Technology

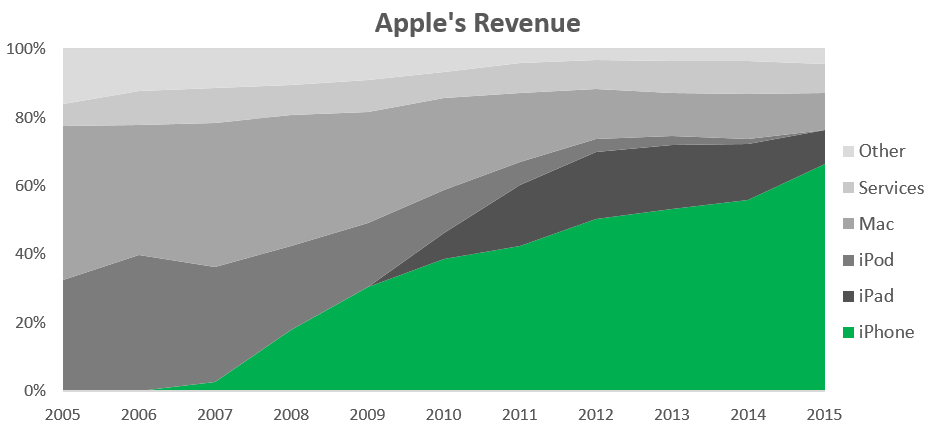

Chart: Apple is Becoming a One Trick Pony

Near the end of last year, Apple CEO Tim Cook said that 2015 was the company’s “most successful year ever” with $234 billion of revenue.

The numbers were impressive. About 48 million iPhones were sold in Q4 for a 36% increase in sales over the same quarter in 2014. The company’s solid financial position was underlined by its war chest of $205 billion in cash. Investors were delighted, and the stock ran to $120 per share, which is close to its all-time highs.

The only problem?

Apple’s robust iPhone sales are also the company’s biggest weakness:

An over-reliance on iPhone sales is okay if the smartphone category is booming – but financials from Q2 in 2016 provided a wake up call to investors on Apple’s future potential iPhone prospects. Sales for the company’s flagship product declined by 16% from the quarter a year ago, and revenue fell with it by 13%.

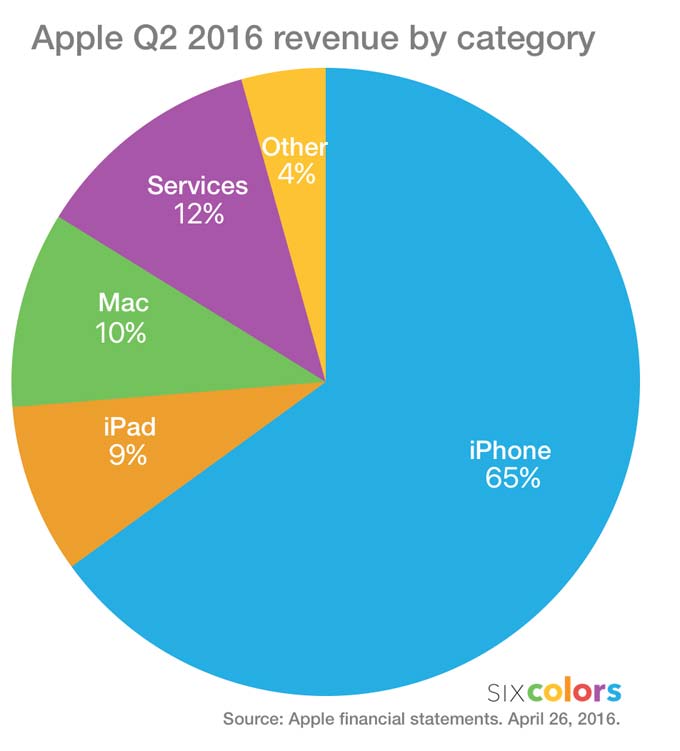

Despite this drop, iPhone sales still made up 65% of Apple’s entire revenue for the quarter.

It’s now clear to investors that perhaps there is a ceiling for iPhone sales in the future – and even if it isn’t here yet, it raises the urgent question of what Apple’s next big ticket product will be.

One area to look at may be the company’s “Other Products” category, which is growing fast with 29% in quarterly revenue growth year-over-year. Comprised of the Apple Watch, Apple TV, Beats headphones, and other hardware products, could this hold the next golden goose?

Right now, it’s not looking like it, as this entire group of products amounted to only $2.2 billion of revenue in Q2, equal to a measly 4.3% of iPhone sales for the same time period. Even if the “Other Products” category continues to grow at a 30% clip, it will be over 10 years before it makes a significant dent on the income statement relative to the might of the iPhone.

What’s Next?

If the next hit isn’t in Apple’s product offering today, then hopefully it is still behind closed curtains. After all, Tim Cook has hinted that there are plenty of innovative products in store.

The fact that Apple has been working on an electric car has been one of the tech giant’s worst-kept secrets. MacRumors even has an entire microsite dedicated to the potential project. However, not expected to launch until 2020, will the Apple car be early enough for investors to ward off the effect of plateauing iPhone sales?

Apple’s virtual reality game hasn’t been particularly impressive, either. While it has patented a VR headset to work with smartphones and there is mounting evidence that Apple is making a significant bet on VR, the company is still considered to be “behind” leaders such as Facebook’s Oculus Rift or HTC.

That’s because Apple does not have a VR/AR product or an articulated strategy in the sector – not yet, anyways.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue