Money

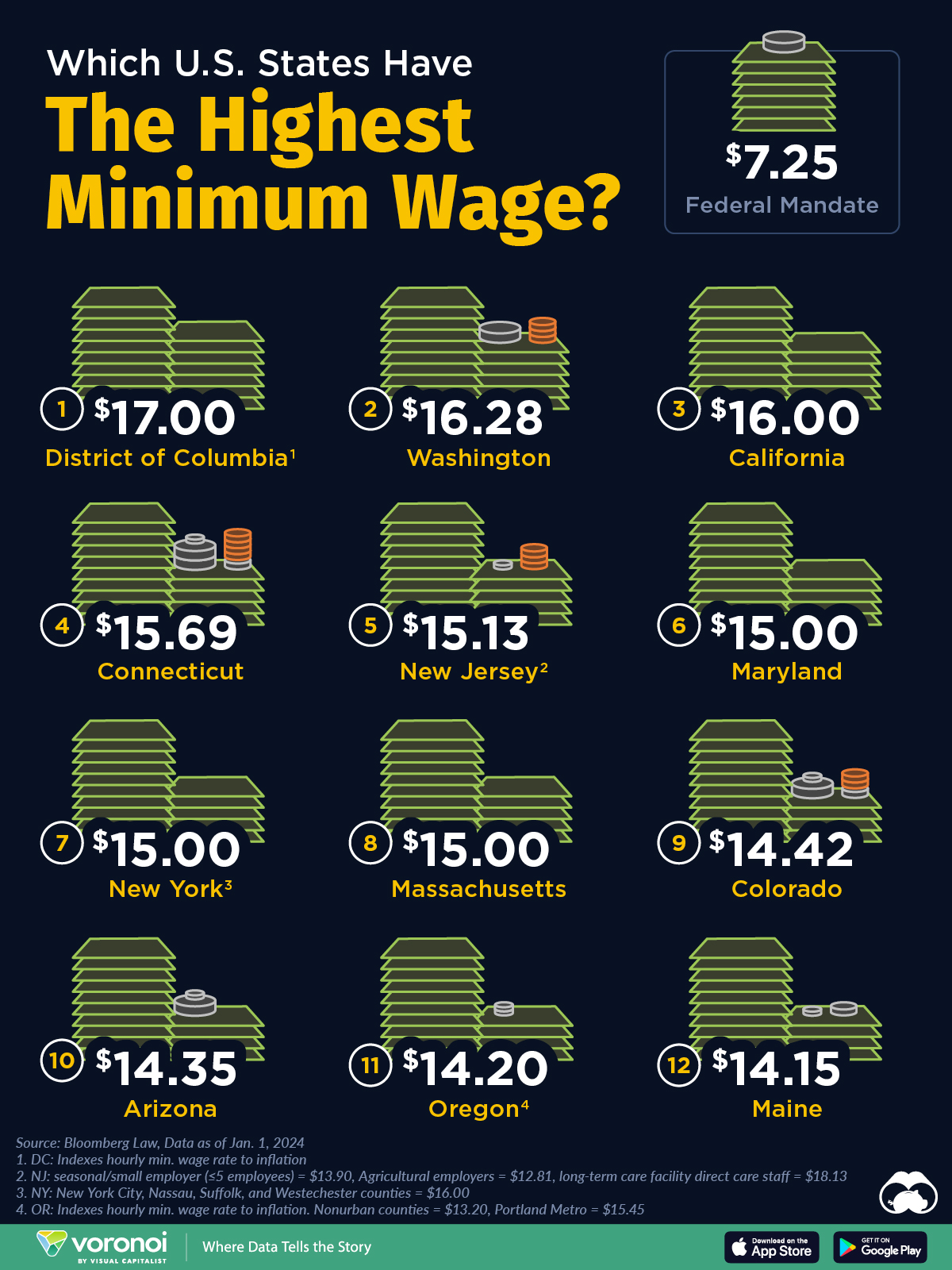

Which States Have the Highest Minimum Wage in America?

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Which States Have the Highest Minimum Wage in America?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This year, 22 states are raising their minimum wage, impacting almost 10 million workers across the country.

Many states raise the minimum wage each year to adjust to a cost of living index, while others have raised the pay floor for delivery drivers and fast-food workers. Today, the federal minimum wage stands at $7.25, a rate that has remained the same for 15 years.

This graphic shows the states with the highest minimum wage in America, based on data from Bloomberg Law.

The Highest Minimum Wages, by State

Here are the states with the highest minimum wage as of January 1, 2024:

| Rank | State | Minimum Wage |

|---|---|---|

| 1 | District of Columbia1 | $17.00 |

| 2 | Washington | $16.28 |

| 3 | California | $16.00 |

| 4 | Connecticut | $15.69 |

| 5 | New Jersey2 | $15.13 |

| 6 | Maryland | $15.00 |

| 7 | New York3 | $15.00 |

| 8 | Massachusettes | $15.00 |

| 9 | Colorado | $14.42 |

| 10 | Arizona | $14.35 |

| 11 | Oregon4 | $14.20 |

| 12 | Maine | $14.15 |

| U.S. Federal Mandate | $7.25 |

1District of Columbia: Indexes hourly minimum wage rate to inflation

2New Jersey: Seasonal/small employer with five employees or less= $13.90, agricultural employers= $12.81, long term care facility direct care staff= $18.13

3New York: New York City, Nassau, Suffolk, and Westchester counties= $16.00

4Oregon: Indexes hourly minimum wage rate to inflation. Nonurban counties= $13.20, Portland metro= $15.45

The District of Columbia has the highest minimum wage in the country, at $17 an hour.

Next in line is Washington state, where the minimum wage was raised to $16.28 an hour at the start of the year, up from $15.74. Both jurisdictions tie their minimum wage increases to inflation, along with several of the states on this list such as New York, Colorado, and Arizona.

With the largest planned increase nationally, Hawaii is raising its minimum wage to $18 an hour by 2028. Currently, the minimum wage stands at $14 an hour in the Aloha State.

As we can see, many of the top states have minimum wages that are more than double the federal minimum wage, which has declined in real value for many years. For context, the real value of the federal minimum wage hit a peak in 1970, where it would be worth $12.61 today.

California’s New Fast-Food Wage Hike

Fast-food workers in California recently received a pay bump after a new law raised the minimum wage to $20 an hour, $4 more than the state’s minimum wage.

In response, Pizza Hut announced it was laying off over 1,200 delivery drivers, while McDonalds said that it would increase prices in California due to higher wage costs. Other chain operators are reducing hours, while El Pollo Loco plans to automate part of how it makes salsa.

Affecting half a million workers at 33,000 restaurants, the law applies to chains with 60 or more locations across the country, making it the highest minimum wage in America.

Markets

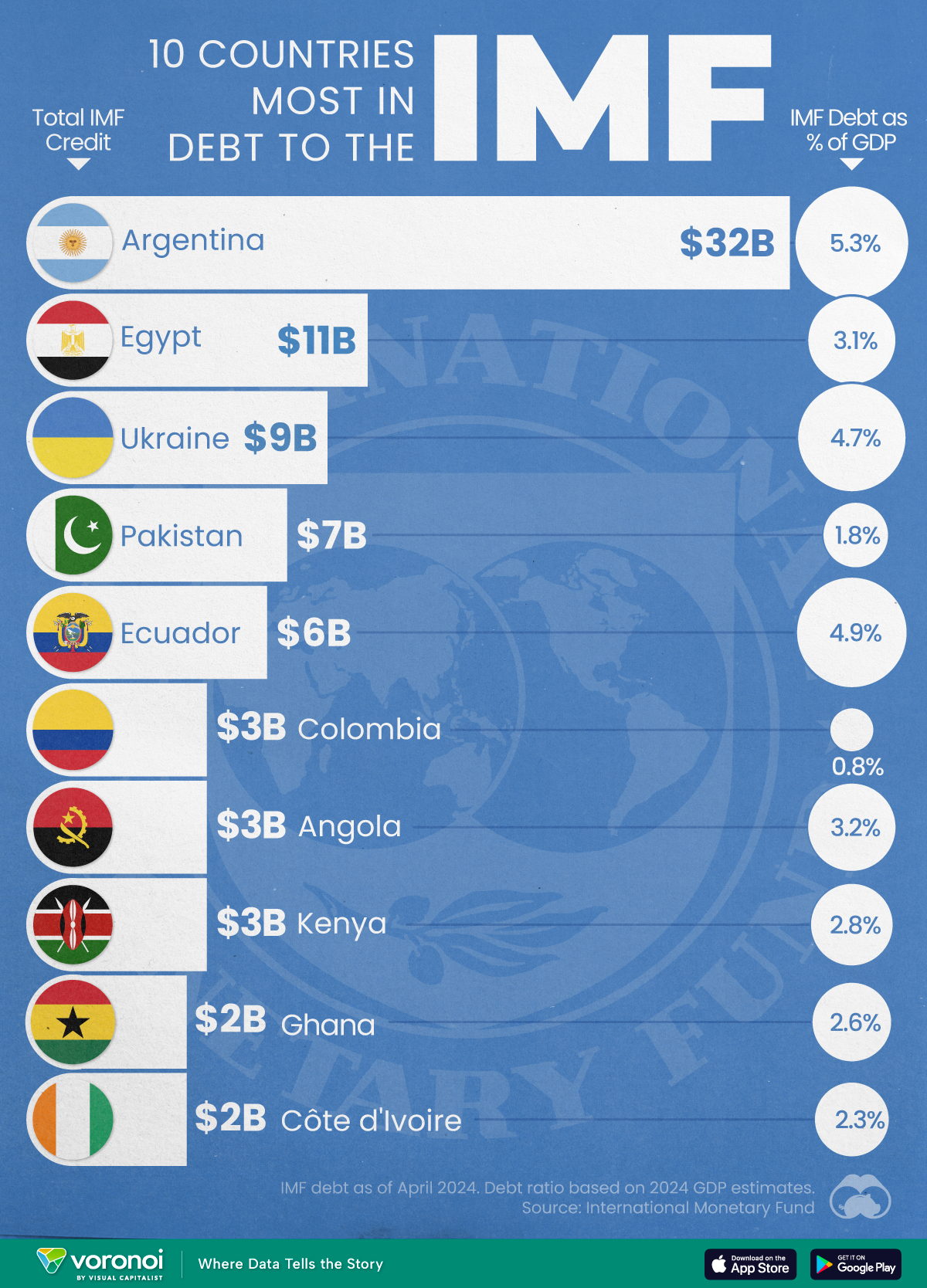

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Personal Finance7 days ago

Personal Finance7 days agoVisualizing the Tax Burden of Every U.S. State

-

Mining1 week ago

Mining1 week agoWhere the World’s Aluminum is Smelted, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Money1 week ago

Money1 week agoCharted: What Frustrates Americans About the Tax System

-

Economy1 week ago

Economy1 week agoMapped: Europe’s GDP Per Capita, by Country

-

Stocks1 week ago

Stocks1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Healthcare1 week ago

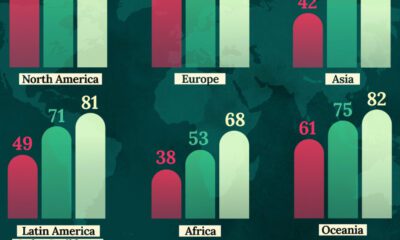

Healthcare1 week agoLife Expectancy by Region (1950-2050F)