Technology

Timeline: The Shocking Collapse of Silicon Valley Bank

![]()

Timeline: The Shocking Collapse of Silicon Valley Bank

Just days ago, Silicon Valley Bank (SVB) was still viewed as a highly-respected player in the tech space, counting thousands of U.S. venture capital-backed startups as its customers.

But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run.

So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list.

Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet.

The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued.

Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits.

By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years.

In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy.

Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.”

| Year | U.S. Venture Capital Activity | Annual % Change |

|---|---|---|

| 2021 | $330B | 98% |

| 2020 | $167B | 15% |

| 2019 | $145B | 1% |

| 2018 | $144B | 64% |

| 2017 | $88B | 6% |

| 2016 | $83B | -3% |

Source: Pitchbook

Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low.

During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses.

In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

| Name | Stock Price Change, March 10 2023 | Unrealized Losses / Tangible Equity |

|---|---|---|

| SVB Financial | -60%* | -99% |

| First Republic Bank | -15% | -29% |

| Zions Bancorp | -2% | -47% |

| Comerica | -5% | -47% |

| U.S. Bancorp | -4% | -55% |

| Fifth Third Bancorp | -4% | -38% |

| Bank of America | -1% | -54% |

| Wells Fargo | 1% | -33% |

| JPMorgan | -1% | -21% |

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.

The whole sector is in crisis, and the banks and investors that support these assets are going to have to figure out what to do.-Christopher Whalen, The Institutional Risk Analyst

Technology

Charting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology3 weeks ago

Technology3 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Demographics7 days ago

Demographics7 days agoMapped: U.S. Immigrants by Region

-

United States2 weeks ago

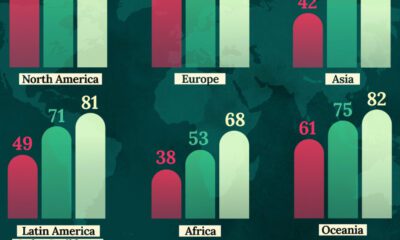

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare2 weeks ago

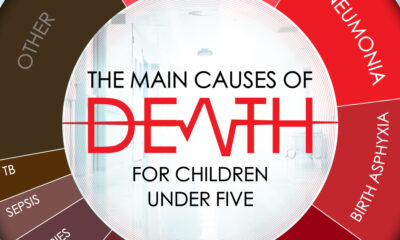

Healthcare2 weeks agoWhat Causes Preventable Child Deaths?

-

Energy2 weeks ago

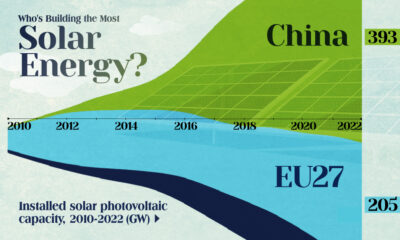

Energy2 weeks agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

-

Healthcare1 week ago

Healthcare1 week agoLife Expectancy by Region (1950-2050F)