Business

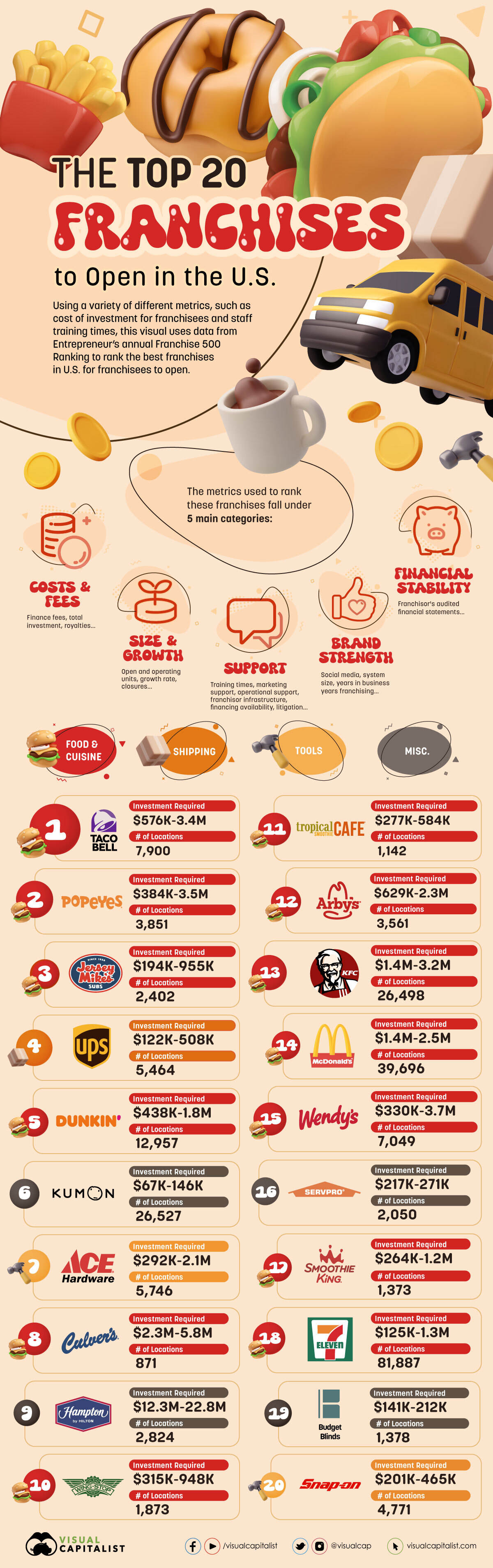

Ranked: The 20 Best Franchises to Open in the U.S.

Ranked: The 20 Best Franchises in the U.S.

The U.S. is famous for chain restaurants, franchised shops, and brand name hotels. One thing these franchises aim for is consistency in store feel, customer service, product offerings, and prices, no matter which state you’re in.

This visualization uses Entrepreneur’s annual Franchise 500 Ranking to showcase the best franchises in the U.S. worth owning, from Dunkin’ Donuts to Snap-on Tools.

The Best and How They Were Selected

The report assessed five broad categories to score the country’s famous chains:

- Costs & fees: including franchise fee, total investment needed to open one store, and royalty fees

- Support: including training times, marketing support, operational support, franchisor infrastructure, financing infrastructure, and litigation

- Size & growth: including open & operating units, growth rate, and closures

- Brand strength: including social media, system size, years in business, years franchising

- Financial strength & stability: including franchisor’s audited financial statements

A franchise was only considered if it was actively seeking new franchisees and must have already had at least 10 units operating.

Here’s a closer look at the top 20:

| Rank | Franchise | Initial Investment Needed | Global Units 2022 |

|---|---|---|---|

| #1 | Taco Bell | $576K - $3.4M | 7,900 |

| #2 | Popeyes Louisiana Kitchen | $384K - $3.5M | 3,851 |

| #3 | Jersey Mike's Subs | $194K - $955K | 2,402 |

| #4 | The UPS Store | $122K - $508K | 5,464 |

| #5 | Dunkin' | $438K - $1.8M | 12,957 |

| #6 | Kumon | $67K - $146K | 26,527 |

| #7 | Ace Hardware | $292K - $2.1M | 5,746 |

| #8 | Culver's | $2.3M - $5.8M | 871 |

| #9 | Hampton by Hilton | $12.3M - $22.8M | 2,824 |

| #10 | Wingstop | $315K - $948K | 1,873 |

| #11 | Tropical Smoothie Cafe | $277K - $584K | 1,142 |

| #12 | Arby's | $629K - $2.3M | 3,561 |

| #13 | KFC | $1.4M - $3.2M | 26,498 |

| #14 | McDonald's | $1.4M - $2.5M | 39,696 |

| #15 | Wendy's | $330K - $3.7M | 7,049 |

| #16 | Servpro | $217K - $271K | 2,050 |

| #17 | Smoothie King | $264K - $1.2M | 1,373 |

| #18 | 7-Eleven | $125K - $1.3M | 81,887 |

| #19 | Budget Blinds | $141K - $212K | 1,378 |

| #20 | Snap-on Tools | $201K - $465K | 4,771 |

The number one franchise, Taco Bell, has been in business since 1964 and has 7,900 locations as of 2022, spanning beyond the U.S. to Canada, Australia, Europe, and other regions of the world. The average cost of investment to be a franchisee is between $576,000 to $3.4 million.

While most of the top 20 are in the food service industry, there is also one hotel, one shipping company, and a few hardware and home goods stores that make the list.

Ace Hardware (#7), for example, which specializes in home improvement goods, is actually an international franchise with close to 6,000 units. Kumon (#6) is an education center and is the only non-U.S. franchise on the list.

The Feasibility of Being a Franchisee

To get a better sense of the costs needed to start a franchise, let’s take a look at one of the most famous convenience stores in the world. Here’s a sample of the different fees involved in 7-Eleven’s initial franchisee process:

| Initial Franchise Fee | $0 - $1,000,000 |

| Initial Investment | $125,250 - $1,333,500 |

| Cash Requirement | $50,000 - $250,000 |

| Veteran Incentives | 10-20% off franchise fee, up to $50,000; preferred interest rates and special financing |

| Royalty Fee | Varies |

| Ad Royalty Fee | 1% |

| Term of Agreement | 15 years |

| Is franchise term renewable? | Yes |

In terms of low-cost franchises, 7-Eleven is among one of the cheapest to open, according to Entrepreneur, sometimes costing less than $150K. Other franchises with lower cost barriers of entry include UPS ($122K – $508K) and Cinnabon ($112K – $547K).

There is more to consider than cost, of course, and some franchises provide better support than others in aspects such as financing, industry training, or legal support. Popeye’s, for instance, provides in-house financing for their franchise fee, as well as connections with third-party sources to help cover equipment, inventory, payroll, and other expenses.

Looking at feasibility in regards to opportunities, some of the fastest-growing franchises include chains like Jersey Mike’s Subs and Wingstop. Here’s a closer look at the Franchise 500’s fastest growing list:

- #1 Stratus Building Solutions

- #2 Jersey Mike’s Subs

- #3 Goosehead Insurance

- #4 Signal

- #5 Wingstop

In total there are almost 800,000 franchises in the U.S. The franchise market in the country has an economic output of over $825 billion and employs over 8.4 million people. With many of these franchises continuing to grow and seek new franchisees, there is ample opportunity in the market.

Venture Capital

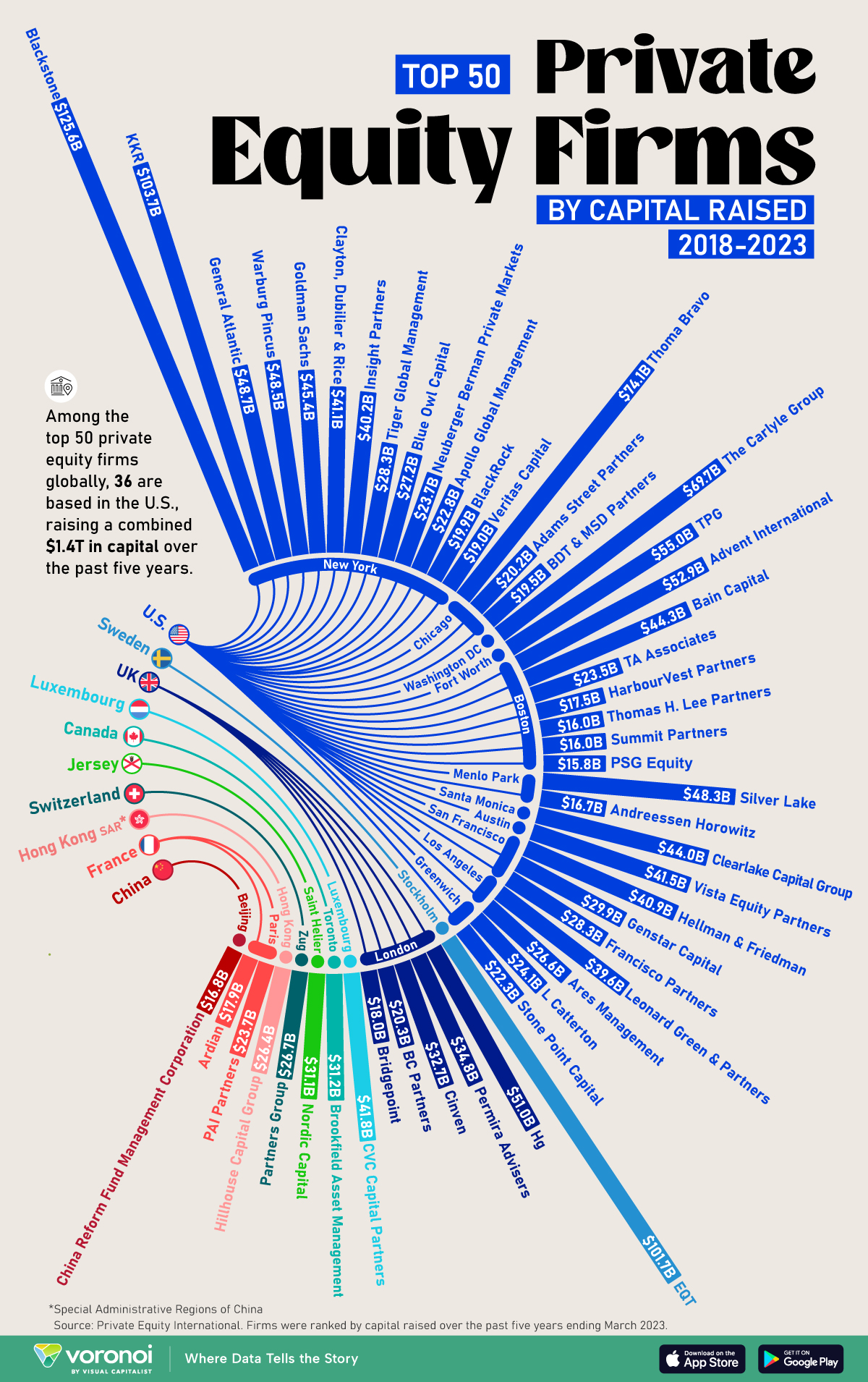

Ranked: The World’s 50 Largest Private Equity Firms

In this graphic, we show the largest private equity firms in the world—from titan Blackstone to China’s leading alternative funds.

The World’s 50 Largest Private Equity Firms

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, private equity firms controlled $8.2 trillion in assets globally according to McKinsey & Company, a figure that has rapidly expanded since the industry first emerged 40 years ago.

As large investors such as pension funds and insurance companies increasingly look to private markets, these alternative asset managers have seen their assets grow by more than twofold in the last five years.

This graphic shows the top 50 private equity firms worldwide, based on data from Private Equity International (PEI).

The Top 50 Private Equity Firms

To determine the rankings, private equity firms were defined as those that raise capital with the purpose of directly investing in businesses, covering diversified private equity, venture capital, growth equity, buyouts, along with turnaround or control-oriented distressed investment capital.

The ranking does not include funds of funds, private investment in public equity (PIPE), or funds that follow a secondaries, real estate, infrastructure, hedge fund, debt or mezzanine strategies.

Below, we show the 50 biggest private equity companies around the world, measured by the scale of capital raised over the five-year period ending March 31, 2023:

| Ranking | Fund Manager | City | Capital Raised |

|---|---|---|---|

| 1 | Blackstone | New York | $125.6B |

| 2 | KKR | New York | $103.7B |

| 3 | EQT | Stockholm | $101.7B |

| 4 | Thoma Bravo | Chicago | $74.1B |

| 5 | The Carlyle Group | Washington DC | $69.7B |

| 6 | TPG | Fort Worth | $55.0B |

| 7 | Advent International | Boston | $52.9B |

| 8 | Hg | London | $51.0B |

| 9 | General Atlantic | New York | $48.7B |

| 10 | Warburg Pincus | New York | $48.5B |

| 11 | Silver Lake | Menlo Park | $48.3B |

| 12 | Goldman Sachs | New York | $45.4B |

| 13 | Bain Capital | Boston | $44.3B |

| 14 | Clearlake Capital Group | Santa Monica | $44.0B |

| 15 | CVC Capital Partners | Luxembourg | $41.8B |

| 16 | Vista Equity Partners | Austin | $41.5B |

| 17 | Clayton, Dubilier & Rice | New York | $41.1B |

| 18 | Hellman & Friedman | San Francisco | $40.9B |

| 19 | Insight Partners | New York | $40.2B |

| 20 | Leonard Green & Partners | Los Angeles | $39.6B |

| 21 | Permira Advisers | London | $34.8B |

| 22 | Cinven | London | $32.7B |

| 23 | Brookfield Asset Management | Toronto | $31.2B |

| 24 | Nordic Capital | Saint Helier | $31.1B |

| 25 | Genstar Capital | San Francisco | $29.9B |

| 26 | Francisco Partners | San Francisco | $28.3B |

| 27 | Tiger Global Management | New York | $28.3B |

| 28 | Blue Owl Capital | New York | $27.2B |

| 29 | Partners Group | Zug | $26.7B |

| 30 | Ares Management | Los Angeles | $26.6B |

| 31 | Hillhouse Capital Group | Singapore | $26.4B |

| 32 | L Catterton | Greenwich | $24.1B |

| 33 | Neuberger Berman Private Markets | New York | $23.7B |

| 34 | PAI Partners | Paris | $23.7B |

| 35 | TA Associates | Boston | $23.5B |

| 36 | Apollo Global Management | New York | $22.8B |

| 37 | Stone Point Capital | Greenwich | $22.3B |

| 38 | BC Partners | London | $20.3B |

| 39 | Adams Street Partners | Chicago | $20.2B |

| 40 | BlackRock | New York | $19.9B |

| 41 | BDT & MSD Partners | Chicago | $19.5B |

| 42 | Veritas Capital | New York | $19.0B |

| 43 | Bridgepoint | London | $18.0B |

| 44 | Ardian | Paris | $17.9B |

| 45 | HarbourVest Partners | Boston | $17.5B |

| 46 | China Reform Fund Management Corporation | Beijing | $16.8B |

| 47 | Andreessen Horowitz | Menlo Park | $16.7B |

| 48 | Thomas H. Lee Partners | Boston | $16.0B |

| 49 | Summit Partners | Boston | $16.0B |

| 50 | PSG Equity | Boston | $15.8B |

Private equity titan Blackstone is the top in the United States and the world, raising $125.6 billion in capital from 2018 to 2023.

Headquartered in New York, Blackstone’s total assets under management stood at $991 billion as of the first quarter of 2023, and have since surpassed $1 trillion this year. For perspective, this is comparable to the GDP of the Netherlands.

Following next in line are KKR and Sweden’s EQT, each raising over $100 billion. In fact, this was the first time three firms achieved this $100 billion equity-raise milestone in PEI’s ranking over a five-year period. This was particularly notable given a challenging fundraising landscape amid higher borrowing costs and lagging dealmaking activity.

North American Firms Dominate Private Equity

As we can see, the vast majority of the biggest private equity firms are based in America, accounting for 36 of the top 50 firms globally. North American PE firms made up $1.34 trillion (72%) of the $1.85 trillion raised by the top 50 firms in the ranking.

Falling in second by a wide margin is Europe, with nine firms making up $179 billion (9.7%) of the total funds raised. Many of Europe’s largest private equity firms are based in London, England, with the most prominent asset managers in the city being Hg and Permira Advisors.

Across Asia, the top alternative investment firm was Singapore-based Hillhouse Capital Group, which launched in 2005. The firm has backed several internet companies spanning from Tencent, the largest publicly-traded company in China, to Baidu, but has faced increasing setbacks amid regulatory crackdowns and a sluggish Chinese stock market.

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Misc1 week ago

Misc1 week agoVisualizing Global Losses from Financial Scams

-

population1 week ago

population1 week agoMapped: U.S. States By Number of Cities Over 250,000 Residents

-

Culture1 week ago

Culture1 week agoCharted: How the Logos of Select Fashion Brands Have Evolved

-

United States1 week ago

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Misc1 week ago

Misc1 week agoVisualized: Aircraft Carriers by Country

-

Culture2 weeks ago

Culture2 weeks agoHow Popular Snack Brand Logos Have Changed

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023