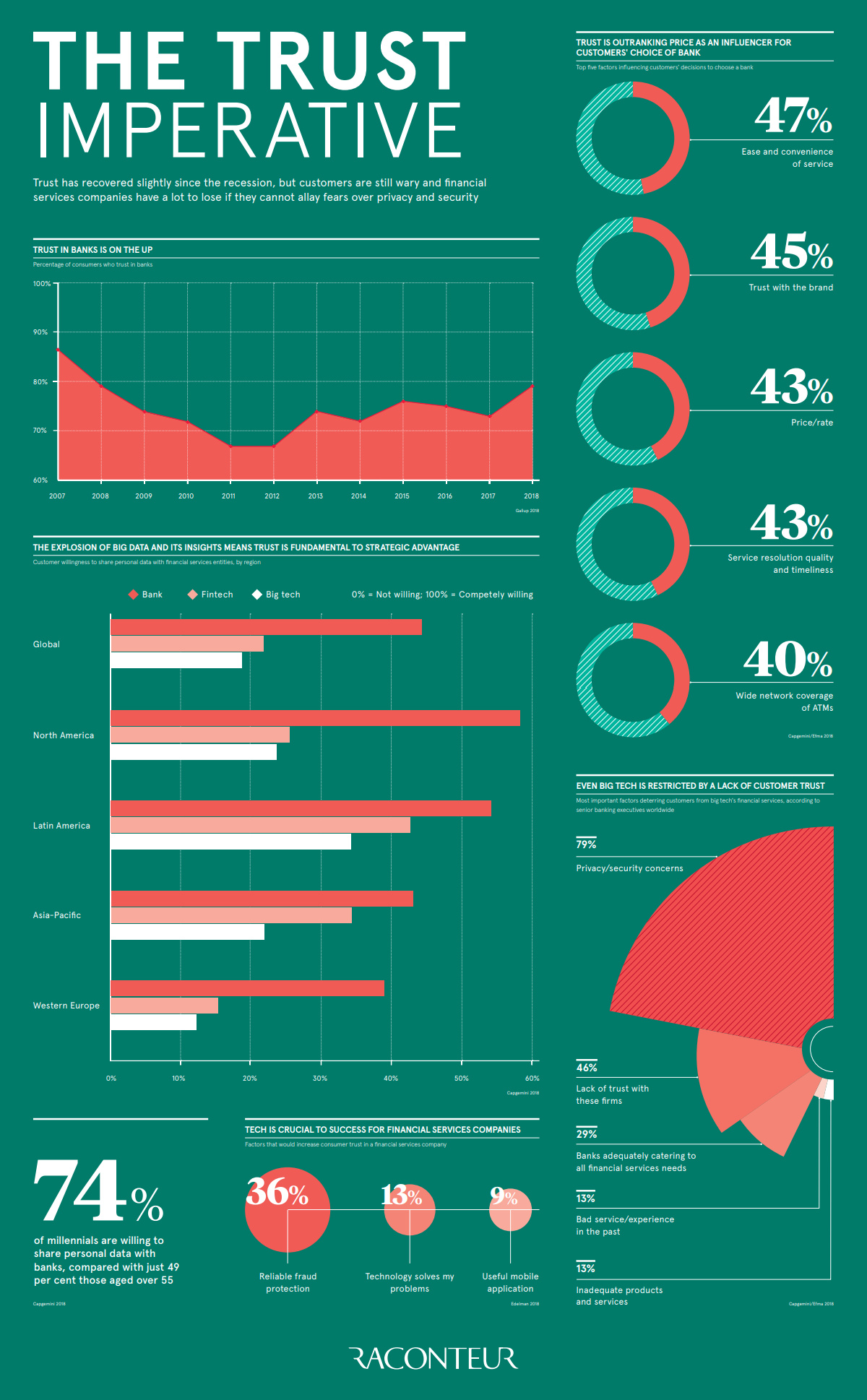

However, as today’s infographic from Raconteur shows, this digital migration has a crucial side effect: trust in financial services has emerged as a dominant driver of consumer activity.

This likely boils down to a couple major factors:

- Tangibility

Financial services are becoming less grounded in physical experiences (using cash, visiting a branch, personal relationships, etc.) - Personal Data

Consumers are rightfully concerned about how personal data gets treated in the digital age

Further, the above factors are compounded by memories of the 2008 Financial Crisis. These events not only damaged institutional reputations, but they elevated trust to become a key concern and selling point for consumers.

Trust, by the Numbers

In general, trust in banks has been slowly on the rise since hitting a low point in 2011 and 2012.

At the same time, consumers are consistently ranking trust as a more important factor in their decision of where to bank. To the modern consumer, trust even outweighs price.

Top Five Factors for Choosing a Bank:

- Ease and convenience of service (47%)

- Trust with the brand (45%)

- Price/rate (43%)

- Service resolution quality and timeliness (43%)

- Wide network coverage of ATMs (40%)

It’s important to recognize here that all five of the above factors rank quite closely in percentage terms. That said, while they are all crucial elements to a service offering, trust may be the most abstract one to try and tackle for companies in the space.

With this in mind, how can financial services leverage tech to increase the amount of trust that consumers have in them?

Tech Factors That Would Increase Consumer Trust:

- Reliable fraud protection (36%)

- Technology solves my problems (13%)

- Useful mobile application (9%)

Better fraud protection capability stands out as one major trust-builder, while designing technology that is useful and effective is another key area to consider.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees