Markets

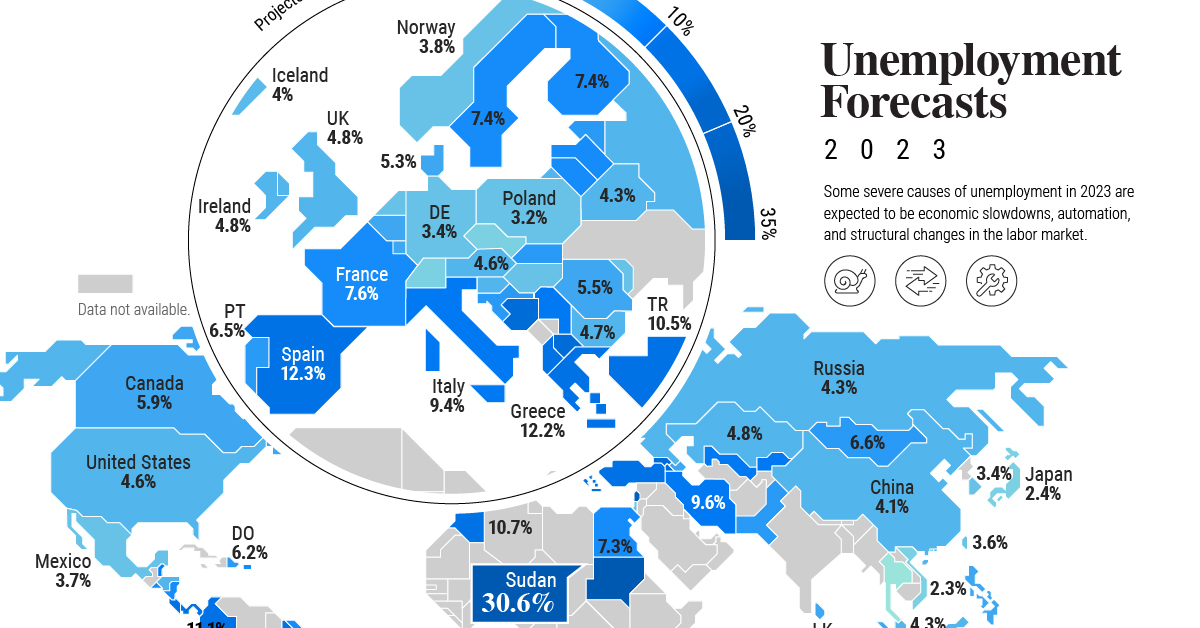

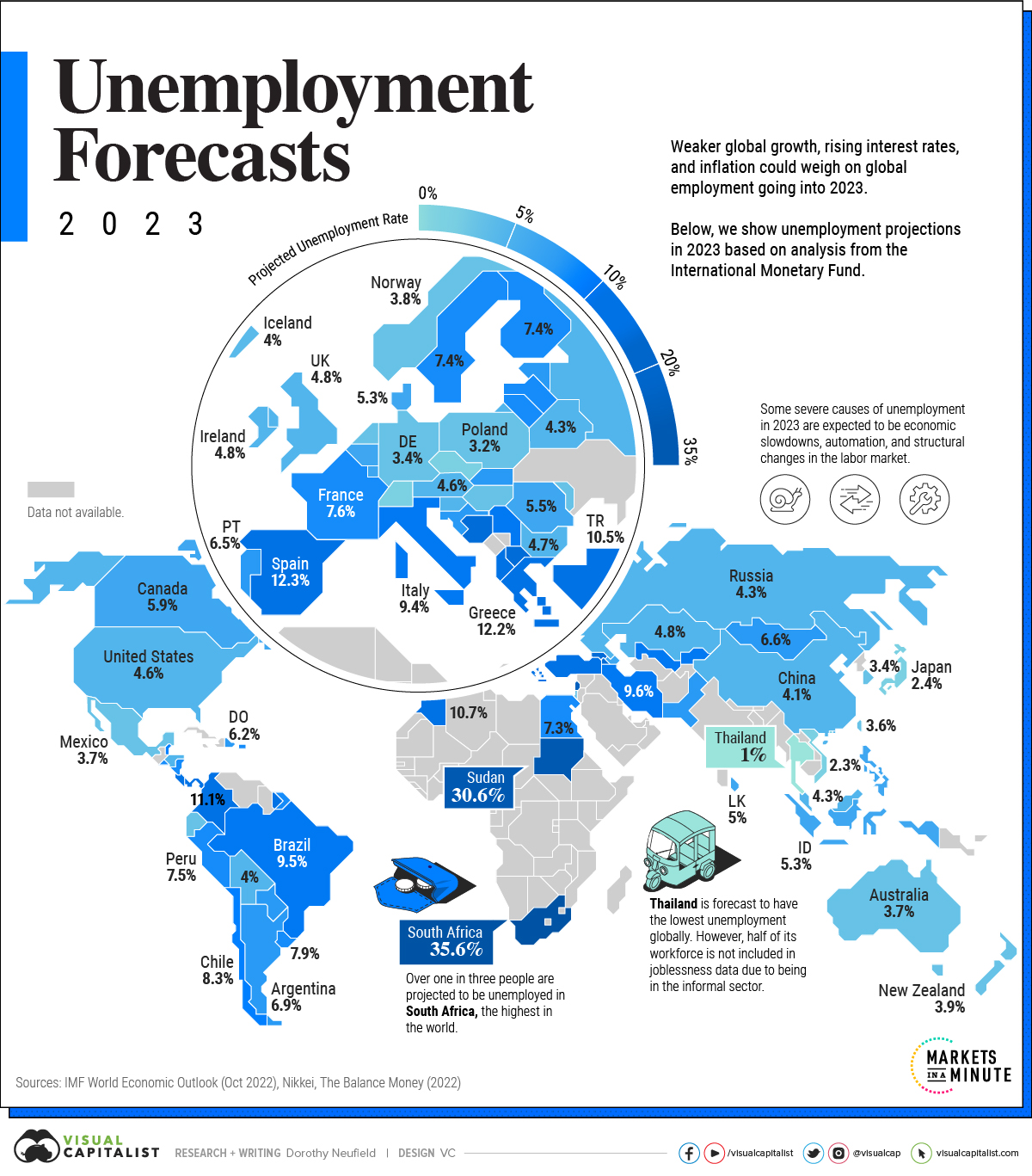

Mapped: Unemployment Forecasts, by Country in 2023

Mapped: Unemployment Forecasts, by Country in 2023

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

As 2022 clearly illustrated, the global job market can surprise expectations.

So far, this year is no different. The unemployment rate in six of the G7 countries hovers near the lowest in a century. With an unemployment rate of 3.4%, the U.S. jobless rate hasn’t fallen this low since 1969.

But as some economies navigate a strong labor market against high inflation and hawkish monetary policy, others are facing more challenging conditions. In the above graphic, we map unemployment forecasts in 2023 using data from the IMF’s World Economic Outlook.

Uncertainty Clouds the Surface

Across many countries, the pandemic has made entrenched labor trends worse. It has also altered job market conditions.

South Africa is projected to see the highest jobless rate globally. As the most industrialized nation on the continent, unemployment is estimated to hit 35.6% in 2023. Together, slow economic growth and stringent labor laws have prevented firms from hiring workers. Over the last two decades, unemployment has hovered around 20%.

| Country / Region | 2023 Unemployment Rate(Projected) |

|---|---|

| 🇿🇦 South Africa | 35.6% |

| 🇸🇩 Sudan | 30.6% |

| 🇵🇸 West Bank and Gaza | 25.0% |

| 🇬🇪 Georgia | 19.5% |

| 🇧🇦 Bosnia and Herzegovina | 17.2% |

| 🇦🇲 Armenia | 15.1% |

| 🇲🇰 North Macedonia | 15.0% |

| 🇨🇷 Costa Rica | 13.2% |

| 🇧🇸 The Bahamas | 12.7% |

| 🇪🇸 Spain | 12.3% |

| 🇬🇷 Greece | 12.2% |

| 🇨🇴 Colombia | 11.1% |

| 🇲🇦 Morocco | 10.7% |

| 🇸🇷 Suriname | 10.6% |

| 🇹🇷 Turkiye | 10.5% |

| 🇧🇧 Barbados | 10.0% |

| 🇦🇱 Albania | 10.0% |

| 🇵🇦 Panama | 10.0% |

| 🇷🇸 Serbia | 9.7% |

| 🇮🇷 Iran | 9.6% |

| 🇺🇿 Uzbekistan | 9.5% |

| 🇧🇷 Brazil | 9.5% |

| 🇮🇹 Italy | 9.4% |

| 🇰🇬 Kyrgyz Republic | 9.0% |

| 🇨🇻 Cabo Verde | 8.5% |

| 🇨🇱 Chile | 8.3% |

| 🇧🇿 Belize | 8.0% |

| 🇵🇷 Puerto Rico | 7.9% |

| 🇺🇾 Uruguay | 7.9% |

| 🇦🇼 Aruba | 7.7% |

| 🇫🇷 France | 7.6% |

| 🇵🇪 Peru | 7.5% |

| 🇸🇻 El Salvador | 7.5% |

| 🇸🇪 Sweden | 7.4% |

| 🇫🇮 Finland | 7.4% |

| 🇲🇺 Mauritius | 7.4% |

| 🇪🇬 Egypt | 7.3% |

| 🇱🇻 Latvia | 7.2% |

| 🇳🇮 Nicaragua | 7.2% |

| 🇱🇹 Lithuania | 7.0% |

| 🇦🇷 Argentina | 6.9% |

| 🇪🇪 Estonia | 6.8% |

| 🇧🇳 Brunei Darussalam | 6.8% |

| 🇲🇳 Mongolia | 6.6% |

| 🇭🇷 Croatia | 6.6% |

| 🇨🇾 Cyprus | 6.5% |

| 🇵🇹 Portugal | 6.5% |

| 🇵🇰 Pakistan | 6.4% |

| 🇵🇾 Paraguay | 6.4% |

| 🇸🇰 Slovak Republic | 6.2% |

| 🇩🇴 Dominican Republic | 6.2% |

| 🇨🇦 Canada | 5.9% |

| 🇦🇿 Azerbaijan | 5.8% |

| 🇸🇲 San Marino | 5.7% |

| 🇧🇪 Belgium | 5.6% |

| 🇷🇴 Romania | 5.5% |

| 🇫🇯 Fiji | 5.5% |

| 🇵🇭 Philippines | 5.4% |

| 🇮🇩 Indonesia | 5.3% |

| 🇩🇰 Denmark | 5.3% |

| 🇱🇰 Sri Lanka | 5.0% |

| 🇱🇺 Luxembourg | 5.0% |

| 🇮🇪 Ireland | 4.8% |

| 🇰🇿 Kazakhstan | 4.8% |

| 🇬🇧 United Kingdom | 4.8% |

| 🇧🇬 Bulgaria | 4.7% |

| 🇦🇹 Austria | 4.6% |

| 🇭🇳 Honduras | 4.6% |

| 🇺🇸 U.S. | 4.6% |

| 🇧🇭 Bahrain | 4.4% |

| 🇷🇺 Russia | 4.3% |

| 🇧🇾 Belarus | 4.3% |

| 🇸🇮 Slovenia | 4.3% |

| 🇲🇾 Malaysia | 4.3% |

| 🇨🇳 China | 4.1% |

| 🇮🇸 Iceland | 4.0% |

| 🇧🇴 Bolivia | 4.0% |

| 🇭🇰 Hong Kong SAR | 4.0% |

| 🇳🇱 Netherlands | 3.9% |

| 🇳🇿 New Zealand | 3.9% |

| 🇭🇺 Hungary | 3.8% |

| 🇳🇴 Norway | 3.8% |

| 🇮🇱 Israel | 3.8% |

| 🇪🇨 Ecuador | 3.8% |

| 🇦🇺 Australia | 3.7% |

| 🇲🇽 Mexico | 3.7% |

| 🇹🇼 Taiwan | 3.6% |

| 🇲🇩 Moldova | 3.5% |

| 🇰🇷 South Korea | 3.4% |

| 🇩🇪 Germany | 3.4% |

| 🇲🇹 Malta | 3.3% |

| 🇵🇱 Poland | 3.2% |

| 🇸🇨 Seychelles | 3.0% |

| 🇲🇴 Macao SAR | 2.7% |

| 🇯🇵 Japan | 2.4% |

| 🇨🇭 Switzerland | 2.4% |

| 🇻🇳 Vietnam | 2.3% |

| 🇨🇿 Czech Republic | 2.3% |

| 🇸🇬 Singapore | 2.1% |

| 🇹🇭 Thailand | 1.0% |

In Europe, Bosnia and Herzegovina is estimated to see the highest unemployment rate, at over 17%. It is followed by North Macedonia (15.0%) and Spain (12.7%). These jobless rates are more than double the projections for advanced economies in Europe.

The U.S. is forecast to see an unemployment rate of 4.6%, or 1.2% higher than current levels.

This suggests that today’s labor market strength will ease as U.S. economic indicators weaken. One marker is the Conference Board’s Leading Economic Index, which fell for its tenth straight month in December. Lower manufacturing orders, declining consumer expectations, and shorter work weeks are among the indicators it tracks.

Like the U.S., many advanced countries are witnessing labor market strength, especially in the United Kingdom, Asia, and Europe, although how long it will last is unknown.

A Closer Look at U.S. Numbers

Unlike some declining economic indicators mentioned above, the job market is one of the strongest areas of the global economy. Even as the tech sector reports mass layoffs, unemployment claims in the U.S. fall below recent averages. (It’s worth noting the tech sector makes up just 4% of the workforce).

In 2022, 4.8 million jobs were added, more than double the average seen between 2015-2019. Of course, the pandemic recovery has impacted these figures.

Some analysts suggest that despite a bleaker economic outlook, companies are hesitant to conduct layoffs. At the same time, the labor market is absorbing workers who have lost employment.

Consider the manufacturing sector. Even as the January ISM Purchasing Managers Index posted lower readings, hitting 47.4—a level of 48.7 and below generally indicates a recession—factories are not laying off many workers. Instead, manufacturers are saying they are confident conditions will improve in the second half of the year.

Containing Aftershocks

Today, strong labor markets pose a key challenge for central bankers globally.

This is because the robust job market is contributing to high inflation numbers. Yet despite recent rate increases, the impact has yet to prompt major waves in unemployment. Typically, monetary policy moves like these takes about a year to take peak effect. To combat inflation, monetary policy has been shown to take over three or even four years.

The good news is that inflation can potentially be tamed by other means. Fixing supply-side dynamics, such as preventing supply shortages and improving transportation systems and infrastructure could cool inflation.

As investors closely watch economic data, rising unemployment could come on the heels of higher interest rates, but so far this has yet to unravel.

Maps

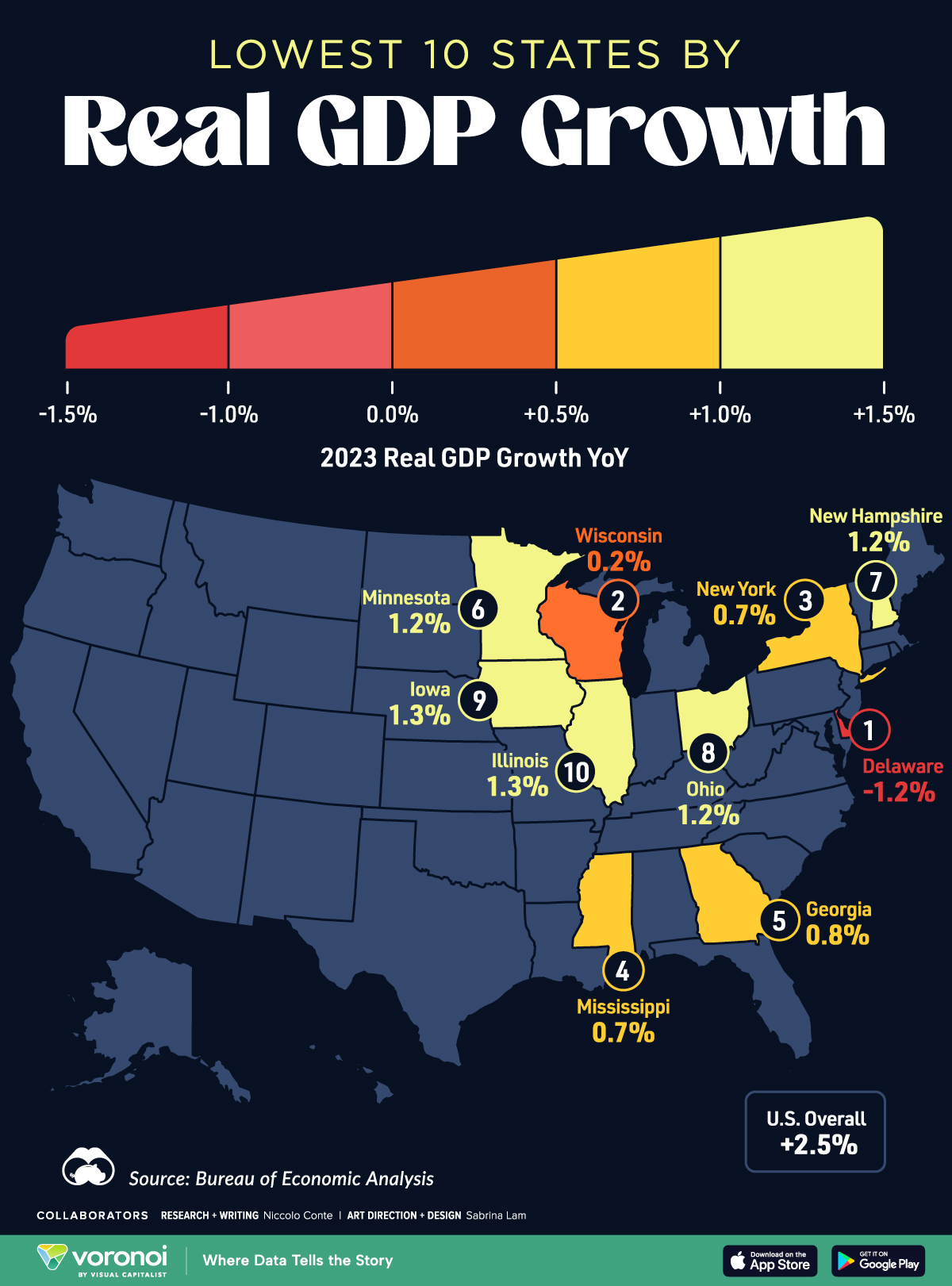

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc7 days ago

Misc7 days agoVisualized: Aircraft Carriers by Country

-

Culture7 days ago

Culture7 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

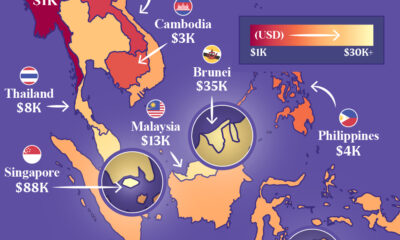

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country