Technology

Charting the Number of Failed Crypto Coins, by Year (2013-2022)

The Number of Failed Crypto Coins, by Year (2013-2022)

Ever since the first major crypto boom in 2011, tens of thousands of cryptocurrency coins have been released to market.

And while some cryptocurrencies performed well, others have ceased to trade or have ended up as failed or abandoned projects.

These graphics from CoinKickoff break down the number of failed crypto coins by the year they died, and the year they started. The data covers a decade of coin busts from 2013 through 2022.

Methodology

What is the marker of a “dead” crypto coin?

This analysis reviewed data from failed crypto coins listed on Coinopsy and cross-referenced against CoinMarketCap to verify previous market activity. The reason for each coin death was also tabulated, including:

- Failed Initial Coin Offerings (ICOs)

- Abandonment with less than $1,000 in trade volume over a three-month period

- Scams or coins that were meant as a joke

Dead Crypto Coins from 2013 to 2022

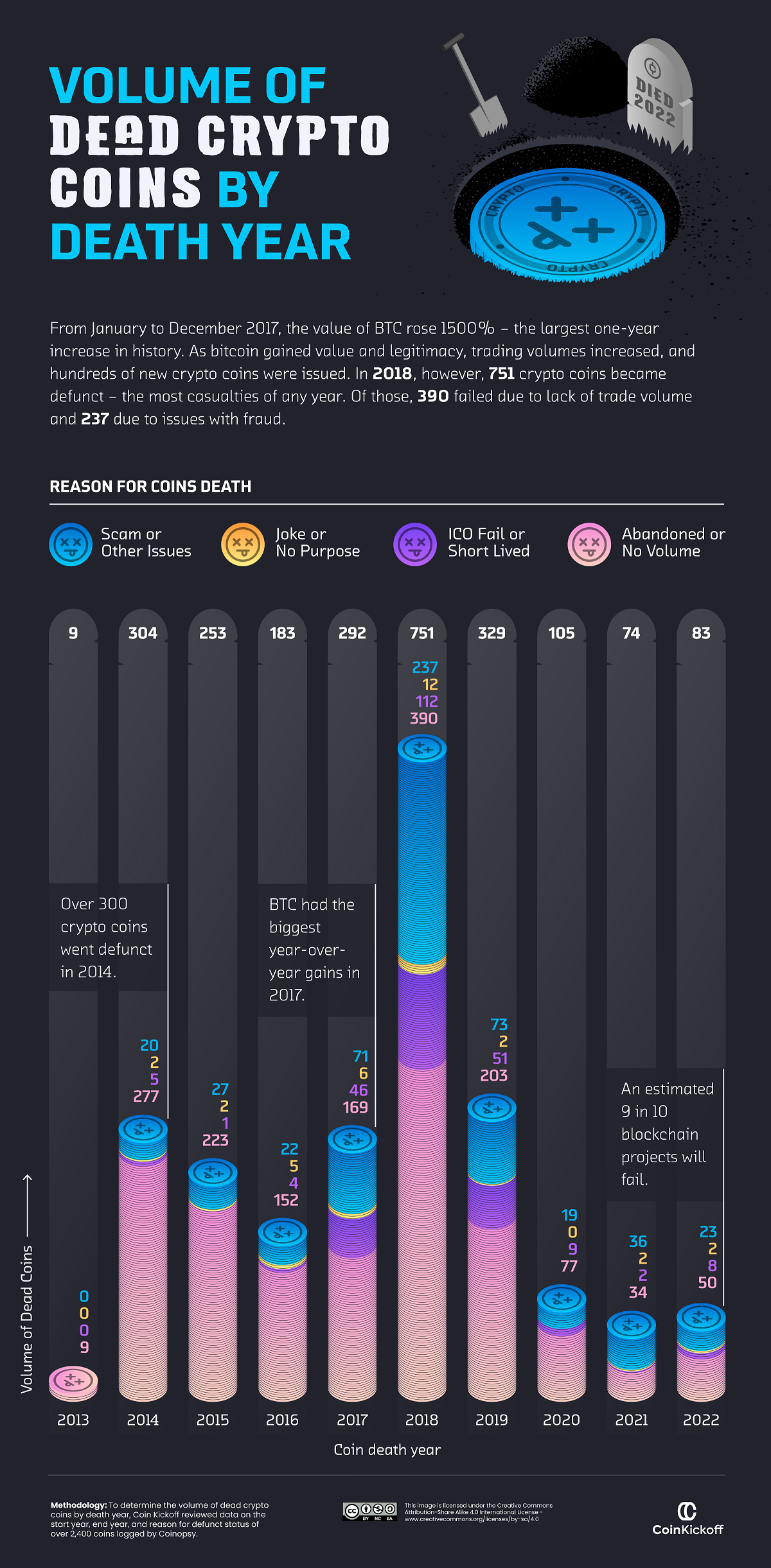

While many familiar crypto coins—Litecoin, Dogecoin, and Ethereum—are still on the market today, there were at least 2,383 crypto coins that bit the dust between 2013 and 2022.

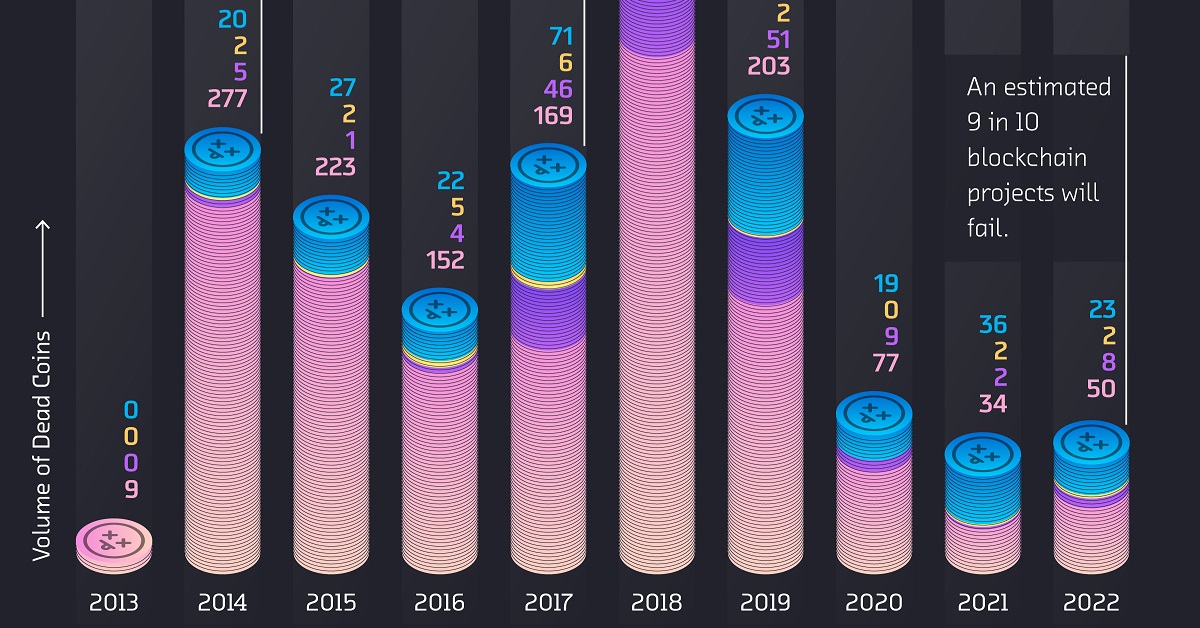

Here’s a breakdown of how many crypto coins died each year by reason:

| Dead Coins by Year | Abandoned / No Volume | Scams / Other Issues | ICO Failed / Short-Lived | Joke / No purpose |

|---|---|---|---|---|

| 2013 | 9 | 0 | 0 | 0 |

| 2014 | 277 | 20 | 5 | 2 |

| 2015 | 223 | 27 | 1 | 2 |

| 2016 | 152 | 22 | 4 | 5 |

| 2017 | 169 | 71 | 46 | 6 |

| 2018 | 390 | 237 | 112 | 12 |

| 2019 | 203 | 73 | 51 | 2 |

| 2020 | 77 | 19 | 9 | 0 |

| 2021 | 34 | 36 | 2 | 2 |

| 2022 | 50 | 23 | 8 | 2 |

| Total | 1,584 | 528 | 238 | 33 |

Abandoned coins with flatlining trading volume accounted for 1,584 or 66.5% of analyzed crypto failures over the last decade. Comparatively, 22% ended up being scam coins, and 10% failed to launch after an ICO.

As for individual years, 2018 saw the largest total of annual casualties in the crypto market, with 751 dead crypto coins. More than half of them were abandoned by investors, but 237 coins were revealed as scams or embroiled in other controversies, such as BitConnect which turned out to be a Ponzi scheme.

Why was 2018 such a big year for crypto failures?

This is largely because the year prior saw Bitcoin prices climb above $1,000 for the first time with an eventual peak near $19,000. As a result, speculation ran hot, new crypto issuances boomed, and many investors and firms got bullish on the market for the first time.

How Many Newly Launched Coins Died?

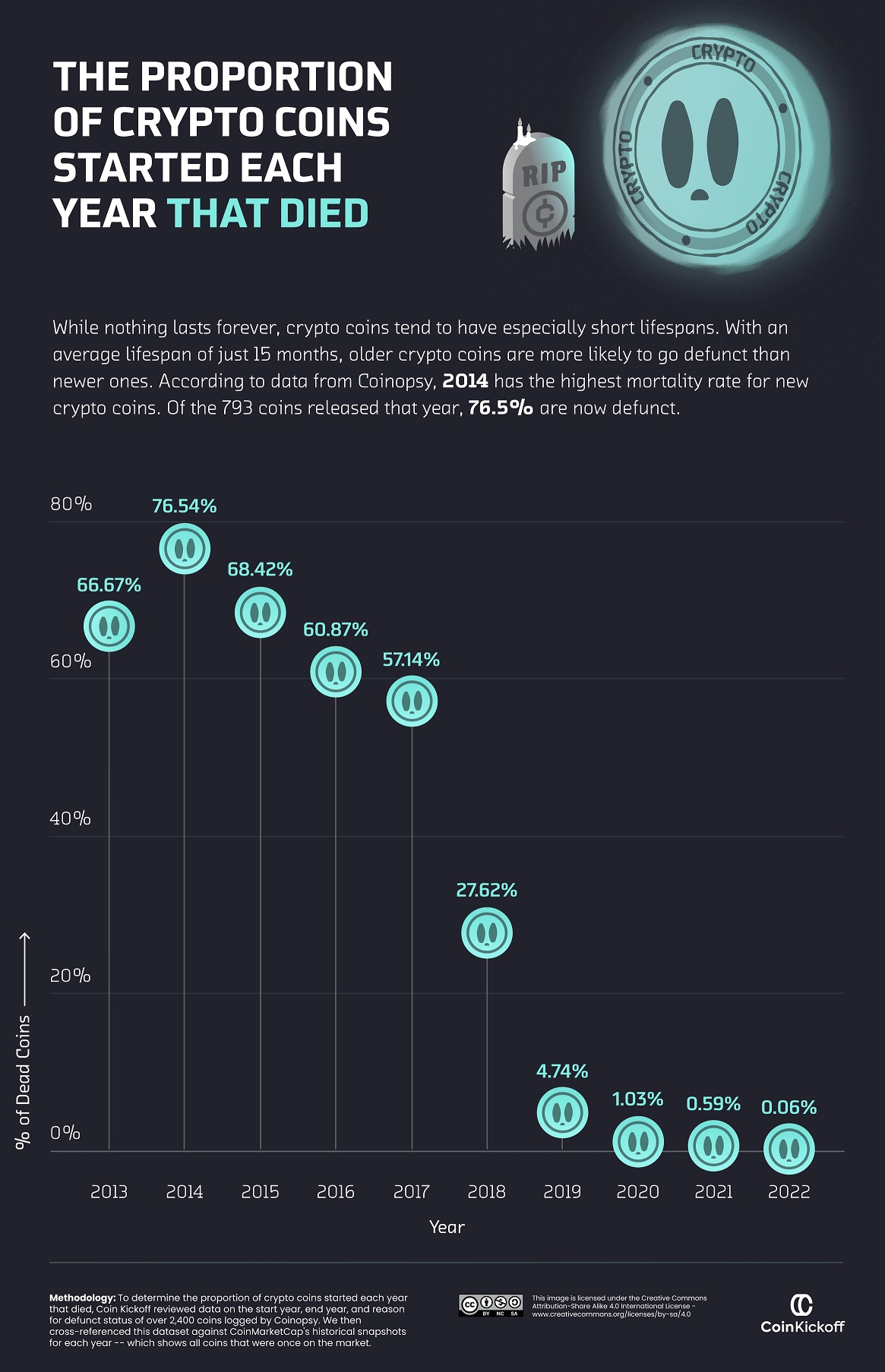

Of the hundreds of coins that launched in 2017, more than half were considered defunct by the end of 2022.

Indeed, a lot of earlier-launched coins have since died. The majority of coins launched between 2013 and 2017 have already become “dead coins” by the end of 2022.

| Coin Start Year | Dead Coins by 2022 |

|---|---|

| 2013 | 66.67% |

| 2014 | 76.54% |

| 2015 | 68.42% |

| 2016 | 60.87% |

| 2017 | 57.14% |

| 2018 | 27.62% |

| 2019 | 4.74% |

| 2020 | 1.03% |

| 2021 | 0.59% |

| 2022 | 0.06% |

Part of this is because the cryptocurrency field itself was still being figured out. Many coins were launched in a time of experimentation and innovation, but also of volatility and uncertainty.

However, the trend began to shift in 2018. Only 27.62% of coins launched in that year have bit the dust so far, and the failure rates in 2019 and 2020 fell further to only 4.74% and 1.03% of launched coins, respectively.

This suggests that the crypto industry has become more mature and stable, with newer projects establishing themselves more securely and investors becoming wiser to potential scams.

How will this trend evolve into 2023 and beyond?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

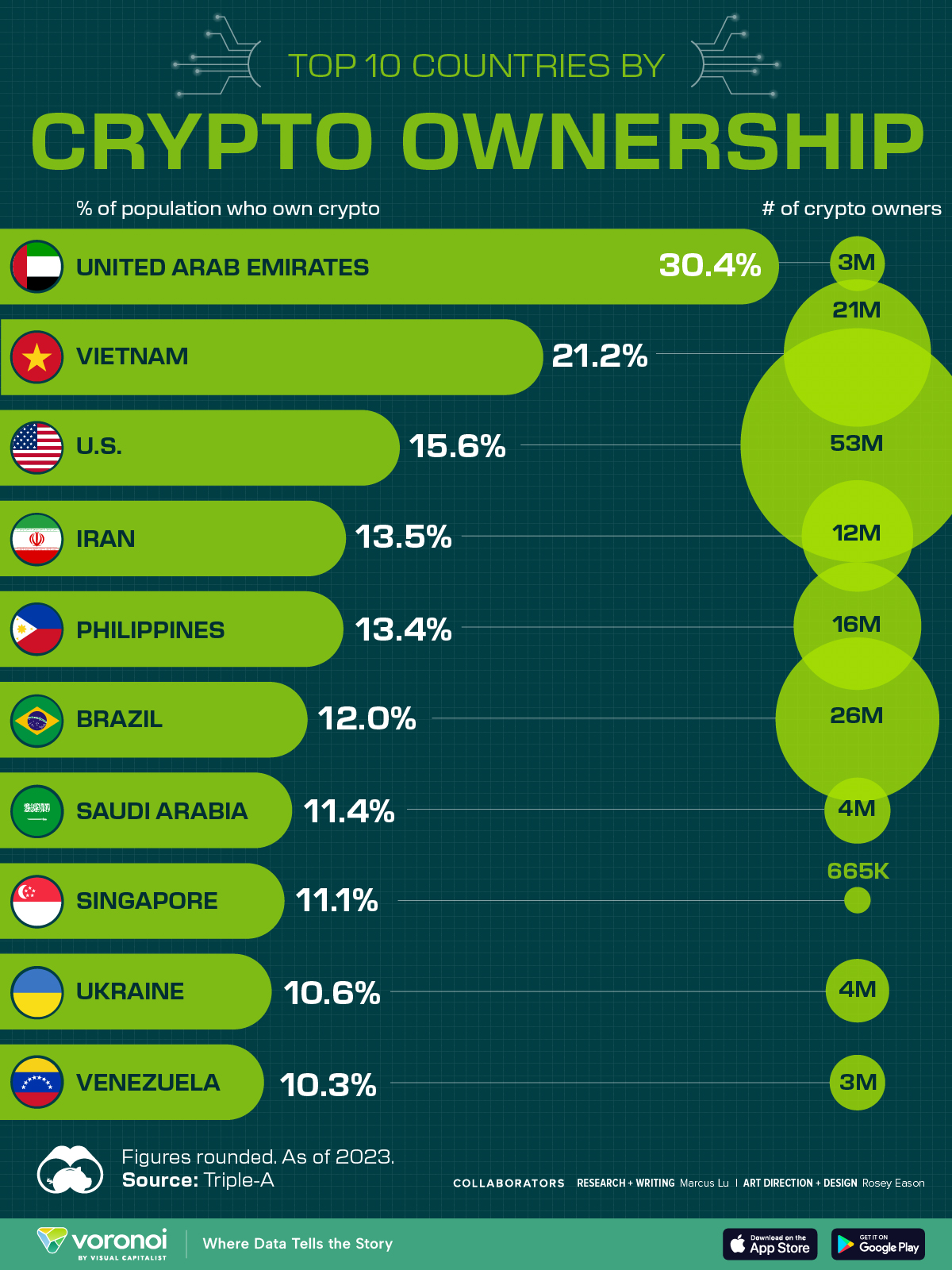

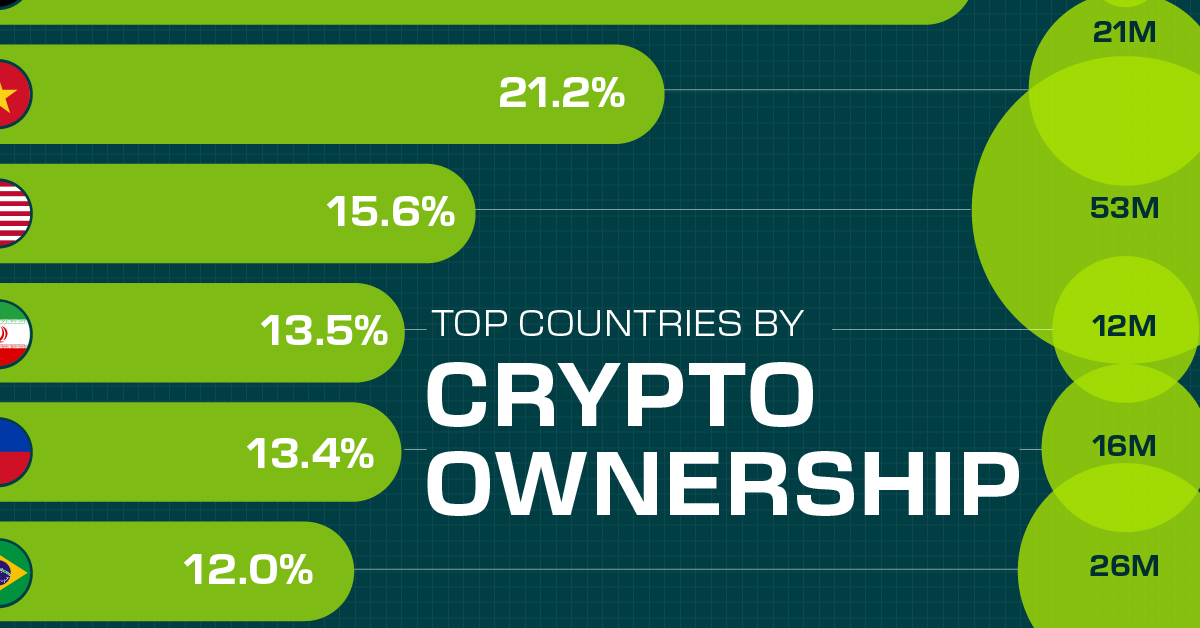

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Healthcare5 days ago

Healthcare5 days agoLife Expectancy by Region (1950-2050F)

-

Economy2 weeks ago

Economy2 weeks agoRanked: The Top 20 Countries in Debt to China

-

Politics2 weeks ago

Politics2 weeks agoCharted: Trust in Government Institutions by G7 Countries

-

Energy2 weeks ago

Energy2 weeks agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Global Gold Production in 2023

-

Markets1 week ago

Markets1 week agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Economy1 week ago

Economy1 week agoThe Most Valuable Companies in Major EU Economies

-

Markets1 week ago

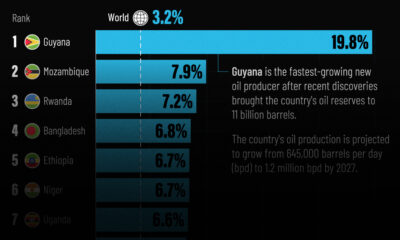

Markets1 week agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)