Markets

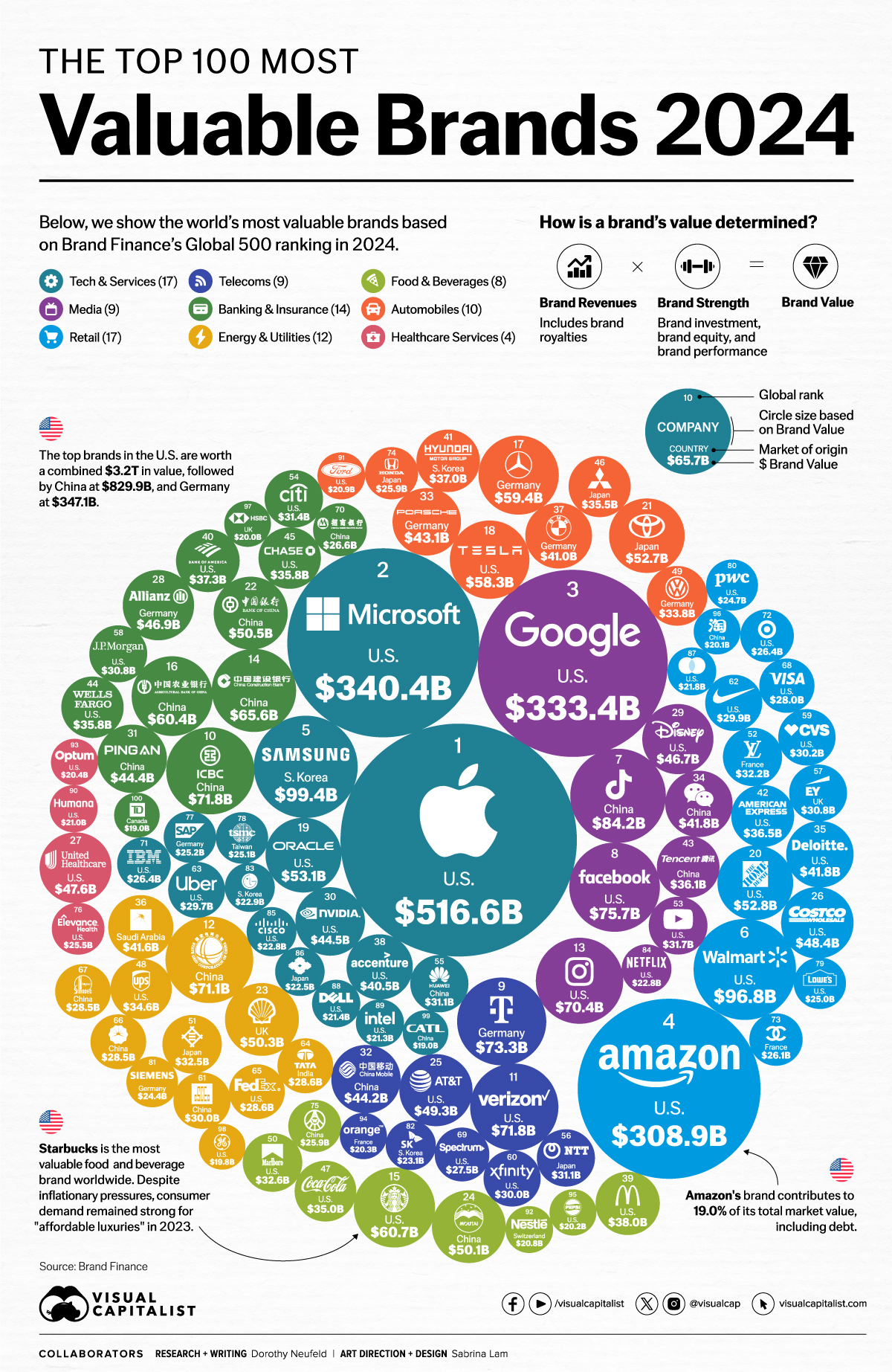

The Top 100 Most Valuable Brands in 2024

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The Top 100 Most Valuable Brands in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Together, the 100 most valuable brands in the world are worth more than $5 trillion.

Brands play an important role in driving shareholder value, yet pinpointing how much a brand is worth can be challenging. Investments in brand could pay dividends for many decades, but because those financial benefits are fairly open to interpretation, most financial regulators don’t usually accept brand assets on balance sheets.

To look at it another way, Apple is missing one of its most valuable assets on its financial reporting—a brand worth $516.6 billion.

This visualization ranks the top 100 brands by brand value, based on the annual global ranking from Brand Finance.

How Do You Value a Brand?

Overall, a brand’s value was calculated by the degree that it generated profits for the company. Brand Finance analyzed individual companies along with their subsidiaries, like in the case of Meta which owns Instagram and WhatsApp.

More details on the methodology can be found at the end of this article.

Ranking the Top Brands, by Value

Here are the most valuable brands globally in 2024:

| Ranking 2024 | Name | Country | Value | Annual Change |

|---|---|---|---|---|

| 1 | Apple | 🇺🇸 U.S. | $516.6B | +73.6% |

| 2 | Microsoft | 🇺🇸 U.S. | $340.4B | +77.7% |

| 3 | 🇺🇸 U.S. | $333.4B | +18.5% | |

| 4 | Amazon | 🇺🇸 U.S. | $308.9B | +3.2% |

| 5 | Samsung Group | 🇰🇷 South Korea | $99.4B | -0.3% |

| 6 | Walmart | 🇺🇸 U.S. | $96.8B | -14.9% |

| 7 | TikTok/Douyin | 🇨🇳 China | $84.2B | +28.2% |

| 8 | 🇺🇸 U.S. | $75.7B | +28.4% | |

| 9 | Deutsche Telekom | 🇩🇪 Germany | $73.3B | +16.5% |

| 10 | ICBC | 🇨🇳 China | $71.8B | +3.3% |

| 11 | Verizon | 🇺🇸 U.S. | $71.8B | +6.4% |

| 12 | State Grid Corporation of China | 🇨🇳 China | $71.1B | +20.9% |

| 13 | 🇺🇸 U.S. | $70.4B | +48.5% | |

| 14 | China Construction Bank | 🇨🇳 China | $65.6B | +4.7% |

| 15 | Starbucks | 🇺🇸 U.S. | $60.7B | +13.5% |

| 16 | Agricultural Bank Of China | 🇨🇳 China | $60.4B | +4.7% |

| 17 | Mercedes-Benz | 🇩🇪 Germany | $59.4B | +1.1% |

| 18 | Tesla | 🇺🇸 U.S. | $58.3B | -12.0% |

| 19 | Oracle | 🇺🇸 U.S. | $53.1B | +34.2% |

| 20 | Home Depot | 🇺🇸 U.S. | $52.8B | -13.6% |

| 21 | Toyota | 🇯🇵 Japan | $52.7B | +0.3% |

| 22 | Bank of China | 🇨🇳 China | $50.5B | +6.6% |

| 23 | Shell | 🇬🇧 UK | $50.3B | +4.3% |

| 24 | Moutai | 🇨🇳 China | $50.1B | +0.7% |

| 25 | AT&T | 🇺🇸 U.S. | $49.3B | -0.7% |

| 26 | Costco | 🇺🇸 U.S. | $48.4B | +3.9% |

| 27 | UnitedHealthcare | 🇺🇸 U.S. | $47.6B | +28.4% |

| 28 | Allianz Group | 🇩🇪 Germany | $46.9B | -3.0% |

| 29 | Disney | 🇺🇸 U.S. | $46.7B | -5.6% |

| 30 | Nvidia | 🇺🇸 U.S. | $44.5B | +162.9% |

| 31 | Ping An | 🇨🇳 China | $44.4B | -0.7% |

| 32 | China Mobile | 🇨🇳 China | $44.2B | +2.0% |

| 33 | Porsche | 🇩🇪 Germany | $43.1B | +17.3% |

| 34 | 🇨🇳 China | $41.8B | -16.8% | |

| 35 | Deloitte | 🇺🇸 U.S. | $41.8B | +21.0% |

| 36 | Aramco | 🇸🇦 Saudi Arabia | $41.6B | -8.1% |

| 37 | BMW | 🇩🇪 Germany | $41.0B | +1.5% |

| 38 | accenture | 🇮🇪 Ireland | $40.5B | +1.6% |

| 39 | McDonald's | 🇺🇸 U.S. | $38.0B | +3.1% |

| 40 | Bank of America | 🇺🇸 U.S. | $37.3B | -3.6% |

| 41 | Hyundai Group | 🇰🇷 South Korea | $37.0B | +35.6% |

| 42 | American Express | 🇺🇸 U.S. | $36.5B | +7.0% |

| 43 | Tencent | 🇨🇳 China | $36.1B | -5.3% |

| 44 | Wells Fargo | 🇺🇸 U.S. | $35.8B | +8.6% |

| 45 | Chase | 🇺🇸 U.S. | $35.8B | +14.3% |

| 46 | Mitsubishi Group | 🇯🇵 Japan | $35.5B | +1.7% |

| 47 | Coca-Cola | 🇺🇸 U.S. | $35.0B | +4.6% |

| 48 | UPS | 🇺🇸 U.S. | $34.6B | -2.4% |

| 49 | Volkswagen | 🇩🇪 Germany | $33.8B | -0.5% |

| 50 | Marlboro | 🇺🇸 U.S. | $32.6B | -6.3% |

| 51 | Mitsui | 🇯🇵 Japan | $32.5B | +5.8% |

| 52 | Louis Vuitton | 🇫🇷 France | $32.2B | +22.6% |

| 53 | YouTube | 🇺🇸 U.S. | $31.7B | +6.8% |

| 54 | Citi | 🇺🇸 U.S. | $31.4B | +2.8% |

| 55 | Huawei | 🇨🇳 China | $31.1B | -29.8% |

| 56 | NTT Group | 🇯🇵 Japan | $31.1B | -15.1% |

| 57 | EY | 🇬🇧 UK | $30.8B | +20.0% |

| 58 | J.P. Morgan | 🇺🇸 U.S. | $30.8B | -3.3% |

| 59 | CVS | 🇺🇸 U.S. | $30.2B | -1.1% |

| 60 | Xfinity | 🇺🇸 U.S. | $30.0B | +4.5% |

| 61 | CSCEC | 🇨🇳 China | $30.0B | -6.1% |

| 62 | Nike | 🇺🇸 U.S. | $29.9B | -4.6% |

| 63 | Uber | 🇺🇸 U.S. | $29.7B | +27.6% |

| 64 | Tata Group | 🇮🇳 India | $28.6B | +8.5% |

| 65 | FedEx | 🇺🇸 U.S. | $28.6B | -1.0% |

| 66 | PetroChina | 🇨🇳 China | $28.5B | -3.9% |

| 67 | Sinopec Group | 🇨🇳 China | $28.5B | +4.9% |

| 68 | VISA | 🇺🇸 U.S. | $28.0B | -5.4% |

| 69 | Spectrum | 🇺🇸 U.S. | $27.5B | +17.8% |

| 70 | China Merchants Bank | 🇨🇳 China | $26.6B | +8.6% |

| 71 | IBM Group | 🇺🇸 U.S. | $26.4B | +0.9% |

| 72 | Target | 🇺🇸 U.S. | $26.4B | -4.5% |

| 73 | Chanel | 🇫🇷 France | $26.1B | +34.5% |

| 74 | Honda | 🇯🇵 Japan | $25.9B | +7.1% |

| 75 | Wuliangye | 🇨🇳 China | $25.9B | -14.5% |

| 76 | Elevance Health | 🇺🇸 U.S. | $25.5B | +28.4% |

| 77 | SAP | 🇩🇪 Germany | $25.2B | +19.3% |

| 78 | TSMC | 🇹🇼 Taiwan | $25.1B | +16.2% |

| 79 | Lowe's | 🇺🇸 U.S. | $25.0B | -20.8% |

| 80 | PWC | 🇺🇸 U.S. | $24.7B | -2.6% |

| 81 | Siemens Group | 🇩🇪 Germany | $24.4B | +13.9% |

| 82 | SK Group | 🇰🇷 South Korea | $23.1B | +2.5% |

| 83 | LG Group | 🇰🇷 South Korea | $22.9B | +7.7% |

| 84 | Netflix | 🇺🇸 U.S. | $22.8B | -5.5% |

| 85 | Cisco | 🇺🇸 U.S. | $22.8B | -4.8% |

| 86 | Sumitomo Group | 🇯🇵 Japan | $22.5B | -5.9% |

| 87 | Mastercard | 🇺🇸 U.S. | $21.8B | -12.2% |

| 88 | Dell Technologies | 🇺🇸 U.S. | $21.4B | -5.2% |

| 89 | Intel | 🇺🇸 U.S. | $21.3B | -7.3% |

| 90 | Humana | 🇺🇸 U.S. | $21.0B | +27.1% |

| 91 | Ford | 🇺🇸 U.S. | $20.9B | -6.1% |

| 92 | Nestlé | 🇨🇭 Switzerland | $20.8B | -7.4% |

| 93 | Optum | 🇺🇸 U.S. | $20.4B | +1.2% |

| 94 | Orange | 🇫🇷 France | $20.3B | +10.2% |

| 95 | Pepsi | 🇺🇸 U.S. | $20.2B | +10.2% |

| 96 | Taobao | 🇨🇳 China | $20.1B | -34.0% |

| 97 | HSBC | 🇬🇧 UK | $20.0B | +1.0% |

| 98 | General Electric | 🇺🇸 U.S. | $19.8B | +2.2% |

| 99 | CATL | 🇨🇳 China | $19.0B | +29.4% |

| 100 | TD | 🇨🇦 Canada | $19.0B | -7.1% |

Ranking first overall, the value of Apple’s brand has ballooned by over $217 billion since last year’s ranking.

While iPhone sales have plateaued, the company has been expanding its product lines from wearables to Apple TV. Over 50% of people surveyed by Brand Finance said that their products were worth the price, even though it was expensive.

On the other hand, Tesla’s brand value sank to $58.3 billion, dropping out of the top 10 since last year. This came as new and more affordable electric vehicle (EV) makers saw increasing sales, notably BYD. Supported by strong demand in China’s market, BYD became the world’s bestselling EV company in 2023. In fact, over a third of new cars sold in the country were EVs.

The Fastest Growing Brands

Which brands jumped the most in value?

| Brand | Change in Ranking 2023-2024 | Change in Brand Value |

|---|---|---|

| Nvidia | +87 | +162.9% |

| CATL | +36 | +29.4% |

| Humana | +32 | +27.1% |

| Hyundai Group | +26 | +35.6% |

| Chanel | +25 | +34.5% |

| Elevance Health | +19 | +28.4% |

| Louis Vuitton | +18 | +22.6% |

| Uber | +18 | +27.6% |

| Oracle | +16 | +34.2% |

| EY | +15 | +20.0% |

Nvidia’s brand value soared as investors flocked to AI stocks and demand for memory chips accelerated.

For perspective, tens of thousands of chips are needed for AI models to run in order to simultaneously calculate computational tasks. The company joined the $1 trillion market cap club in late January 2024—the fifth company to do this ever. Not only that, it is worth more than Netflix, Tesla, and Walmart combined.

Most Valuable Brands: U.S. Leads the Pack

In 2024, more than half of the 100 most valuable brands are based in the United States, with a combined value of $3.2 trillion.

| Country | Top 100 Total Brand Value | Number of Brands |

|---|---|---|

| 🇺🇸 U.S. | $3,241.0B | 51 |

| 🇨🇳 China | $829.9B | 19 |

| 🇩🇪 Germany | $347.1B | 8 |

| 🇯🇵 Japan | $200.2B | 6 |

| 🇰🇷 South Korea | $182.4B | 4 |

| 🇬🇧 UK | $101.1B | 3 |

| 🇫🇷 France | $78.6B | 3 |

| 🇸🇦 Saudi Arabia | $41.6B | 1 |

| 🇮🇪 Ireland | $40.5B | 1 |

| 🇮🇳 India | $28.6B | 1 |

| 🇹🇼 Taiwan | $25.1B | 1 |

| 🇨🇭 Switzerland | $20.8B | 1 |

| 🇨🇦 Canada | $19.0B | 1 |

China has the second-highest number of companies on the ranking, with TikTok as its most valuable brand, worth $84.2 billion. Interestingly, many of China’s most valuable brands are heavily concentrated in the financial sector.

As a rising economic powerhouse, India’s most valuable brand is Tata Group.

The conglomerate, founded in 1868, spans across 30 companies in multiple sectors, from technology and manufacturing to automotive and steel. Its subsidiary, Tata Technologies, is scheduled to IPO in late 2024 with a $2.5 billion valuation.

With 245 million mobile customers in over 50 countries, Germany’s Deutsche Telekom is the most valuable in Europe, overtaking Verizon as the most valuable telecom brand globally.

Where does this data come from?

Source: Brand Finance Global 500 Report

Important note: The values shown above are brand value calculations as opposed to market capitalization. See below for more details.

How is brand value calculated? Generally speaking, the methodology for calculating “brand value” is a formula that is as follows:

Brand Strength (BSI) x Brand Royalty Rate x Brand Revenues = Brand Value

Brand Strength Index (BSI) looks at brand investment, brand equity, and brand performance. The brand royalty rate is determined based on sector. Lastly, forecast brand-specific revenues are determined based on the proportion of parent company revenues attributable to the brand in question. Brand value itself is discounted to net present value.

Maps

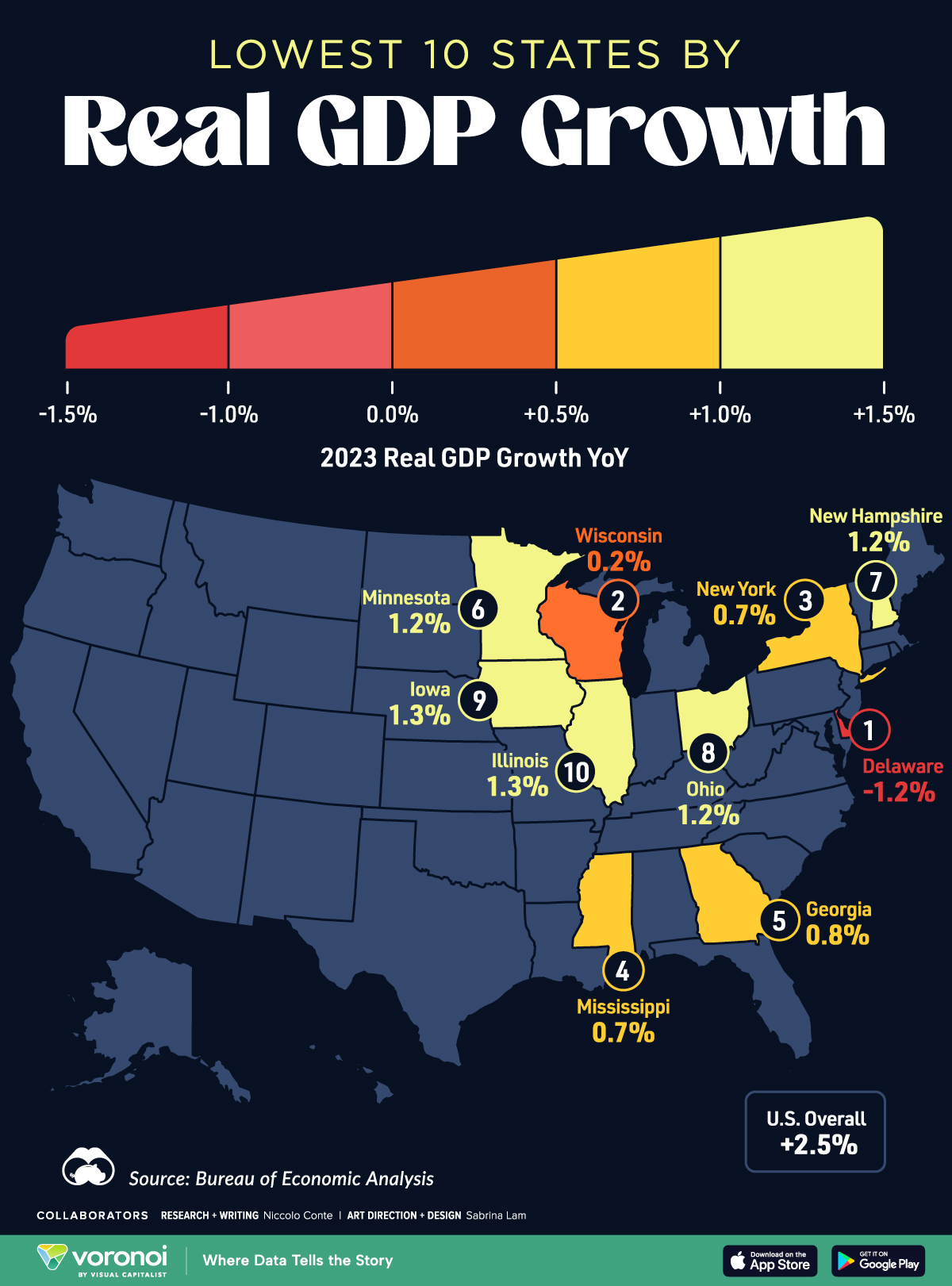

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country