Misc

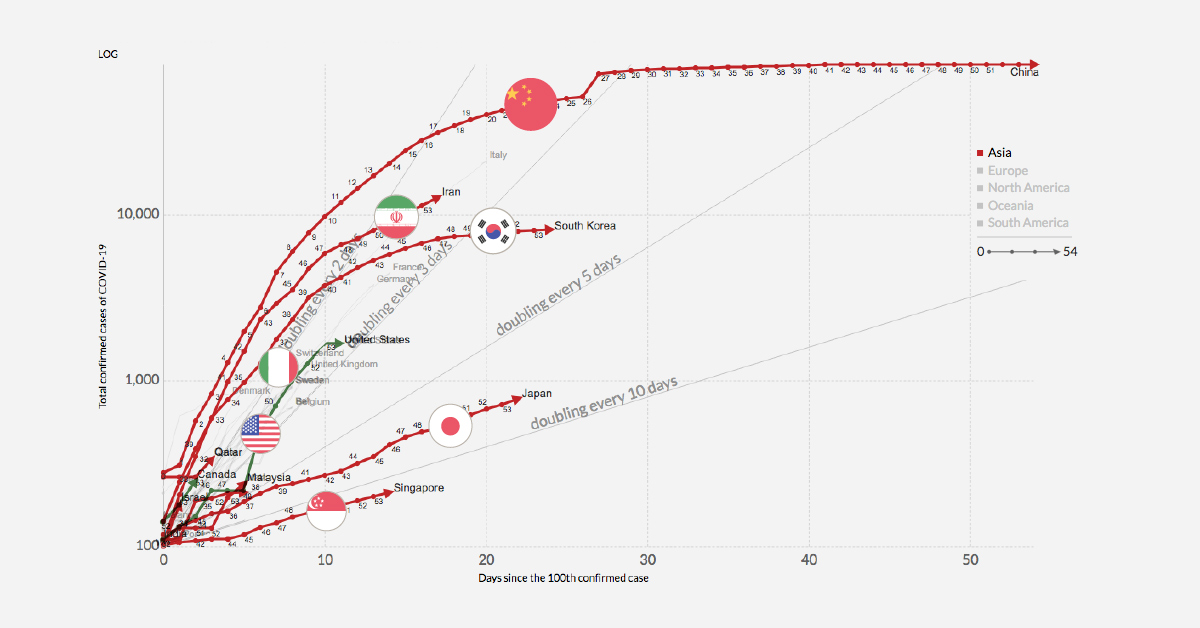

Infection Trajectory: See Which Countries are Flattening Their COVID-19 Curve

NOTE: This chart updates daily with new data. Also, the search button in the lower–left corner allows filtering of specific countries.

At the outset of 2020, the world looked on as China grappled with an outbreak that seemed be spiraling out of control.

Two months later, the situation is markedly different. After aggressive testing and quarantine efforts, China’s outbreak of Novel Coronavirus (COVID-19) appears to be leveling off.

Now, numerous countries around the world are in the beginning stages of managing their own outbreaks. March 15th, 2020, marked a significant statistical milestone for this, as confirmed cases of COVID-19 outside of China surpassed the Chinese total.

The tracker above, by Our World in Data, charts the trajectory of the growing number of countries with more than 100 confirmed cases of COVID-19. As the number of new infections reported around the world continues to grow, which countries are winning the battle against COVID-19, and which are still struggling to slow the rate of infection?

What’s Your National Infection Trajectory?

As of publishing time, 39 countries have passed the threshold of 100 confirmed cases, with many more countries on the cusp. By comparing infection trajectories from the 100 case mark, we’re able to see a clearer picture of how quickly the virus is spreading within various countries.

A rapid “doubling rate” can spell big trouble, as even countries with advanced healthcare systems can become overwhelmed by the sheer number of cases. This was the case in the Lombardy region of Italy, where hospitals were overloaded and an increasing number of medical staff are under quarantine after testing positive for the virus. Nearly 10% of COVID-19 patients in Lombardy required intensive care, which stretched resources to their breaking point.

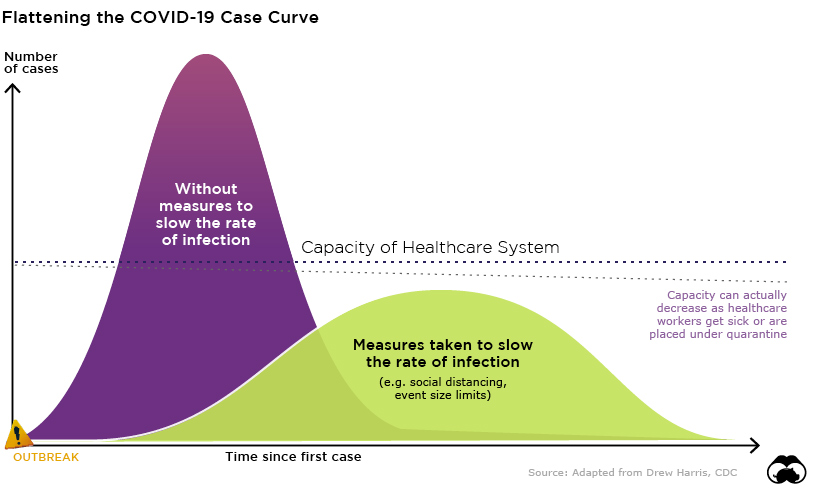

Other countries are looking to avoid this situation by “flattening the curve” of the pandemic. In other words, preventing and delaying the spread of the virus so that large portions of the population aren’t sick at the same time.

Original concept by Drew Harris

Everything’s Canceled

While all the countries on this tracker are united behind a common goal – stamping out COVID-19 as soon as possible – each country has its own approach and unique challenges when it comes to keeping their population safe. Of course, countries that are just beginning to experience exponential growth in case numbers have the benefit of learning from mistakes made elsewhere, and adopting ideas that are proving successful at slowing the rate of infection.

Many jurisdictions are implementing some or all of these measures to help flatten the curve:

- Quarantining

- Encouraging social distancing

- Encouraging working from home

- Closing schools and other institutions

- Placing hard limits on the size of crowds at events

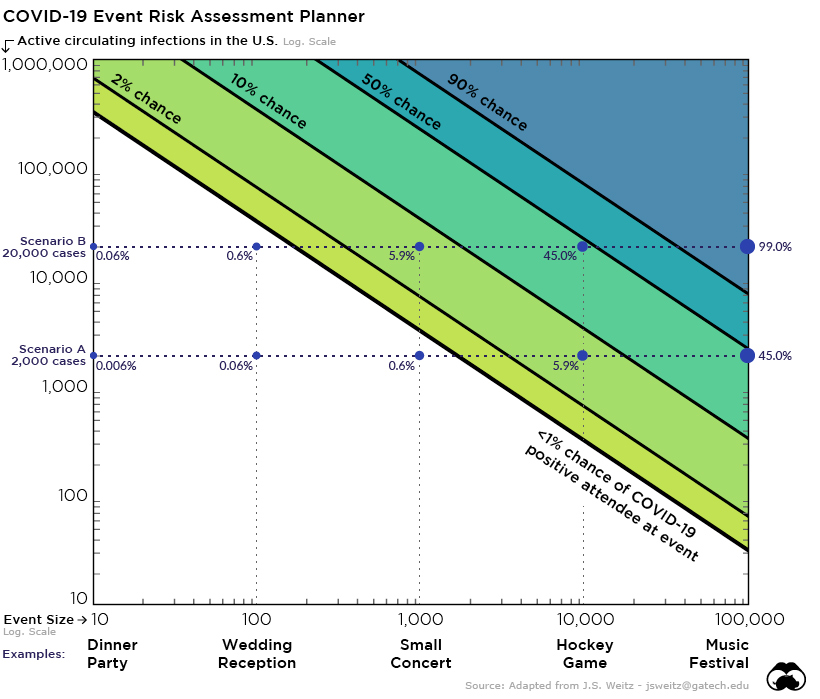

The following chart explains why this last measure is critical to limiting the spread of the virus.

View the interactive Event Risk Assessment Tool here.

In scenario B above, which assumes just 20,000 active cases of COVID-19 in the U.S., there’s nearly a 50% chance an infected person will be attending a 10,000 person conference or sporting event. This is precisely the reason why temporary limits on crowd size are popping up in many jurisdictions around the world.

Direct losses due to canceled tech conferences alone, such as SXSW and the Electronic Entertainment Expo, have already surpassed the $1 billion mark, but despite the short-term economic pain of cancellations and decreased entertainment spending, the costs of business-as-usual could be incalculable.

Maps

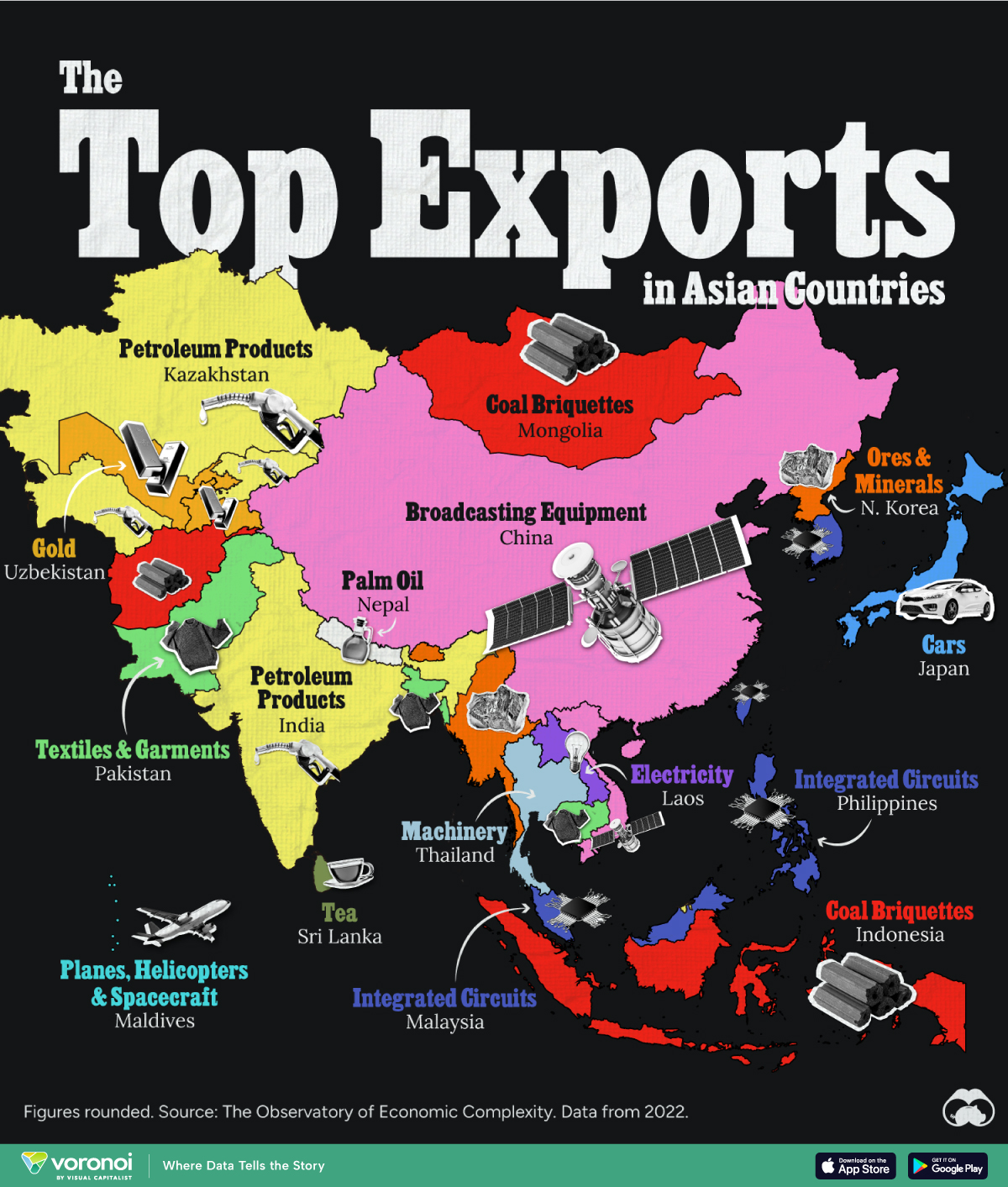

Mapped: The Top Exports in Asian Countries

Asia’s exports span a wide range, from petroleum to technology components and textile products.

The Top Exports in Asian Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Asia’s exports span a wide range, from petroleum and minerals to technology components and textile products.

In this map, we display the top exports (as of 2022) of Asian countries, excluding Middle Eastern nations. Data was sourced from The Observatory of Economic Complexity.

Editor’s Note: For our most recent Middle East themed version of this map, go here.

Diverse Economies Across the Continent

Like in many other countries around the world, petroleum is a significant component of the Asian continental economy, with petroleum products as India’s top exporting category, amounting to approximately $86 billion per year in trade.

Another top product coming from Asia is integrated circuits. These are used in a multitude of applications spanning computing, communications, consumer electronics, automotive, industrial automation, medical devices, aerospace and defense.

| Country | Top Export (2022) | Top Export Value (USD Billions) |

|---|---|---|

| 🇨🇳 China | Broadcasting Equipment | $272.0 |

| 🇹🇼 Taiwan | Integrated Circuits | $223.0 |

| 🇰🇷 South Korea | Integrated Circuits | $121.0 |

| 🇯🇵 Japan | Cars | $89.0 |

| 🇮🇳 India | Petroleum Products | $86.2 |

| 🇸🇬 Singapore | Integrated Circuits | $81.9 |

| 🇲🇾 Malaysia | Integrated Circuits | $78.9 |

| 🇻🇳 Vietnam | Broadcasting Equipment | $58.5 |

| 🇮🇩 Indonesia | Coal Briquettes | $50.8 |

| 🇰🇿 Kazakhstan | Petroleum Products | $47.6 |

| 🇵🇭 Philippines | Integrated Circuits | $32.4 |

| 🇦🇿 Azerbaijan | Petroleum Products | $19.4 |

| 🇹🇭 Thailand | Machinery | $19.3 |

| 🇹🇲 Turkmenistan | Petroleum Products | $9.2 |

| 🇧🇩 Bangladesh | Textiles and Garments | $9.1 |

| 🇲🇳 Mongolia | Coal Briquettes | $6.5 |

| 🇺🇿 Uzbekistan | Gold | $5.2 |

| 🇧🇳 Brunei | Petroleum Products | $4.9 |

| 🇵🇰 Pakistan | Textiles and Garments | $4.9 |

| 🇲🇲 Myanmar (Burma) | Ore & Minerals | $4.1 |

| 🇰🇭 Cambodia | Textiles and Garments | $3.1 |

| 🇱🇦 Laos | Electricity | $2.4 |

| 🇱🇰 Sri Lanka | Tea | $1.3 |

| 🇬🇪 Georgia | Ore & Minerals | $1.0 |

| 🇦🇲 Armenia | Ore & Minerals | $0.7 |

| 🇹🇯 Tajikistan | Gold | $0.6 |

| 🇦🇫 Afghanistan | Coal Briquettes | $0.4 |

| 🇲🇻 Maldives | Planes, Helicopters, Spacecraft | $0.4 |

| 🇧🇹 Bhutan | Ore & Minerals | $0.3 |

| 🇹🇱 Timor-Leste (East Timor) | Petroleum Products | $0.3 |

| 🇳🇵 Nepal | Palm Oil | $0.2 |

| 🇰🇬 Kyrgyzstan | Petroleum Products | $0.1 |

| 🇰🇵 North Korea | Ore & Minerals | $0.03 |

In addition, the region is also a big manufacturer of semiconductors, crucial for applications ranging from telecommunications and artificial intelligence to renewable energy and healthcare. Taiwan holds a 68% share of the advanced semiconductor market.

Pakistan, Bangladesh, and Cambodia are major producers of textile products such as t-shirts, sweaters, and household linens. Most of their products go to the United States and Europe, feeding popular outfit brands.

Asia stands out as a top producer of minerals and fuel, with Afghanistan, Indonesia, and Mongolia being top producers of coal briquettes used for heating, cooking, and industrial processes, while Armenia, Georgia, Bhutan, Myanmar (Burma), and North Korea rely on ore and mineral extraction as their top exporting sector.

The largest Asian economy, China, is known for the production of a variety of products, but its top exports come from broadcasting equipment, including TVs, cameras, and radios.

-

Demographics7 days ago

Demographics7 days agoMapped: U.S. Immigrants by Region

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare2 weeks ago

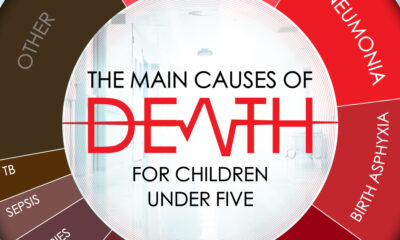

Healthcare2 weeks agoWhat Causes Preventable Child Deaths?

-

Energy2 weeks ago

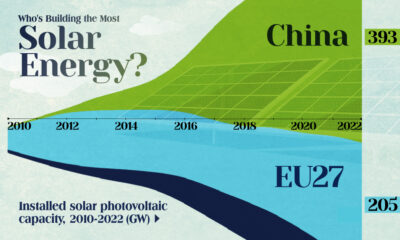

Energy2 weeks agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

-

Healthcare1 week ago

Healthcare1 week agoLife Expectancy by Region (1950-2050F)