United States

Charted: U.S. Median House Prices vs. Income

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

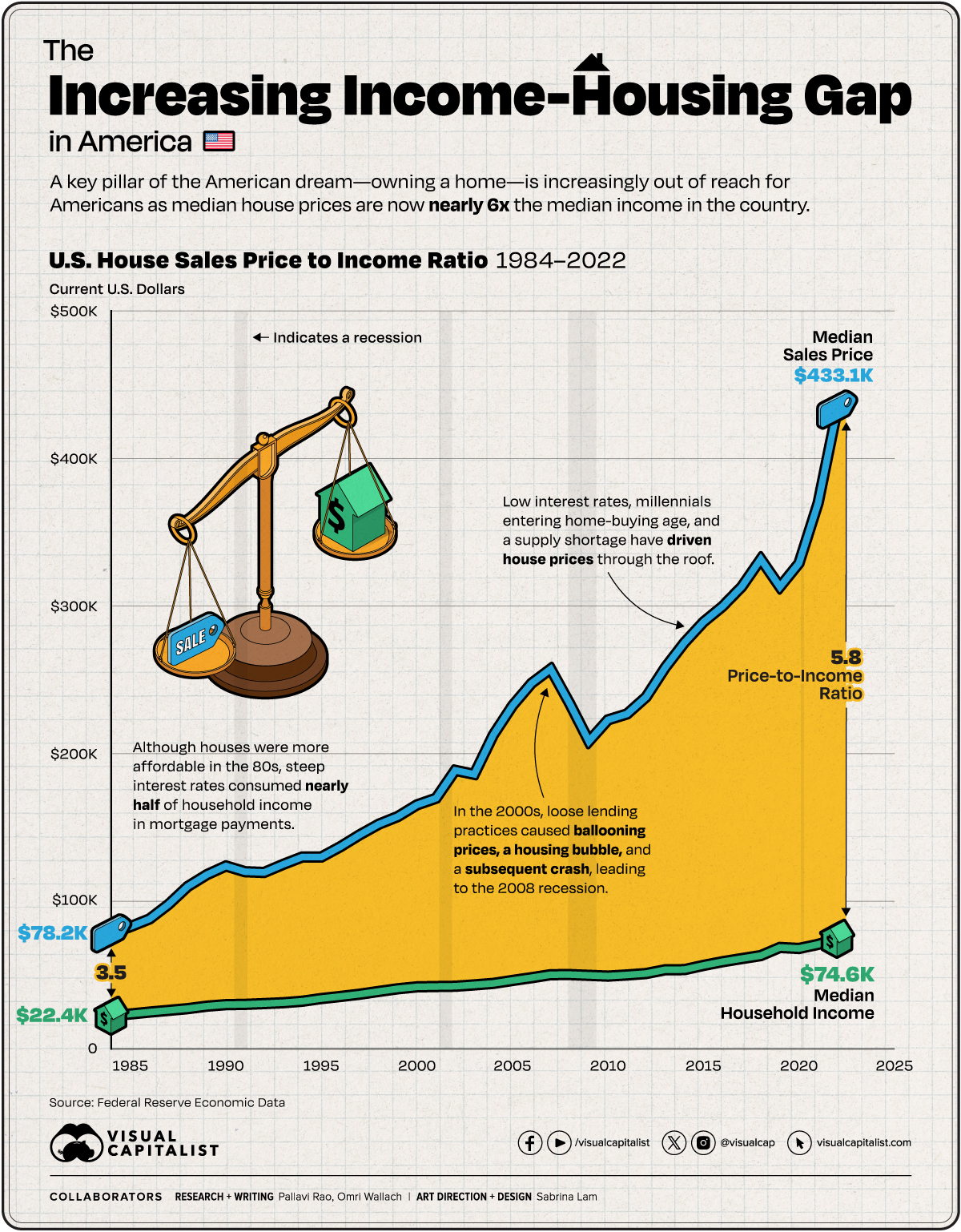

Houses in America Now Cost Six Times the Median Income

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

As of 2023, an American household hoping to buy a median-priced home, needs to make at least $100,000 a year. In some cities, they need to make nearly 3–4x that amount.

The median household income in the country is currently well below that $100,000 threshold. To look at the trends between median incomes and median house prices through the years, we charted their movement using the following datasets data from the Federal Reserve:

- Median household income (1984–2022).

- Median Sales Price of Houses Sold (1963–2023).

Importantly this graphic does not make allowances for actual household disposable income, nor how monthly mortgage payments change depending on the interest rates at the time. Finally, both datasets are in current U.S. dollars, meaning they are not adjusted for inflation.

Timeline: Median House Prices vs. Income in America

In 1984, the median annual income for an American household stood at $22,420, and the median house sales price for the first quarter of the year came in at $78,200. The house sales price-to-income ratio stood at 3.49.

By pure arithmetic, this is the most affordable houses have been in the U.S. since the Federal Reserve began tracking this data, as seen in the table below.

A hidden caveat of course, was inflation: running rampant towards the end of the 70s and the start of the 80s. While it fell significantly in the next five years, in 1984 the 30-year fixed rate was close to 14%, meaning a significant chunk of household income went to interest payments.

| Date | Median House Sales Price | Median Household Income | Price-to-Income Ratio |

|---|---|---|---|

| 1984-01-01 | $78,200 | $22,420 | 3.49 |

| 1985-01-01 | $82,800 | $23,620 | 3.51 |

| 1986-01-01 | $88,000 | $24,900 | 3.53 |

| 1987-01-01 | $97,900 | $26,060 | 3.76 |

| 1988-01-01 | $110,000 | $27,230 | 4.04 |

| 1989-01-01 | $118,000 | $28,910 | 4.08 |

| 1990-01-01 | $123,900 | $29,940 | 4.14 |

| 1991-01-01 | $120,000 | $30,130 | 3.98 |

| 1992-01-01 | $119,500 | $30,640 | 3.90 |

| 1993-01-01 | $125,000 | $31,240 | 4.00 |

| 1994-01-01 | $130,000 | $32,260 | 4.03 |

| 1995-01-01 | $130,000 | $34,080 | 3.81 |

| 1996-01-01 | $137,000 | $35,490 | 3.86 |

| 1997-01-01 | $145,000 | $37,010 | 3.92 |

| 1998-01-01 | $152,200 | $38,890 | 3.91 |

| 1999-01-01 | $157,400 | $40,700 | 3.87 |

| 2000-01-01 | $165,300 | $41,990 | 3.94 |

| 2001-01-01 | $169,800 | $42,230 | 4.02 |

| 2002-01-01 | $188,700 | $42,410 | 4.45 |

| 2003-01-01 | $186,000 | $43,320 | 4.29 |

| 2004-01-01 | $212,700 | $44,330 | 4.80 |

| 2005-01-01 | $232,500 | $46,330 | 5.02 |

| 2006-01-01 | $247,700 | $48,200 | 5.14 |

| 2007-01-01 | $257,400 | $50,230 | 5.12 |

| 2008-01-01 | $233,900 | $50,300 | 4.65 |

| 2009-01-01 | $208,400 | $49,780 | 4.19 |

| 2010-01-01 | $222,900 | $49,280 | 4.52 |

| 2011-01-01 | $226,900 | $50,050 | 4.53 |

| 2012-01-01 | $238,400 | $51,020 | 4.67 |

| 2013-01-01 | $258,400 | $53,590 | 4.82 |

| 2014-01-01 | $275,200 | $53,660 | 5.13 |

| 2015-01-01 | $289,200 | $56,520 | 5.12 |

| 2016-01-01 | $299,800 | $59,040 | 5.08 |

| 2017-01-01 | $313,100 | $61,140 | 5.12 |

| 2018-01-01 | $331,800 | $63,180 | 5.25 |

| 2019-01-01 | $313,000 | $68,700 | 4.56 |

| 2020-01-01 | $329,000 | $68,010 | 4.84 |

| 2021-01-01 | $369,800 | $70,780 | 5.22 |

| 2022-01-01 | $433,100 | $74,580 | 5.81 |

Note: The median house sale price listed in this table and in the chart is from the first quarter of each year. As a result the ratio can vary between quarters of each year.

The mid-2000s witnessed an explosive surge in home prices, eventually culminating in a housing bubble and subsequent crash—an influential factor in the 2008 recession. Subprime mortgages played a pivotal role in this scenario, as they were issued to buyers with poor credit and then bundled into seemingly more attractive securities for financial institutions. However, these loans eventually faltered as economic circumstances changed.

In response to the recession and to stimulate economic demand, the Federal Reserve reduced interest rates, consequently lowering mortgage rates.

While this measure aimed to make homeownership more accessible, it also contributed to a significant increase in housing prices in the following years. Additionally, a new generation entering the home-buying market heightened demand. Simultaneously, a scarcity of new construction and a surge in investors and corporations converting housing units into rental properties led to a shortage in supply, exerting upward pressure on prices.

As a result, median house prices are now nearly 6x the median household income in America.

How Does Unaffordable Housing Affect the U.S. Economy?

When housing costs exceed a significant portion of household income, families are forced to cut back on other essential expenditures, dampening consumer spending. Given how expanding housing supply helped drive U.S. economic growth in the 20th century, the current constraints in the country are especially ironic.

Unaffordable housing also stifles mobility, as individuals may be reluctant to relocate for better job opportunities due to housing constraints. On the flip side, many cities are seeing severe labor shortages as many lower-wage workers simply cannot afford to live in the city. Both phenomena affect market efficiency and productivity growth.

Misc

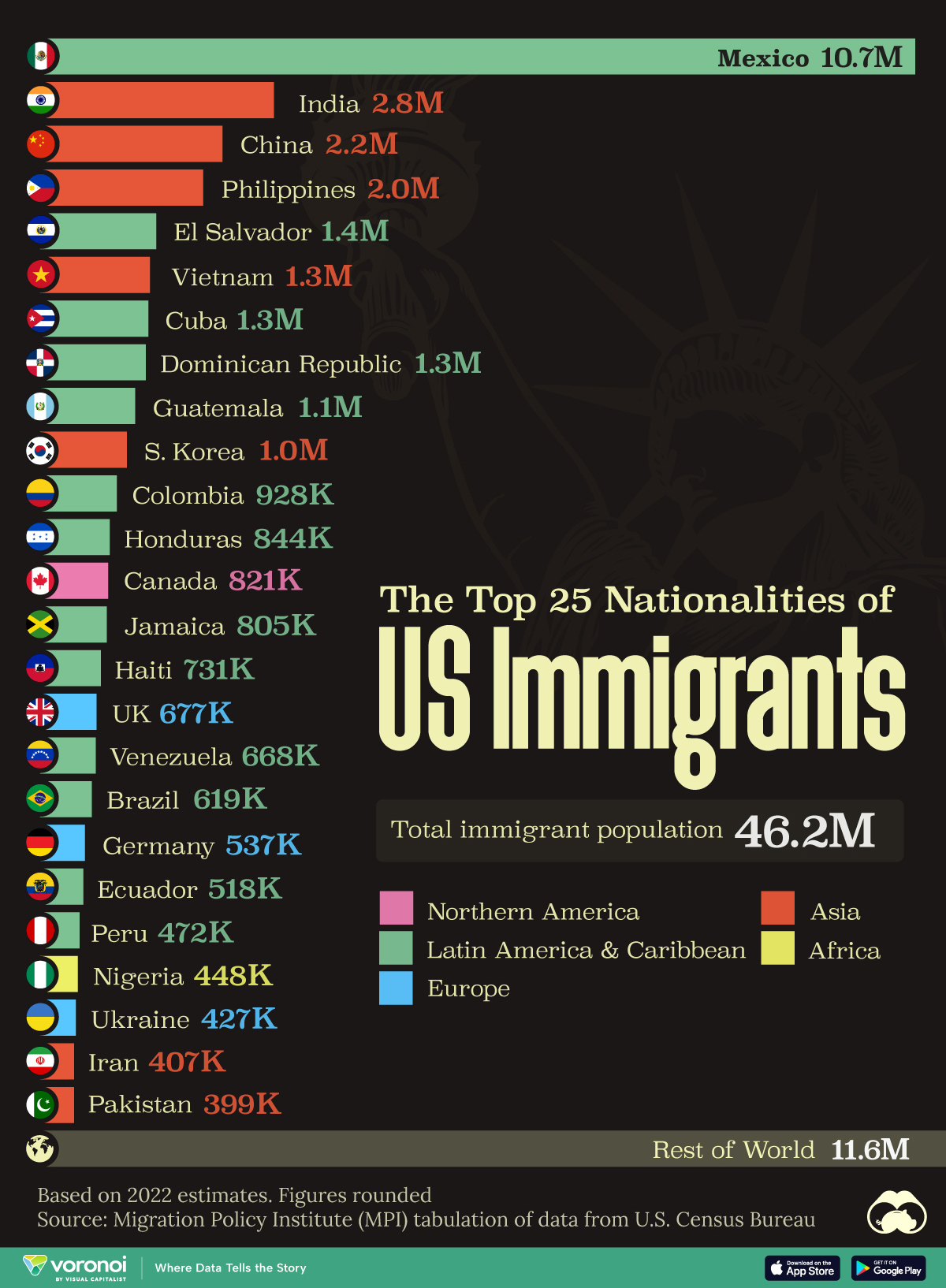

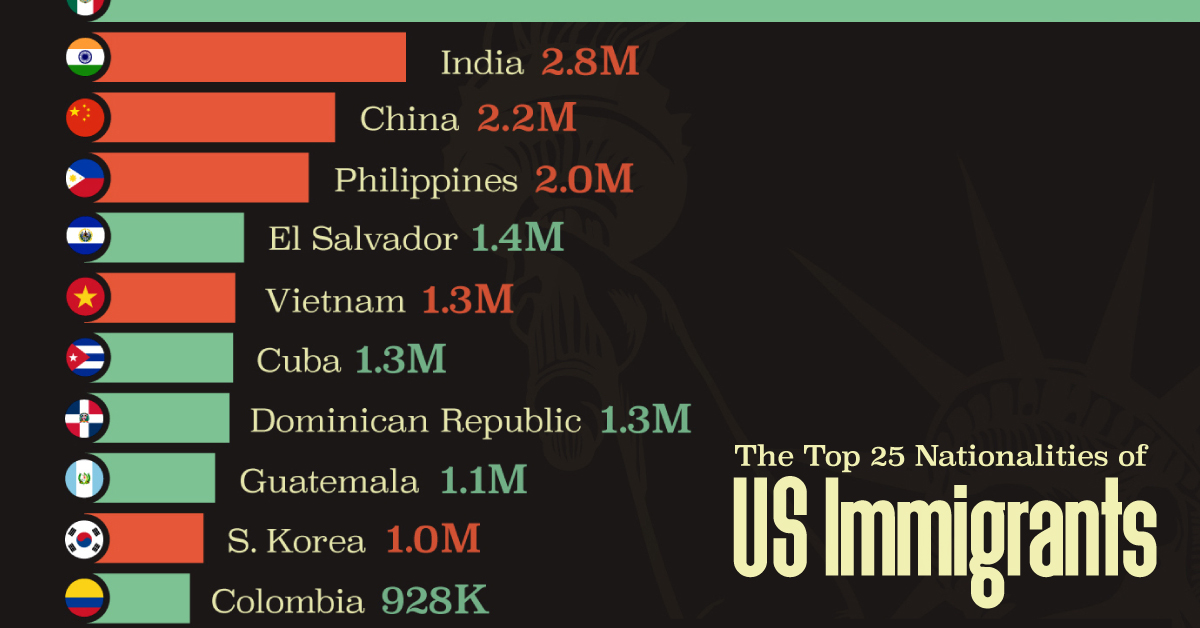

The Top 25 Nationalities of U.S. Immigrants

Mexico is the largest source of immigrants to the U.S., with almost 11 million immigrants.

The Top 25 Nationalities of U.S. Immigrants

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The United States is home to more than 46 million immigrants, constituting approximately 14% of its total population.

This graphic displays the top 25 countries of origin for U.S. immigrants, based on 2022 estimates. The data is sourced from the Migration Policy Institute (MPI), which analyzed information from the U.S. Census Bureau’s 2022 American Community Survey.

In this context, “immigrants” refer to individuals residing in the United States who were not U.S. citizens at birth.

Mexico Emerges as a Leading Source of Immigration

Mexico stands out as the largest contributor to U.S. immigration due to its geographical proximity and historical ties.

Various economic factors, including wage disparities and employment opportunities, motivate many Mexicans to seek better prospects north of the border.

| Country | Region | # of Immigrants |

|---|---|---|

| 🇲🇽 Mexico | Latin America & Caribbean | 10,678,502 |

| 🇮🇳 India | Asia | 2,839,618 |

| 🇨🇳 China | Asia | 2,217,894 |

| 🇵🇭 Philippines | Asia | 1,982,333 |

| 🇸🇻 El Salvador | Latin America & Caribbean | 1,407,622 |

| 🇻🇳 Vietnam | Asia | 1,331,192 |

| 🇨🇺 Cuba | Latin America & Caribbean | 1,312,510 |

| 🇩🇴 Dominican Republic | Latin America & Caribbean | 1,279,900 |

| 🇬🇹 Guatemala | Latin America & Caribbean | 1,148,543 |

| 🇰🇷 Korea | Asia | 1,045,100 |

| 🇨🇴 Colombia | Latin America & Caribbean | 928,053 |

| 🇭🇳 Honduras | Latin America & Caribbean | 843,774 |

| 🇨🇦 Canada | Northern America | 821,322 |

| 🇯🇲 Jamaica | Latin America & Caribbean | 804,775 |

| 🇭🇹 Haiti | Latin America & Caribbean | 730,780 |

| 🇬🇧 United Kingdom | Europe | 676,652 |

| 🇻🇪 Venezuela | Latin America & Caribbean | 667,664 |

| 🇧🇷 Brazil | Latin America & Caribbean | 618,525 |

| 🇩🇪 Germany | Europe | 537,484 |

| 🇪🇨 Ecuador | Latin America & Caribbean | 518,287 |

| 🇵🇪 Peru | Latin America & Caribbean | 471,988 |

| 🇳🇬 Nigeria | Africa | 448,405 |

| 🇺🇦 Ukraine | Europe | 427,163 |

| 🇮🇷 Iran | Middle East | 407,283 |

| 🇵🇰 Pakistan | Asia | 399,086 |

| Rest of World | 11,637,634 | |

| Total | 46,182,089 |

Mexicans are followed in this ranking by Indians, Chinese, and Filipinos, though most immigrants on this list come from countries in the Latin American and Caribbean region.

On the other hand, only three European countries are among the top sources of U.S. immigrants: the UK, Germany, and Ukraine.

Immigration continues to be a significant factor contributing to the overall growth of the U.S. population. Overall population growth has decelerated over the past decade primarily due to declining birth rates.

Between 2021 and 2022, the increase in the immigrant population accounted for 65% of the total population growth in the U.S., representing 912,000 individuals out of nearly 1.4 million.

If you enjoyed this post, be sure to check out Visualized: Why Do People Immigrate to the U.S.? This visualization shows the different reasons cited by new arrivals to America in 2021.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country