Technology

Visualizing the Massive $15.7 Trillion Impact of AI

For the people most immersed in the tech sector, it’s hard to think of a more controversial topic than the ultimate impact of artificial intelligence (AI) on society.

By eventually empowering machines with a level of superintelligence, there are many different possible outcomes ranging from Kurzweil’s technological singularity to the more dire predictions popularized by Elon Musk.

Despite this wide gap in potential outcomes, most technologists do agree on one thing: AI will have a profound impact on the society and the way we do business.

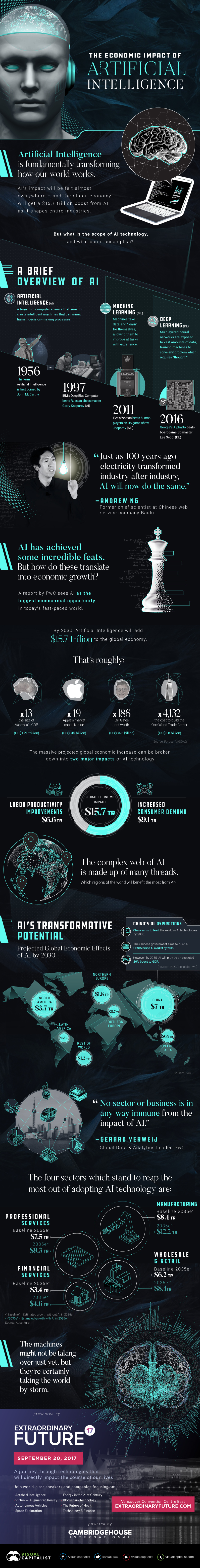

The Economic Impact of AI

Today’s infographic comes from the Extraordinary Future 2017, a new conference in Vancouver, BC that focuses on emerging technologies such as AI, autonomous vehicles, fintech, and blockchain tech.

In the below infographic, we look recent projections from PwC and Accenture regarding AI’s economic impact, as well as the industries and countries that will be the most profoundly affected.

According to PwC’s most recent report on the topic, the impact of artificial intelligence (AI) will be transformative.

By 2030, AI is expected to provide a $15.7 trillion boost to GDP worldwide – the equivalent of adding 13 new Australias to the global economy.

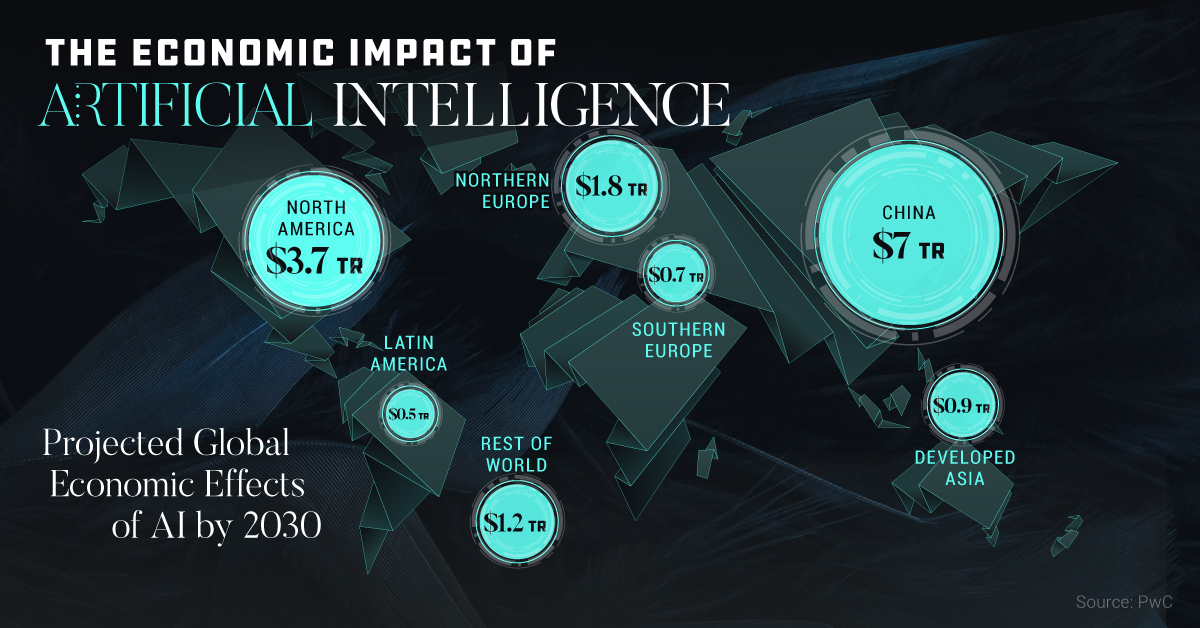

A Geographic Breakdown

Where will AI’s impact be most pronounced?

According to PwC, China will be the region receiving the most economic benefit ($7.0 trillion) from AI being integrated into various industries:

| Region | Economic Impact of AI (2030) | % of Total |

|---|---|---|

| China | $7.0 trillion | 44.6% |

| North America | $3.7 trillion | 23.6% |

| Northern Europe | $1.8 trillion | 11.5% |

| Developed Asia | $0.9 trillion | 5.7% |

| Southern Europe | $0.7 trillion | 4.5% |

| Latin America | $0.5 trillion | 3.2% |

| Rest of World | $1.2 trillion | 7.6% |

| Total | $15.7 trillion | 100.0% |

Further, the global growth from AI can be divided into two major areas, according to PwC: labor productivity improvements ($6.6 trillion) and increased consumer demand ($9.1 trillion).

Industries Most Affected

But how will AI impact industries on an individual level?

For that, we turn to Accenture’s recent report, which breaks down a similar projection of $14 trillion of gross value added (GVA) by 2035, with estimates for AI’s impact on specific industries.

| Industry | 2035 GVA (Baseline) | 2035 GVA (AI steady state) |

|---|---|---|

| Manufacturing | $8.4 trillion | $12.2 trillion |

| Professional Services | $7.5 trillion | $9.3 trillion |

| Wholesale & Retail | $6.2 trillion | $8.4 trillion |

| Public Services | $4.0 trillion | $4.9 trillion |

| Information & Communication | $3.7 trillion | $4.7 trillion |

| Financial Services | $3.4 trillion | $4.6 trillion |

| Construction | $2.8 trillion | $3.3 trillion |

| Transportation & Storage | $2.1 trillion | $2.9 trillion |

Manufacturing will see nearly $4 trillion in growth from AI alone – and many other industries will undergo significant changes as well.

To learn more about other tech that will have a big impact on our future, see a Timeline of Future Technology.

Technology

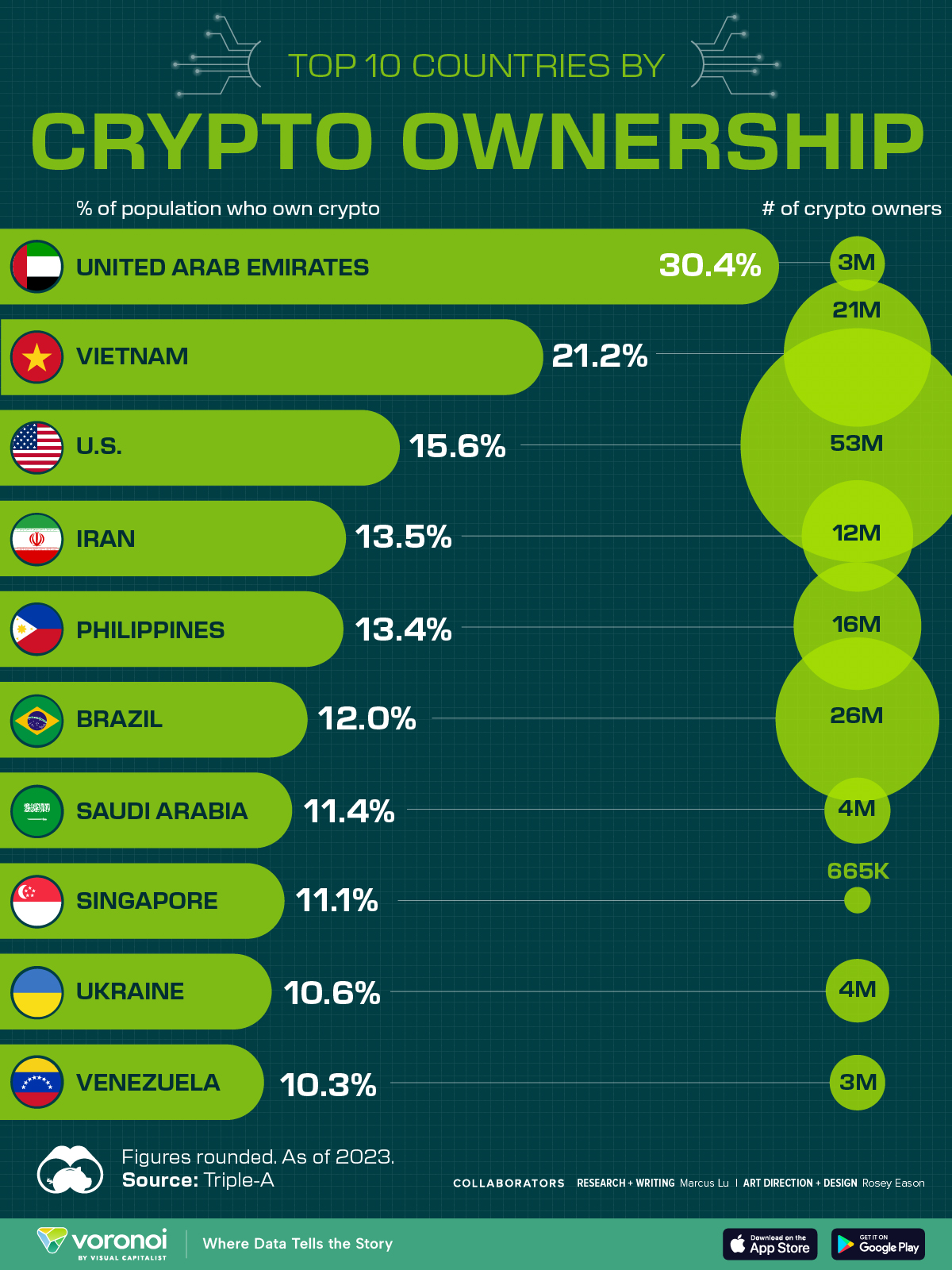

Countries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

Countries With the Highest Rates of Crypto Ownership

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic ranks the top 10 countries by their rate of cryptocurrency ownership, which is the percentage of the population that owns crypto. These figures come from crypto payment gateway, Triple-A, and are as of 2023.

Data and Highlights

The table below lists the rates of crypto ownership in the top 10 countries, as well as the number of people this amounts to.

| Country | % of Population Who Own Crypto | # of Crypto Owners |

|---|---|---|

| 🇦🇪 United Arab Emirates | 30.4 | 3M |

| 🇻🇳 Vietnam | 21.2 | 21M |

| 🇺🇸 U.S. | 15.6 | 53M |

| 🇮🇷 Iran | 13.5 | 12M |

| 🇵🇭 Philippines | 13.4 | 16M |

| 🇧🇷 Brazil | 12 | 26M |

| 🇸🇦 Saudi Arabia | 11.4 | 4M |

| 🇸🇬 Singapore | 11.1 | 665K |

| 🇺🇦 Ukraine | 10.6 | 4M |

| 🇻🇪 Venezuela | 10.3 | 3M |

Note that if we were to rank countries based on their actual number of crypto owners, India would rank first at 93 million people, China would rank second at 59 million people, and the U.S. would rank third at 52 million people.

The UAE Takes the Top Spot

The United Arab Emirates (UAE) boasts the highest rates of crypto ownership globally. The country’s government is considered to be very crypto friendly, as described in Henley & Partners’ Crypto Wealth Report 2023:

In the UAE, the Financial Services Regulatory Authority (FSRA-ADGM) was the first to provide rules and regulations regarding cryptocurrency purchasing and selling. The Emirates are generally very open to new technologies and have proposed zero taxes for crypto owners and businesses.

Vietnam leads Southeast Asia

According to the Crypto Council for Innovation, cryptocurrency holdings in Vietnam are also untaxed, making them an attractive asset.

Another reason for Vietnam’s high rates of ownership could be its large unbanked population (people without access to financial services). Cryptocurrencies may provide an alternative means of accessing these services without relying on traditional banks.

Learn More About Crypto From Visual Capitalist

If you enjoyed this post, be sure to check out The World’s Largest Corporate Holders of Bitcoin, which ranks the top 12 publicly traded companies by their Bitcoin holdings.

-

Markets6 days ago

Markets6 days agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Technology2 weeks ago

Technology2 weeks agoAll of the Grants Given by the U.S. CHIPS Act

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

Best of1 week ago

Best of1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Markets1 week ago

Markets1 week agoThe Top Private Equity Firms by Country