Visualizing $2.5 Trillion in Private Equity Cash Reserves

Visualizing $2.5 Trillion in Private Equity Cash Reserves

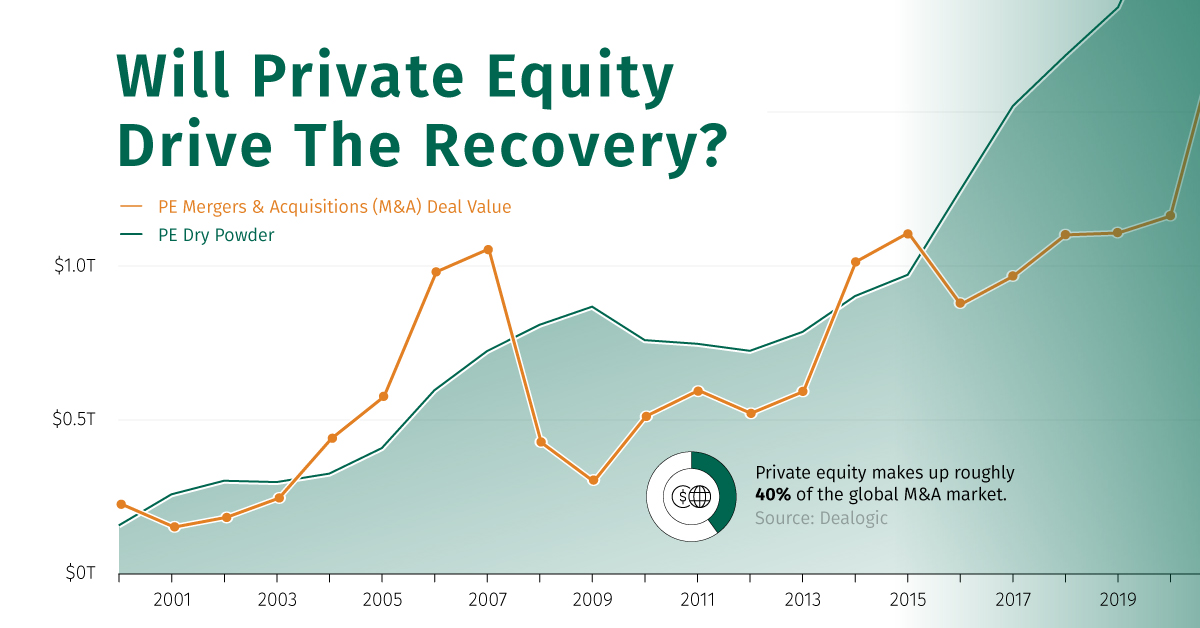

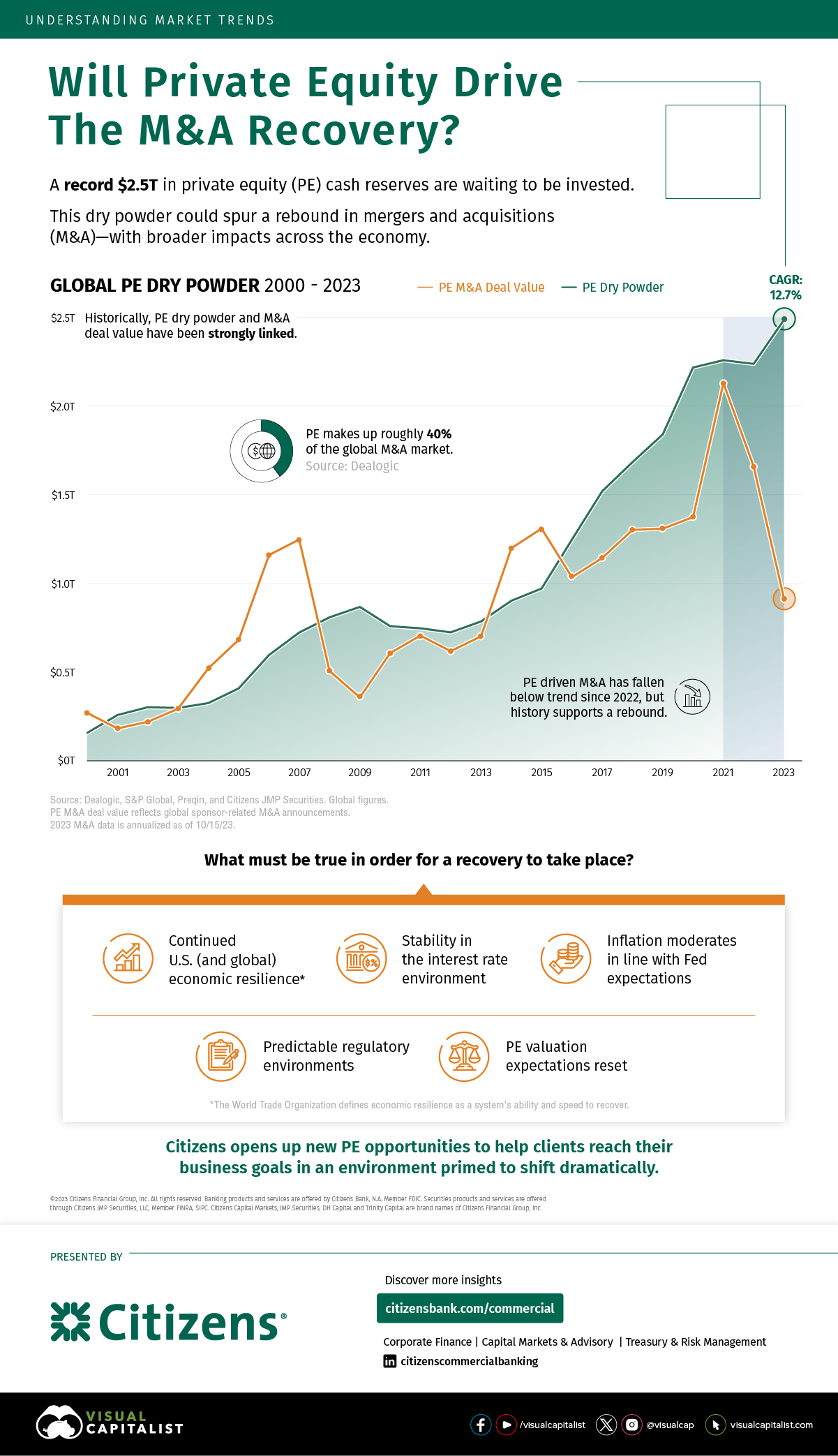

Private equity (PE) firms, which invest in companies that are not publicly-listed, are sitting on a record $2.5 trillion in cash reserves.

PE firms deploy this cash to acquire private companies ripe for growth, with the goal of driving higher valuations. Historically, a higher store of cash has been strongly linked to greater PE deal activity.

Despite this stockpile, activity remains muted. As interest rates sit at multi-decade highs in an uncertain market environment, mergers and acquisitions (M&A) have fallen to 10-year lows.

This graphic, sponsored by Citizens, shows the historic rise in cash reserves, and why this may spur a recovery in M&A deal activity.

Is Private Equity Primed for a Rebound?

Since 2000, global PE cash reserves—also known as dry powder—have grown at a 12.7% compound annual growth rate.

This capital has been a key source of growth and funding for companies, with PE making up roughly 40% of the global M&A market. The table below shows global PE dry powder and M&A deal value in 2023:

| Year | Global Dry Powder | Global M&A Deal Value |

|---|---|---|

| 2023 | $2,485B | $776B* |

| 2022 | $2,237B | $1,403B |

| 2021 | $2,258B | $2,130B |

| 2020 | $2,217B | $1,162B |

| 2019 | $1,840B | $1,107B |

| 2018 | $1,683B | $1,101B |

| 2017 | $1,520B | $967B |

| 2016 | $1,246B | $876B |

| 2015 | $971B | $1,108B |

| 2014 | $902B | $1,014B |

| 2013 | $786B | $594B |

| 2012 | $724B | $523B |

| 2011 | $747B | $597B |

| 2010 | $759B | $514B |

| 2009 | $868B | $302B |

| 2008 | $809B | $429B |

| 2007 | $723B | $1,056B |

| 2006 | $596B | $982B |

| 2005 | $408B | $577B |

| 2004 | $326B | $441B |

| 2003 | $298B | $249B |

| 2002 | $302B | $186B |

| 2001 | $258B | $155B |

| 2000 | $158BB | $229B |

*2023 M&A deal value annualized as of 10/15/2023. Source: Dealogic, S&P Global, Preqin, and Citizens JMP Securities. PE M&A deal value reflects sponsor-related M&A announcements.

As we can see in the table above, 2023 has been an aberration for global M&A deal activity. Since last year, M&A deal value has declined 75% to $776 billion.

Today, high interest rates are putting pressure on borrowing costs, with many PE firms waiting in the wings for conditions to improve. The majority of deals are happening among smaller companies, while PE firms hold out on mega-deals.

Nevertheless, this vast amount of dry powder could help fuel an eventual recovery.

Key Factors for a Recovery

Looking ahead, the following market conditions will be important for a revival in PE deal activity:

- Continued U.S. (and global) economic resilience

- Stability in the interest rate environment

- Inflation moderates in line with Fed expectations

- Predictable regulatory environments

- PE valuation expectations reset

With PE firms holding significant cash piles, key opportunities could open up if conditions improve. As a result, the PE market could be well-positioned for growth in an environment primed for a rebound—with impacts across the wider economy.

Explore more insights with Citizens.

-

Economy5 days ago

Economy5 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets3 weeks ago

Markets3 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.