Technology

The Most Overhyped Sectors in Tech, According to Entrepreneurs

Most Overhyped Sectors in Tech

What founders think about emerging technologies

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Founders are at the very ground level, and their pursuits have a ripple effect on the entire startup ecosystem.

As a result, how entrepreneurs think about different subsectors within tech is of utmost importance. Not only do their perceptions influence what projects they themselves choose to build, but how founders allocate their time and energy may also be a useful gauge of where future economic potential lies.

Today’s chart focuses on what entrepreneurs think of specific technologies, using data from a survey of 869 entrepreneurs that was done by First Round Capital.

Seeing Through the Hype

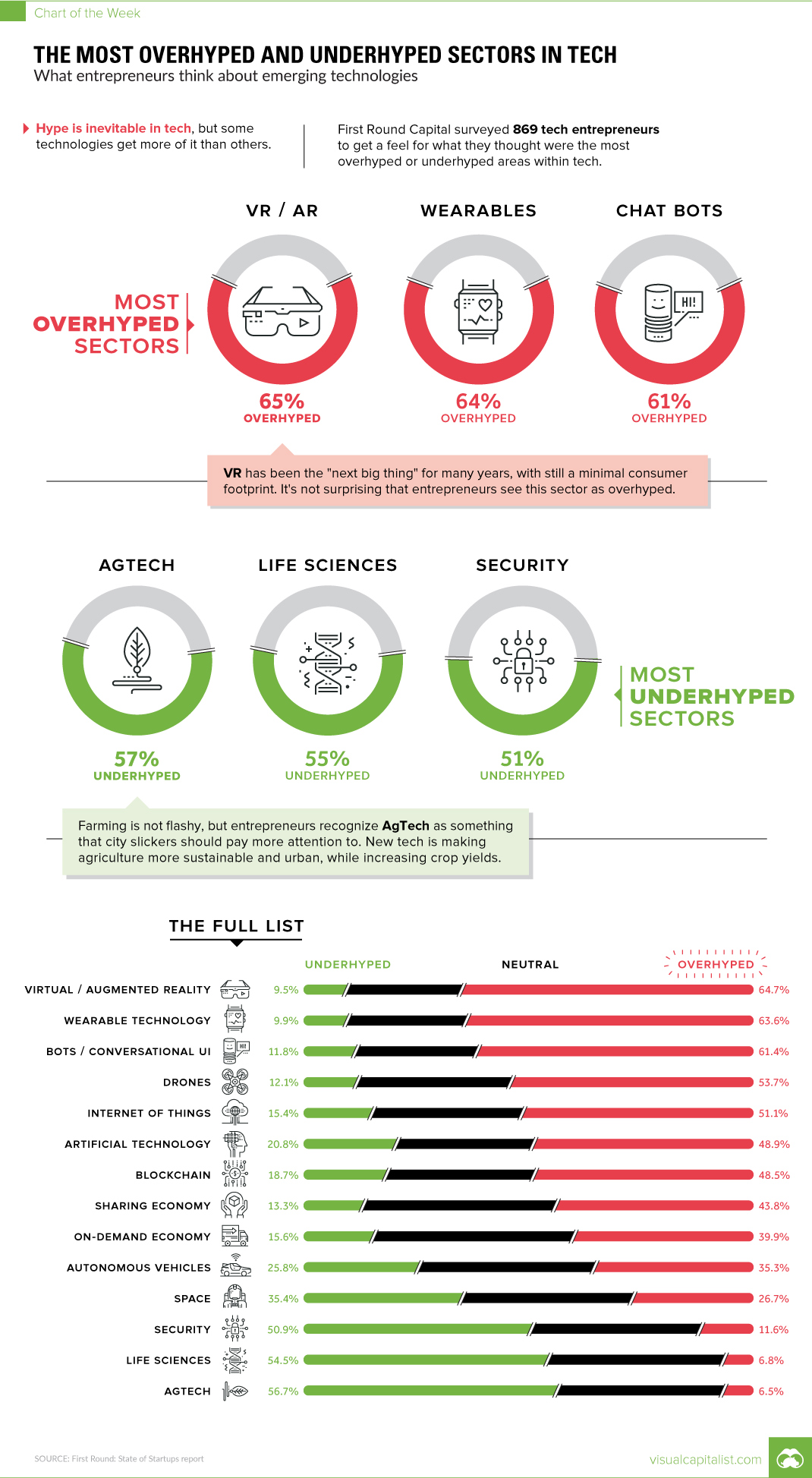

In the survey, entrepreneurs were asked to give their opinions on 14 different technologies, on whether they were overhyped or underhyped. Entrepreneurs could also answer “neutral” to any of the questions.

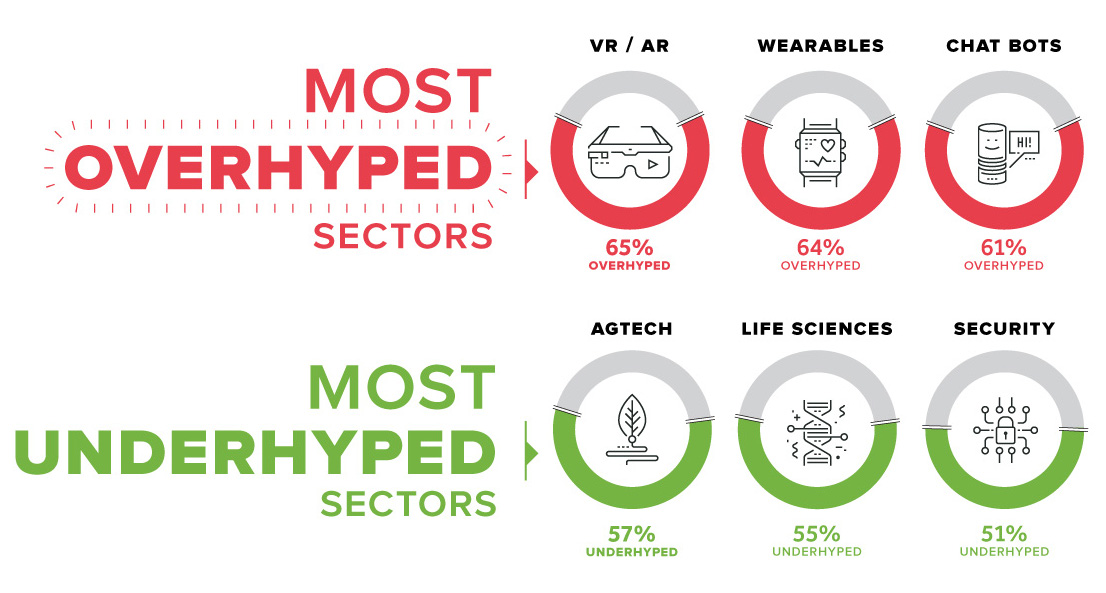

Here are the three technologies that were considered the most overhyped:

1. VR/AR: 65% Overhyped

VR has been the “next big thing” for many years, with still a minimal consumer footprint. It’s not surprising that entrepreneurs see this sector as overhyped. For companies like Facebook and Magic Leap to reverse the perception of VR/AR, they’ll need to get consumers adopting these technologies at a faster rate.

2. Wearables: 64% Overhyped

When Google Glass first came out in 2013, hype about a future filled with wearables seemed inevitable. Now it’s almost five years later, and wearables haven’t delivered on the scale that many entrepreneurs thought was possible.

3. Chatbots: 61% Overhyped

Will chatbots really change customer service, health, and other industries? Most entrepreneurs seem to be a little skeptical about their potential impact.

Diamonds in the Rough?

Entrepreneurs also thought some sectors deserve more attention – and this is where there may be some potential opportunities for investors or new founders.

1. Agtech: 57% Underhyped

Farming is not flashy, but entrepreneurs recognize agtech as something that city slickers should pay more attention to. New tech is making agriculture more sustainable and urban, while increasing crop yields.

We covered some of these interesting next generation food systems in a previous infographic post.

2. Life Sciences: 55% Underhyped

Advances in areas such as longevity, genomics, and biotechnology are unnerving to some people, but life sciences seems to be at a tipping point. Founders see this as an area that deserves more attention from the media and investors.

3. Security: 51% Underhyped

Last year, $450 billion was spent on cybersecurity – and this number is growing fast as the IoT becomes even more prevalent. Stopping hackers is not flashy, but it is vital to the global economy and many dollars will be spent on it in the coming years.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024