Money

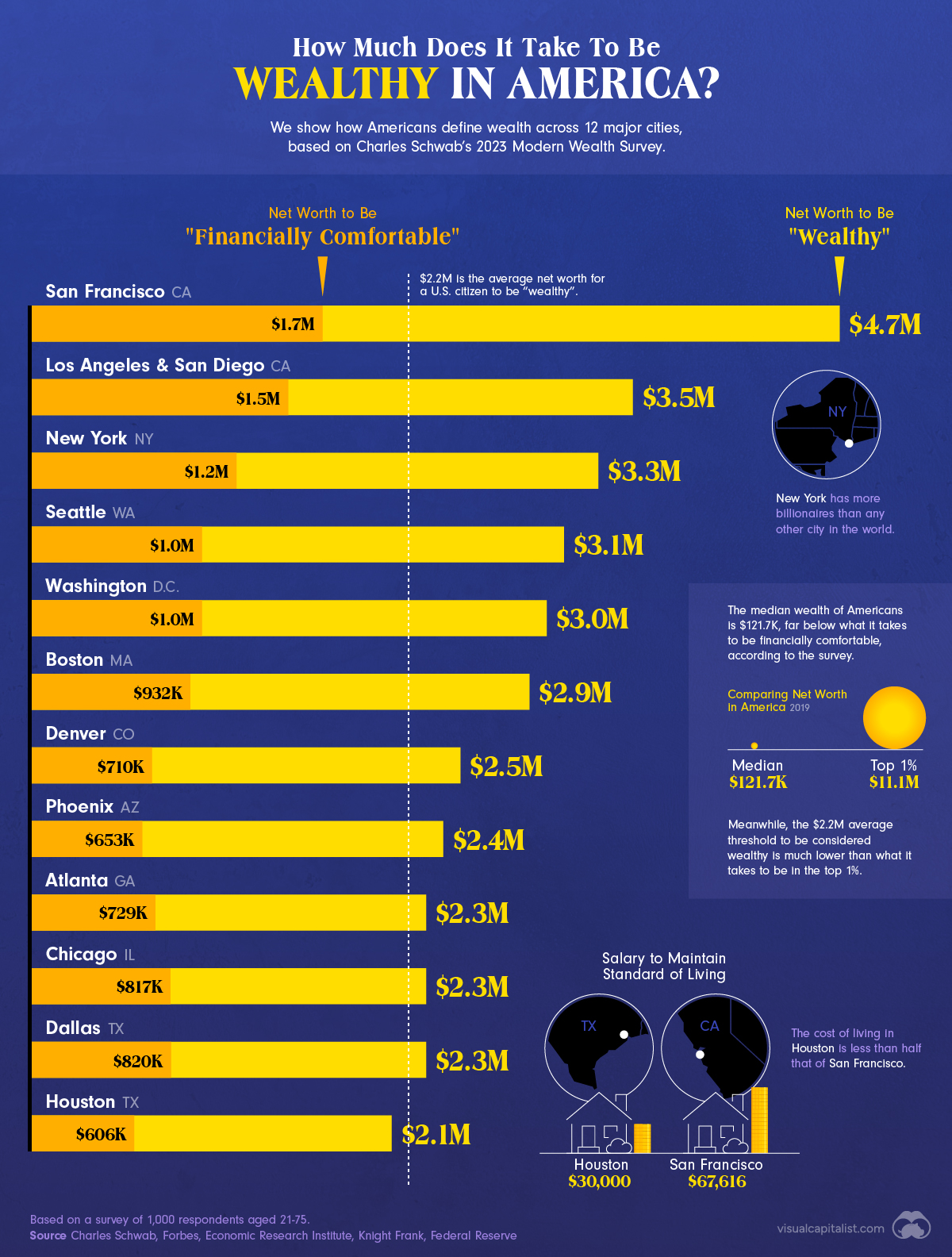

How Much Does it Take to Be Wealthy in America?

How Much Does it Take to Be Wealthy in America?

Is it possible to pin down an exact number on what it takes to be wealthy, or is wealth far more complex and nuanced than that?

The above graphic looks at data from the 2023 Modern Wealth Survey by Charles Schwab, which asks respondents what net worth is required to be considered wealthy in America.

Later, we look at data that partially contradicts those findings, showing that wealth is more than just a number for many of those same respondents.

Wealthy in America: A Closer Look

Overall, the net worth that Americans say that is needed to be “wealthy” in the United States is $2.2 million in 2023.

Here are the average wealth numbers indicated by respondents across 12 major U.S. cities, based on a survey of 1,000 people between 21 and 75:

| Rank | City | Net Worth to Be "Wealthy" | Net Worth to Be "Financially Comfortable" |

|---|---|---|---|

| 1 | San Francisco, CA | $4.7M | $1.7M |

| 2 | Los Angeles & San Diego, CA | $3.5M | $1.5M |

| 3 | New York, NY | $3.3M | $1.2M |

| 4 | Seattle, WA | $3.1M | $1.0M |

| 5 | Washington, D.C. | $3.0M | $1.0M |

| 6 | Boston, MA | $2.9M | $932,000 |

| 7 | Denver, CO | $2.5M | $710,000 |

| 8 | Phoenix, AZ | $2.4M | $653,000 |

| 9 | Atlanta, GA | $2.3M | $729,000 |

| 10 | Chicago, IL | $2.3M | $817,000 |

| 11 | Dallas, TX | $2.3M | $820,000 |

| 12 | Houston, TX | $2.1M | $606,000 |

In San Francisco, respondents said they needed $4.7 million in net worth to be wealthy, the highest across all cities surveyed, and more than double the national average.

This figure dropped from last year, when it stood at $5.4 million. The vast majority of people in San Francisco say that inflation has had an impact on their finances, and over half say that living in the city impedes their ability to reach their financial goals, citing steep costs of living.

In Los Angeles and San Diego, it takes $3.5 million to be wealthy, the second-highest across cities surveyed. In New York, it takes $3.3 million in net worth to reach this target. It is home to over 345,000 millionaires, the highest worldwide.

Houston, where the cost of living is less than half of San Francisco, respondents said a net worth of $2.1 million is needed to be wealthy. The average salary is $67,000 in Houston, while in San Francisco it falls at $81,000.

The Wealth Paradox

Separately, the survey asked whether respondents “feel wealthy” themselves.

Overall, 48% of all respondents said they feel wealthy, and those people had an average net worth of $560,000. This is a considerable divergence from the $2.2 million benchmark they said was needed to be wealthy.

Here’s the breakdown for major cities, illustrating the paradox:

Millennials were most likely to feel wealthy, at 57% of respondents, while 40% of boomers felt wealthy, the lowest across generations surveyed.

Explaining the Divergence

When digging deeper, it becomes clear that wealth is not simply a number.

In fact, the survey indicates that many Americans place greater importance on non-monetary assets over monetary assets when they think of wealth.

For instance, 72% said having a fulfilling personal life was a better descriptor of wealth than working on a career, which was only chosen by 28% of respondents. Meanwhile, enjoying experiences (70%) was a better reflection of wealth compared to owning many nice things (30%).

Interestingly, there was a narrower margin in choosing between the importance of time (61%) over money (39%).

Beyond monetary figures, these findings illustrate the layers that influence what it means to feel financially healthy today, and how this affects an individual’s overall quality of life.

Markets

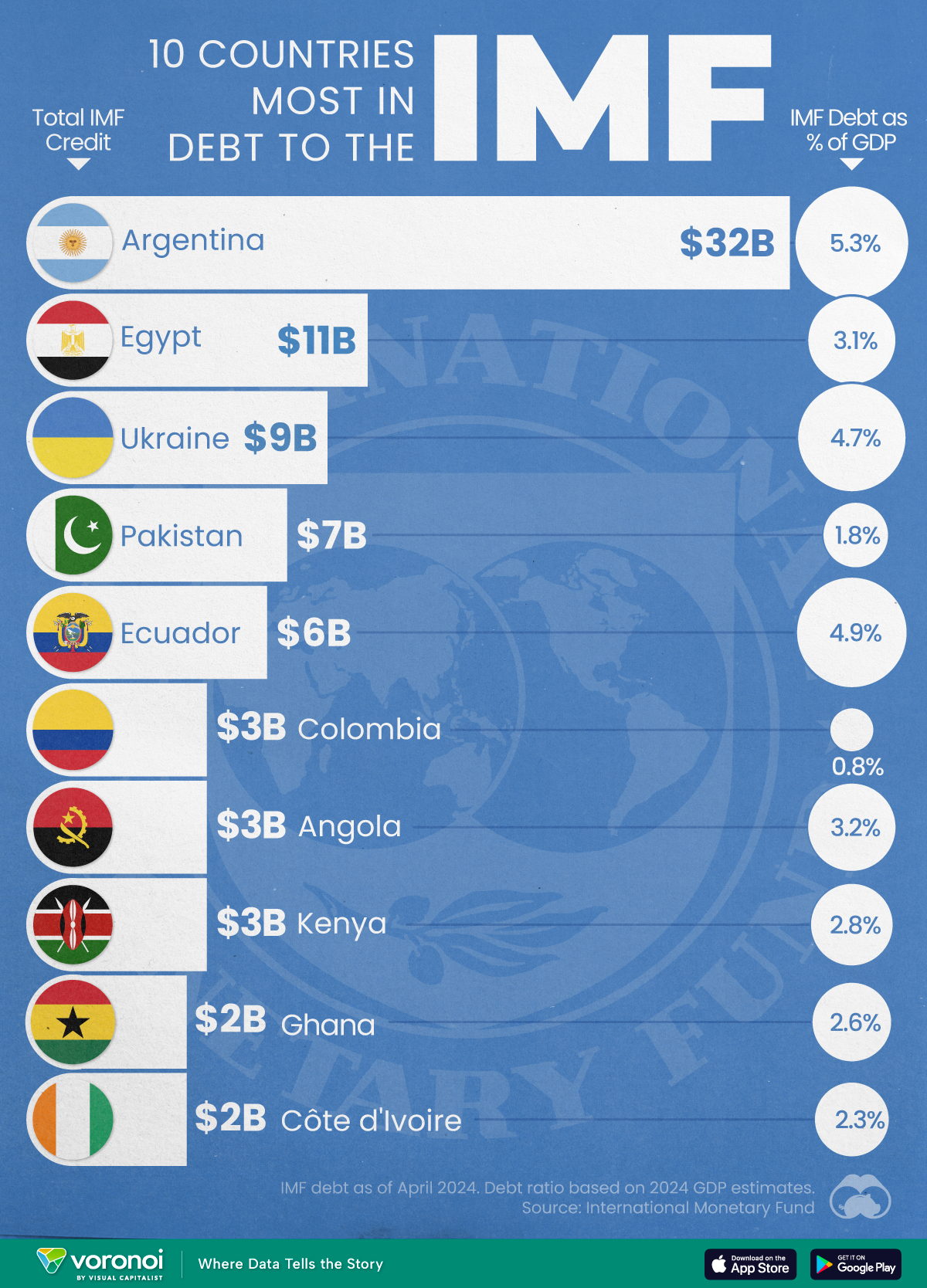

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Mining6 days ago

Mining6 days agoVisualizing Copper Production by Country in 2023

-

Politics7 days ago

Politics7 days agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Economy1 week ago

Economy1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Automotive1 week ago

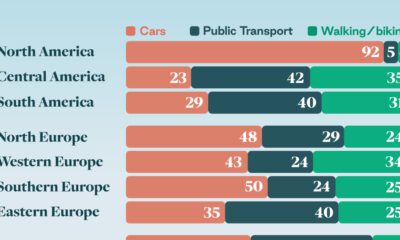

Automotive1 week agoHow People Get Around in America, Europe, and Asia

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State