Investors’ Top 5 ESG Challenges

The following content is sponsored by iShares by BlackRock.

Investors’ Top Five ESG Challenges

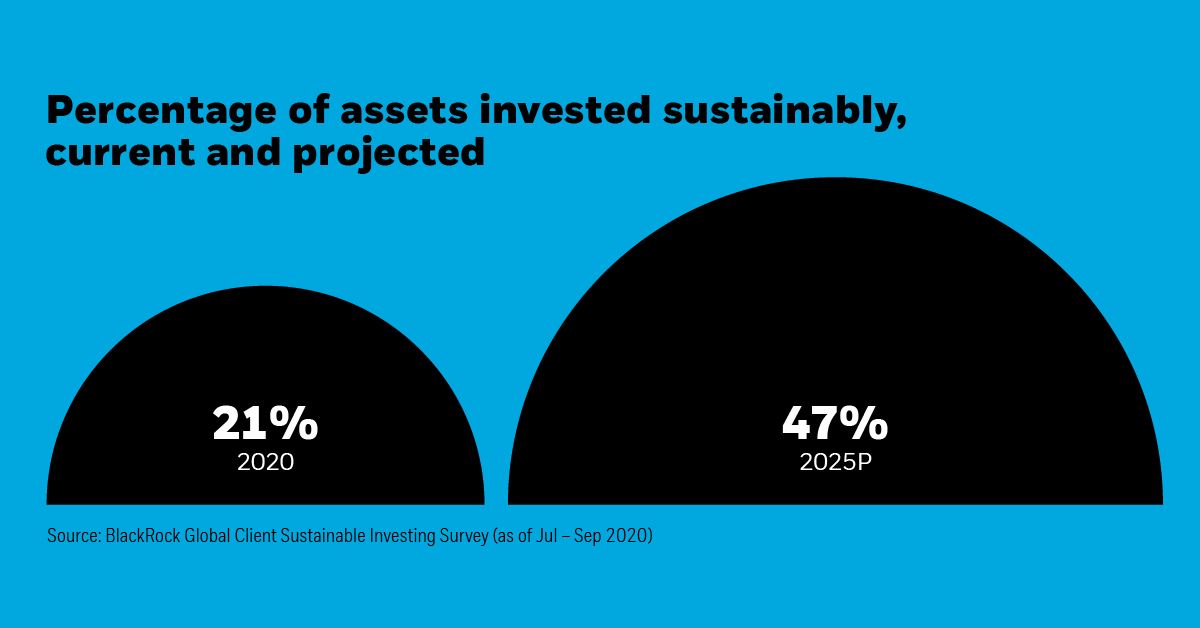

Investors in Europe, the Middle East and Africa (EMEA) expect to dramatically increase their sustainable assets. In fact, sustainable assets are projected to grow from 21% of total assets in 2020 to 47% of total assets in 2025.

In this graphic from iShares by BlackRock, we outline the top five ESG challenges that European investors face amid this shift.

1. Transitioning Your Portfolio

Building a sustainable portfolio tailored to specific requirements can be time consuming, and the financial and sustainable impact may be unclear.

iShares’ approach: iShares offers transparency for investors across all their sustainable exchange traded funds (ETFs). Investors can evaluate a fund based on various sustainability characteristics on iShares ETF product pages. They can also build a portfolio using sustainable ETFs as core building blocks.

For investors looking for a ready-made portfolio, 80% of the assets within BlackRock’s Multi-Asset Portfolio ESG ETFs seek to track indices that meet certain ESG criteria.

2. Making Sense of the Data

Investors must be able to find and interpret ESG data so they can assess the measurable output of their investments.

iShares’ approach: At iShares, they are driving a push for standardisation across the industry to bring consistency and transparency to all investors. In 2021, they leveraged over 1,200 sustainability metrics within Aladdin, their risk and portfolio management system. They also strengthened multiple partnerships with data analytics firms.

3. Choosing the Right Product

Almost 50 new sustainable ETFs were launched in Europe in the first half of 2021 alone. With so many sustainable products, investors need clarity navigating the options.

iShares’ approach: To help investors choose an ETF that aligns with their goals, all iShares ETFs are classified according to BlackRock’s Sustainable Investing Framework.

- Screened: Funds that seek to track indices that eliminate exposure to certain business areas.

- ESG Broad: Funds that have an explicit ESG objective, which may also include a targeted quantifiable ESG outcome.

- ESG Thematic: Funds with a focus on a particular Environmental, Social, or Governance theme.

- Impact: Funds that seek to generate a measurable financial outcome alongside a financial return.

iShares believes that they have an approach for every sustainable investor.

4. The Emerging Climate Trend

Climate change has emerged as a crucial factor for investors to consider, yet investors often aren’t sure how to incorporate climate considerations into their portfolio.

iShares’ approach: iShares has three approaches to climate investing to help investors select the best climate option for them.

- Reduce exposure to carbon emissions or fossil fuels. For example, this can include minimising or eliminating companies that have high carbon emissions relative to their sector peers.

- Prioritise companies based on climate risks and opportunities. For example, this can include increasing the weighting of companies based on their commitments to align with Paris Agreement temperature goals.

- Target climate themes and impact outcomes. For example, this can include investing in a specific sustainable activity or project, such as clean energy.

Based on these approaches, investors can pick an option that meets their climate goals.

5. Company Engagement

Investors want to ensure their sustainable fund provider is driving long-term value through engagement with companies.

iShares’ approach: iShares is backed by BlackRock’s investment stewardship team, which is one of the largest in the industry. The team has 10 offices around the world. This enables the team to have a local presence and frequent dialogue with companies.

In fact, during the 2020-2021 proxy year, BlackRock had 3,650 unique engagements—a new record for the team.

Navigating ESG Challenges

From choosing the right product to engaging with companies, sustainable investors have a lot to consider. iShares can help investors navigate the ESG challenges they face.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.