Mining

Why Gold Mining Stocks Outperform Gold in Bull Markets

Why Gold Mining Stocks Outperform Gold in Bull Markets

Gold is highly revered for its great returns and resilience during economic downturns, but during gold bull markets there’s something that regularly provides even greater returns: the ownership of gold mining stocks.

Over the past 20 years, gold mining stocks have outperformed the price of gold bullion in bull markets, offering what can be seen as a leveraged play on gold’s price appreciation.

While gold miners offer more potential upside, they also have higher volatility and greater downside during dips, making market timing and strong hands all the more important.

This infographic comes to us from Sprott and compares the returns of gold stocks and gold bullion in bull markets. It also explains how gold stocks outperform thanks to profit expansion, and shows why there might be more upside for gold miners to come.

How Operating Leverage Benefits Gold Mining Companies

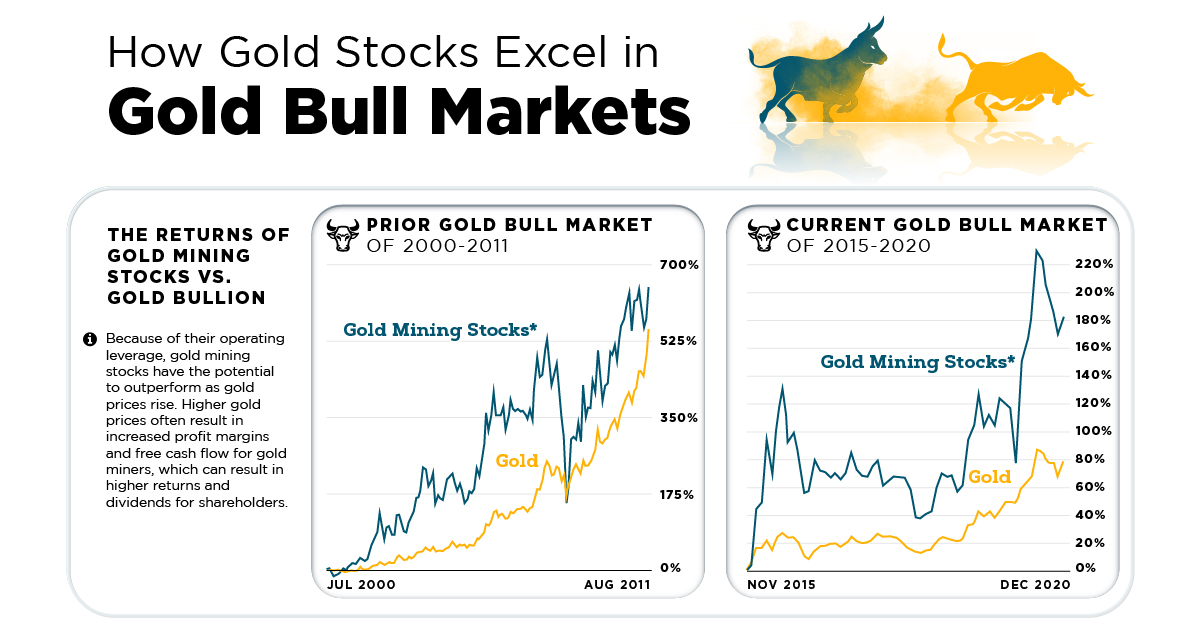

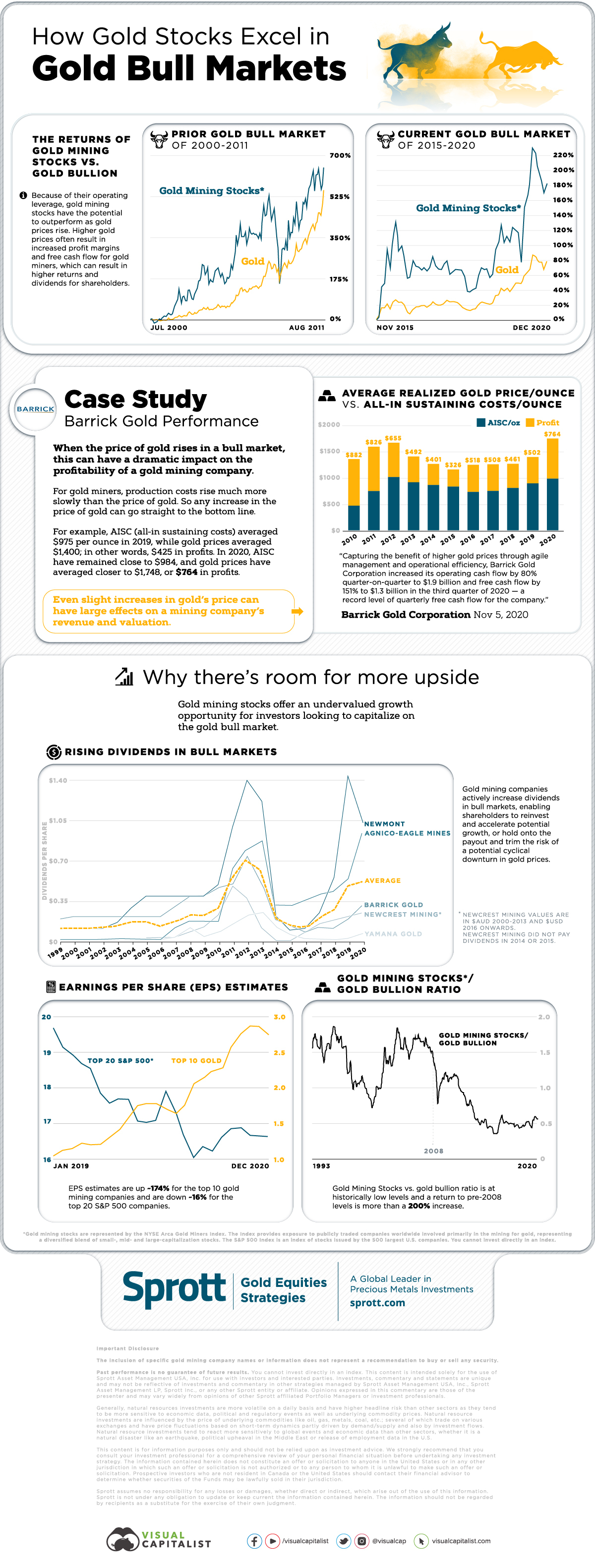

During the 2000-2011 gold bull market, the price of physical gold rose 550%. While you might think that number is hard to beat, over the same period of time gold mining equities (represented by the NYSE Arca Gold Miners Index) returned more than 690%.

In the current gold bull market which started in 2015, gold mining stocks are up more than 182%, more than doubling gold bullion’s 78% returns.

This outperformance in bull markets is largely due to how gold mining companies use their operating leverage to maximize profits, resulting in their share prices appreciating.

Breaking Down Gold Mining Costs and Profits

As a gold mining company mines and produces gold, the gold is sold on the market fairly quickly to avoid the risk of gold’s price depreciating.

When the price of gold rises, miners immediately start to see greater profits from selling their ounces on the market. While the costs to mine gold also rise in bull markets, they rise less and at a slower rate.

The result of this is profit expansion: when operationally efficient gold mining companies are able to capture larger profits, resulting in increased operating and free cash flow.

Breakdown of Barrick Gold’s Profit per Ounce of Gold

| Year | All-in Sustaining Costs/oz (in USD) | Realized Gold Price/oz (in USD) | Profit/oz (in USD) |

|---|---|---|---|

| 2015 | $831 | $1,157 | $326 |

| 2016 | $730 | $1,248 | $518 |

| 2017 | $750 | $1,258 | $508 |

| 2018 | $806 | $1,267 | $461 |

| 2019 | $894 | $1,396 | $502 |

| 2020 | $984 | $1,748 | $764 |

During the current gold bull run which started in 2015, Barrick Gold’s average realized price per troy ounce of gold increased by 50%, while their all-in sustaining costs per troy ounce only went up by 18%.

This has resulted in the company increasing their profit per ounce of gold sold by a staggering 134% over the past six years.

Making the Most of Golden Times

While higher profit margins during bull markets are great, it’s up to the individual company to ensure the extra cash is being used prudently to efficiently support their operations.

Bull markets don’t last forever, and gold miners must use these prosperous times to strengthen their balance sheets, reward shareholders, and reinvest into projects which will provide future value and returns.

Dividend-paying gold stocks increase dividends to reward loyal shareholders, with the average dividend increase of top gold mining stocks in a bull market often doubling.

Over the decades, companies have gotten better at making the most of bull markets in order to be well-guarded for when gold prices stop appreciating, and eventually start declining.

Why Gold Mining Stocks May Still Be Undervalued

Even if gold mining stocks have already seen impressive returns over the past five years, there are some technical indicators which point to them still being undervalued compared to other equities and gold bullion.

- The top 10 gold mining companies have seen their earnings per share estimates almost triple in the past two years.

- The top 20 S&P 500 companies have seen around a -15% decline in their earnings per share estimates.

Along with having better earnings per share compared to the top U.S. equities, gold mining stocks may also be undervalued compared to gold bullion.

The gold mining stocks to gold bullion ratio is at historically low levels after having dropped more than 60% following the 2008 financial crisis. While gold bullion is increasingly seen as a safe haven asset for investors, gold miners are still overlooked despite their strong technicals.

Gold and Gold Miners’ Role in the Future Economy

As money printing has been the Federal Reserve’s main answer to an increasingly volatile economic climate, gold and its producers are set to play a crucial role in helping investors preserve their wealth.

Gold has yet again outperformed just about every other asset class in 2020, and gold miners offer even greater returns for those willing to manage the additional risk they present.

Gold mining stocks are much more volatile compared to gold bullion, and have a variety of additional risks dependent on their company structure, jurisdiction of operations, and operational efficiency. But for investors who are looking for exceptional returns in gold bull markets, they can be an alluring option.

Mining

The Biggest Salt Producing Countries in 2023

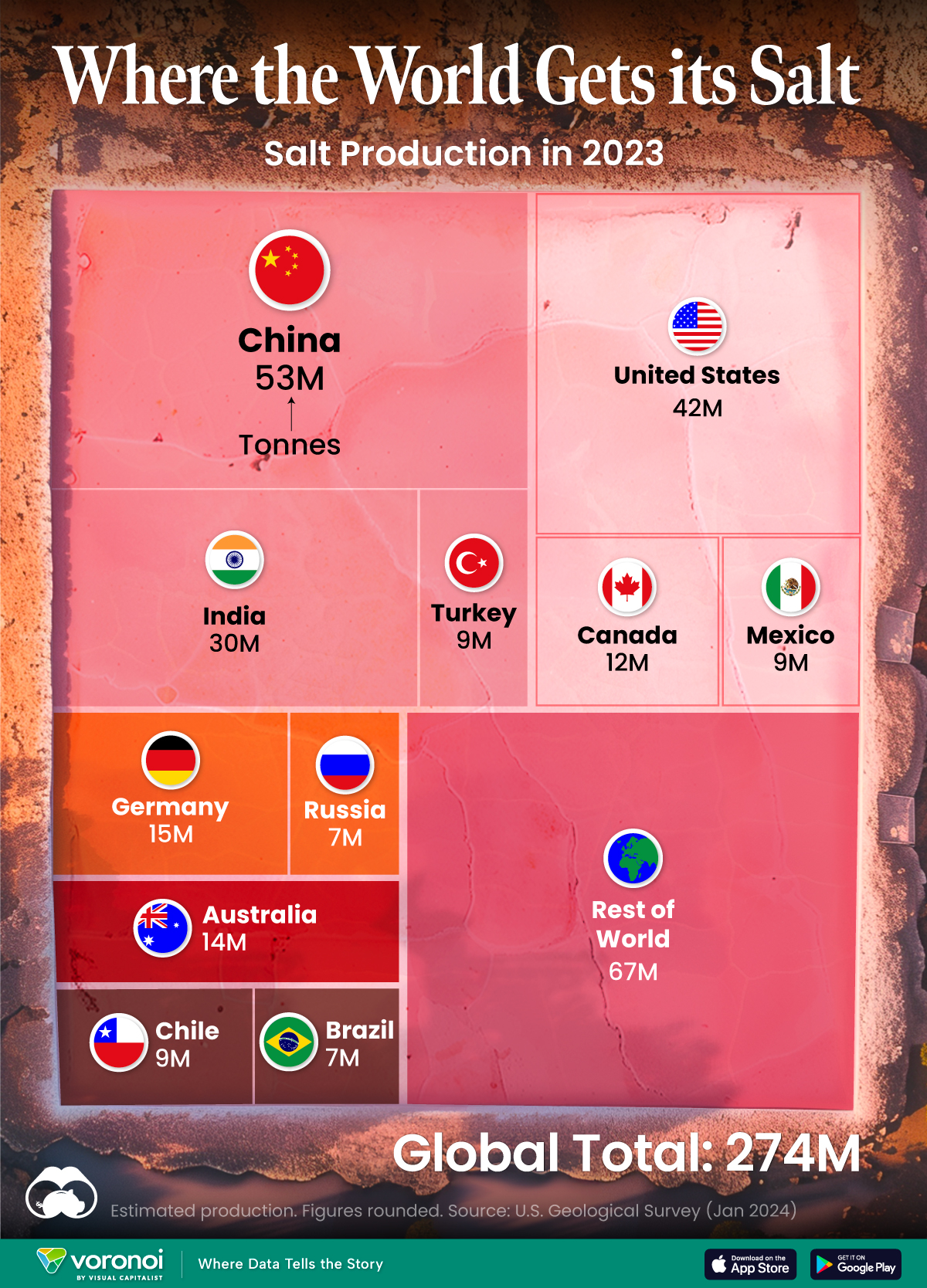

In this graphic, we break down global salt production in 2023. China is currently the top producer, accounting for almost 20% of output.

The Biggest Salt Producing Countries in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Humanity has utilized salt for thousands of years, dating back to ancient civilizations. The U.S. alone consumes more than 48 million tonnes of salt per year.

In this graphic, we break down global salt production in 2023, measured in tonnes. These estimates come from the U.S. Geological Survey’s latest commodity report on salt.

Ample Supply

Salt is essential for human life, serving various purposes including food preservation, flavor enhancement, industrial processes, and health maintenance. The good news is that the world’s continental resources of salt are vast, and the salt content in the oceans is nearly unlimited.

China is currently the top producer of salt, with almost 20% of the output, followed by the U.S. (15%) and India (11%).

| Country | Production (tonnes) |

|---|---|

| 🇨🇳 China | 53,000,000 |

| 🇺🇸 United States | 42,000,000 |

| 🇮🇳 India | 30,000,000 |

| 🇩🇪 Germany | 15,000,000 |

| 🇦🇺 Australia | 14,000,000 |

| 🇨🇦 Canada | 12,000,000 |

| 🇨🇱 Chile | 9,200,000 |

| 🇲🇽 Mexico | 9,000,000 |

| 🇹🇷 Turkey | 9,000,000 |

| 🇷🇺 Russia | 7,000,000 |

| 🇧🇷 Brazil | 6,600,000 |

| Rest of world | 67,000,000 |

| Global total | 273,800,000 |

The global salt market was valued at $32.6 billion in 2022.

It’s projected to grow from $34.1 billion in 2023 to $48.6 billion by 2030, with a CAGR of 5.2% during the forecast period. This suggests a surprising amount of growth for what is one of the world’s oldest and most common commodities.

Facts About the U.S. Salt Industry

In the U.S., salt is produced by 25 companies, which operate 63 plants across 16 states.

The states that produce the most salt are Kansas, Louisiana, Michigan, New York, Ohio, Texas, and Utah. Altogether, these states account for 95% of domestic production.

The primary uses of salt in the U.S. are highway de-icing (41%), chemical production (38%), and food processing (10%).

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Personal Finance7 days ago

Personal Finance7 days agoVisualizing the Tax Burden of Every U.S. State

-

Mining1 week ago

Mining1 week agoWhere the World’s Aluminum is Smelted, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Money1 week ago

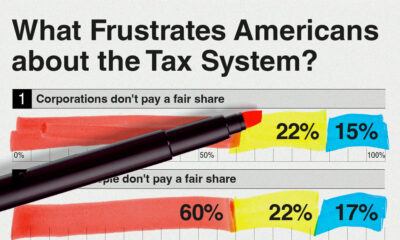

Money1 week agoCharted: What Frustrates Americans About the Tax System

-

Economy1 week ago

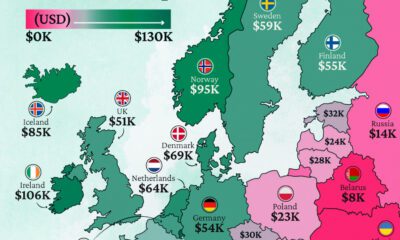

Economy1 week agoMapped: Europe’s GDP Per Capita, by Country

-

Stocks1 week ago

Stocks1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Healthcare1 week ago

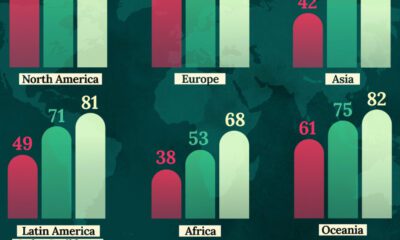

Healthcare1 week agoLife Expectancy by Region (1950-2050F)