The Global Uranium Market in 3 Charts

The Global Uranium Market in 3 Charts

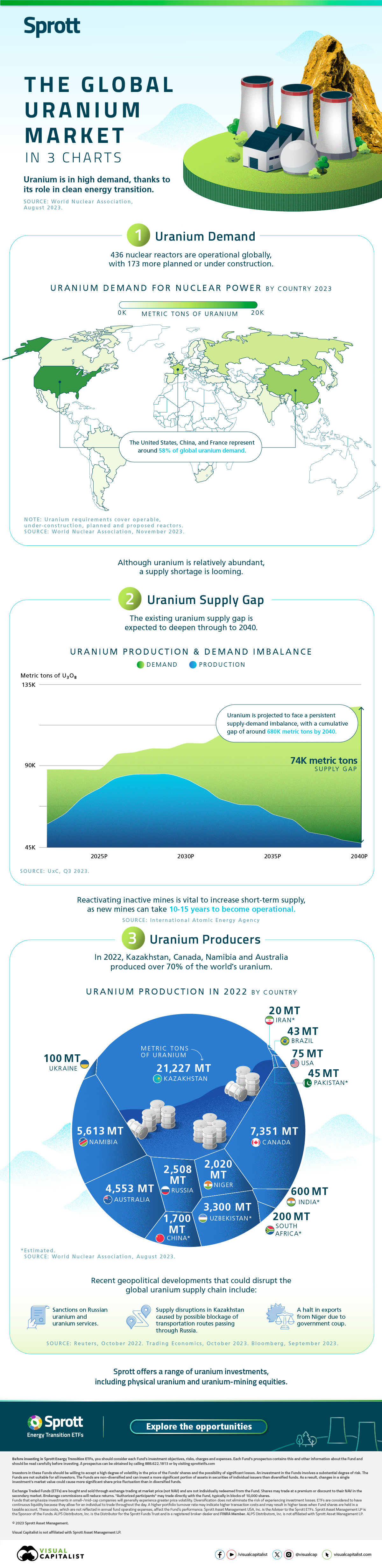

The uranium market is experiencing increased demand, driven by its integral role in clean energy generation through its use in nuclear power.

In this graphic, our sponsor Sprott explores three pivotal areas shaping the global uranium landscape.

Uranium Demand

With 436 operational nuclear reactors worldwide and 173 more in the pipeline, the demand for uranium is on the rise.

The United States, China, and France collectively represent approximately 58% of the global uranium demand.

Despite its relative abundance, the looming scarcity of supply poses a significant challenge.

The Uranium Supply Gap

Forecasts project a persistent supply-demand imbalance for uranium, with an anticipated cumulative gap of approximately 680,000 metric tons by 2040.

Meanwhile, the existing supply gap is expected to intensify, signifying a prolonged shortage in the market.

| Millions of U3O8 lbs | Production | Demand | Gap |

|---|---|---|---|

| 2022 | 129 | 194 | 65 |

| 2023P | 142 | 195 | 53 |

| 2024P | 160 | 196 | 36 |

| 2025P | 172 | 198 | 26 |

| 2026P | 184 | 208 | 24 |

| 2027P | 188 | 213 | 25 |

| 2028P | 189 | 217 | 28 |

| 2029P | 190 | 221 | 31 |

| 2030P | 185 | 223 | 38 |

| 2031P | 174 | 226 | 52 |

| 2032P | 158 | 235 | 77 |

| 2033P | 154 | 242 | 88 |

| 2034P | 150 | 249 | 99 |

| 2035P | 139 | 253 | 114 |

| 2036P | 135 | 255 | 120 |

| 2037P | 118 | 257 | 139 |

| 2038P | 114 | 260 | 146 |

| 2039P | 108 | 269 | 161 |

| 2040P | 106 | 270 | 164 |

To bridge the immediate supply deficit, reactivating dormant mines becomes crucial, considering the extensive timeline of 10-15 years for new mines to become operational.

Uranium Producers

In 2022, Kazakhstan, Canada, Namibia, and Australia were responsible for over 70% of the global uranium production.

However, recent geopolitical developments threaten disruptions in the uranium supply chain, including:

- Potential sanctions on Russian uranium and related services.

- Risks of supply interruptions in Kazakhstan due to transportation routes passing through Russia.

- Halts in uranium exports from Niger following government coups.

Despite these risks, the demand for uranium in nuclear reactors is projected to escalate over the next decade, increasing by 28% by 2030 and anticipated to nearly double by 2040.

The surge will be driven by governments scaling up nuclear power capacity to achieve zero-carbon targets.

Explore Sprott’s range of uranium investments, including physical uranium and uranium-mining equities.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.