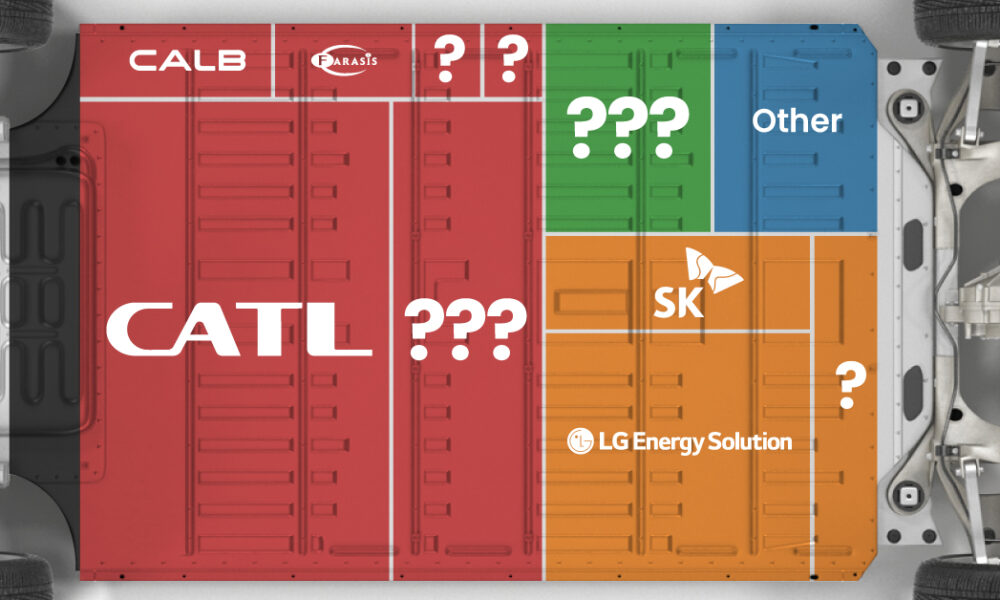

Asia dominates this ranking of the world's largest EV battery manufacturers in 2023.

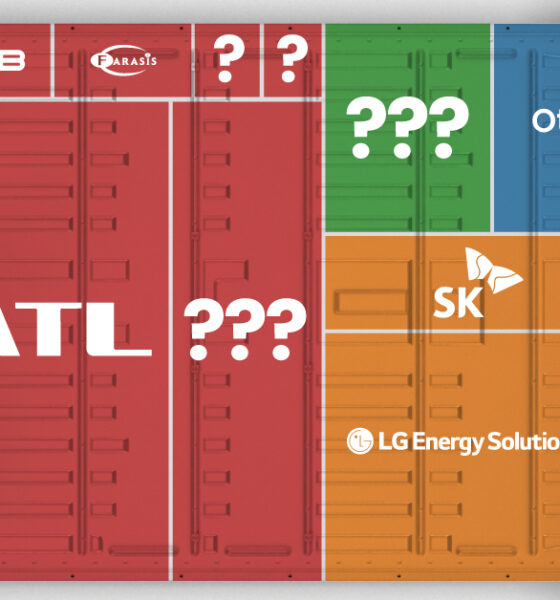

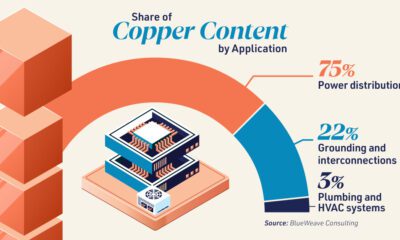

Explore three key insights into the future of the copper market, from soaring demand to potential supply constraints.

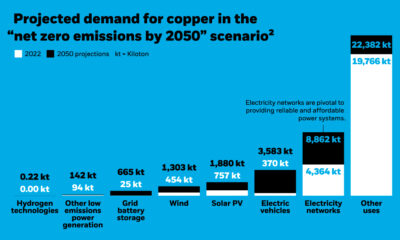

Discover three key insights that could shape the future of lithium, from soaring demand to supply challenges.

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.

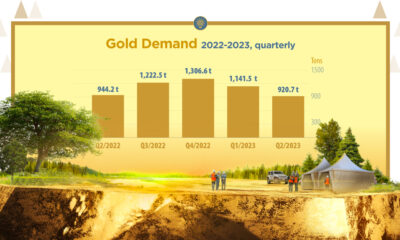

This infographic highlights the need for new gold mining projects and shows the next generation of America's gold deposits.

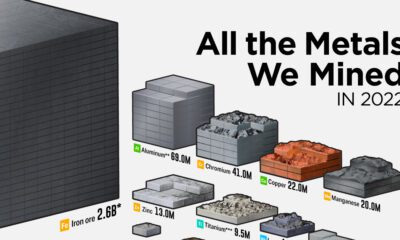

This infographic visualizes the 2.8 billion tonnes of metals mined in 2022.

Copper consumption for data centers in North America is estimated to jump from 197,000 tonnes in 2020 to 238,000 tonnes in 2030.

Who are the leaders in rough diamond production and how much is their diamond output worth?

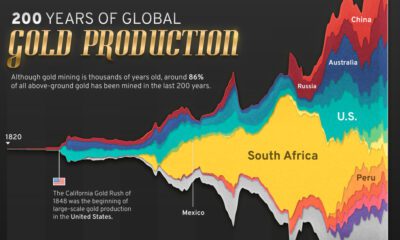

Global gold production has grown exponentially since the 1800s, with 86% of all above-ground gold mined in the last 200 years.

Mining represents 7% of British Columbia's GDP despite only accounting for 0.04% of the land use.

Metals are critical to the rollout of clean energy technologies like wind and solar, but just how much do they use?