Money

Ranked: The Largest Gold Reserves, by Country

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Ranked: The Largest Gold Reserves, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold remains an important store of value, serving as a hedge and retaining value during economic crises. In 2023, amid uncertainty about US interest rates and continued geopolitical risks, the metal once again demonstrated its importance by hitting a new record in December.

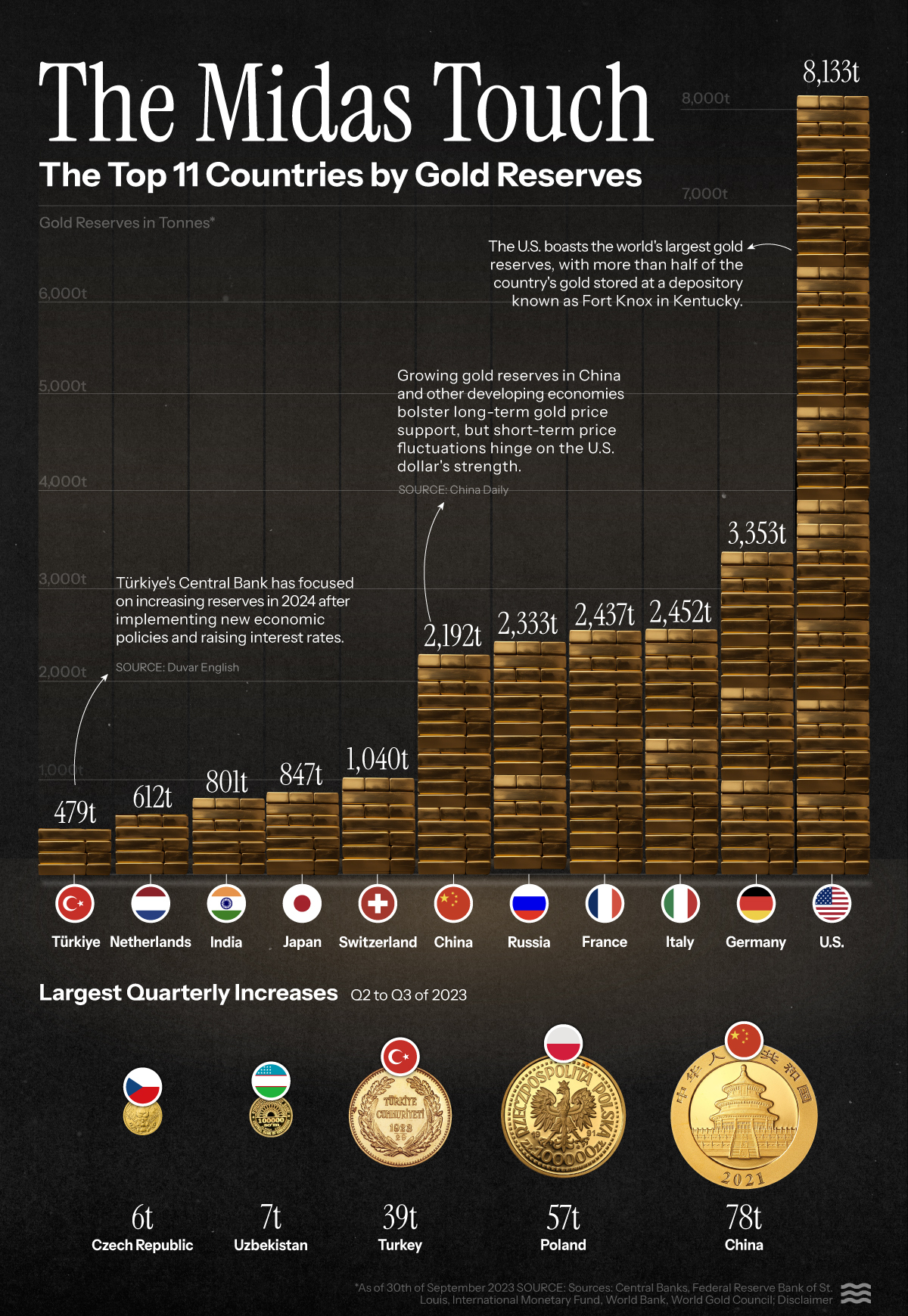

This graphic, by Sam Parker, displays the top 11 countries by gold reserves as of September 2023, based on data from Central Banks, the Federal Reserve Bank of St. Louis, the International Monetary Fund, the World Bank, and the World Gold Council.

Central Bank Gold Demand

Most of the world’s gold is stored in various locations, including central bank vaults, private depositories, and jewelry holdings.

Countries maintain gold reserves for various reasons.

Firstly, gold serves as a stable and dependable store of value, enhancing confidence in a nation’s economic stability, especially during times of financial uncertainty.

Additionally, despite the waning relevance of the gold standard, some countries still deem gold reserves crucial for maintaining currency stability.

Moreover, gold’s tangibility enables countries to diversify their overall portfolio. Currently, almost one-fifth of all the gold ever mined is held by central banks.

The U.S. boasts the world’s largest gold reserves, with 8,133 tonnes stored in 12 Federal Reserve Banks across the country:

| Country | Tonnes of Gold |

|---|---|

| 🇺🇸 USA | 8,133 t |

| 🇩🇪 Germany | 3,353 t |

| 🇮🇹 Italy | 2,452 t |

| 🇫🇷 France | 2,437 t |

| 🇷🇺 Russia | 2,333 t |

| 🇨🇳 China | 2,192 t |

| 🇨🇭 Switzerland | 1,040 t |

| 🇯🇵 Japan | 847 t |

| 🇮🇳 India | 801 t |

| 🇳🇱 Netherlands | 612 t |

| 🇹🇷 Turkey | 479 t |

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. The People’s Bank of China was the biggest buyer of gold last year, purchasing 225 tonnes.

Seven of the top countries by gold reserves are also among the top 10 biggest economies.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001