Three Emerging Trends in the Space Industry

The following content is sponsored by MSCI

Three Emerging Trends in the Space Industry

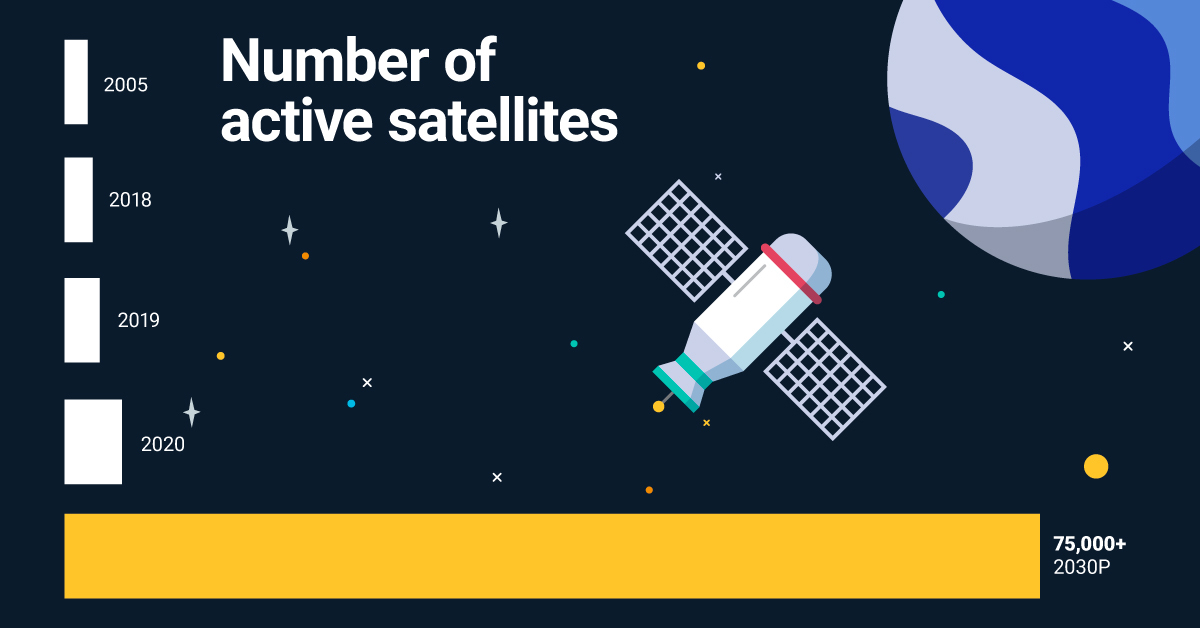

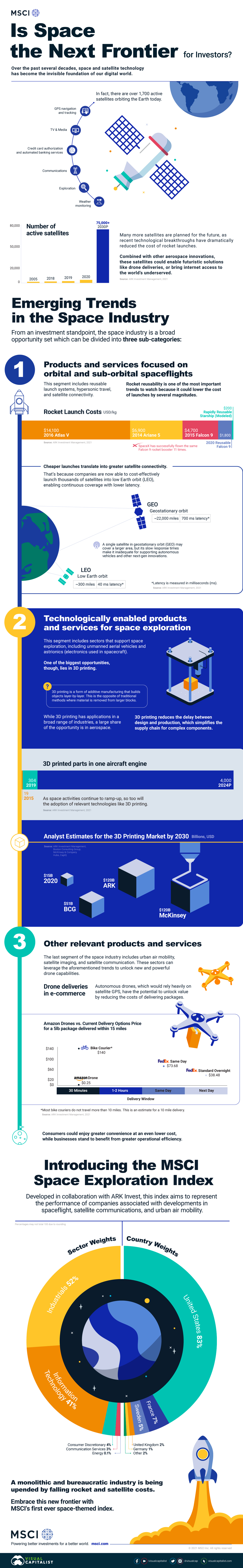

Over the past several decades, space and satellite technology has become the invisible foundation of our digital world. 1,700 active satellites are currently orbiting the Earth, and together, they enable many of the technologies we use on a daily basis.

Looking forward, this industry is on the cusp of a significant ramp-up. Recent technological breakthroughs have drastically reduced the cost of rocket launches, and by 2030, analysts expect the number of active satellites to increase by several magnitudes.

Greater satellite coverage is significant because it could unlock futuristic solutions like drone deliveries, or bring internet access to the world’s underserved. To help you learn more, this infographic from MSCI provides an overview of the entire space opportunity.

Emerging Trends in the Space Industry

The space industry is a broad opportunity set which can be divided into three segments.

#1: Products and services focused on orbital and sub-orbital spaceflights

This segment includes reusable launch systems, hypersonic travel, and satellite connectivity. Rocket reusability has the greatest potential because it could greatly lower the cost of launches going forward.

This table lists rocket launch costs in terms of USD/kg.

| Rocket | Manufacturer | Cost (USD/kg) |

|---|---|---|

| 2016 Atlas V | United Launch Alliance (ULA)* | $14,100 |

| 2014 Ariane 5 | Airbus | $6,900 |

| 2015 Falcon 9 | SpaceX | $4,700 |

| 2020 Reusable Falcon 9 | SpaceX | $1,800 |

| Rapidly Reusable Starship | Theoretical model based on ARK estimates | $200 |

*Joint venture between Lockheed Martin and Boeing. Source: ARK Investment Management (2021)

Rocket reusability can significantly drive down costs and allow companies to cost-effectively launch thousands of satellites into low Earth orbit (LEO). LEO refers to an altitude of 100 to 1,200 miles, as opposed to geostationary orbit (GEO) which has an altitude of roughly 22,000 miles.

The primary benefit of LEO satellites is that they have a much lower latency (delay measured in milliseconds) as opposed to GEO satellites. The drawback of LEO is that each satellite covers a much smaller area of the Earth, though as stated above, the ability to launch many satellites at relatively low cost negates this problem.

#2: Technologically enabled products and services for space exploration

This segment includes sectors that support space exploration, including unmanned aerial vehicles and astrionics (electronics used in spacecraft).

An important technology within this sector is 3D printing, which is a form of additive manufacturing that builds objects layer-by-layer. While still a relatively new technology, the use of 3D printing within the space industry is growing.

This table lists the number of 3D printed parts that are found in one aircraft engine.

| Year | Number of 3D printed parts in one engine |

|---|---|

| 2015 | 19 |

| 2019 | 304 |

| 2024 (projection) | 4000 |

Source: ARK Investment Management (2021)

Increasing activities in space are likely to create downstream benefits for the 3D printing industry. Analysts believe the industry could be worth $120 billion in 2030, up from $15 billion in 2020.

#3: Other relevant products and services

This final segment includes urban air mobility, satellite imaging, and satellite communication. Decreasing rocket launch costs will be a significant catalyst for these sectors.

One area of focus is autonomous drones, which would rely heavily on satellite GPS. These drones could unlock value for ecommerce businesses by reducing the cost of deliveries.

| Delivery method | Delivery window | Price for a 5lb package |

|---|---|---|

| FedEx Standard Overnight | Next day | $38.48 |

| FedEx Same Day | Same day | $73.68 |

| Bike Courier* | 1-2 hours | $140 |

| Amazon Drone (projection) | 30 minutes | $0.25 |

*Most bike couriers do not travel more than 10 miles. This estimate is for a 10 mile delivery.

Source: ARK Investment Management (2021)

The potential cost savings from drone deliveries would benefit businesses, by way of larger margins, as well as consumers, through better convenience.

Introducing the MSCI Space Exploration Index

The MSCI Space Exploration Index was developed in collaboration with ARK Invest, and aims to represent the performance of companies associated with the developments in spaceflight, satellite communications, and urban air mobility.

| Sector | Index Weight (%) |

|---|---|

| Industrials | 52% |

| Information Technology | 41% |

| Consumer Discretionary | 4% |

| Communication Services | 3% |

| Energy | 0.1% |

Percentages may not total 100 due to rounding.

Source: MSCI

A monolithic and bureaucratic industry is being upended by falling rocket and satellite costs. Embrace this new frontier with MSCI’s first ever space-themed index.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.