Debt

Ranked: Government Debt by Country, in Advanced Economies

Government Debt by Country, in Advanced Economies

The amount of debt a government holds is a crucial indicator for the sustainability of its finances.

If the debt is excessively high—especially as a percentage of gross domestic product (GDP)—it may signal challenges in meeting financial obligations, potentially leading to economic instability.

This graphic ranks government debt by country for advanced economies, using their gross debt-to-GDP ratio. The ranking is based on IMF Outlook from October 2023.

Debt-to-GDP Ratio for Advanced Economies in 2023

From 20 economies analyzed, 11 have a debt-to-GDP ratio of over 100%.

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023.

| Economy by Gross Debt | % of GDP (2023) |

|---|---|

| 🇯🇵 Japan | 255% |

| 🇬🇷 Greece | 168% |

| 🇸🇬 Singapore | 168% |

| 🇮🇹 Italy | 144% |

| 🇺🇸 United States* | 123% |

| 🇫🇷 France | 110% |

| 🇵🇹 Portugal | 108% |

| 🇪🇸 Spain | 107% |

| 🇨🇦 Canada* | 106% |

| 🇧🇪 Belgium | 106% |

| 🇬🇧 United Kingdom | 104% |

| 🇨🇾 Cyprus | 79% |

| 🇦🇹 Austria | 75% |

| 🇫🇮 Finland | 74% |

| 🇸🇮 Slovenia | 69% |

| 🇩🇪 Germany | 66% |

| 🇭🇷 Croatia | 64% |

| 🇮🇸 Iceland | 61% |

| 🇮🇱 Israel | 58% |

| 🇸🇰 Slovak Republic | 57% |

| 🌎 G7 Average | 128% |

*For the U.S. and Canada, gross debt levels were adjusted to exclude unfunded pension liabilities of government employees’ defined-benefit pension plans.

Japan has indeed been borrowing heavily, though mainly in the form of intergovernmental holdings with interest rates around 0%. However, with the country experiencing a rapidly aging population, an increasing burden of social security expenses could lead to an even larger fiscal deficit in the future.

The U.S. national debt hit $32 trillion in 2023, making up 123% of the country’s GDP. To put it in perspective, two decades ago, the U.S. debt-to-GDP ratio was less than half of what it is today. Nonetheless, it remains below the G7 average of 128%.

Germany’s ratio of 66% is the lowest in the G7, though it climbed following the COVID-19 pandemic. All EU member states attempt to keep their ratios below 60% for stability. Otherwise, when debt grows beyond what countries can pay, emergency bailouts and defaults lead to economies crashing, as seen in the European debt crisis from 2009 to 2014.

However, a high gross debt-to-GDP ratio (over 100%) is not always a cause for concern. Net ratios that take intergovernmental holdings into account can indicate exposure to debt better in the short-term, as does comparing liabilities and assets. The question is, where are debt ratios heading in the future?

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

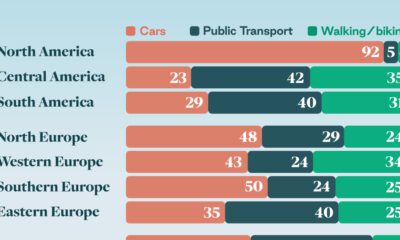

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn