Business

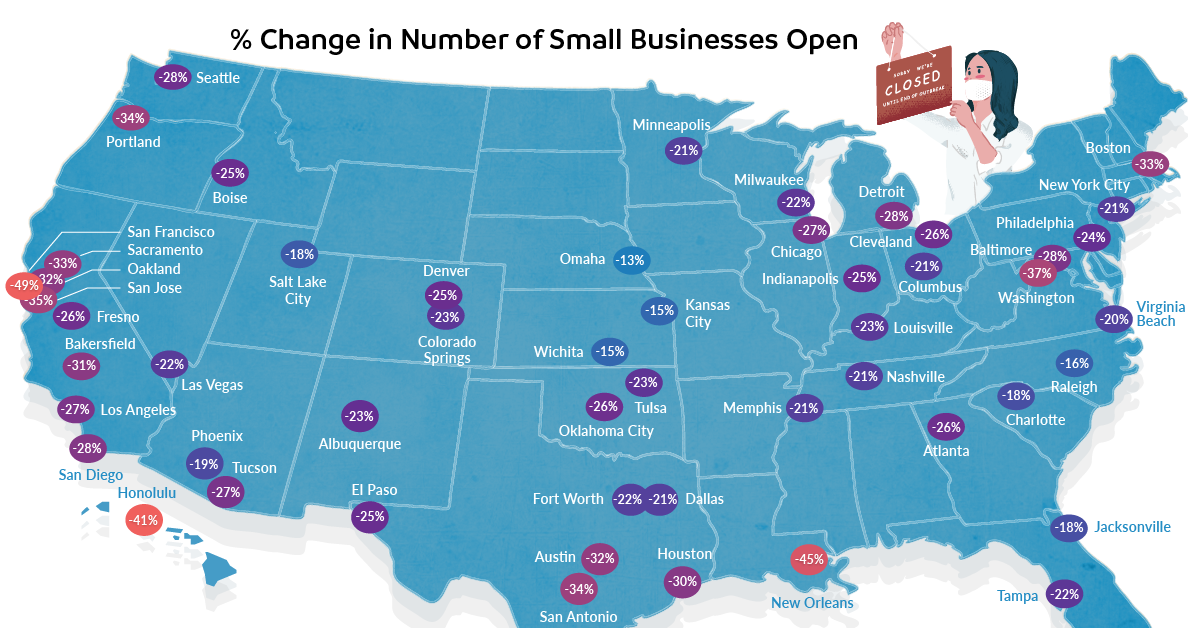

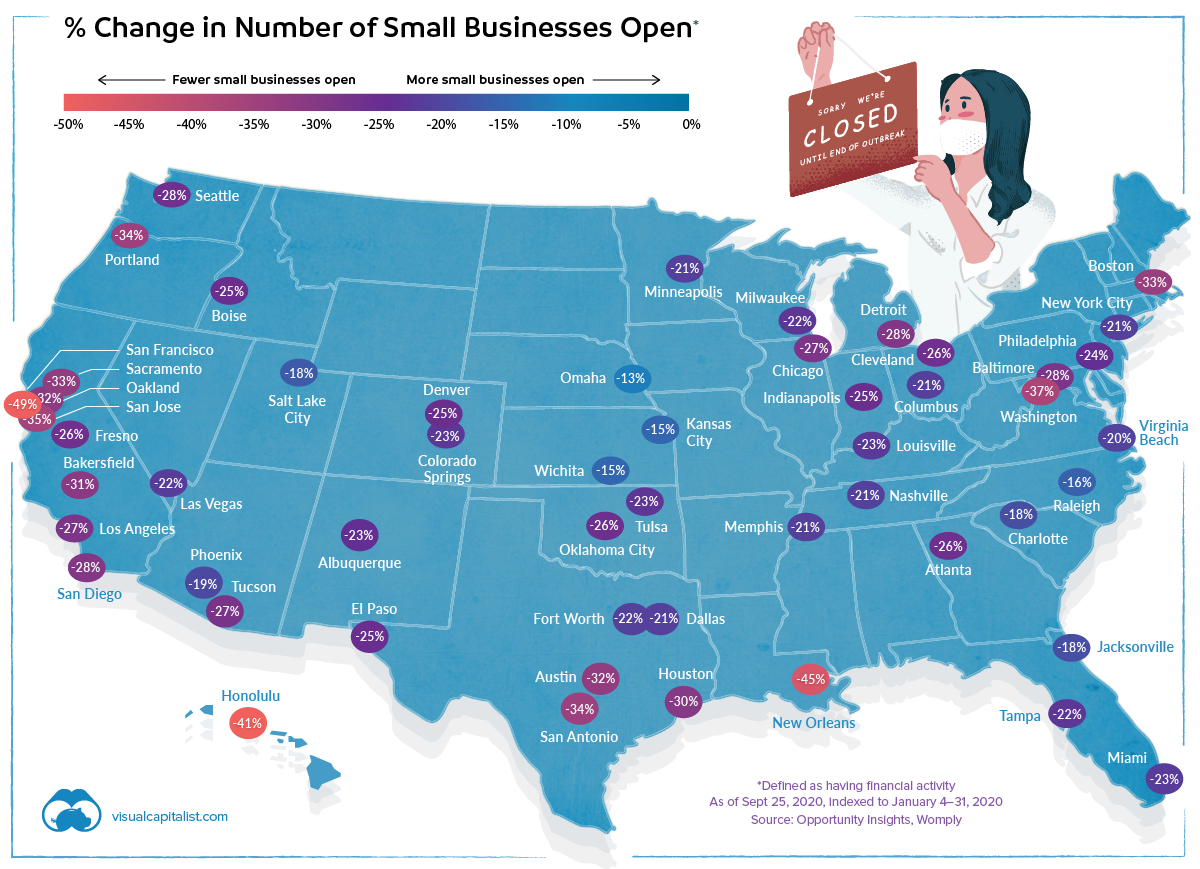

Mapped: The Uneven Recovery of U.S. Small Businesses

Mapped: The Uneven Recovery of U.S. Small Businesses

Small businesses are the backbone of the U.S. economy, employing nearly half of the private sector workforce.

Unfortunately, lockdown and work-from-home measures brought about by COVID-19 have disproportionately affected small businesses – particularly in the leisure and hospitality sectors.

As metro-level data from Opportunity Insights points out, geography makes a great deal of difference in the proportion of U.S. small businesses that have flipped their open sign. While some cities are mostly back to business as usual, others are in a situation where the majority of small businesses are still shuttered.

The Big Picture

In the U.S. as a whole, data suggests that nearly a quarter of all small businesses remain closed. Of course, the situation on the ground differs from place to place. Here’s how cities around the country are doing, sorted by percentage of small businesses closed as of September 2020:

| Metros | Small Businesses Closed | Small Businesses Closed (Leisure & Hosp.) |

|---|---|---|

| San Francisco | -49% | -65% |

| New Orleans | -45% | -72% |

| Honolulu | -41% | -39% |

| Washington DC | -37% | -55% |

| San Jose | -35% | -41% |

| Portland | -34% | -46% |

| San Antonio | -34% | -60% |

| Sacramento | -33% | -43% |

| Boston | -33% | -42% |

| Oakland | -32% | -52% |

| Austin | -32% | -65% |

| Bakersfield | -31% | -64% |

| Houston | -30% | -58% |

| Seattle | -28% | -47% |

| San Diego | -28% | -41% |

| Baltimore | -28% | -43% |

| Detroit | -28% | -44% |

| Los Angeles | -27% | -39% |

| Chicago | -27% | -37% |

| Tucson | -27% | -37% |

| Atlanta | -26% | -33% |

| Fresno | -26% | -50% |

| Oklahoma City | -26% | -56% |

| Cleveland | -26% | -39% |

| Denver | -26% | -56% |

| Indianapolis | -25% | -29% |

| Denver | -25% | -38% |

| El Paso | -25% | -34% |

| Philadelphia | -24% | -34% |

| Tulsa | -23% | -40% |

| Albuquerque | -23% | -42% |

| Colorado Springs | -23% | -37% |

| Louisville | -23% | -25% |

| Miami | -23% | -38% |

| Fort Worth | -22% | -34% |

| Las Vegas | -22% | -35% |

| Tampa | -22% | -45% |

| Milwaukee | -22% | -30% |

| New York City | -21% | -40% |

| Dallas | -21% | -38% |

| Memphis | -21% | -37% |

| Minneapolis | -21% | -36% |

| Nashville | -21% | -39% |

| Columbus | -21% | -35% |

| Phoenix | -19% | -36% |

| Jacksonville | -18% | -35% |

| Salt Lake City | -18% | -24% |

| Charlotte | -18% | -42% |

| Raleigh | -16% | -34% |

| Wichita | -15% | -29% |

| Kansas City | -15% | -24% |

| Omaha | -13% | -14% |

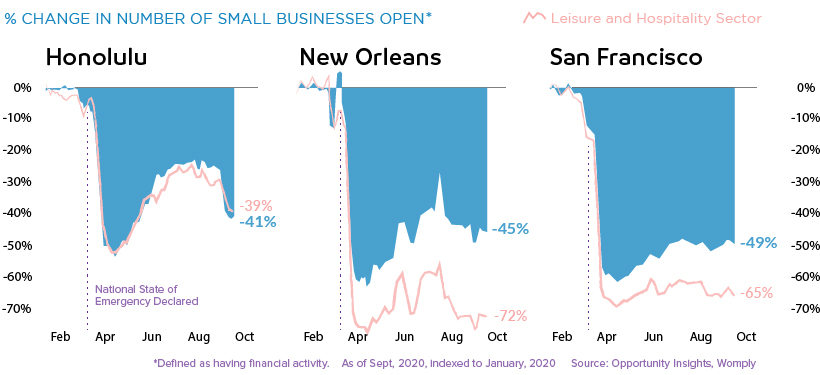

New Orleans and the Bay Area are still experiencing rates of small business closures that are almost double the national median.

Small businesses in the leisure and hospitality sector have been particularly hard hit, with 37% reporting no transaction data.

Getting Back to Business

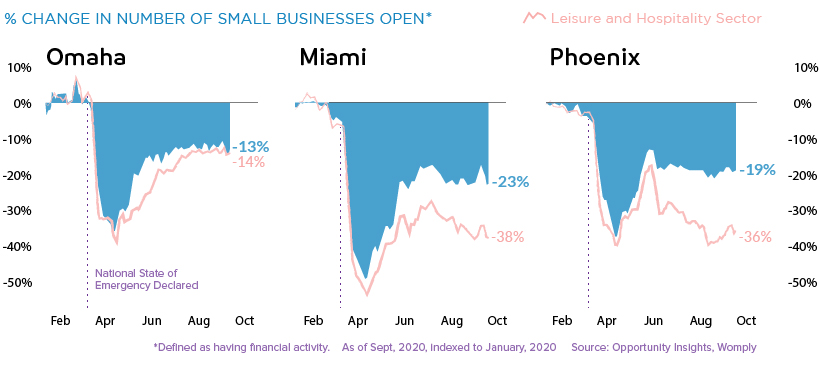

Some cities are seeing rates of small business operation that are nearing pre-pandemic levels.

Of the cities covered in the data set, Omaha had the highest rate of small businesses open.

Still Shuttered

In cities with a large technology sector, such as San Francisco and Austin, COVID-19 is shaking up the economic patterns as entire companies switched to remote working almost overnight. This is bad news for the constellation of restaurants and services that cater to those workers.

Likewise, cities that have an economy built around serving visitors – Honolulu and New Orleans, for example – have seen a very high rate of small business closures as vacations and conferences have been paused indefinitely.

As the pandemic drags on, many of these temporary closures are looking to be permanent. Yelp recently reported that of the restaurants marked as closed on their platform, 61% are shut down permanently. As well, businesses in the retail and nightlife categories also saw more than half of closures become permanent.

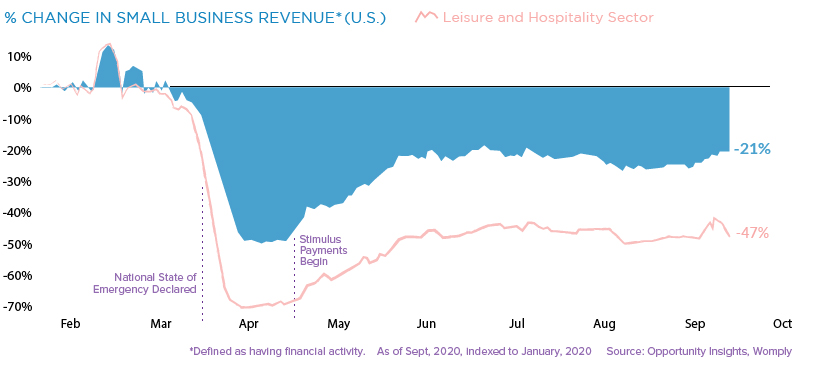

In Remembrance of Revenue

A business being completely closed is a definitive measure, but it doesn’t tell the whole story. Even for businesses that remained open, revenue is often far below pre-pandemic rates.

Once again, businesses in the leisure and hospitality sector have been hit the hardest, with revenue falling by almost half since the beginning of 2020.

At present, it’s hard to predict when, or even if, economic activity will completely recover. Though travel and some level of in-office work will eventually ramp back up, the small business landscape will continue to face major upheaval in the meantime.

Markets

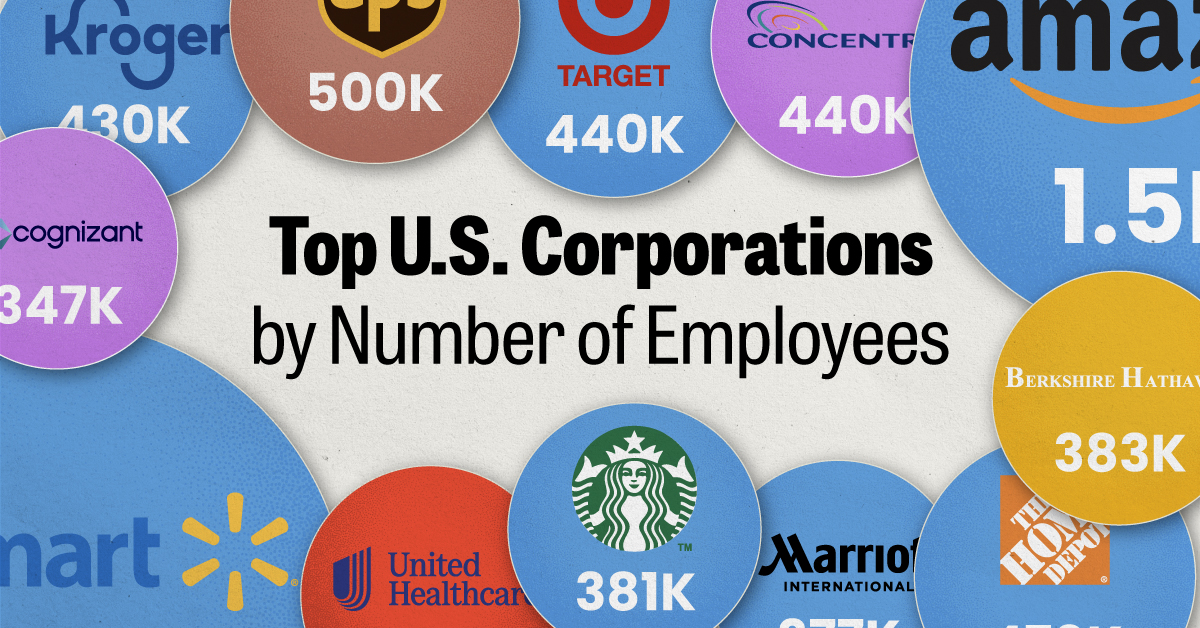

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001