Investing in the Impending E-commerce Future

The following content is sponsored by eToro

Investing in the Impending E-commerce Future

The rise of e-commerce has been a long time coming, but the market’s progressive size and impact has caught many by surprise.

Tied initially to the advent of the internet and the Dot-com boom, online shopping saw companies like Amazon and eBay become well-known billion-dollar names. Digital commerce was a big market, but only for a few players.

Fast forward to today, and more companies than ever are launching their own marketplaces or embracing online retail. The shift was happening before COVID-19, but the pandemic has sped things up dramatically.

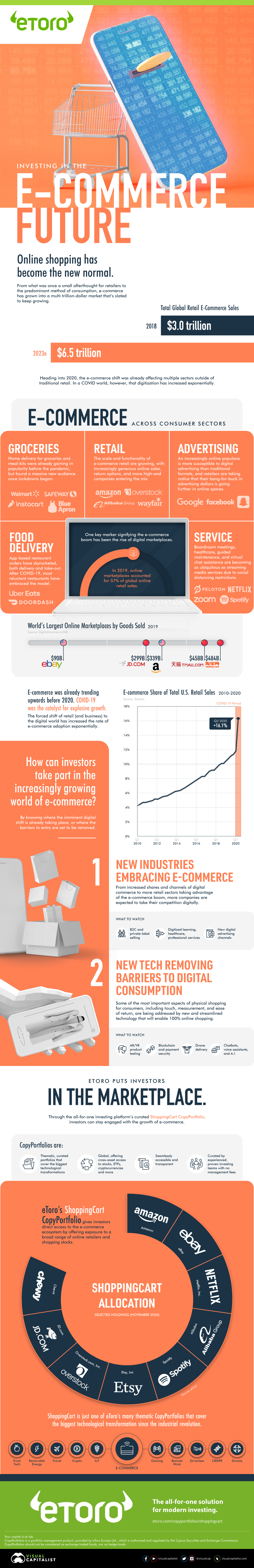

Today’s infographic from eToro highlights the increasing relevance of e-commerce in the modern economy and how investors can enter the market.

The Digital Marketplace Footprint

How big is modern e-commerce? While multiple sectors are experiencing their own online revolutions, retail is leading the way.

Total global retail e-commerce sales already numbered $3 trillion in 2018, and are expected to more than double to $6.5 trillion in 2023.

The increasing ease and security of online payments have encouraged many businesses to embrace B2C sales, especially in light of a pandemic that forced many brick and mortar stores to close. But less documented is the boom of digital marketplaces, which accounted for 57% of global online retail sales in 2019.

The biggest marketplaces are well-known leaders like Amazon and China’s Taobao and Tmall, but more and more companies are capturing a slice of the online distribution market.

| Largest U.S. Marketplaces | Gross Merchandise Value |

|---|---|

| Amazon | $339B |

| Ebay | $90B |

| Walmart | $49B |

| Wish | $10B |

| Houzz | $9B |

Source: DigitalCommerce360

Walmart and Best Buy have both launched marketplaces for third-party product sales, with Walmart recently seeing a 79% increase of e-commerce sales alone.

The E-commerce Transformation

The growth of e-commerce in retail by itself is staggering, but its growing availability in other sectors is the bigger story.

Groceries and restaurants are a key marker, with home-delivery of takeout, groceries, and ready-to-prepare meal-kits all ordered digitally. Companies like Doordash, Just Eat, and Uber Eats have experienced massive growth, with Doordash positioning for a 2020 IPO, while grocery retailers including Walmart and Safeway are embracing delivery sales.

Online services are likewise rising in popularity, including everything from streaming services to virtual meetings, healthcare and assistance. Just as with the retail sector, e-commerce is making its way into sectors previously thought to be “un-digitizable.”

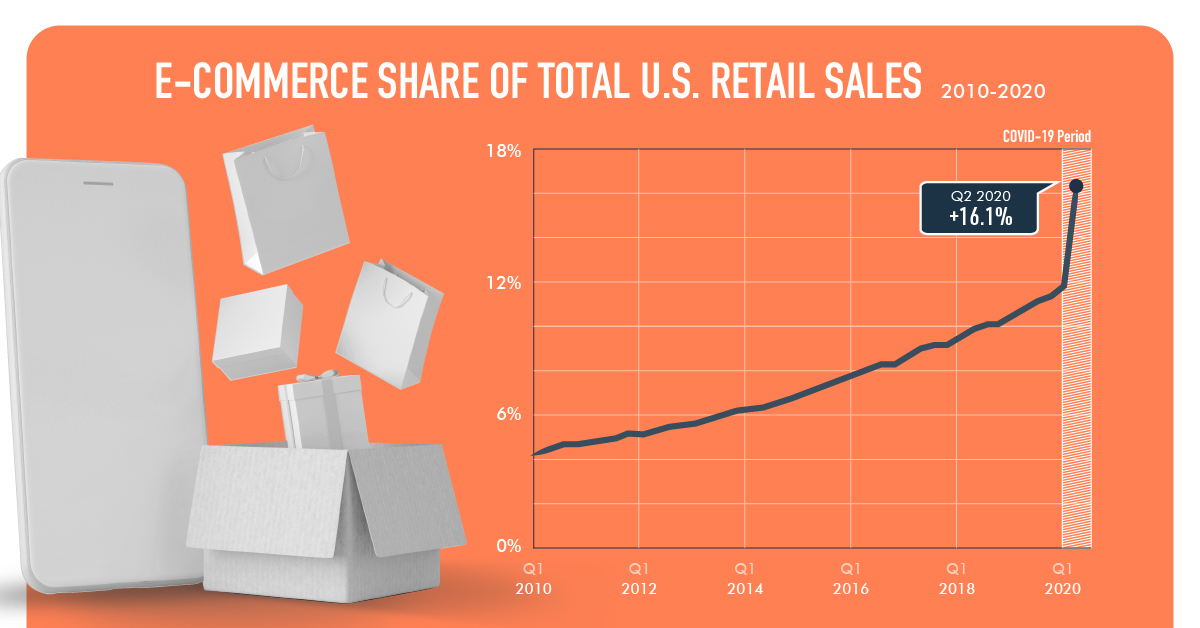

That type of transformation is usually slow, but the result of COVID-19 restrictions forcing thousands of businesses to go digital sped up the schedule. U.S. e-commerce penetration experienced 10 years of growth in the first quarter of 2020 alone.

| Year | U.S. E-commerce Penetration |

|---|---|

| 2016 | 11.8% |

| 2017 | 13.2% |

| 2018 | 14.4% |

| 2019 | 16.0% |

| 2020 (Q1) | 33.0% |

Source: McKinsey

A Widening Landscape for Future Growth

It might be hard to believe, but even with the headway made by e-commerce over the past year, the industry is slated for massive future growth.

One big reason is the rising demand for digital goods and services. As the global pandemic has reimagined virtual business, many companies have also come face-to-face with the decreased costs of operating remotely, while retailers are seeing higher margins by cutting out the distributor (or the lease).

At the same time, another massive shift is the increase in technological capabilities. Alongside the rollout of 5G, blockchain, and improved AI, companies are looking for tech to streamline their processes and keep customers online where possible.

That includes the use of drones for delivery by Amazon, augmented and virtual reality for product testing by Ikea and Wayfair, and improved payment platforms by Shopify.

While 100% online shopping is still a ways away from becoming a reality, the wave of e-commerce is set to continue rising.

How can investors take part?

eToro’s ShoppingCart CopyPortfolio* gives investors direct access to the e-commerce ecosystem.

Curated by experienced and proven investment teams, the thematic portfolio offers exposure to a broad range of online retailers and shopping stocks, with no management fees.

*Your capital is at risk.

CopyPortfolios is a portfolio management product, provided by eToro Europe Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

CopyPortfolios should not be considered as exchange traded funds, nor as hedge funds.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.