Markets

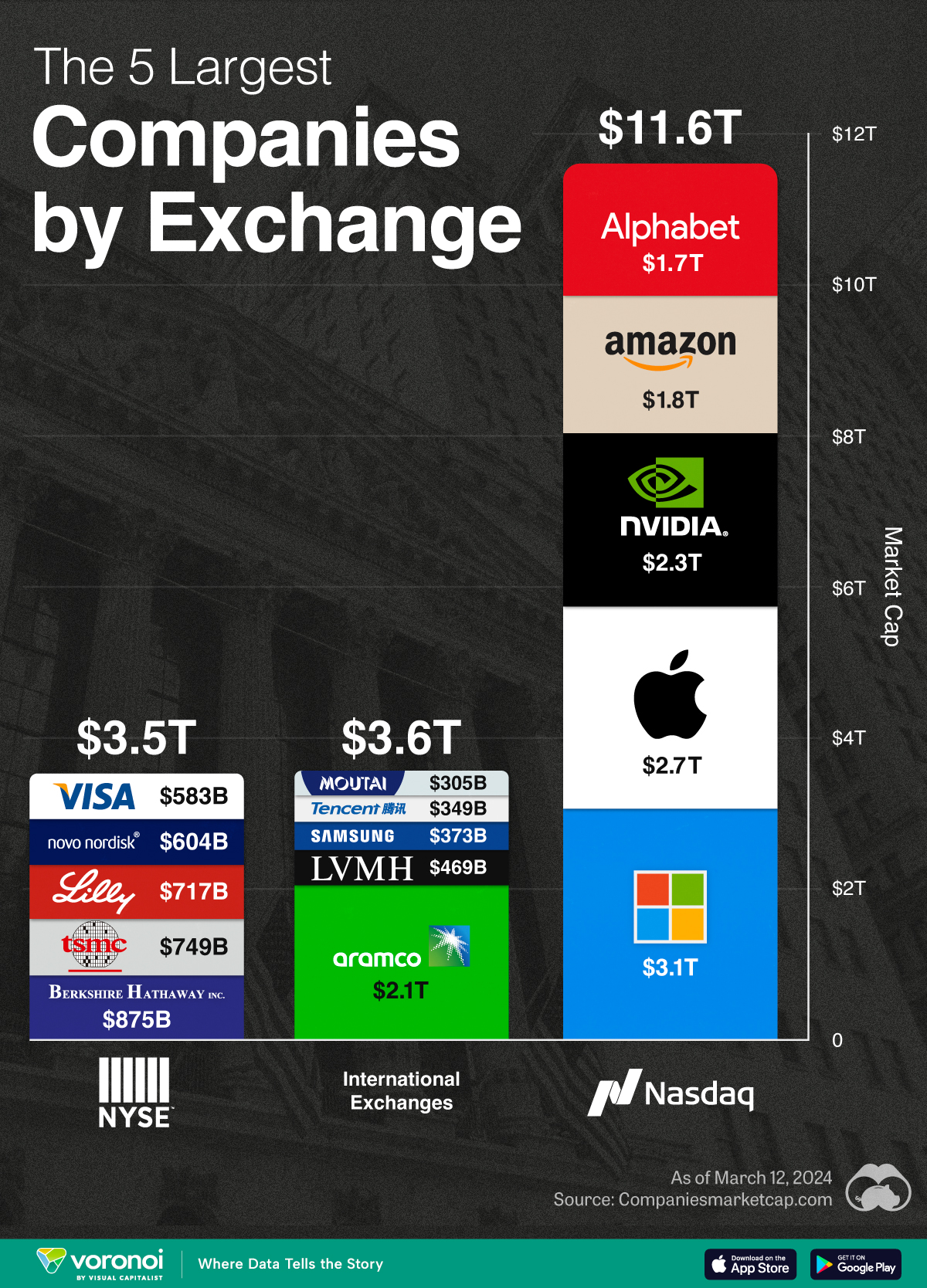

Visualizing the Biggest Companies on Major Stock Exchanges

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Comparing the Top Five Companies on Major Stock Exchanges

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

With many companies nearing or surpassing the $1 trillion market capitalization milestone, we’ve put together a graphic that visualizes the five largest companies trading on the Nasdaq, New York Stock Exchange (NYSE), and international exchanges.

These figures come from Companiesmarketcap.com, and are as of March 12, 2024.

Biggest Companies on the Nasdaq

The Nasdaq is largely dominated by the tech industry, with all of its top five companies belonging to the Magnificent Seven group of U.S. tech stocks.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Microsoft | $3.1T |

| 🇺🇸 Apple | $2.7T |

| 🇺🇸 Nvidia | $2.3T |

| 🇺🇸 Amazon | $1.8T |

| $1.7T |

Altogether, these five companies have a combined market capitalization of nearly $12 trillion. To put this figure into context, the entire U.S. equity market is worth around $53 trillion.

Biggest Companies on the NYSE

The NYSE’s largest companies are more diversified, with a combination of tech, financial services, and healthcare names present. Among this list, Warren Buffett’s Berkshire Hathaway is the closest to becoming the next trillion dollar company.

| Company | Market Cap (USD) |

|---|---|

| 🇺🇸 Berkshire Hathaway | $875B |

| 🇹🇼 TSMC | $749B |

| 🇺🇸 Eli Lilly | $717B |

| 🇩🇰 Novo Nordisk | $604B |

| 🇺🇸 Visa | $583B |

Biggest Companies on International Exchanges

Saudi Aramco is the largest public company listed outside of the U.S., with a mammoth $2.1 trillion valuation.

| Company | Market Cap (USD) |

|---|---|

| 🇸🇦 Saudi Aramco | $2.1T |

| 🇫🇷 LVMH | $469B |

| 🇰🇷 Samsung | $373B |

| 🇨🇳 Tencent | $349B |

| 🇨🇳 Kweichow Moutai | $305B |

It should be noted, however, that the Saudi government directly owns 90% of the company, while another 8% is held by the country’s sovereign wealth fund.

This means that only 2% of shares are actually available to the public, prompting one Bloomberg columnist to call the firm’s valuation an “illusion”.

Markets

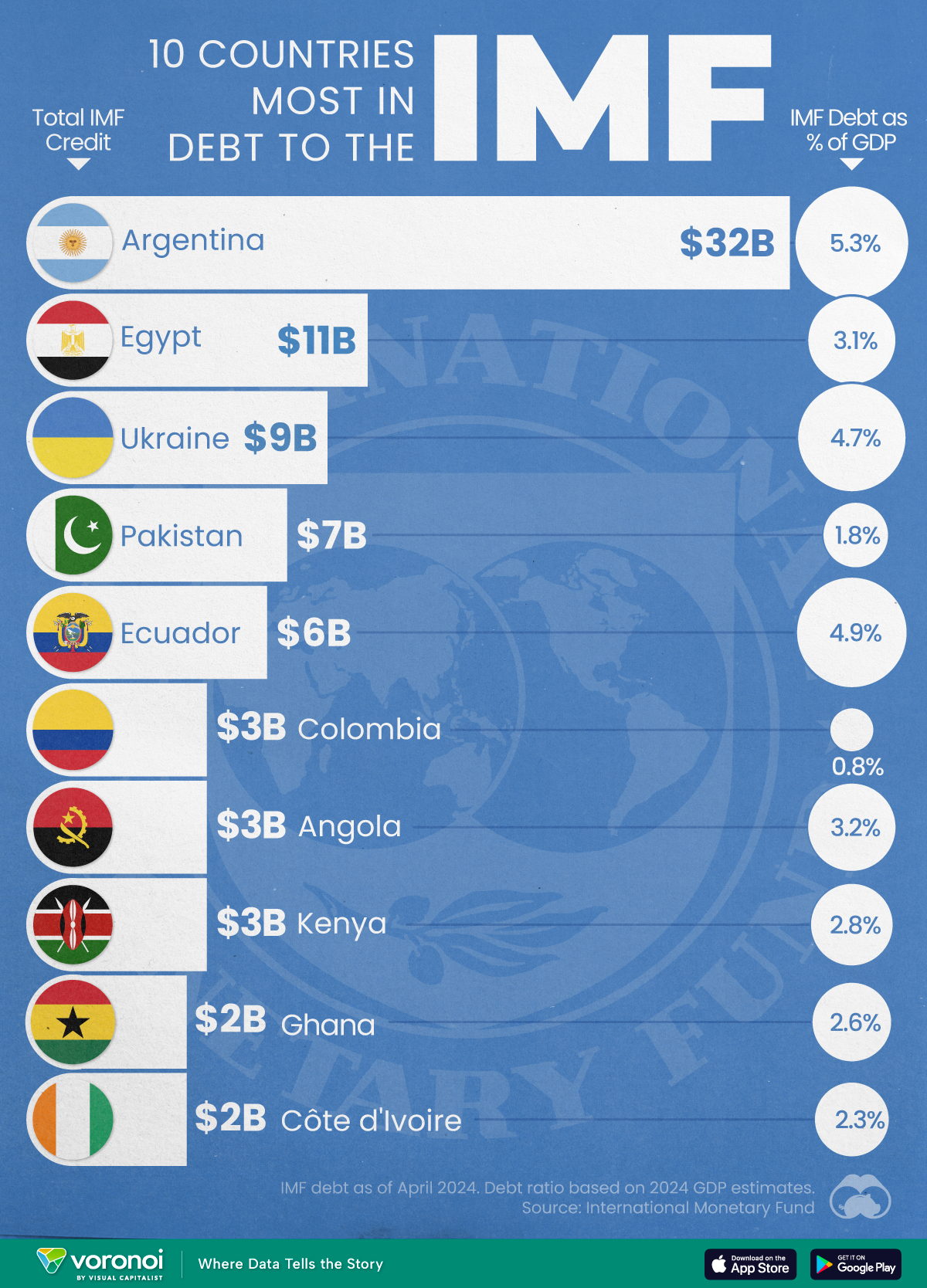

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Personal Finance6 days ago

Personal Finance6 days agoVisualizing the Tax Burden of Every U.S. State

-

Mining7 days ago

Mining7 days agoWhere the World’s Aluminum is Smelted, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Money1 week ago

Money1 week agoCharted: What Frustrates Americans About the Tax System

-

Economy1 week ago

Economy1 week agoMapped: Europe’s GDP Per Capita, by Country

-

Stocks1 week ago

Stocks1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Healthcare1 week ago

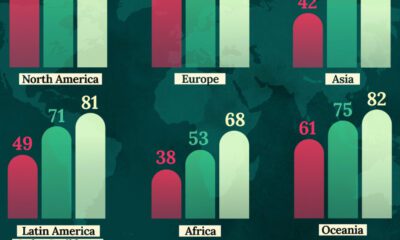

Healthcare1 week agoLife Expectancy by Region (1950-2050F)