Markets

Why Investors Tuned Out Netflix

Why Investors Tuned Out Netflix

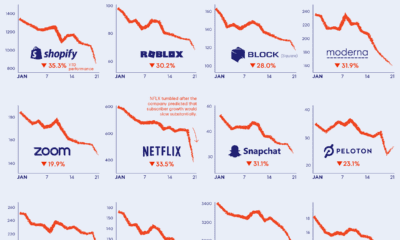

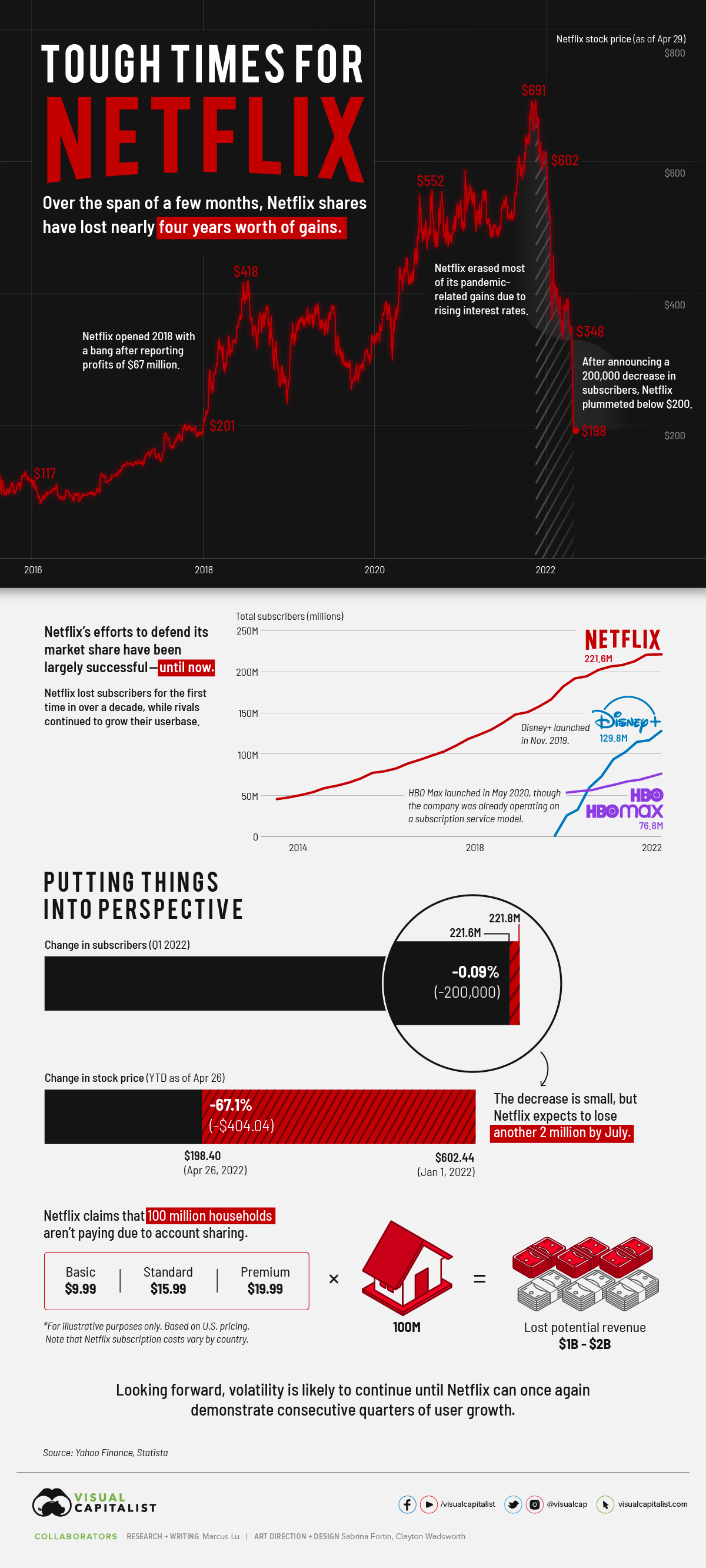

Netflix shares have enjoyed an incredible run over the past decade. Subscriber growth seemed limitless, profitability was improving, and the pandemic gave us a compelling case for watching TV at home.

Things took a drastic turn on April 19, 2022, when Netflix announced its Q1 results. Rather than gaining subscribers as forecasted, the company lost 200,000. This was the first decline in over a decade, and investors rushed to pull their money out.

So, is there a buying opportunity now that Netflix shares are trading at multi-year lows? To help you decide, we’ve provided further context around this historic crash.

Netflix Shares Fall Flat

Over the span of a few months, Netflix shares have erased roughly four years worth of gains. Not all of these losses are due to the drop in subscribers, however.

Prior to the Q1 earnings announcement, Netflix had lost most of its pandemic-related gains. This was primarily due to rising interest rates and people spending less time at home. Still, analysts expected Netflix to add 2.7 million subscribers.

After announcing it had lost 200,000 subscribers instead, the stock quickly fell below $200 (the first time since late 2017). YTD performance (as of April 29, 2022) is an abysmal -67%.

What’s to Blame?

Netflix pointed to three culprits for its loss in subscribers:

- The suspension of its services in Russia

- Increasing competition

- Account sharing

Let’s focus on the latter two, starting with competition. The following table compares the number of subscribers between Netflix and two prominent rivals: Disney+ and HBO.

| Date | Netflix Subscribers | Disney+ Subscribers | HBO & HBO Max Subscribers |

|---|---|---|---|

| Q1 2020 | 182.8M | 26.5M | 53.8M |

| Q2 2020 | 192.9M | 33.5M | 55.5M |

| Q3 2020 | 195.1M | 60.5M | 56.9M |

| Q4 2020 | 203.6M | 73.7M | 60.6M |

| Q1 2021 | 207.6M | 94.9M | 63.9M |

| Q2 2021 | 209.2M | 103.6M | 67.5M |

| Q3 2021 | 213.6M | 116.0M | 69.4M |

| Q4 2021 | 221.8M | 118.1M | 73.8M |

| Q1 2022 | 221.6M | 129.8M | 76.8M |

Disney+ was launched in November 2019, while HBO Max was launched in May 2020. HBO (the channel) and HBO Max subscribers are rolled up as one.

Based on this data, Netflix may be starting to feel the heat of competition. A loss in subscribers is bad news, but it’s even worse when competitors report growth over the same time period.

Keep in mind that we’re only talking about a single quarter, and not a long-term trend. It’s too early to say whether Netflix is actually losing ground, though the company has warned it could shed another 2 million subscribers by July.

Next is account sharing, which according to Netflix, amounts to 100 million non-paying households. This is spread out across the entire world, but if we use the company’s U.S. pricing as a benchmark, it translates to between $1 to $2 billion in lost revenue.

Growth is Everything

In the tech sector, growth is everything. If Netflix can’t return to posting consecutive quarters of subscriber growth, it could be many years before the stock returns to its previous high.

“We’ve definitely seen that once you get to 70, 80 millions of subs, things really tend to slow down. We saw it with HBO, and we’ve seen the same issues with Disney. They’re hitting the upper limit on the big growth.”

– David Campo, NYU

Regaining that momentum is going to be difficult, but Netflix does have plans. To address password sharing, the service may charge a fee for out-of-household profiles that are added to an account. The specifics around enforcement are vague, but Netflix is also considering a lower-priced subscription plan that includes advertising.

Only time will tell if these strategies can stop the bleeding, or perhaps even boost profitability. Rampant inflation, which might persuade consumers to cut down on their subscriptions, could be a source of additional headwinds.

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

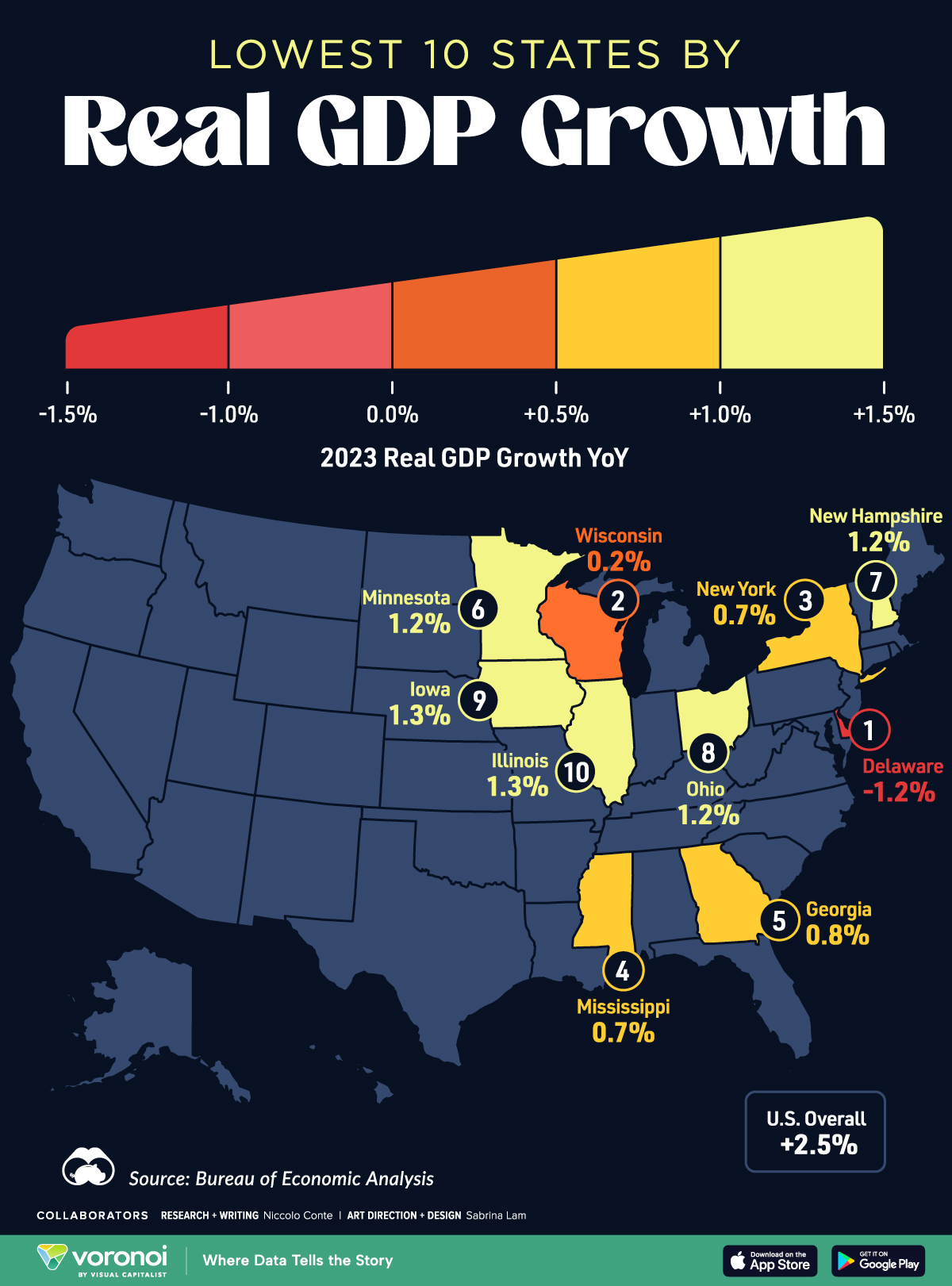

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

United States1 week ago

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Money2 weeks ago

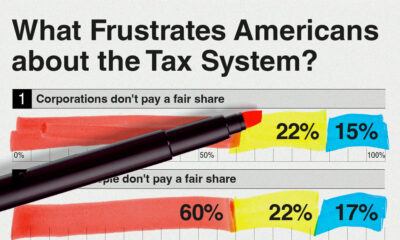

Money2 weeks agoCharted: What Frustrates Americans About the Tax System

-

Technology2 weeks ago

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

-

Mining2 weeks ago

Mining2 weeks agoWhere the World’s Aluminum is Smelted, by Country

-

Personal Finance2 weeks ago

Personal Finance2 weeks agoVisualizing the Tax Burden of Every U.S. State