Mining

All the Metals We Mined in One Visualization

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

All the Metals We Mined in One Visualization

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

Metals are a big part of our daily lives, found in every building we enter and all devices we use.

Today, major industries that directly consume processed mineral materials contribute 14% of the United States economy.

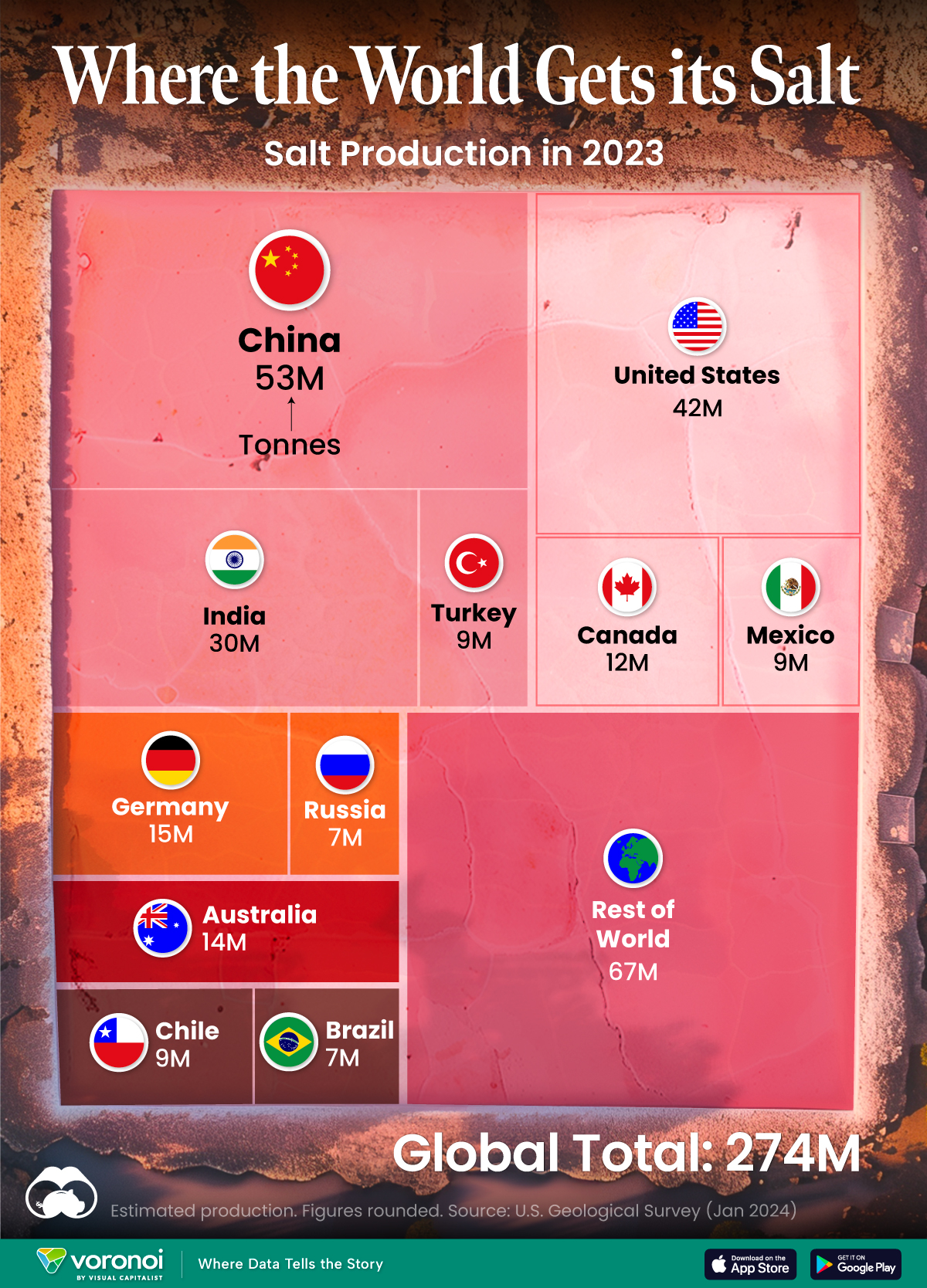

The above infographic visualizes all 2.8 billion tonnes of metals mined in 2022 and highlights each metal’s largest end-use using data from the United States Geological Survey (USGS).

Iron Ore Dominance

Iron ore dominates the metals mining landscape, comprising 93% of the total mined. In 2022, 2.6 billion tonnes of iron ore were mined, containing about 1.6 billion tonnes of iron.

| Metal/Ore | Quantity Mined in 2022 (tonnes) | % of Total |

|---|---|---|

| Iron ore | 2,600,000,000 | 93.3% |

| Industrial metals | 185,111,835 | 6.6% |

| Technology and Precious Metals | 1,500,008 | 0.05% |

| Total | 2,786,611,843 | 100% |

Percentages may not add up to 100 due to rounding.

Iron ores are found in various geologic environments, such as igneous, metamorphic, or sedimentary rocks, and can contain over 70% iron, with many falling in the 50-60% range.

Combined with other materials like coke and limestone, iron ore is primarily used in steel production. Today, almost all (98%) iron ore is dedicated to steelmaking.

The ore is typically mined in about 50 countries, but Australia, Brazil, China, and India are responsible for 75% of the production.

Because of its essential role in infrastructure development, iron ore is one of the most crucial materials underpinning urbanization and economic growth.

Industrial Metals

Industrial metals occupy the second position on our list, constituting 6.6% of all metals mined in 2022. These metals, including copper, aluminum, lead, and zinc, are employed in construction and industrial applications.

Aluminum constituted nearly 40% of industrial metal production in 2022. China was responsible for 56% of all aluminum produced.

| Industrial Metals | 2022 Mine Production (tonnes) | % of Total |

|---|---|---|

| Aluminum | 69,000,000 | 37.3% |

| Chromium | 41,000,000 | 22.1% |

| Copper | 22,000,000 | 11.9% |

| Manganese | 20,000,000 | 10.8% |

| Zinc | 13,000,000 | 7.0% |

| Titanium (mineral concentrates) | 9,500,000 | 5.1% |

| Lead | 4,500,000 | 2.4% |

| Nickel | 3,300,000 | 1.8% |

| Zirconium Minerals (Zircon) | 1,400,000 | 0.8% |

| Magnesium | 1,000,000 | 0.5% |

| Strontium | 340,000 | 0.2% |

| Uranium | 49,355 | 0.03% |

| Bismuth | 20,000 | 0.01% |

| Mercury | 2,200 | 0.00% |

| Beryllium | 280 | 0.00% |

| Total | 185,111,835 | 100.00% |

In the second position is chromium, which plays a primary role in rendering stainless steel corrosion-resistant. South Africa led chromium production, accounting for 44% of the total mined last year.

Technology and Precious Metals

Despite representing less than 1% of all the metals mined, technology metals have been on the news over the last few years as countries and companies seek these materials to reduce carbon emissions and improve productivity.

| Technology and Precious Metals | 2022 Mine Production (tonnes) | % of Total |

|---|---|---|

| Tin | 310,000 | 20.7% |

| Rare Earth Oxides | 300,000 | 20.0% |

| Molybdenum | 250,000 | 16.7% |

| Cobalt | 190,000 | 12.7% |

| Lithium | 130,000 | 8.7% |

| Vanadium | 100,000 | 6.7% |

| Tungsten | 84,000 | 5.6% |

| Niobium | 79,000 | 5.3% |

| Silver | 26,000 | 1.7% |

| Cadmium | 24,000 | 1.6% |

| Gold | 3,100 | 0.2% |

| Tantalum | 2,000 | 0.1% |

| Indium | 900 | 0.1% |

| Gallium | 550 | 0.04% |

| Platinum Group Metals | 400 | 0.03% |

| Rhenium | 58 | 0.004% |

| Total | 1,500,008 | 100% |

They include lithium and cobalt, used in electric vehicles and battery storage, and rare earths, used in magnets, metal alloys, and electronics. Many of them are considered critical for countries’ security due to their role in clean energy technologies and dependency on other nations to supply domestic demand.

However, despite increasing interest in these metals, they are still behind precious metals such as gold and silver regarding market size.

The gold market, for example, reached $196 billion in 2022, compared to $10.6 billion of the rare earth market.

Mining

The Biggest Salt Producing Countries in 2023

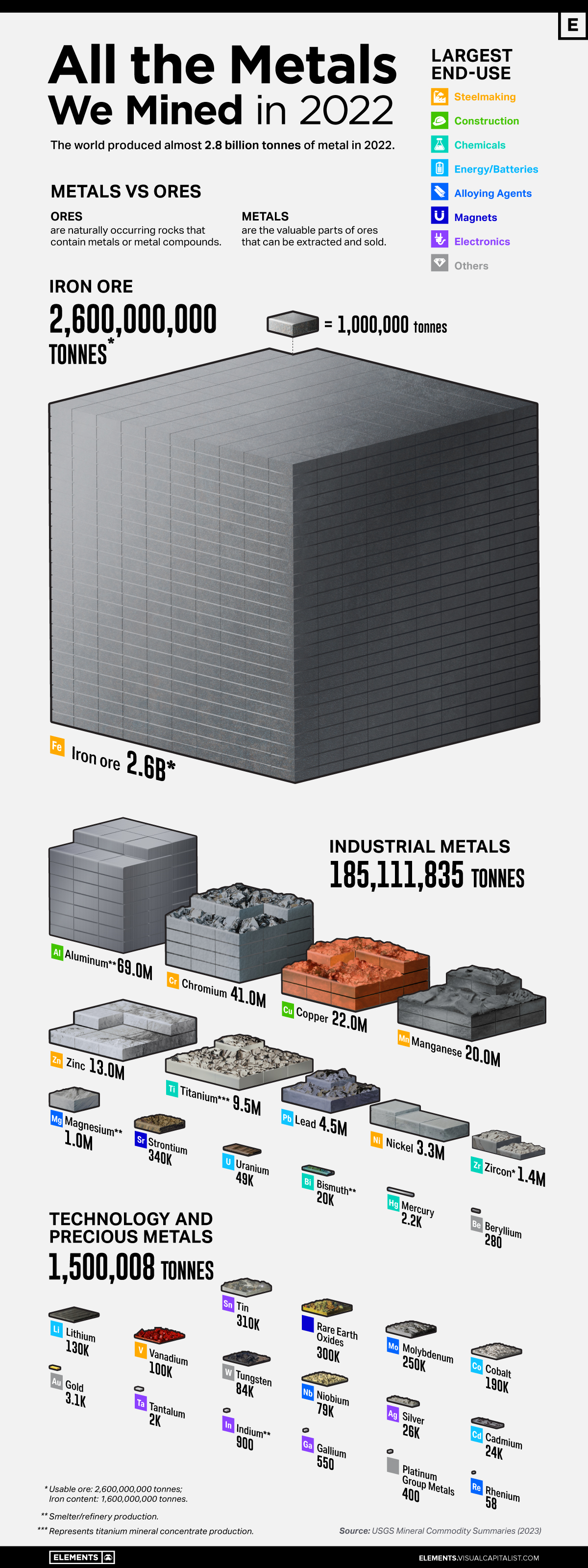

In this graphic, we break down global salt production in 2023. China is currently the top producer, accounting for almost 20% of output.

The Biggest Salt Producing Countries in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Humanity has utilized salt for thousands of years, dating back to ancient civilizations. The U.S. alone consumes more than 48 million tonnes of salt per year.

In this graphic, we break down global salt production in 2023, measured in tonnes. These estimates come from the U.S. Geological Survey’s latest commodity report on salt.

Ample Supply

Salt is essential for human life, serving various purposes including food preservation, flavor enhancement, industrial processes, and health maintenance. The good news is that the world’s continental resources of salt are vast, and the salt content in the oceans is nearly unlimited.

China is currently the top producer of salt, with almost 20% of the output, followed by the U.S. (15%) and India (11%).

| Country | Production (tonnes) |

|---|---|

| 🇨🇳 China | 53,000,000 |

| 🇺🇸 United States | 42,000,000 |

| 🇮🇳 India | 30,000,000 |

| 🇩🇪 Germany | 15,000,000 |

| 🇦🇺 Australia | 14,000,000 |

| 🇨🇦 Canada | 12,000,000 |

| 🇨🇱 Chile | 9,200,000 |

| 🇲🇽 Mexico | 9,000,000 |

| 🇹🇷 Turkey | 9,000,000 |

| 🇷🇺 Russia | 7,000,000 |

| 🇧🇷 Brazil | 6,600,000 |

| Rest of world | 67,000,000 |

| Global total | 273,800,000 |

The global salt market was valued at $32.6 billion in 2022.

It’s projected to grow from $34.1 billion in 2023 to $48.6 billion by 2030, with a CAGR of 5.2% during the forecast period. This suggests a surprising amount of growth for what is one of the world’s oldest and most common commodities.

Facts About the U.S. Salt Industry

In the U.S., salt is produced by 25 companies, which operate 63 plants across 16 states.

The states that produce the most salt are Kansas, Louisiana, Michigan, New York, Ohio, Texas, and Utah. Altogether, these states account for 95% of domestic production.

The primary uses of salt in the U.S. are highway de-icing (41%), chemical production (38%), and food processing (10%).

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture7 days ago

Culture7 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country