Technology

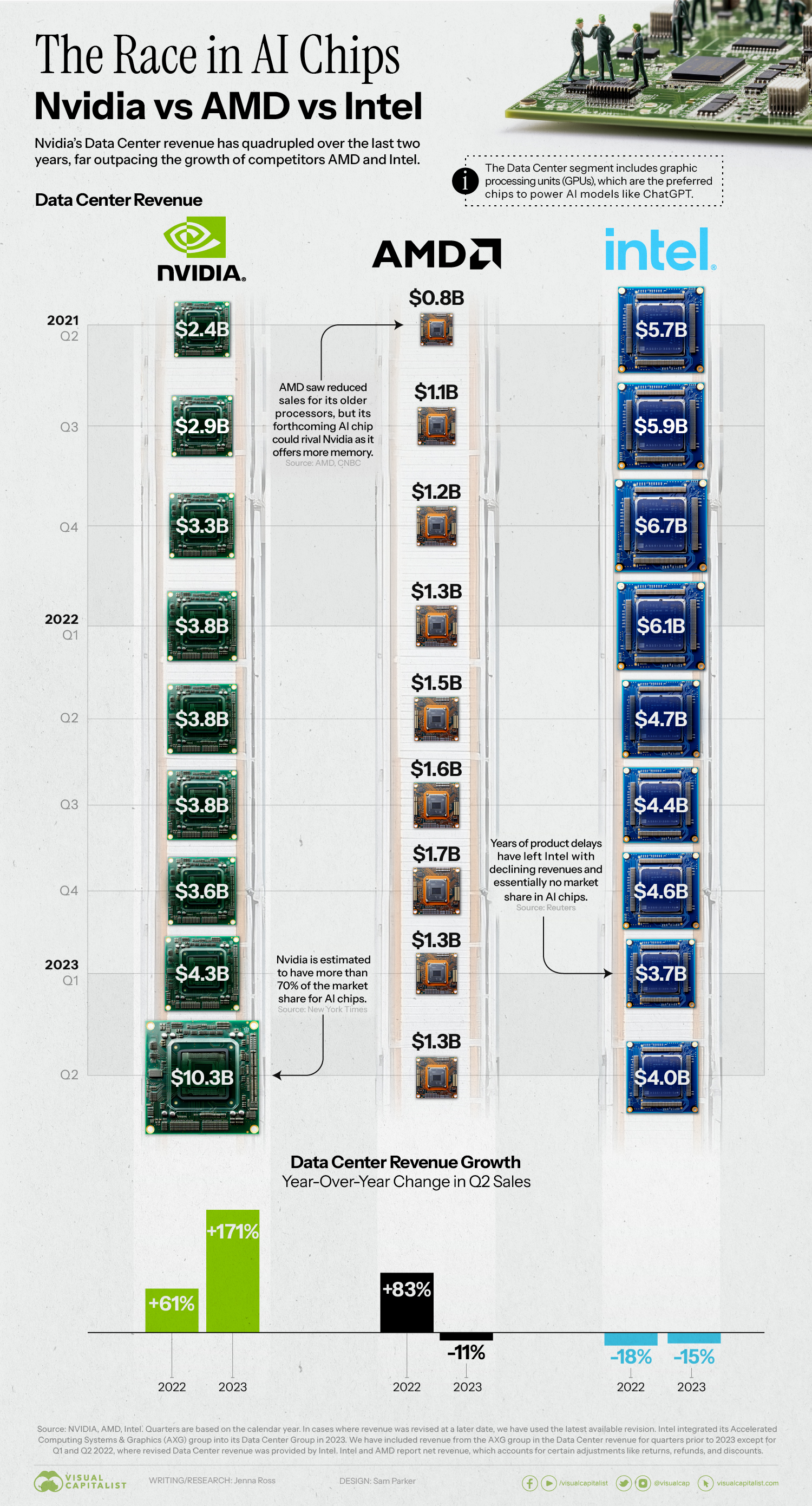

Nvidia vs. AMD vs. Intel: Comparing AI Chip Sales

Nvidia vs. AMD vs. Intel: Comparing AI Chip Sales

Nvidia has become an early winner of the generative AI boom.

The company reported record revenue in its second quarter earnings report, with sales of AI chips playing a large role. If we compare to other American competitors, what do the AI chip sales of Nvidia vs. AMD vs. Intel look like?

In this graphic, we use earnings reports from each company to see their revenue over time.

A Clear Leader Emerges

While the companies don’t report revenue for their AI chips specifically, they do share revenue for their Data Center segment.

The Data Center segment includes chips like Central Processing Units (CPUs), Data Processing Units (DPUs), and Graphic Processing Units (GPUs). The latter are preferred for AI because they can perform many simple tasks simultaneously and efficiently.

Below, we show how quarterly Data Center revenue has grown for Nvidia vs. AMD vs. Intel.

| Nvidia | AMD | Intel | |

|---|---|---|---|

| Q2 2021 | $2.4B | $0.8B | $5.7B |

| Q3 2021 | $2.9B | $1.1B | $5.9B |

| Q4 2021 | $3.3B | $1.2B | $6.7B |

| Q1 2022 | $3.8B | $1.3B | $6.1B |

| Q2 2022 | $3.8B | $1.5B | $4.7B |

| Q3 2022 | $3.8B | $1.6B | $4.4B |

| Q4 2022 | $3.6B | $1.7B | $4.6B |

| Q1 2023 | $4.3B | $1.3B | $3.7B |

| Q2 2023 | $10.3B | $1.3B | $4.0B |

Source: Nvidia, AMD, Intel. Quarters are based on the calendar year. In cases where revenue was revised at a later date, we have used the latest available revision. Intel integrated its Accelerated Computing Systems & Graphics (AXG) group into its Data Center Group in 2023. We have included revenue from the AXG group in the Data Center revenue for quarters prior to 2023 except for Q1 and Q2 2022, where revised Data Center revenue was provided by Intel.

Nvidia’s Data Center revenue has quadrupled over the last two years, and it’s estimated to have more than 70% of the market share for AI chips.

The company achieved dominance by recognizing the AI trend early, becoming a one-stop shop offering chips, software, and access to specialized computers. After hitting a $1 trillion market cap earlier in 2023, the stock continues to soar.

Competition Between Nvidia vs. AMD vs. Intel

If we compare Nvidia vs. AMD, the latter company has seen slower growth and less revenue. Its MI250 chip was found to be 80% as fast as Nvidia’s A100 chip.

However, AMD has recently put a focus on AI, announcing a new MI300X chip with 192GB of memory compared to the 141GB that Nvidia’s new GH200 offers. More memory reduces the amount of GPUs needed, and could make AMD a stronger contender in the space.

In contrast, Intel has seen yearly revenue declines and has virtually no market share in AI chips. The company is better known for making traditional CPUs, and its foray into the AI space has been fraught with issues. Its Sapphire Rapids processor faced years of delays due to a complex design and numerous glitches.

Going forward, all three companies have indicated they plan to increase their AI offerings. It’s not hard to see why: ChatGPT reportedly runs on 10,000 Nvidia A100 chips, which would carry a total price tag of around $100 million dollars.

As more AI models are developed, the infrastructure that powers them will be a huge revenue opportunity.

Technology

Charting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

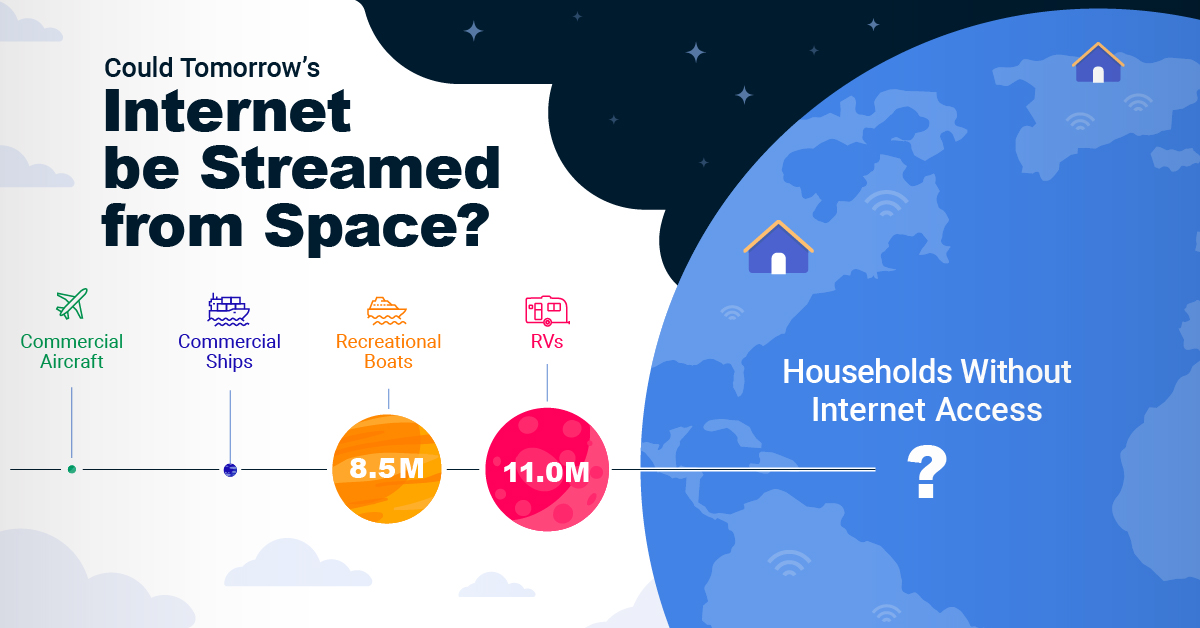

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology2 weeks ago

Technology2 weeks agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology4 weeks ago

Technology4 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country