Technology

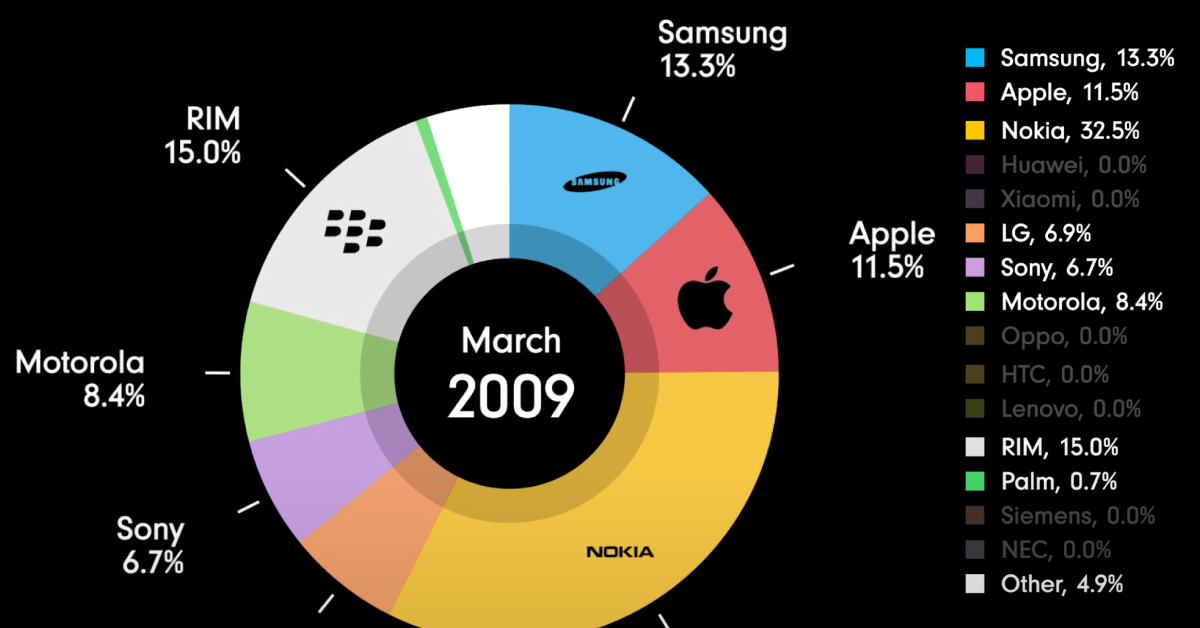

Animation: How the Mobile Phone Market Has Evolved Over 30 Years

How The Mobile Phone Market Has Evolved Since 1993

The mobile phone landscape looks drastically different today than it did three decades ago.

In 1993, Motorola accounted for more than half of the mobile phone market. But by 2021, its market share had shrunk to just 2.2%. How did this happen, and how has the mobile industry changed over the last 30 years?

This video by James Eagle chronicles the evolution of the mobile phone market, showing the rise and fall of various mobile phone manufacturers. The data spans from December 1992 to December 2021.

The Early Days of Mobile Phones

Motorola is known for being a pioneer in the mobile phone industry.

In 1983, the American company launched one of the world’s first commercially available mobile phones—the DynaTAC 8000X. The revolutionary analog phone cost nearly $4,000 and offered users up to 30 minutes of talk time before needing to be recharged.

Motorola went on to launch a few more devices over the next few years, like the MicroTAC 9800X in 1989 and the International 3200 in 1992, and quickly became a dominant player in the nascent industry. In the early days of the market, the company’s only serious competitor was Finnish multinational Nokia, which had acquired the early mobile network pioneer Mobira.

But by the mid-1990s, other competitors like Sony and Siemens started to gain some solid footing, which chipped away at Motorola’s dominance. In September 1995, the company’s market share was down to 32.1%.

| Mobile Phone Market Share by Company | % Share (Sept. 1995) |

|---|---|

| Motorola | 32.1% |

| Nokia | 22.0% |

| Sony | 10.7% |

| NEC | 9.2% |

| Siemens | 2.1% |

| Samsung | 0.4% |

| Other | 23.5% |

By January 1999, Nokia surpassed Motorola as the leading mobile phone manufacturer, accounting for 21.4% of global market share. That put it just slightly ahead of Motorola’s 20.8%.

One of the reasons for Nokia’s surging popularity was the major headway the company was making in the digital phone space. In 1999, the company released the Nokia 7110, the first mobile phone to have a web browser.

But it wasn’t just Nokia’s innovations that were hampering Motorola. In 1999, Motorola fell on hard times after one of its spin-off projects called Iridium SSC filed for bankruptcy. This put a massive financial strain on the company, and it eventually laid off a large chunk of its workforce after the project failed.

From then on, Motorola’s market share hovered between 14% and 20%, until Apple’s iPhone entered the scene in 2007 and turned the mobile phone industry on its head.

The Emergence of the iPhone

Things really started to change with the launch of the iPhone in 2007.

In a keynote presentation at the San Francisco Macworld Expo in 2007, Steve Jobs presented the iPhone as three products wrapped into one device: a touchscreen iPod, a revolutionary cell phone, and an internet communications device.

One year later, Apple launched the App Store, which gave users the ability to download applications and games onto their iPhones. Not only did this greatly enhance the iPhone’s functionality, but it also allowed consumers to customize their mobile devices like never before.

This was the start of a new era of smartphones—one that Motorola failed to keep up with. Less than two years after the iPhone launched, Apple had captured 17.4% of the mobile phone market. In contrast, Motorola’s market share had shrunk down to 4.9%.

By the end of 2021, Apple held about 27.3% of the global mobile market. The iPhone is a key part of the tech giant’s growth, driving more than 50% of the company’s overall revenue.

A Failure to Pivot

While a number of factors contributed to Motorola’s downfall, many point to one central hurdle—the company’s failure to pivot.

The iPhone’s emergence was the start of a new, software-driven era. Motorola had mastered the hardware-driven era, but failed to keep up when the tides changed. And the animation above highlights other companies that also failed to adapt or keep up, including BlackBerry (formerly RIM), Palm, Sony, and LG.

But Apple is not alone. The popularity of Google’s Android mobile operating system has helped competitors like South Korea’s Samsung and China’s Huawei and Xiaomi flourish, with each company establishing strong footholds in the global mobile phone market.

In today’s fast-paced world, the ability to pivot is essential if businesses want to remain competitive. Will today’s mobile phone giants like Apple and Samsung remain on top? Or will other companies like Huawei catch up in the next few years?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries