Graphene: An Investor’s Guide to the Emerging Market

Graphene: An Investor’s Guide to the Emerging Market

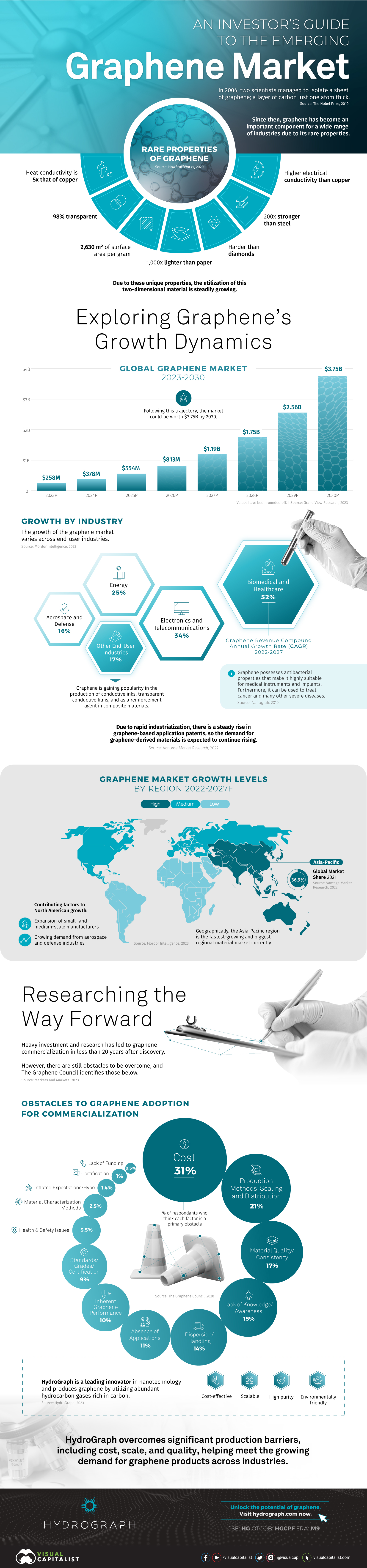

Graphene is an atomic-scale “honeycomb” that is revolutionizing the world of materials and capturing investor attention.

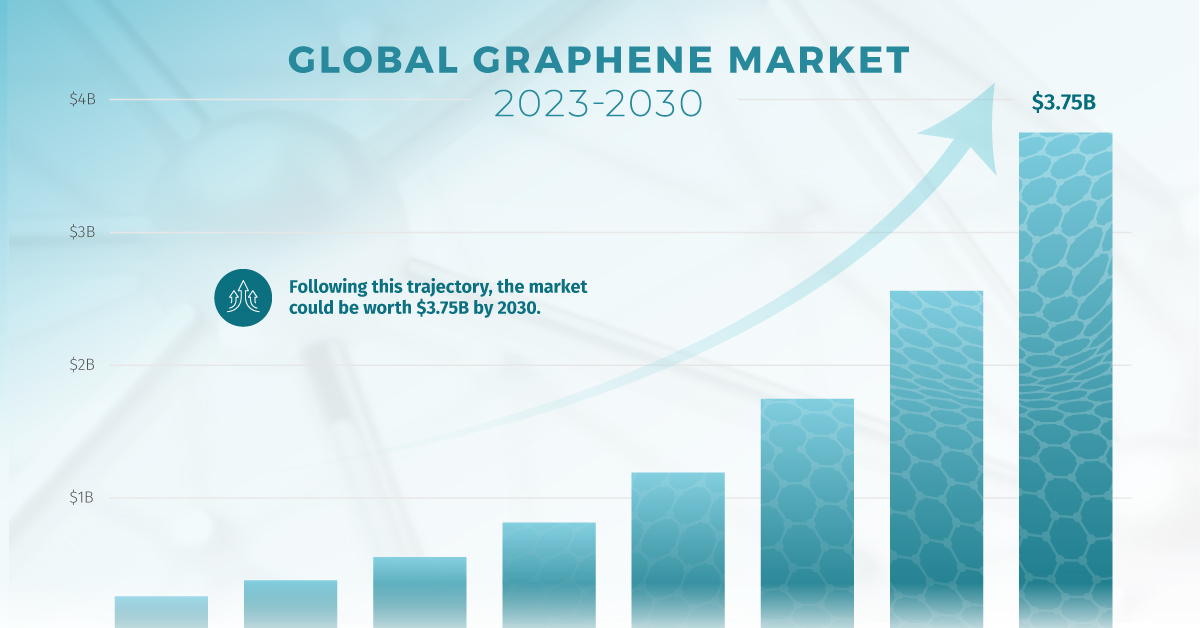

Experts predict that its market value could reach the billion-dollar threshold by 2027 and soar to a staggering $3.75 billion by 2030.

In this infographic sponsored by HydroGraph, we dive into everything investors need to know about this exciting industry and where it’s headed.

Promising Properties

Graphene possesses several unique physical properties which contribute to its wide range of potential applications.

- 200 times stronger than steel

- Harder than diamonds

- 1,000 times lighter than paper

- 98% transparent

- Higher electrical conductivity than copper

- Heat conductivity: 5 times that of copper

- 2,630 m² of surface area per gram

Since its first successful isolation in 2004, graphene’s properties have opened the doors to a multitude of commercial applications and products.

Applications of Graphene

Graphene has permeated numerous sectors like electronics, energy, and healthcare because of its impressive array of end uses.

| Industry | Revenue CAGR of Graphene Across Industries, 2022-2027 |

|---|---|

| Biomedical and Healthcare | 52% |

| Electronics and Telecommunications | 34% |

| Energy | 25% |

| Aerospace and Defense | 16% |

| Other End-User Industries | 17% |

Graphene’s antibacterial properties make it highly suitable for medical instruments and implants. Furthermore, it has shown remarkable potential in helping treat diseases such as cancer.

Another one of the material’s applications is its ability to emit high-speed light pulses, or to combine graphene’s thinness and high-conductivity to create the tiniest possible light sources.

All in all, it’s difficult to sum up graphene’s properties and potential applications in one place. The supermaterial has been covered and cited in thousands of academic journals, and comes up with over 2 million search results on Google Scholar.

Graphene Commercialization

Graphene has evolved from a scientific breakthrough to a commercial reality in less than two decades, putting it firmly on the radar of many future-focused investors.

But despite the strides the industry is making, it is still in its infancy, and therefore challenges exist on the path to widespread adoption. Here are the top five commercialization obstacles perceived by industry players.

| Obstacle | % of survey respondents |

|---|---|

| Cost | 31% |

| Production Methods, Scaling, and Distribution | 21% |

| Material Quality/Consistency | 17% |

| Lack of Knowledge/Awareness | 15% |

| Dispersion/Handling | 14% |

When transitioning cutting-edge materials from the laboratory to consumer products, challenges like these can be expected. But one company is tackling them head-on.

By producing 99.8% pure graphene, and ensuring batch-to-batch consistency, HydroGraph is helping meet the growing demand for graphene products across industries while addressing challenges like cost, scale, and quality.

Interested in learning more? Explore investment opportunities with HydroGraph now.

-

Economy1 day ago

Economy1 day agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.