Lessons from Recessions: Analyzing the TSX During Financial Crises

Lessons from Recessions: The TSX During Financial Crises

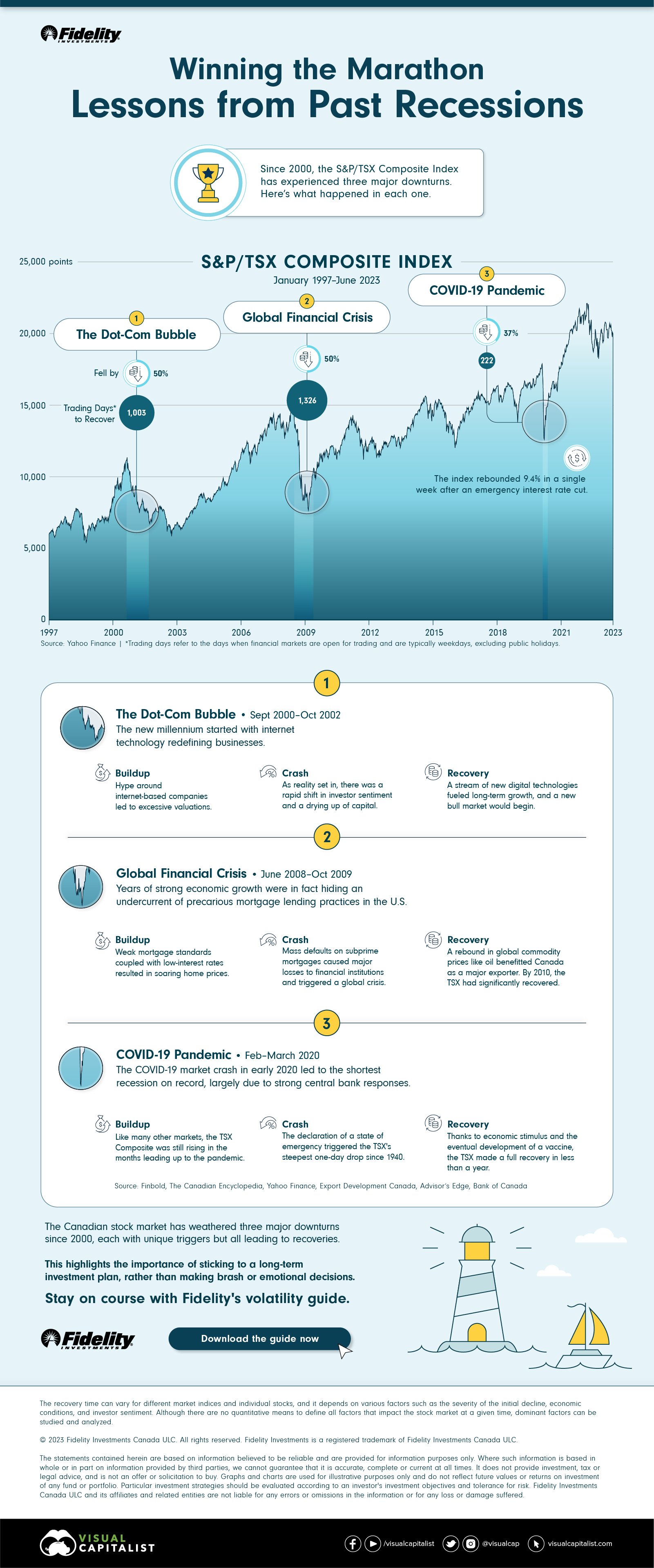

Since 2000, the Toronto Stock Exchange (TSX) has gone through three major downturns.

This infographic, sponsored by Fidelity Investments, explores the buildup, crash triggers, and subsequent recoveries from the three major downturns in the S&P/TSX Composite Index, the benchmark Canadian index.

The Three Downturns

Following historical data from Yahoo Finance, here’s a closer look at the three financial crises that led to downturns, impacting the TSX Composite between 2000 and 2022.

1) The Dot-Com Bubble

The new millennium started with internet technology redefining businesses.

Buildup: The hype and speculation surrounding the internet’s vast potential formed a bubble, leading to inflated stock prices despite many companies lacking profits or revenue.

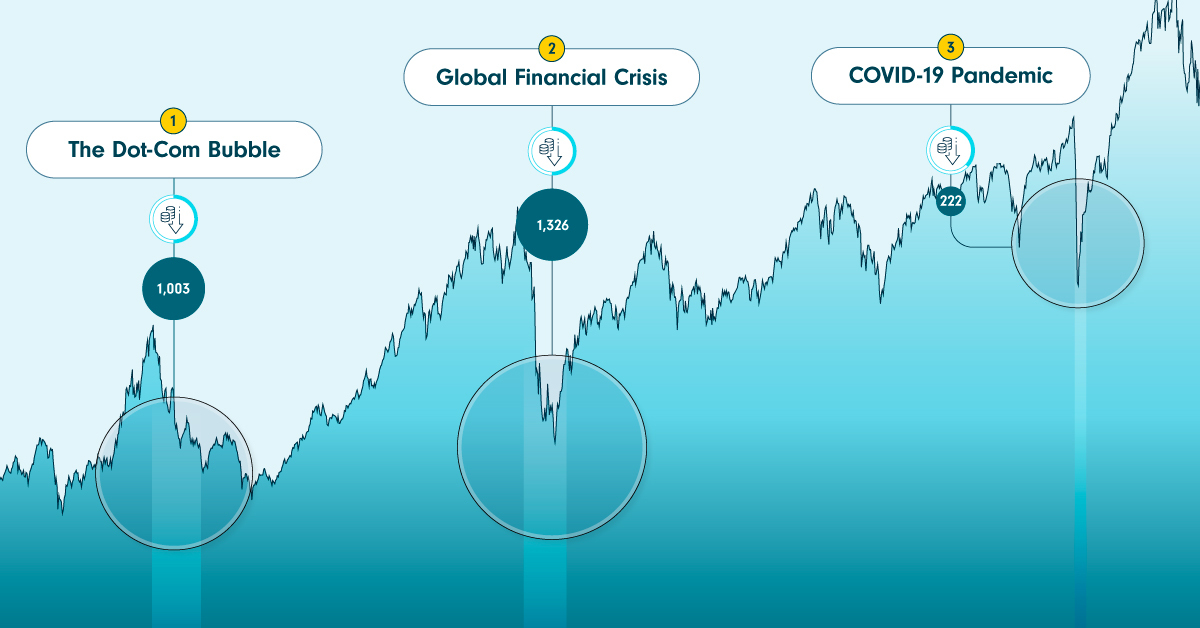

Market Crash: As reality took hold, investor sentiment swiftly shifted, triggering rapid sell-offs. From September 2000 to October 2002, the TSX Composite fell by 50%.

Venture capitalist Fred Wilson said:

“Much of the capital invested was lost, but also much of it was invested in a very high throughput backbone for the Internet…All that stuff has allowed what we have today, which has changed our lives.”

Recovery: Investments were reevaluated, while new digital technologies were also emerging. This ignited a resurgence that laid the groundwork for a new bull market. However, it took over 1,000 trading days to recover.

2. Global Financial Crisis

The global financial crisis that started in 2007 brought this about.

Buildup: High-risk mortgage lending and inadequate regulatory oversight in the U.S. led to a chain reaction of bank failures, credit freezes, and economic contraction.

Market Crash: The implosion of subprime mortgages sent shockwaves through financial markets worldwide, including in Canada. From June 2008 to March 2009, the TSX fell by 50%.

Recovery: The index took more than 1,300 trading days to recover, but Canada’s export-oriented economy benefited from the resurgence of global commodity prices.

Interestingly, while Canada suffered an equally dramatic economic collapse as the U.S., none of its banks failed due to a well-regulated system of large financial institutions. In contrast, the U.S. had a fragmented setup with numerous smaller banks overseen by competing regulators.

3. COVID-19 Pandemic

In 2020, a new challenge arose—the COVID-19 pandemic, impacting global economies and leading to short but jolting recessions around the globe.

Buildup: Similar to other indices, the TSX Composite was ascending in the months preceding the pandemic.

Market Crash: The declaration of a state of emergency triggered the TSX’s sharpest one-day drop since 1940 of over 12%. Within weeks, the index fell by 37%.

Recovery: With an emergency interest rate cut, the index rebounded by 9.4% in a week. With economic stimulus policies and vaccine development efforts, the TSX Composite recovered in 222 trading days.

The Lessons

While each downturn has distinct triggers, historical patterns show they all give way to recovery and growth.

Also, various sectors get hit differently, and a diversified portfolio across asset classes and industries can act as a failsafe.

And lastly, it is crucial to maintain a long-term perspective, strategize with patience, and even take advantage of buying opportunities during the dip.

As it is said, investing is a marathon, not a sprint.

Download Fidelity’s free volatility guide to help navigate turbulent markets.

-

Economy4 days ago

Economy4 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.