In Canada, tax-loss harvesting allows investors to turn losses into tax savings. This graphic breaks down how it works in four simple steps.

Learn how tax-loss harvesting works by using capital losses to offset capital gains, potentially reducing your tax bill.

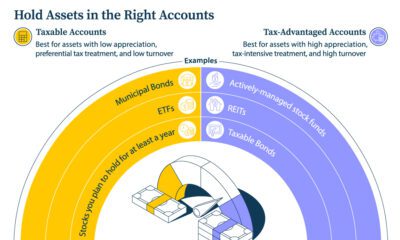

Learn five tax tips that may help maximize the after-tax value of your investments, including which assets may be best for certain accounts.