Visualized: What is a Digital Goldmine?

What is a Digital Goldmine?

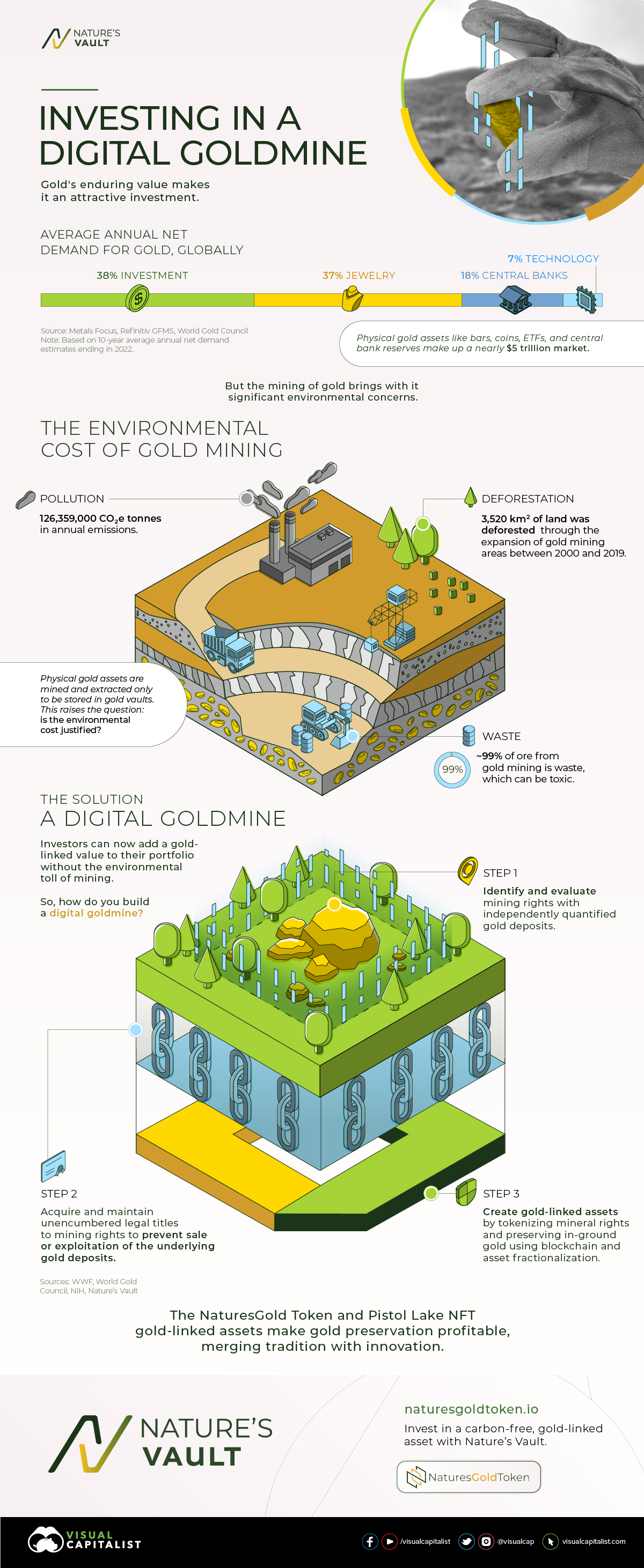

Gold has played a pivotal role in the global economy for thousands of years, and even after the abandonment of the gold standard, the yellow metal has remained an important part of many investment portfolios.

Today, whether in the form of bars, coins, ETFs, or digital tokens, gold’s enduring value continues to make it an attractive asset. However, mining a physical metal also comes with significant environmental costs.

In this graphic, our sponsor Nature’s Vault looks at the impact of gold mining and demonstrates how adding gold-linked assets to your portfolio can be an environmentally friendly alternative.

The Environmental Cost of Gold Mining

To start, gold mining’s environmental implications include deforestation, waste production, and carbon emissions.

The expansion of gold mines from 2000 to 2019 led to over 3,500 km² of deforestation. In addition, annual emissions are estimated to be around 126 million CO²e tonnes.

What’s more, approximately 99% of the ore extracted from gold mining goes to waste. Tailings, the main waste generated from gold extraction, contain high levels of heavy metals. When exposed to water or wind, these metals can leach into the surrounding environment, posing a variety of health risks and inflicting long-term harm on ecosystems.

After extraction, processing, and refinement, physical gold used as assets are stored away in vaults, raising the question: is the environmental cost justified?

The Solution: A Digital Goldmine

Investors can now add a gold-linked asset to their portfolio without the environmental toll.

Nature’s Vault is decarbonizing the gold mining sector by creating digital assets like the NaturesGold Token and the Pistol Lake NFT that monetize the preservation of gold in the ground. As a result, the emissions and the environmental damage associated with mining are avoided.

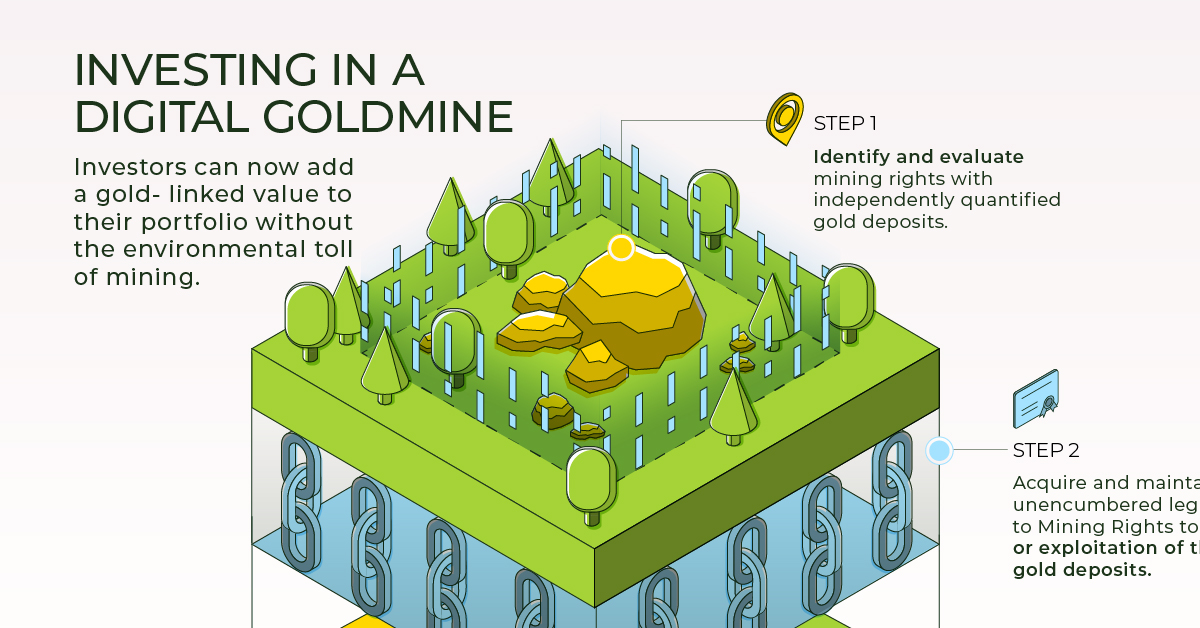

So, how does a digital goldmine work exactly?

- Nature’s Vault identifies and evaluates mining rights with independently quantified gold deposits.

- They then acquire and maintain unencumbered legal titles to these mining rights to prevent the sale or exploitation of the underlying gold deposits.

- Finally, gold-linked assets are created by tokenizing mineral rights and preserving in-ground gold using blockchain and asset fractionalization.

This way, gold for investment can still be used without the associated damage of mining.

Learn more about gold-linked assets from Nature’s Vault.

-

Technology3 days ago

Technology3 days agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology4 days ago

Technology4 days agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

Technology3 weeks ago

Technology3 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

AI3 weeks ago

AI3 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

The Nvidia rocket ship is refusing to slow down, leading the pack of strong stock performance for most major U.S. chipmakers.

-

Technology4 weeks ago

Technology4 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

This graphic breaks down America’s most preferred smartphone brands, according to a December 2023 consumer survey.