How Gold Royalties Offer Inflation-Resistant Gold Exposure

How Gold Royalties Offer Inflation-Resistant Gold Exposure

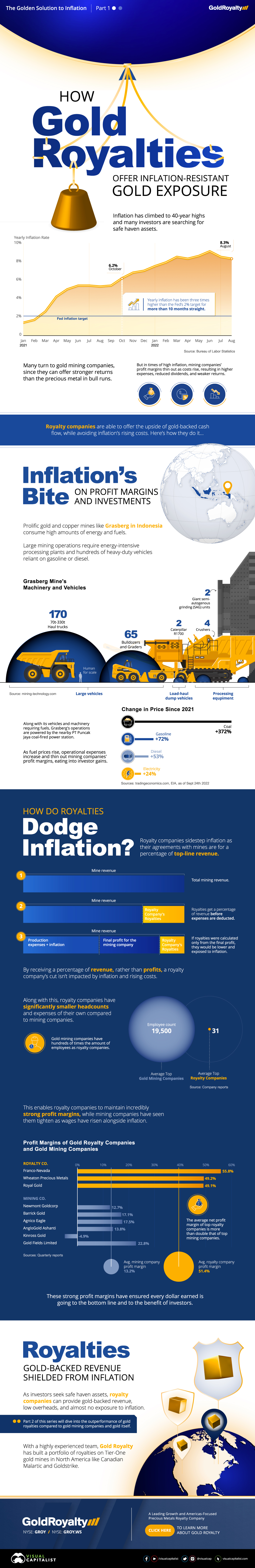

As rising inflation has increased the operational expenses of gold mining companies, gold royalty companies have emerged as an inflation-resistant alternative for investors seeking exposure to the precious metal.

Without exposure to rising wages, fuel, and energy costs, gold royalty companies are able to maintain strong profit margins that are often more than double those of gold mining companies.

This infographic sponsored by Gold Royalty is the first in a two-part series and showcases exactly how royalty companies naturally avoid inflation, along with the superior profit margins that come as a result.

Inflation’s Dampening Effect on Gold Mining Profits

Since mid-2021, inflation has become a constant risk-factor for investors to keep in mind as they manage their portfolio. Every energy fuel has risen in price over the last year alongside wage increases around the world, greatly impacting the expenses of material production and refining.

Gold mining is no exception, and while operational costs have risen, gold’s price has actually decreased slightly over the same time period, further impacting gold mines’ profitability and margins.

| Commodity | Price change since the start of 2021 |

|---|---|

| Coal | +372% |

| Gasoline | +72% |

| Diesel | +53% |

| Electricity | +24% |

| Gold | -13% |

The impact of inflation can’t be understated when it comes to mining operations, which require large amounts of machinery, electricity, and people.

Along with massive haul trucks, bulldozers, and machinery like large-scale grinding units that require diesel and other fuels to operate, refinery operations also consume large amounts of electricity.

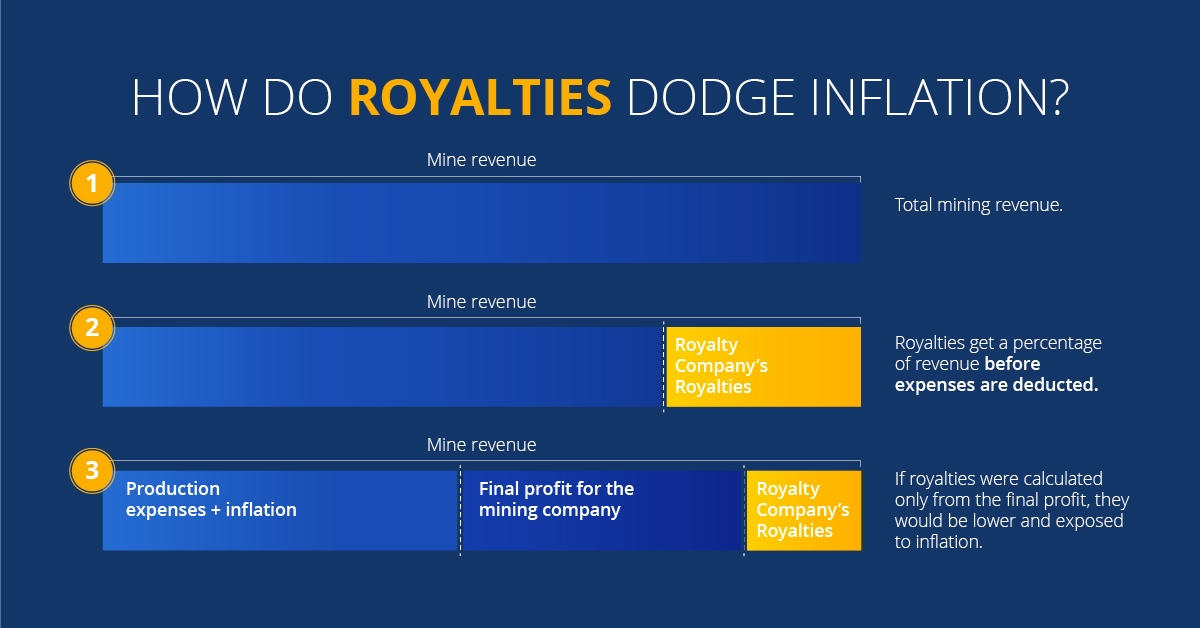

How Gold Royalty Companies Avoid Inflation

With no large fleets of vehicles to fuel, refining plants to power, along with significantly smaller headcounts and wage bills, royalty companies barely suffer from rising inflation. Compared to gold mining companies with tens of thousands of employees across the world, gold royalty companies rarely employ more than 50 people.

Along with this, while royalty companies’ revenue comes from royalty and streaming agreements with mining companies, these agreements are structured to ensure royalty companies face none of the operational expenses (and inflation) that miners do.

This is because royalty agreements calculate royalties (which royalty companies receive) as a percentage of the mine’s top-line revenue rather than from the mine’s final profits after expenses, meaning royalty companies get their cut before operational costs and other expenses are deducted.

The Golden Profit Margins of Royalty Companies

With gold’s price having remained stagnant while inflation has pushed expenses up, gold mining company profit margins have been crunched from both sides while royalty companies have avoided the impact.

Over the last four quarters, gold mining giant Newmont Goldcorp’s average profit margin declined to 6.6% when compared to the 22.9% average margins of the four quarters prior. On the other hand, royalty company Franco-Nevada’s profit margins increased from 54.8% to 57.3% over the same time periods.

Without inflation impacting their bottom line, royalty companies have been able to maintain strong financials in a chaotic period for the economy.

In part 2 of this series, we’ll take a closer look at the returns of gold royalty companies, and how exactly they’ve outperformed both gold mining companies and the precious metal itself.

Gold Royalty offers inflation-resistant gold exposure with a portfolio of royalties on top-tier mines across the Americas. Click here to find out more about Gold Royalty.

-

Mining3 weeks ago

Mining3 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining8 months ago

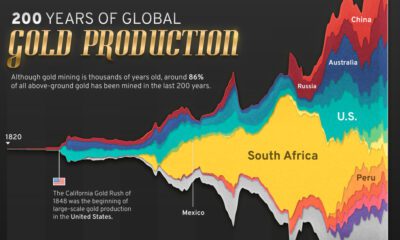

Mining8 months ago200 Years of Global Gold Production, by Country

Global gold production has grown exponentially since the 1800s, with 86% of all above-ground gold mined in the last 200 years.

-

Mining1 year ago

Mining1 year agoCharted: 30 Years of Central Bank Gold Demand

Globally, central banks bought a record 1,136 tonnes of gold in 2022. How has central bank gold demand changed over the last three decades?

-

Mining2 years ago

Mining2 years agoMapped: The 10 Largest Gold Mines in the World, by Production

Gold mining companies produced over 3,500 tonnes of gold in 2021. Where in the world are the largest gold mines?

-

Financing3 years ago

Financing3 years agoHow to Avoid Common Mistakes With Mining Stocks (Part 5: Funding Strength)

A mining company’s past projects and funding strength are interlinked. This infographic outlines how a company’s ability to raise capital can determine the fate of a…

-

Gold3 years ago

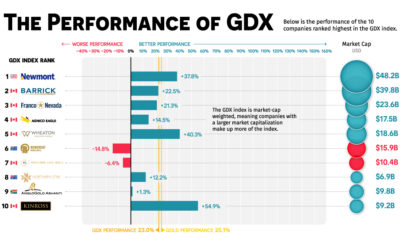

Gold3 years agoHow the World’s Top Gold Mining Stocks Performed in 2020

The GDX is an ETF that tracks the performance of the top gold mining stocks. How did the GDX and its constituents perform in 2020?