Technology

The Jeff Bezos Empire in One Giant Chart

The Jeff Bezos Empire in One Giant Chart

With a fortune largely tied to his 79 million Amazon shares, the net worth of Jeff Bezos has continued to rise.

Most recently, the Amazon founder was even able to surpass Bill Gates on the global wealth leaderboard with $137 billion to his name – however, this ascent to the very top may be extremely short-lived.

On January 9th, 2019, Jeff Bezos announced on Twitter that he was divorcing MacKenzie Bezos, his wife of 25 years. While the precise ramifications of the news are not yet clear, it’s anticipated that MacKenzie Bezos could end up with a considerable portion of shares in Amazon as a result.

There is much to be decided as the world’s wealthiest couple splits their assets – but for now, here is a list of what Jeff Bezos owns today.

The Jeff Bezos Empire in 2019

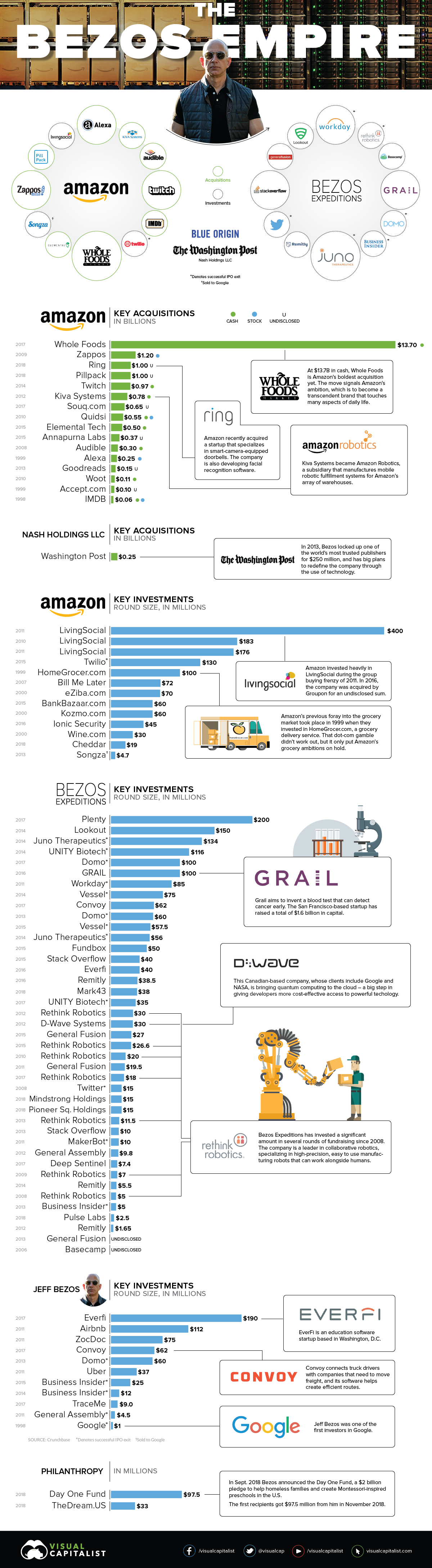

The obvious centerpiece to the Jeff Bezos Empire is the 16% ownership stake in Amazon.com.

However, beyond that, there is a wide variety of other investments and acquisitions that Jeff Bezos has made through Amazon or his other investment vehicles. These range from household names to more secretive endeavors, and are worth looking at to truly understand his assets and fortune.

Amazon.com

Amazon makes acquisitions and investments that relate to the company’s core business and future ambitions. This includes acquisitions of Whole Foods ($13.7 billion in 2017), Zappos.com ($1.2 billion in 2009), PillPack ($1 billion in 2018), Twitch.tv ($970 million in 2014), and Kiva Systems ($780 million in 2012).

This also includes investments in everything form failed dot-com company Kozmo.com (2000) to Twilio, which successfully IPO’d in 2016.

Bezos Expeditions

Bezos Expeditions manages Jeff Bezos’ venture capital investments. Over the years, this venture arm has put money into Twitter, Domo, Juno Therapeutics, Workday, General Fusion, Rethink Robotics, Business Insider, MakerBot, and Stack Overflow.

More recent investments include GRAIL, a startup that recently raised over $900 million to cure cancer before it happens, as well as EverFi, an edtech startup.

Jeff Bezos

Jeff Bezos also invests money on a personal level. He was an angel investor in Google in 1998, and has also put money in Uber and Airbnb. (Note: these last two companies are listed on the Bezos Expeditions website, but on Crunchbase they are listed as personal investments.)

Nash Holdings LLC

Nash Holdings is the private company owned by Bezos that bought The Washington Post for $250 million.

Bezos Family Foundation

The BFF is run by Jeff Bezos’ parents, and is funded through Amazon stock. It focuses on early education, and has also made an investment in LightSail Education’s $11 million Series B round.

Blue Origin

Finally, it’s also worth noting that Jeff Bezos is the founder of Blue Origin, an aerospace company that is competing with SpaceX in mankind’s final frontier.

Note: This article and infographic were originally published in June 20, 2017. Both have been updated as of January 11, 2019 to include more up-to-date acquisitions and investments.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024