Datastream

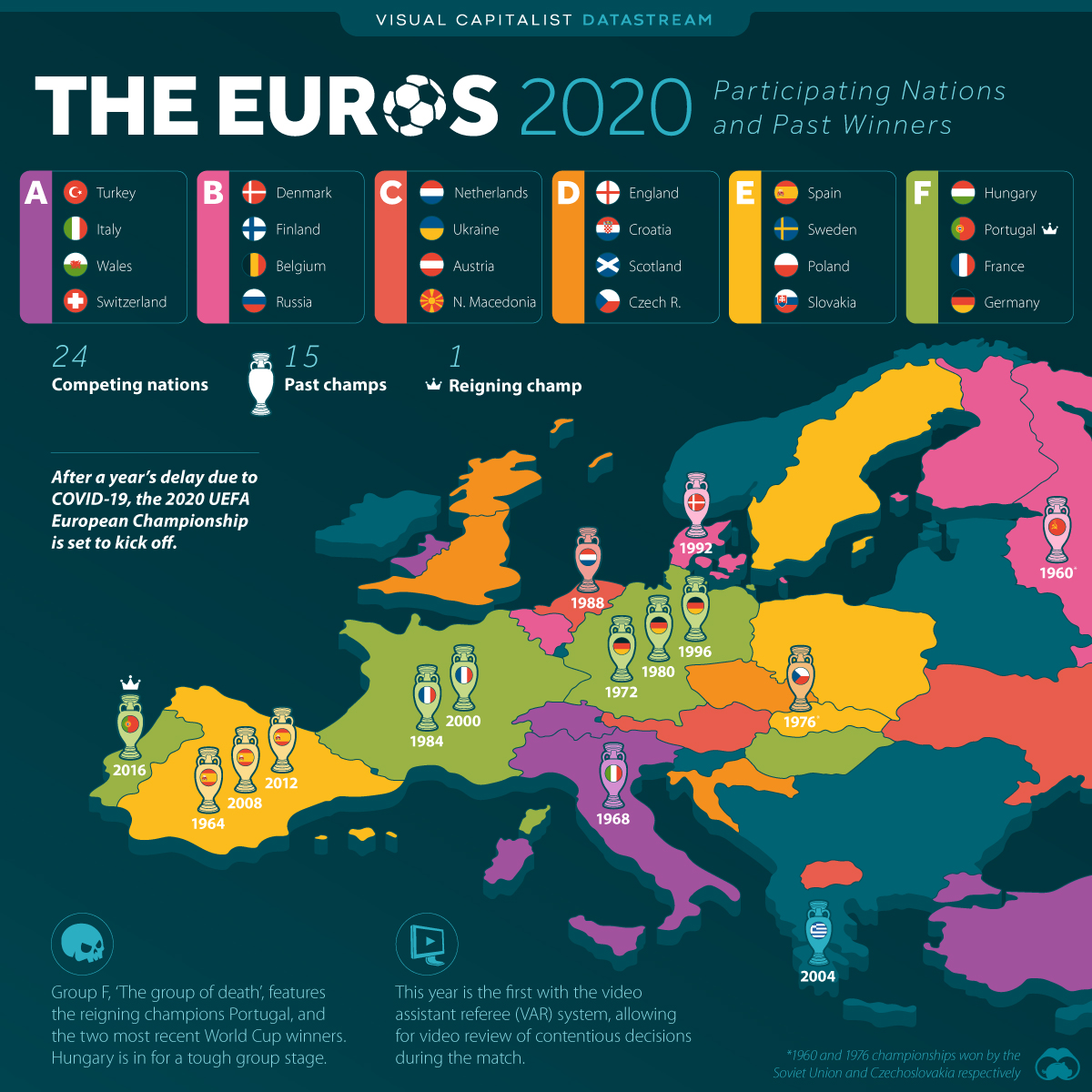

Euro 2020: Qualified Nations and Past Winners

The Briefing

- The 2020 UEFA European Football Championship will kick off Friday, June 11th 2021 after a year-long delay due to COVID-19

- The tournament will take place across 11 host cities and feature new rules, reduced spectators, and fierce competition

The 2020 European Championship Returns with New Rules

After a year-long delay, the 2020 UEFA European Championship is set to kick off what will be the largest international sports tournament to take place since the pandemic.

While the final stage of the tournament typically takes place in one or two nations, this year’s will be played across 11 different countries.

Running from June 11th to July 11th 2021, the opening game between Italy and Turkey will kick off at the Stadio Olimpico in Rome, and the final will take place at London’s Wembley Stadium.

COVID-19’s Impact on Teams and Spectators

Aside from the initial year-long delay, COVID-19 has changed how teams and spectators will participate in the tournament.

Squads have been expanded from 23 to 26 players, and coaches will be permitted to call up more players if COVID-19 infections force players into isolation.

For spectators, individual stadiums within host cities have announced varying capacities ranging from 20-100%, with strict stadium entry requirements across the board. Since these capacities are pre-tournament estimates, we’ll have to wait until matchday to see how many ticket-holders are comfortable attending the fixtures in person.

| Host Stadium and City | Spectator Capacity |

|---|---|

| Johann Cruijff ArenA, Amsterdam | 25-45% |

| Baku Olympic Stadium, Baku | 50% |

| Arena Națională, Bucharest | 25-45% |

| Puskás Aréna, Budapest | Aiming for 100% |

| Parken Stadium, Copenhagen | 25-45% |

| Hampden Park, Glasgow | 25-45% |

| Wembley Stadium, London | Minimum of 25% |

| Football Arena Munich (Allianz Arena), Munich | Minimum of 14,500 spectators (~22%) |

| Stadio Olimpico, Rome | 25-45% |

| Estadio La Cartuja, Seville | 25-45% |

| Krestovsky Stadium (Gazprom Arena), Saint Petersburg | 50% |

Source: UEFA

More Substitutions and the Video Assistant Referee System

This edition of the tournament will also feature two new rule changes to the action on the field.

Coaches will now be able to make up to five substitutions (six if the match goes to extra time), a change first introduced in domestic leagues to allow players more rest as match calendars became congested.

Another key change which was already in play at the 2018 FIFA World Cup is the Video Assistant Referee (VAR) system. This system appoints a match official who reviews the head referee’s decisions with video footage, and allows the head referee to conduct an on-field video review and potentially change decisions.

Strong Competition Among Euro 2020’s Favorites

Despite current world champions France remaining as undeniable favorites, bookies are putting England to win the tournament (despite a fairly young squad) partially due to the home field advantage in the semi-finals and final.

Spain, Germany, and Italy remain formidable competitors, and Belgium’s golden generation will have one final shot at silverware after their third place finish at the 2018 FIFA World Cup.

European champions Portugal are another obvious threat, as Cristiano Ronaldo will be looking to become the tournament’s top goalscorer of all time (currently tied with Michel Platini at 9 goals).

While the 2020 edition of UEFA’s European Championship features a variety of on-field and off-the-field changes, the trophy truly feels up for grabs and is a welcome return to international football for fans around the world.

»Like this? Then you might enjoy this article, The Top 10 Football Clubs by Market Value

Where does this data come from?

Source: UEFA

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Misc2 weeks ago

Misc2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Culture2 weeks ago

Culture2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time