Money

Here’s How Reserve Currencies Have Evolved Over 120 Years

Here’s How Reserve Currencies Have Evolved Over 120 Years

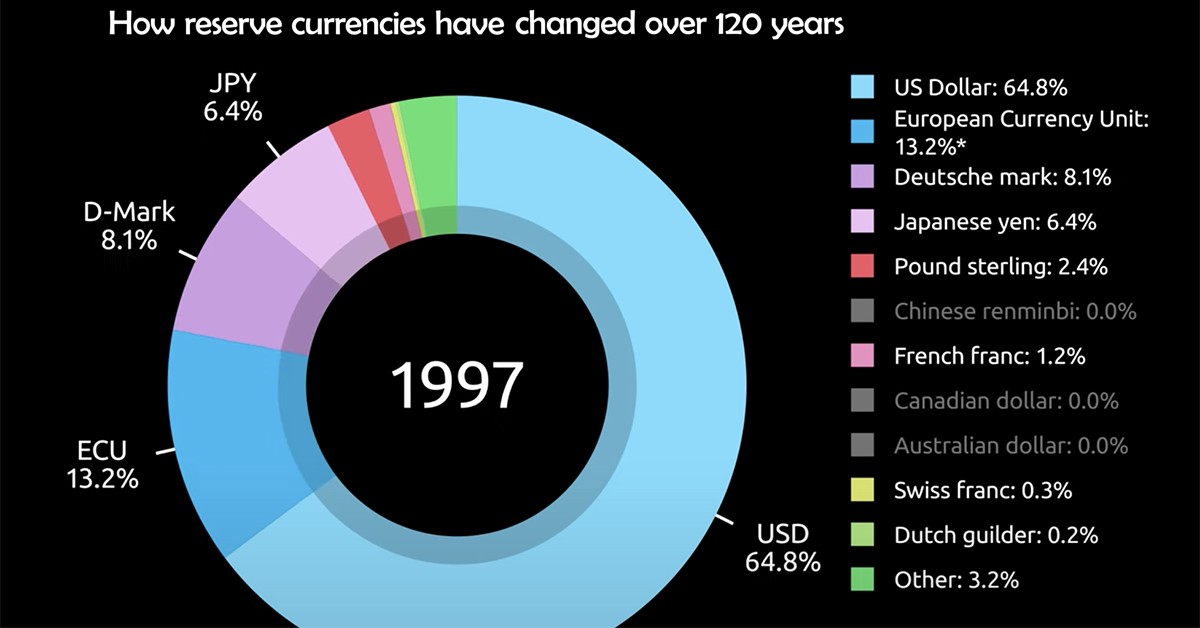

Over the last 120 years, the popularity of different reserve currencies have ebbed and flowed, reflecting the shifting fortunes of leading global economies.

For example, in the year 1900, the U.S. dollar and pound sterling made up 0% and 62% of global reserves respectively. But fast forward to 2020, and the pound now represents just 4.7% of global currency reserves, while the U.S. dollar stands at nearly 60%.

Today’s motion graphic from James Eagle looks at the year-over-year change in currency reserves as a portion of total reserves, spread across 120 years.

| Currency | 1900 | 1920 | 1940 | 1960 | 1980 | 2000 | 2020 |

|---|---|---|---|---|---|---|---|

| U.S. Dollar | 0.0% | 28.4% | 27.9% | 61.7% | 57.9% | 71.2% | 59.0% |

| Euro | 0.0% | 0.0% | 0.0% | 0.0% | 17.5% | 18.5% | 21.2% |

| Deutsche mark | 14.7% | 4.2% | 0.0% | 0.0% | 12.9% | 0.0% | 0.0% |

| Japanese yen | 0.0% | 0.0% | 0.0% | 0.0% | 3.9% | 5.8% | 6.0% |

| Pound sterling | 62.0% | 57.3% | 68.9% | 35.1% | 2.4% | 2.7% | 4.7% |

| Chinese renminbi | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.3% |

| French franc | 17.5% | 6.2% | 2.1% | 1.3% | 1.0% | 0.0% | 0.0% |

| Canadian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.1% |

| Australian dollar | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.8% |

| Swiss franc | 0.0% | 0.0% | 0.8% | 0.3% | 2.2% | 0.3% | 0.2% |

| Dutch guilder | 0.0% | 3.9% | 0.3% | 0.1% | 0.9% | 0.0% | 0.0% |

| Other | 5.7% | 0.0% | 0.0% | 1.6% | 1.3% | 1.5% | 2.7% |

What is a Reserve Currency?

A reserve currency is a large quantity of currency held in “reserve” by monetary authorities like central banks.

Currencies are often held in reserve in preparation for investments and transactions, among other things. Our vast global trade system, which is approaching $20 trillion in value, means plenty of currencies are always needed in reserve. In fact, an estimated $5 trillion in currency swaps hands every single day.

Here are some reasons that currency reserves are held:

- Exchange rate stability for the domestic currency

- To ensures liquidity in times of crisis

- To diversify central bank portfolios, which can reduce risk and improve credit ratings

- More than 65 countries peg their currencies to the U.S. dollar

- Five U.S. territories and a number of sovereign countries, such as Ecuador and Panama, use it as an official currency of exchange

- Around 90% of all Forex trading involves the U.S. dollar

All things equal, countries benefit economically from greater demand for their respective currencies.

The Rise and Fall of Reserve Currencies

Some economists argue that the demand for currencies in the long run revolves around the economic relevance of a country. In general, the larger and more powerful a nation’s economy is, the greater the network effect, and the more interlinked they are to the global economy. Thus, the greater demand there is to hold their currency in reserve.

The last 120 years of currency reserve data shows some support for this claim. For example, Japan’s economy hit a peak in terms of its relative share of global GDP in the early 1990s, just before the effects of the Lost Decade were felt. Subsequently, their peak as a reserve currency was around the same horizon, at 9.4% in 1990.

America’s Era of Dominance

Due to the economic strength of the United States in the post-WWII era, the dollar is what economists call a vehicle currency.

This means many non-dollar economies still choose to engage in international transactions using the dollar. These smaller and less accepted currencies are often converted to U.S. dollars before proceeding with any business or trade dealings. This is why, although Asian economies tend to have neighboring states as their top trade partners, they still engage in a massive portion of these transactions with the U.S. greenback as the currency of choice.

Here are some facts that further exemplify the strength and power of the U.S. dollar:

Additionally, the dollar is often seen as a haven in times of extreme uncertainty and tumult. Given its status as the world’s reserve currency, it can be perceived as less risky and can withstand economic shock to a greater degree relative to other currencies.

New Challengers to the Dollar

In the not too distant past, the U.S. displaced the UK economically and as the world’s reserve currency. Today, the U.S. economy is showing signs of slowing down, based on GDP growth.

China is on the rise, having already displaced the U.S. as the EU’s top trade partner. With projections for China to overtake the U.S. as the world’s largest economy before 2030 in nominal terms, could a new global reserve currency emerge?

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Wealth

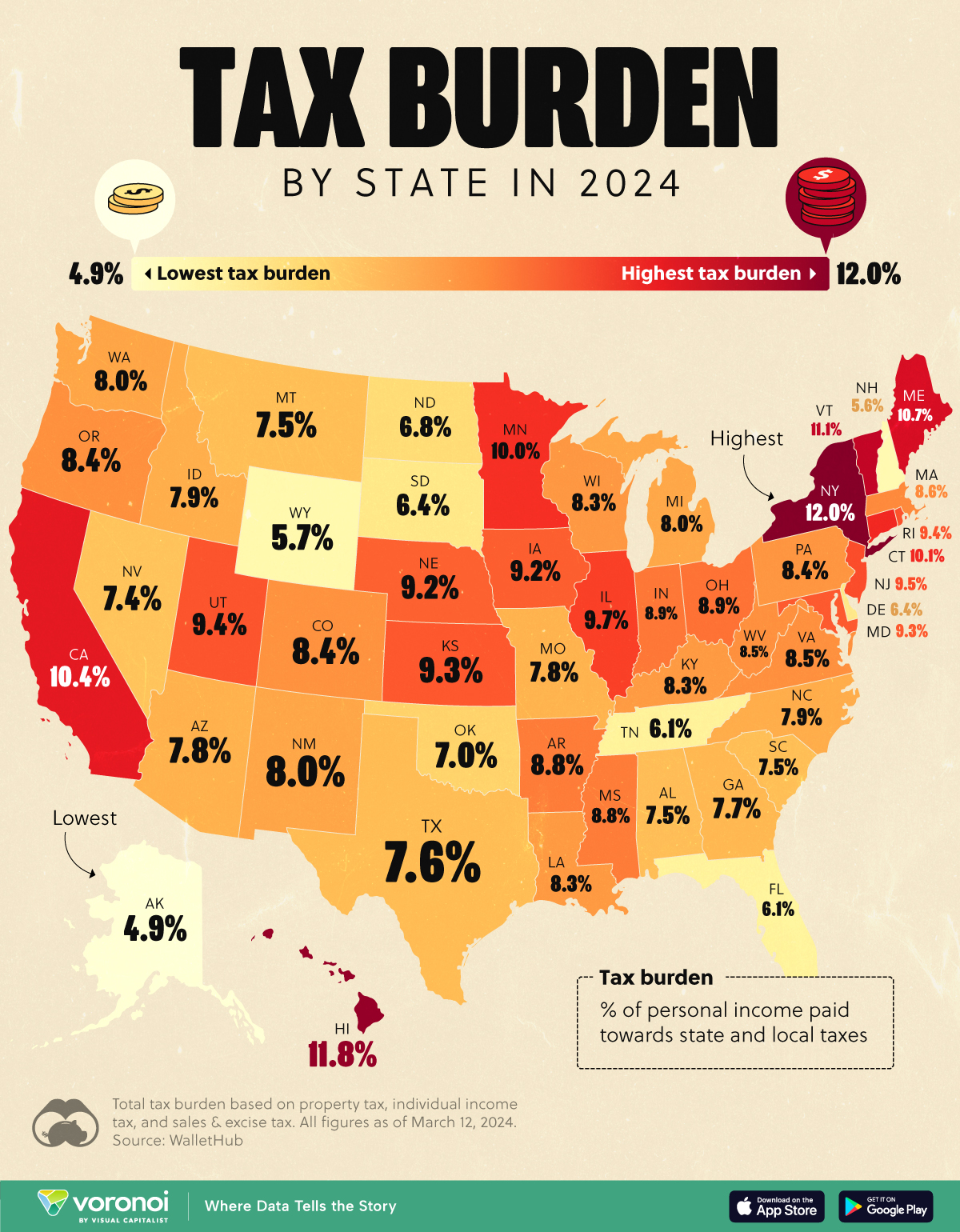

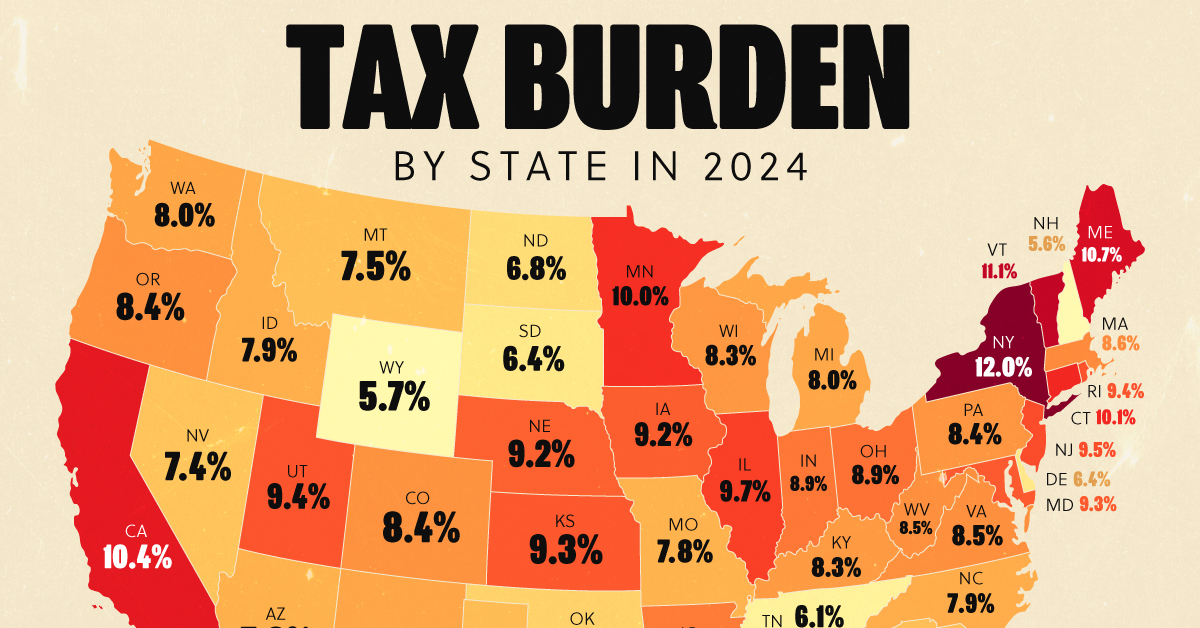

Visualizing the Tax Burden of Every U.S. State

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

| State | Total Tax Burden |

|---|---|

| New York | 12.0% |

| Hawaii | 11.8% |

| Vermont | 11.1% |

| Maine | 10.7% |

| California | 10.4% |

| Connecticut | 10.1% |

| Minnesota | 10.0% |

| Illinois | 9.7% |

| New Jersey | 9.5% |

| Rhode Island | 9.4% |

| Utah | 9.4% |

| Kansas | 9.3% |

| Maryland | 9.3% |

| Iowa | 9.2% |

| Nebraska | 9.2% |

| Ohio | 8.9% |

| Indiana | 8.9% |

| Arkansas | 8.8% |

| Mississippi | 8.8% |

| Massachusetts | 8.6% |

| Virginia | 8.5% |

| West Virginia | 8.5% |

| Oregon | 8.4% |

| Colorado | 8.4% |

| Pennsylvania | 8.4% |

| Wisconsin | 8.3% |

| Louisiana | 8.3% |

| Kentucky | 8.3% |

| Washington | 8.0% |

| New Mexico | 8.0% |

| Michigan | 8.0% |

| North Carolina | 7.9% |

| Idaho | 7.9% |

| Arizona | 7.8% |

| Missouri | 7.8% |

| Georgia | 7.7% |

| Texas | 7.6% |

| Alabama | 7.5% |

| Montana | 7.5% |

| South Carolina | 7.5% |

| Nevada | 7.4% |

| Oklahoma | 7.0% |

| North Dakota | 6.8% |

| South Dakota | 6.4% |

| Delaware | 6.4% |

| Tennessee | 6.1% |

| Florida | 6.1% |

| Wyoming | 5.7% |

| New Hampshire | 5.6% |

| Alaska | 4.9% |

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This is partly due to the fact that Alaskans do not pay state income tax.

Hate Paying Taxes?

In addition to Alaska, there are several other U.S. states that don’t charge income taxes. These are: Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

It’s also worth noting that New Hampshire does not have a regular income tax, but does charge a flat 4% on interest and dividend income according to the Tax Foundation.

Learn More About Taxation From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic which ranks the countries with the lowest corporate tax rates, from 1980 to today.

-

Mining6 days ago

Mining6 days agoWhere the World’s Aluminum is Smelted, by Country

-

Markets2 weeks ago

Markets2 weeks agoVisualized: Interest Rate Forecasts for Advanced Economies

-

Economy2 weeks ago

Economy2 weeks agoThe Most Valuable Companies in Major EU Economies

-

Markets2 weeks ago

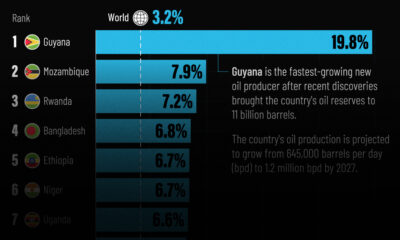

Markets2 weeks agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Markets1 week ago

Markets1 week agoVisualizing Global Inflation Forecasts (2024-2026)

-

Misc1 week ago

Misc1 week agoCharted: What Southeast Asia Thinks About China & the U.S.

-

Misc1 week ago

Misc1 week agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?