Technology

Internet Browser Market Share (1996–2019)

Internet Browser Market Share (1996–2019)

Web browsers are a ubiquitous part of the internet experience and one of the most commonly used digital tools of the modern era.

Since the first rudimentary interfaces were created in the 1990s, a number of browsers have entered the market, with a select few achieving market dominance over our access to web content.

Today’s bar chart race video, by the YouTube channel Data is Beautiful, is a nostalgic look back at how people used to access the internet, from Mosaic to Chrome.

The First Wave of Browsers

Simply put, web browsers are the software applications that act as our portal to the internet. Today, aside from the occasional pop-up box, we barely notice them. In the early ’90s though, when the web was in its infancy, the crude, boxy interfaces were a revolutionary step in making the internet usable to people with access to a computer.

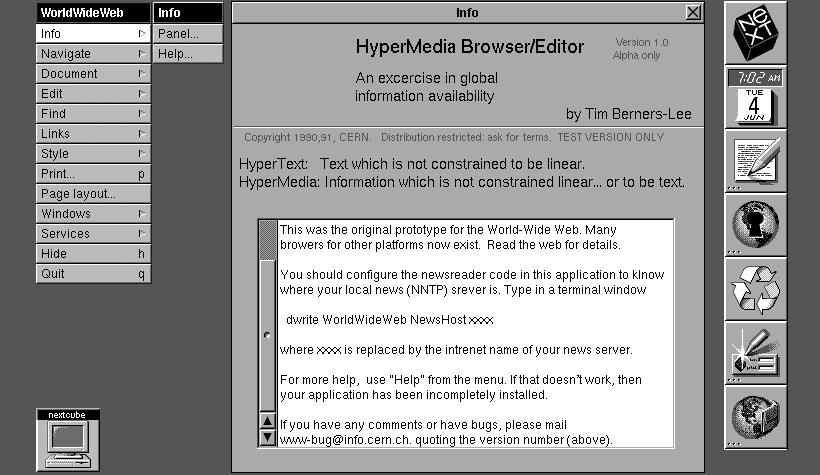

The first step in this journey came in 1990, when the legendary Tim Berners-Lee developed the first-ever web browser called “WorldWideWeb” – later renamed Nexus. Nexus was a graphical user interface (GUI) that allowed users to view text on web pages. Images were still beyond reach, but since most connections were dial-up, that wasn’t much of a limitation at the time.

The precurser to the modern browser was Mosaic, originally developed as a temporary project by the the University of Illinois at Urbana–Champaign (UIUC) and the National Center for Supercomputing Applications (NCSA).

After his graduation from UIUC in 1993, Marc Andreessen teamed up with Jim Clark, the founder of Silicon Graphics, to produce a commercial version of the browser. The resulting software, Netscape Navigator, became the first widely used browser, moving the internet from an abstract concept to a network that was accessible to everyday people. The company soon staged a wildly popular IPO, which saw the 16-month-old startup reach a valuation of nearly $3 billion.

Naturally, the fanfare surrounding Netscape had captured Microsoft’s attention. Immediately after Netscape’s IPO, the first version of Internet Explorer (building off a licensed version of Mozilla) was released. The browser wars had begun.

The Internet Explorer Era

In 1995, Bill Gates was looking to capitalize on the “Internet Tidal Wave”, and was up to the challenge of eating into Netscape’s market share, which stood at about 90%.

A new competitor “born” on the Internet is Netscape. We have to match and beat their offerings…

– Bill Gates

Ultimately, Netscape was no match for Internet Explorer (IE) once it was bundled with the Windows operating system. By the dawn of the new millennium (beware Y2K!) the situation had reversed, with IE capturing over 75% of the browser market share.

With Netscape mostly out of the picture, IE had a stranglehold on the market. In fact, Microsoft’s position was so comfortable that after IE6 was released 2001, the next full version wouldn’t ship until 2006.

It was during this time that a new player came onto the scene. Mozilla Firefox was officially launched in 2004, seeing over 60 million downloads within its first nine months. For the first time in years, Microsoft began to feel the heat of competition.

Goliath and Goliath

Despite the growing popularity for Mozilla Firefox, it was a browser backed by another tech giant that would eventually lead to IE’s downfall – Google Chrome.

Chrome was pitched to the public in 2008 as “a fresh take on the browser”. While Microsoft struggled with open web standards, Chrome’s source code was openly available through Google’s Chromium project.

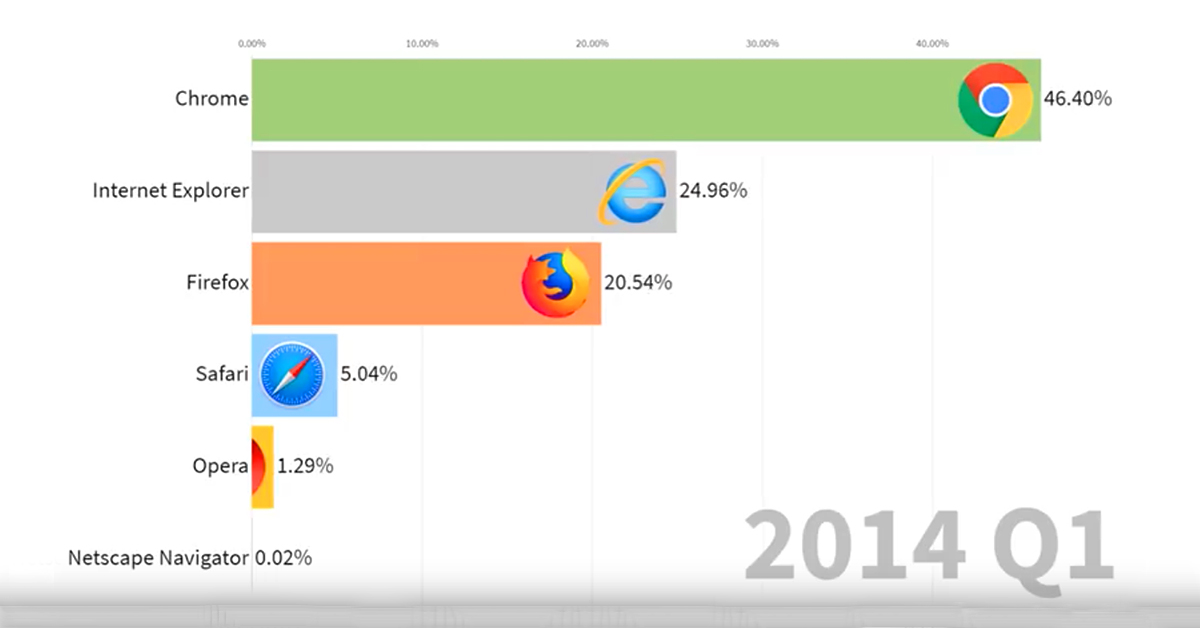

By 2011, Firefox and Chrome had eroded IE’s market share to below 50%, and a year later, Chrome would end Internet Explorer’s 14-year reign as the world’s top internet browser.

Today, the browser market has come full circle. Chrome has now become the dominant browser on the market, while competitors fight to increase their single-digit market shares. IE has dropped to fourth place.

Looking Back at the Peaks

In the 25 years since Netscape gave people access to the internet, a few browsers have had their moment in the sun. Here are the years of peak market share for all the major browsers:

| Browser | Peak Market Share | Peak Year |

|---|---|---|

| Netscape Navigator | 90% | 1995 |

| Internet Explorer | 95% | 2004 |

| Opera | 3% | 2009 |

| Mozilla Firefox | 32% | 2010 |

| Safari | 7% | 2012 |

Once a browser becomes popular, it can be incredibly difficult to carve into its market share. Even during the height of the iPhone era, Apple’s browser, Safari, was only able to manage a 7% market share.

For now, it looks like Chrome will continue to be the world’s preferred method of experiencing the internet. If Chrome’s current trajectory continues, it could become the third major browser to surpass a 90% market share.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees