Markets

Charted: The Global Decline in Consumer Confidence

Charting the Global Decline in Consumer Confidence

Our plans to buy new things, travel, invest, and save money, all rely on one crucial factor—our ability to pay for it.

This ability in turn is dependent on not just our current savings, but our expected income and confidence in the economy, i.e. consumer confidence.

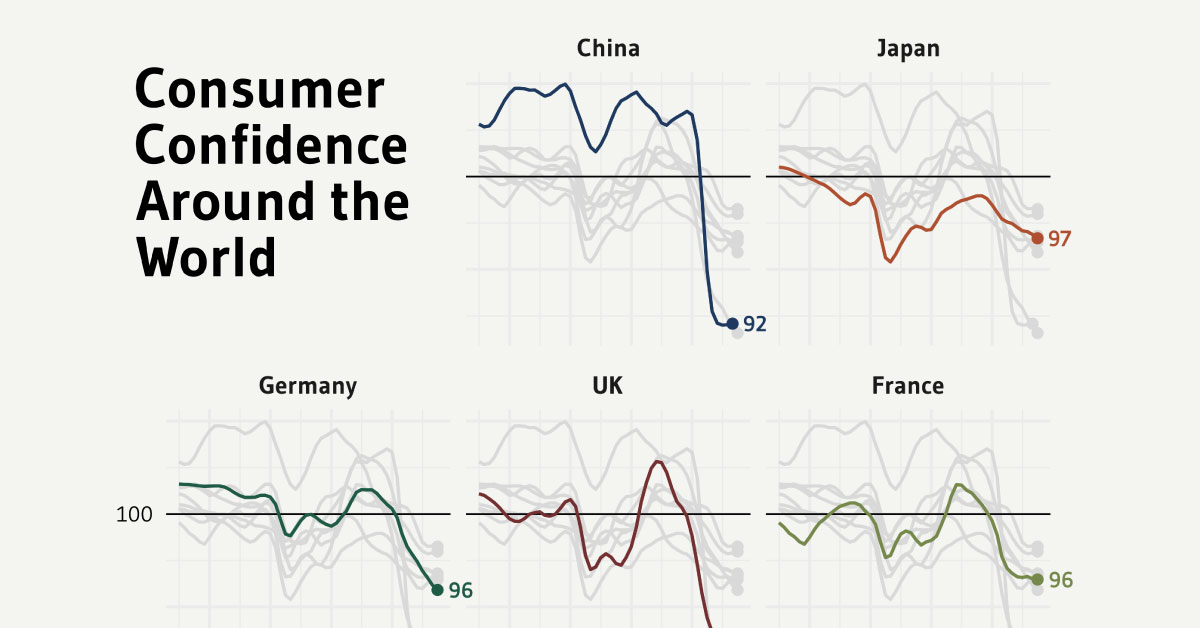

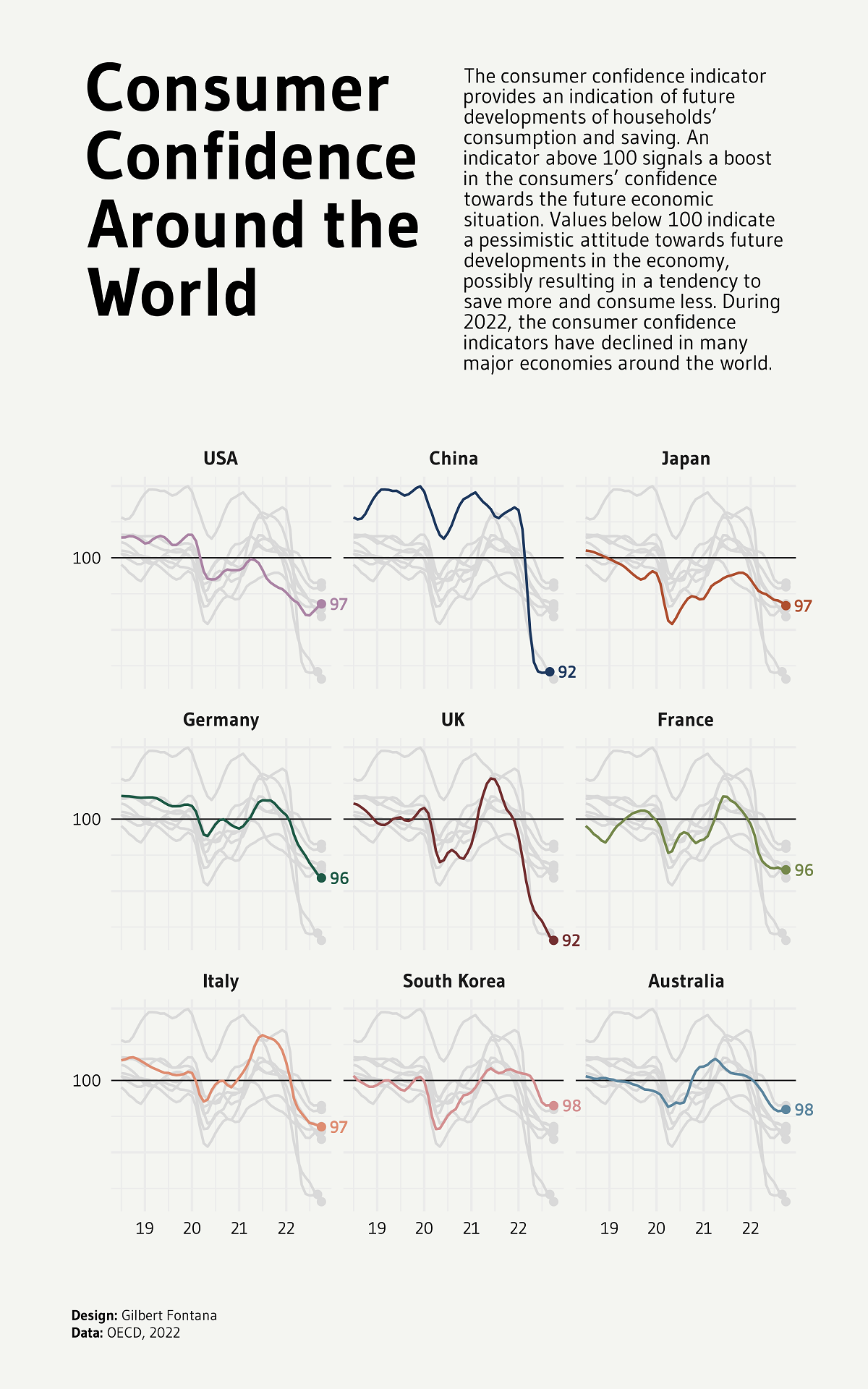

This graphic by Gilbert Fontana uses OECD data from 2019‒2022 to chart the rise and fall of consumer confidence in nine major economies.

What is Consumer Confidence?

Measured at a base value of 100, the Consumer Confidence Index takes consumers’ expectations and sentiments about their financial futures into account to indicate household consumption and saving patterns in the future.

An indicator above 100 means that there is a boost in people’s confidence towards economic prospects. This means that they are less likely to save and more inclined to spend money in the near future.

On the other hand, a value below 100 indicates that consumers are pessimistic about their economic standing in the future. This can result in them saving more and spending less.

Inflation, job losses, and expectations of a not-so-bright financial future can shake this confidence, making consumers think twice about their consumption.

Global Consumers are Becoming Pessimistic

After falling down and quickly recovering during the COVID-19 pandemic in 2020, consumer confidence seems to be trending downwards across the globe.

| Country | Consumer Confidence (Oct 2021) | Consumer Confidence (Oct 2022) |

|---|---|---|

| 🇫🇷 France | 100.8 | 96.5 |

| 🇩🇪 Germany | 101.1 | 95.9 |

| 🇮🇹 Italy | 102.8 | 96.8 |

| 🇯🇵 Japan | 99.0 | 96.7 |

| 🇬🇧 UK | 100.7 | 91.6 |

| 🇺🇸 U.S. | 98.1 | 96.8 |

| 🇨🇳 China | 103.2 | 92.1* (Sept 2022) |

| 🇦🇺 Australia | 100.4 | 98.0 |

| 🇰🇷 South Korea | 100.7 | 98.3 |

The UK was hit the worst as its Consumer Confidence Index (CCI) dropped down to 92 in 2022, from 100.6 in 2021. Just behind is China, which also fell to 92 in 2022 despite sitting at 103 two years prior.

The remaining countries had CCIs between 96‒98, including France, Germany, and the U.S.

Even with the most optimistic populations and a CCI of 98, South Korea and Australia, were below the ideal 100 mark and indicated pessimism.

The main culprits of this declining confidence in global economic markets including expectations of rising inflation—especially for food and gas—as well as high interest rates, the threats of a looming recession, and layoffs in major sectors.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Markets

Which Retailers Operate in the Most Countries?

From fast-fashion giant H&M to Apple, we show the top retailers globally with the largest international presence.

The Top Retailers Operating in the Most Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, international expansion is a key growth strategy for the world’s top retailers as companies target untapped markets with the highest potential to drive revenue and profit streams.

While traditional retailers have sought out digital strategies as the industry evolves and consumer behaviors change, physical storefronts continue to be a dominant driver of retail sales. In 2023, brick-and-mortar sales comprised 81% of retail sales globally.

This graphic shows the top retailers operating in the most markets worldwide, based on data from the National Retail Federation.

Global Retailers With the Largest International Footprint

Here are the global retailers with the widest-reaching presence around the world in 2023:

| Ranking | Retailer | Number of Countries of First-Party Operation | Headquarters |

|---|---|---|---|

| 1 | H&M | 68 | 🇸🇪 Sweden |

| 2 | IKEA | 51 | 🇳🇱 Netherlands |

| 3 | Inditex | 45 | 🇪🇸 Spain |

| 4 | Decathlon | 34 | 🇫🇷 France |

| 5 | Carrefour | 32 | 🇫🇷 France |

| 6 | Sephora (LVMH) | 31 | 🇫🇷 France |

| 7 | Schwarz Group | 30 | 🇩🇪 Germany |

| 8 | Fast Retailing | 27 | 🇯🇵 Japan |

| 9 | Euronics International | 25 | 🇳🇱 Netherlands |

| 10 | Apple | 25 | 🇺🇸 U.S. |

Notably, eight of the top 10 companies with the widest market reach hail from Europe.

Fast-fashion giant H&M ranks first overall, with 4,454 stores across 68 countries last year. In 2023, the Swedish company earned $21.6 billion in revenues, with its largest markets by number of store locations being the U.S., Germany, and the UK. This year, it plans to open 100 new stores in growth markets, along with shutting down 160 stores in established locations, ultimately decreasing its global store count.

In second is IKEA, with a presence in 51 countries. Last year, the company expanded its footprint in India, launching its first store in the tech hub, Hyderabad. While the company has a broad international reach, its number of storefronts is a fraction of H&M, at 477 total stores worldwide.

Looking beyond the continent, Japan’s Fast Retailing is the top retailer in Asia, operating in 27 countries globally. As the parent company to fashion brand Uniqlo, it also stands as the seventh most valuable listed firm by market capitalization in the country.

Additionally, Apple is the sole American company to make this list, with storefronts in 25 countries. Overall, the company operates four types of retail stores: regular, AppleStore+, flagships, and flagship+. Regular stores often earn $40 million annually, while flagship+ stores typically earn more than $100 million.

By 2027, the company plans to build or remodel 53 stores globally, with the majority located in the U.S. and China.

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Misc1 week ago

Misc1 week agoVisualizing Global Losses from Financial Scams

-

population1 week ago

population1 week agoMapped: U.S. States By Number of Cities Over 250,000 Residents

-

Culture1 week ago

Culture1 week agoCharted: How the Logos of Select Fashion Brands Have Evolved

-

United States1 week ago

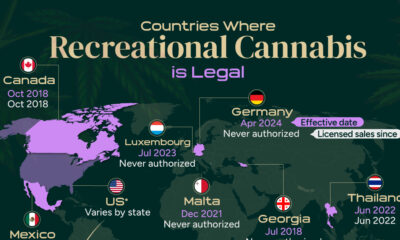

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Misc1 week ago

Misc1 week agoVisualized: Aircraft Carriers by Country

-

Culture1 week ago

Culture1 week agoHow Popular Snack Brand Logos Have Changed

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023