Infographic: Why Collagen Is Vital For the Body

The following content is sponsored by ProT Gold.

Infographic: Why Collagen Is Vital For the Body

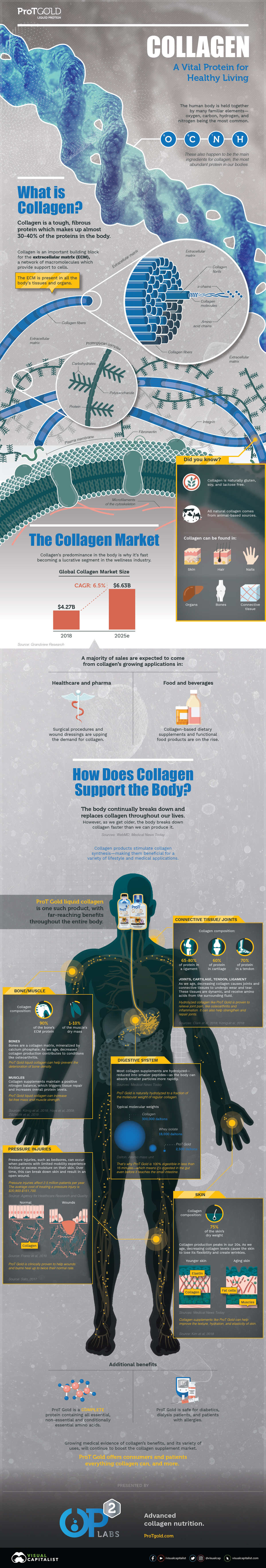

For centuries, collagen has been viewed as the “Fountain of Youth”. While its anti-aging claims may be exaggerated, the protein plays a much bigger role as the body’s structural backbone. Collagen is to our body what steel is to reinforced concrete—in fact, gram-for-gram, some types of collagen are even stronger than steel.

Today’s infographic from ProT Gold highlights the importance of collagen in the body, and how supplements such as ProT Gold can enhance its effects.

Collagen’s Purpose and Potential

Collagen is the most prevalent protein in humans, making up 30-40% of all bodily proteins. Formed from bundled-up amino acid chains, the resulting collagen fibers act as tough, supporting structures to anchor cells to each other.

Collagen is a main component of the extracellular matrix (ECM), a network of macromolecules that also include enzymes and glycoproteins. The ECM is present everywhere in the body, but mainly found in skin, bones, and connective tissues.

Collagen is the glue that holds the body together.

—Whitney Bowe, New York dermatologist

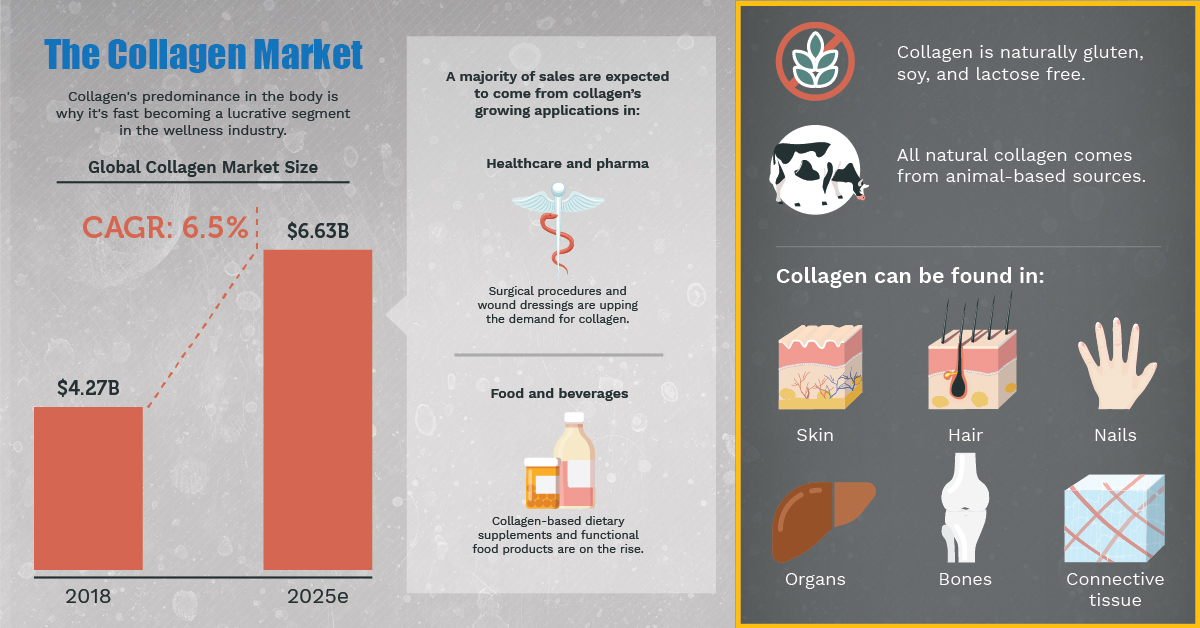

Globally, the market value of collagen is projected at $6.6B by 2025—up from $4.3B in 2018. It’s no surprise that the wellness industry has a close eye on its immense potential.

Collagen’s growing applications will drive sales, mostly in the following sectors:

- Healthcare and pharmaceuticals

Surgical procedures and wound dressing are upping the demand for collagen. - Food and beverages

Collagen-based dietary supplements and functional food products are on the rise.

How Does Collagen Support the Body?

The body is continuously regenerating proteins from the day we are born. However, this process slows down as we age, and collagen in the body is depleted faster than it’s produced.

Collagen supplements can help counter this effect by encouraging collagen synthesis. This contributes to their applications in lifestyle habits and medicine. ProT Gold is one such product with far-reaching benefits.

Skin: 75% Collagen in Dry Weight

Collagen production peaks in our mid-twenties and, over time, a decrease in collagen levels can cause skin to lose its flexibility. ProT Gold liquid collagen can improve the hydration, elasticity, and texture of skin.

Bone: 90% Collagen in ECM Protein

As we age, decreased collagen production contributes to serious conditions such as osteoarthritis. Collagen supplements can thus help prevent bone density deterioration.

Muscle: 1-10% Collagen in Dry Mass

Collagen supplements maintain a positive nitrogen balance triggering tissue repair and increasing overall protein levels. Liquid collagen supplements can strengthen muscles and mitigate injuries, particularly in athletes.

Pressure Injuries: Collagen to the Rescue

Pressure injuries, or bedsores, occur due to friction or excess moisture on the skin, especially for patients with limited mobility. Collagen is vital for healing these wounds, and can help prevent them from escalating into serious infections.

Digestibility of ProT Gold

Most collagen supplements go through a hydrolyzation process, where they are split into smaller molecules. This improves the rapid absorption of particles—and ProT Gold liquid collagen is no exception. The supplement is a fraction of the molecular weight of regular collagen, making it 100% digestible in only 15 minutes.

Joints: 65-80% Collagen in Ligament Protein

Decreasing collagen production causes joints—and connective tissue, such as tendons and cartilage—to undergo significant wear and tear. Hydrolyzed collagen supplements are proven to relieve inflammation, as well as strengthen and repair tissues and joints.

Additional Benefits of Collagen Supplements

While all natural collagen is animal-based, it’s also free of gluten, soy, and lactose. Compared to natural collagen, ProT Gold is also a complete protein—it contains all essential amino acids, as well as non-essential and conditionally essential amino acids. Collagen supplements are also safe for diabetics, dialysis patients, and patients with allergies.

With growing medical evidence of its benefits, ProT Gold offers consumers and patients everything natural collagen can, and more.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.